Real estate refers to properties such as lands and buildings. The real estate industry tends to utilize lands, buildings and the natural resources present on the land to aid wealth building and portfolio diversification. As of 2015, The real estate industry had a total value of 217 trillion dollars. The real estate industry is becoming a suiting means of wealth building due to its liquidity and sustainability. With the increase in global population, it is expected that the value of land and landed properties will also appreciate. Never the less investment in real estate has had its ups and down. Foreign investors are most time burdened with the need for a huge capital, incorporation with local authorities in order to attain legal compliance and other requirements.

Real Estate Investment Trusts(REIT) refers to companies or firms that own or finance income-producing real-estates.REITS came into existence as a result of trying to create an environment for investors notably small-scale investors to be able to invest in portfolios of real estate assets the same way they invest in other industries either through the purchase of company stocks or mutual funds. Stockholders of REITs tend to earn income in the form of dividends on a yearly basis produced through the real estate investment without having to seek real estate opportunities, manage or completely finance the property. The use of REITs tends to take away the requirement for large capital to invest in real estate industry by offering fractions in the form of stocks and taking away the hassle of having to deal with statutory requirements, restriction associated to jurisdiction and type of property funds. REITS of nowadays are known to be overpriced, low on dividends and tumultuous for small-scale investors.

Blockchain technology has shown the tendency to be one of the greatest inventions of the modern era. Blockchain refers to a public ledger with cryptographic encryption designed to be decentralized, open source, transparent and secured via its distribution of records in a peer to peer network. Blockchain technology has led to the invention of cryptocurrency which tends to serve as fuel for transactions on the blockchain. Blockchain and cryptocurrency have shown to be a reliable tool for making transactions but it's yet to get massive adoption in other industry aside from the commercial/finance industry. Holders of cryptocurrency still find it difficult transitioning from their digital assets into physical assets due to numerous restrictions still hindering the crypto eco-space.

Introducing Global REIT

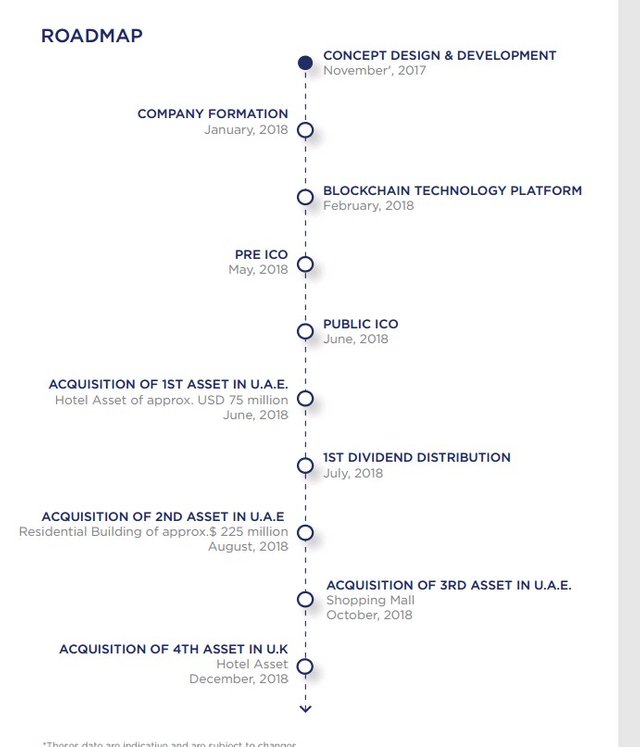

Global REIT is a platform designed to serve a superior purpose compared to traditional REITs by incorporating blockchain technology. The Global REIT platform gives cryptocurrency enthusiasts an avenue to seamlessly dive into real estate investments and grants traditional REITs an avenue to utilize blockchain framework in order to improve their operations. The Global REIT platform exposes investors to the real estate market without the need a acquire a complete property, experience stress associated with management, and compliance to laid down juridical regulations. Unlike traditional REITs, the Global REIT platform gives it's token holders dividends on asset holding companies on a monthly basis and allow them to benefit from funds management income.

Key Features of the Global REIT Platform

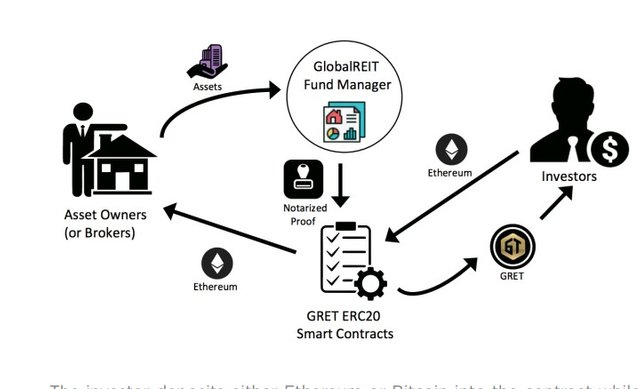

1. Blockchain technology: The Global REIT platform utilizes the ethereum blockchain smart contract features to issue the GRET and GREM tokens. This asset tokens of the Global REIT platform proposes superior alternatives compared to traditional REITs because they are cheaper alternatives, easily traded on all exchange and grant crypto investors another reliable means of hedging their funds asides fiat currencies.

2. Asset Management Modules: This module creates individual interface for both asset managers /investors to access details and information regarding assets on the platform. This module also aids the execution of the smart contracts associated with the GRET tokens.

3. Transaction Module: This module helps validate transactions on the Global REIT platform and help execute instruction on the ecosystem.

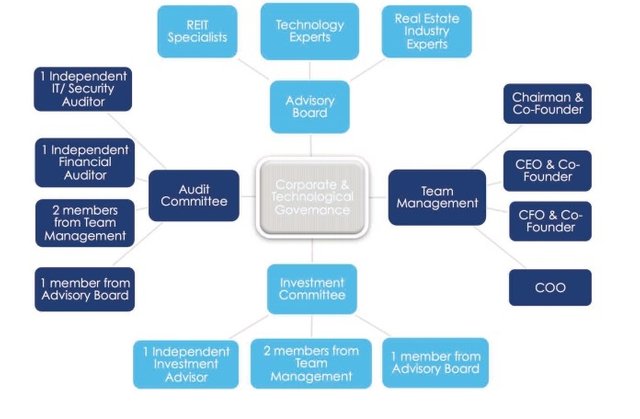

4. Compliance and security modules: This module help eliminates issues of fraud on the platform by carrying out checks and balances on transacting parties via KYC AND AML vendors. The Global REIT platform also incorporates with auditing firms and legal advisors in order to ensure transparency on the platform.The Global REIT platform utilizes the following structure in the image below for maximal functionality.

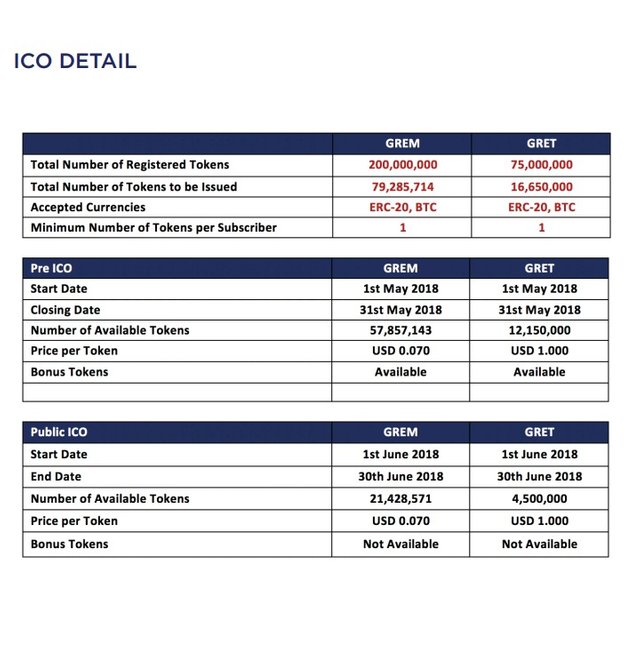

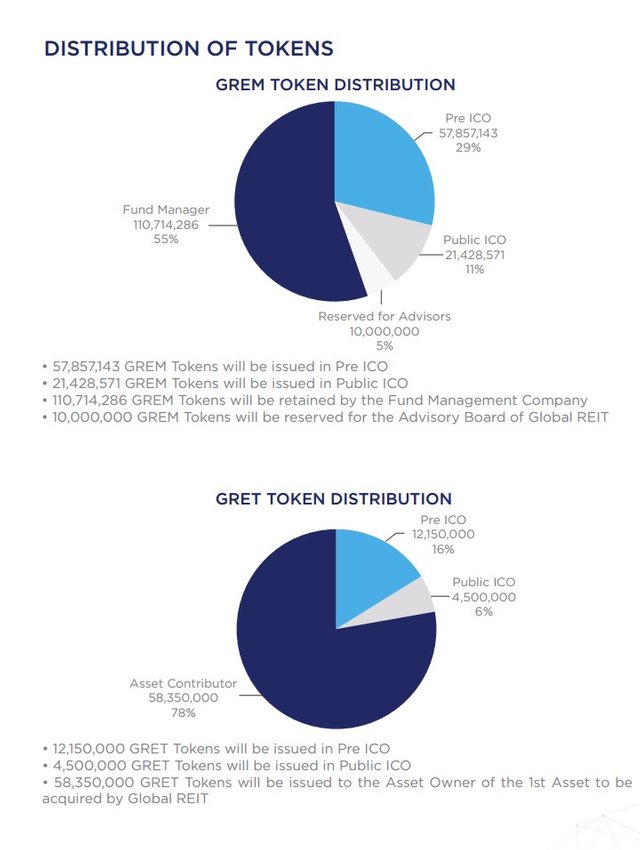

5. GREM and GRET token: The GREM and GRET token serves as the custom asset tokens of the Global REIT platform. Subscribers of the Global REIT initial coin offering (ICO) will get shares of the fund management company in the form of GREM token while shares of the Asset owning company will be in the form of GRET tokens. Holders of GREM and GRET will get access to all assets under Management(AUM) and with a minimum of 5000 units of either tokens,holders will be entitled to free stays every year. Holders of a minimum of 100,000 GREM tokens will also have the option to sell their real estate assets to Global REIT platform.The GREM token has an estimated supply of 200m units while the GRET token has a maximum supply of 75 million unit. Holders of GREM and GRET token are also accrued monthly dividends.

GREM/GRET Token Allocation and Token Sale Details

The Global REIT Team led by Ali Tumbi has put up GREM/GRET tokens for sale in order to raise funds for marketing, compensation of team, administrative expenses, legal and regulatory expenses and acquisition of real estate assets. The tokens can be purchased via ethereum, bitcoin and fiat currencies.

Conclusion

The global REIT platform proposes a seamless transition from digital assets to real estate assets to crypto investors who long for a more stable means of portfolio diversification and income generation while traditional real estate investors can now get means to venture into crypto domain under a reliable structure developed to ensure transparency and efficiency via utilizing blockchain technology and it's applaudable features. The Global REIT platform proposes a more profitable means of investing in real estate compared to traditional REITs. With the overwhelming attention, the crypto community has gotten in recent time, project like this which shows the robustness of blockchain technology will definitely catch the attention of traditional investors.

For more information on the global REIT platform check out the following channels

Website – https://www.globalreit.io

Whitepaper – https://www.globalreit.io/front/whitepaper/Global-REIT.pdf

Telegram – https://t.me/GlobalReit

Twitter – https://www.facebook.com/GlobalReit-144007413076936/

Facebook – https://twitter.com/GlobalReit01

Bitcointalk ANN – https://bitcointalk.org/index.php?topic=3341986.0

Authors detail

Bitcointalk name: Mrsparks

Bitcointalk profile link:https://bitcointalk.org/index.php?action=profile;u=1197564;sa=summary

Is this token registered with US SEC

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Definitely ,the Global Reit team has met all regulatory standards in order to host a successful ICO

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When will tokens be distributed and is there going to be a locking period?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

after the ICO the token will be distributed.. for more information regarding the ICO please join the channels listed inn the write-up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit