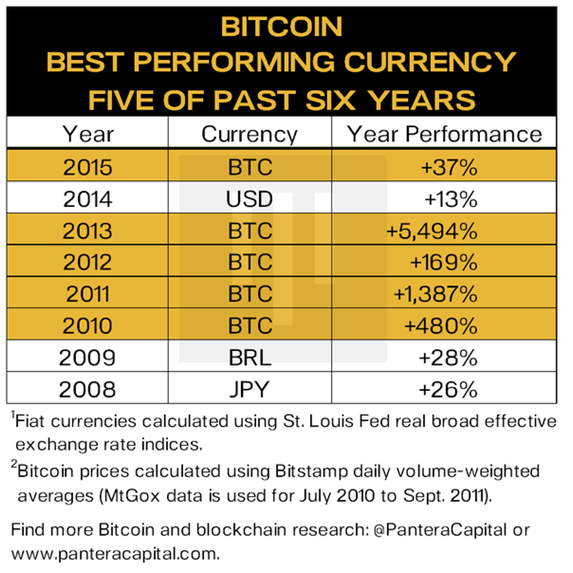

By now, most of you reading this post has heard of cryptocurrencies. Surely, you’ve heard of Bitcoin which has been lavished with international media attention due to factors like being the world’s best performing currency for the past three years and for unprecedented explosive growth fueled by speculation and global economic uncertainty.

Undoubtedly, many of you who have sat on the sidelines watching this gold rush have thought to yourselves, ‘why didn’t I act sooner?’ You might even be thinking it’s too late now and that the lion’s share of the action has already passed.Well, fortunately for the readers, I’m here to tell you otherwise. My goal in making this post is to get you to understand that cryptocurrencies have a very bullish future and that the best days – for investors especially – are ahead of us! I’m going to teach you how to win by developing strategies and criteria to help you chart your own path to success. Perhaps the most important lesson to understand when it comes to investing is that investing is personal. Many people coming into this space are attracted by the stories about people becoming overnight millionaires; the guy in Norway who bought $27 worth of Bitcoin back in 2009 and didn’t pay it any mind until, fast-forward a few years later, he noticed mainstream news about Bitcoin and then checked his wallet which now had almost $1 million worth of Bitcoin. That is a story of incredible good fortune and naturally inspires others to make bitcoin investment decisions AFTER the fact – reactive. As mentioned earlier, when it comes to investing we should consider that everyone starts at a certain place with unique circumstances. These circumstances must be taken into consideration when making decisions about money. The type of investment that might make sense for you, your friend, or someone you may have heard about may not be the best approach for you. You should consider your own situation and use that as a basis for thinking about what to invest in and when; because one of the things to keep in mind about cryptocurrencies is there’s a lot of volatility and that’s why there’s a lot of opportunities to make money, but you can also lose money too.Another important factor to consider is that many of these blockchain projects will likely fail. These first mover projects with ambitious use cases are not going to be successful simply because they seem visionary. Most will fail. I would even wager that none of the top ten cryptocurrencies in market cap size today will be in the top ten list in 3-4 years. We should have a healthy dose of skepticism about the viability of these projects and invest and trade accordingly.My background in cryptocurrencies is unique. One of the things I want to emphasize is that I’m not some average Joe who decided in the past couple of months to start blogging about cryptocurrencies when they’re the latest hot thing. I have a lot of skin in the game because I took some “big shots” – invested a lot of money – into various cryptocurrencies (particularly promising projects with lower valuations, suggesting room for growth. I also networked aggressively and participated in several pre-sales and ICOs. Presales require that you have a minimum amount of money to invest that is too substantial for most crypto investors ($50,000 in the case of one presale I participated in called Civic).Sometimes you get discounts depending on the terms and sometimes you don’t. In the event there isn’t a discount, the main benefit from doing the presale is getting a guaranteed allocation before the ICO happens.In addition to those endeavors, I’ve also attended conferences. I was an attendee at the first ever token summit in New York City back in May, which was just a couple of months ago and a phenomenal experience. One of my favorite things about the crypto space now is the accessibility of project teams. In ordinary investing, let’s say with the stock market, I can’t just call up the CEO of Snapchat and say, “hey man, tell me what you guys are doing behind the scenes and give me some information that I can possibly use to help better inform my investment decisions.” You know that’s just not going to happen; and I’m not even talking about insider trading, but simply normal business activities I may want to have an update on. I don’t have easy access in those kind of situations, but with crypto it’s different. Any one of you can go on Twitter, join Slack or Telegram groups and, in a lot of cases, you’ll see members of the founding team, if not the founder, participating in these kinds of discussions. They are incredible networking opportunities as well.At the Token Summit, I was able to meet some of the special people that I was following on YouTube, namely Tai Zen and Leon Fu – class acts; they took me and some of their other followers out to dinner, including one of my good friends who I travelled to the conference with, Ian Ballina. Some of you may have seen his content; he’s given a lot of insightful information about ICOs. One of Ian’s videos even went viral: “How to make millions and ICOs.” We had a blast at dinner and I must recommend to those of you who have the opportunity, attend conferences in your area and get out and meet people in the space. The information and contacts that you receive really pays for itself ten times over.

Now, my story as far as how I got into crypto shouldn’t even count because my first exposure was way back in 2012, which makes me a decorated vet in crypto years. Back then there weren’t altcoins, US exchanges or a token economy. To buy bitcoin, I would meet with people in strip malls and give them cash in exchange for bitcoin they would send to my personal wallet. There wasn’t any sophisticated investor angle then, just pure lunacy. There was no intimation then that bitcoin would evolve to what we’ve seen in the years since – renown for being the world’s best performing currency for three consecutive years and an increasingly attractive store of value as an alternative to fiat. Back then, it was practically a hobby. Then came the Mt. Gox hack…. and that was significant because Mt. Gox at the time was the largest Bitcoin exchange in the world and the hack led to series of panic sells. Following Mt. Gox, Bitcoin had a three-year period where it’s all time high in 2014 wasn’t surpassed until 2017. I was one of the panic sellers and sold all my bitcoin…at a profit.Fast forward to 2016, I meet someone who tells me about this crypto fund that he’s been managing informally and just how well it was doing. The returns he was telling me sounded like a Disney movie. I asked him: “what’s in your fund? What can you tell me that I can look up and see if this makes sense?” He then told me about Ethereum, which at the time was only $10 per token. I bit the bullet and threw $1,000 into Ethereum at those prices just to test it out. Well, in a few short months, that $1,000 investment turned into $5,000. Realizing a gain for myself, I started doing more research and talked to some other friends who also jumped on the bandwagon. Crypto became a religion for us and we were researching it all day, every day, understanding the many different projects and all of their interesting use cases (i.e. Storj and Sia in the case of decentralized cloud storage on the blockchain, or Ripple’s goal to improve liquidity for the banks vis-à-vis cross border transactions). This new world was fascinating.After flirting with day trading for some time, which was ultimately unprofitable, we realized that we were entering a period of unprecedented fast growth of the crypto market. After the Ethereum win, I started adding more money into crypto, starting with $10,000, and then I upped my contributions to a pretty significant amount of money. The timing was perfect because when I invested more capital, the market cap for cryptos grew from $30 billion to over $110 billion in just two months! The portfolios of my friends and I grew in lockstep, closely tracing the market. I really think a chimpanzee at that time could have just thrown darts at a wall and hit a randomly assorted list of project names and made money. What a truly extraordinary event! Looking back, the mistake my friends and I made were not having a profit taking strategy and loss-limiting strategy. To date, that period of intense market growth result in an all-time high (ATH) for my portfolio, but I only have sexy Blockfolio (app) screenshots to show for it. In crypto investing, I like to recoup initial once I reach a 1x and then let the house money ride. That way you limit or eliminate emotion because you are just leaving in the profits to ride the wave. A general maxim that I follow is for every 1x, I skim 1/3 to 1/2 of profits. I like to sell when I can, not when I have to. For losses, I like exiting out of an investment entirely when my positions are heading southward of a 20% loss. If you’re wrong, admit to it early! I find that this approach is sustainable for me, and my rest is better too. In closing, this is an extraordinary time to invest in cryptocurrencies. I’m not a financial advisor, and don’t play one on the internet, but even with a small amount of money, it’s probably a good idea to invest and realize a gain. Once that happens, you will most likely take a keener interest in investing and commit more time and resources into this endeavor. Get out there and meet others the space by attending conferences, local bitcoin meetups, and engage with others online via Reddit, Bitcointalk Forum, Slack, and Telegram.If you have more personal questions for your unique considerations, let me know by dropping me a line at [email protected]. You can also reach me on my social media platforms using the buttons at the bottom of this page.