Token statistics is perhaps the most boring-yet- essential part of research if you hate data analysis.

-But it’s also the most objective way of analyzing tokens for the biggest ROI. Today, we will discuss some of the important data points to consider when comparing tokens. It’s far less exciting than just chasing the hype (which newbies do a lot) but it’s really necessary if we are to reduce risk to a minimum. Even after doing that, there is still a possibility of failure, so I highly recommend you don’t skip this process (though this is the reason why many quit or never really start). You might have been lucky and earned significantly just by joining a very hyped project before but if you apply data analytics now, there’s a good chance that data would back it up. Knowing these basic principles may make your success much more repeatable and predictable.

Let’s drag-race through the boredom!

Let’s start with this largely undiscussed success principle. You might not like it. In fact, I'm pretty sure many don’t like it because I don't! -But it's a reality: Many people love to read the fantastic stories of success in magazines and watch biographies on Youtube and think “I wish I could be Richard Branson or Oprah or Warren Buffett, or anyone else that people envy. Guess what! We have really no idea! Do we really want to be like them along with the pain, suffering and extreme boredom they had to go through? We always see people passionately discussing stuff that they love and it’s hard to notice the usually short-cut parts and the seemingly insignificant parts of the story. 5% of what it is that they do is really awesome on the stage or on camera, talking or performing perfectly well. -But what we don't usually see is the absolute monotony that precedes those moments.

Image Source

I'm not just talking about the traumatic and painful failures that they go through in the difficulties. All these people encounter a minefield of failure one has the journey through to get to the pinnacle of success. - That’s not it! I'm revealing a deeper truth now. -It is the insignificant and unemotional, downright boring and monotonous day-to-day drag that they have to endure that are not filmed or written. It’s the day-in and day-out routine that they endure doing whether they enjoy it or not. This is what separates the great investor from an average investor. It is the drag: The arduous, boring and mundane times like when you’re researching an ICO founder or working out your budget. Those ahead of us are still dragging along workload when we decide to turn off our computers and call it a day. They’re reading further when we have finished screening 10 ICOs a day. They keep practicing what they do best in the hours not usually filmed. It is the wait and the downtime where others spend thousands of dollars on a summer vacation while you keep working on what you started in winter. I know that this is not a popular answer but it is the principle to consider when you are tired. Successful people are still dragging it when others have lost motivation and are already playing mobile games. Those successful people we look up to seem to perform miracles in their lifetime but we don’t usually see the boring hours when they do preparation and planning for the next venture.

Applying Sabermetrics in cryptocurrency investing

Sabermetrics is about using analytical data in baseball. They compare players’ performance data and factor in their salary in order to determine a combination of players that will make the most amount of money possible depending on their budget. Why don’t we apply that in ICOs and crypto-investing? We can leverage data and analytics to get the best returns. So far, apart from sheer luck, this is the only way to compete with the whales.

I hope you can now see why I elaborated on the ‘drag’. These are the slow moments where they study numbers and seem far less-exciting than the game itself. I don’t like doing this kind of analysis myself but if we are to make any significant income from cryptocurrencies, we’ve got to ‘bite the bullet’.

A spreadsheet is typically needed to start with. You can device your own scoring system based on historical and current data. The first challenge is determining which kinds of data are important.

Here are some important data points you might want to include in your spreadsheet.

Subjective Data Points

MVP/Prototype - 90% of good successful ICOs had a prototype.

Team Members - This is a very subjective way to evaluate ICOs but the way I look at it, you just want to be sure that the team members have been massively successful in other projects before.

Reputable Advisors

Support From the Community

More than 1000 is barely acceptable but you can compare the figure with other ICOs and set your own percentage and weight to the final score. You can think of it as "audience impact" in a competition.

Objective Data Points

Token Price - I usually screen out tokens worth more than a dollar each unless other data suggest that it’s worth it.

Total Tokens Sold - should not be just a very small fraction of the total available tokens

Total Available Tokens - I usually put a red flag on those with 1B token supply and up. It is a huge factor for long-term price and subsequently, your ROI based on the law of supply and demand.

ICO Target vs Amount Raised - Halfway through or towards the end of the ICO (for time-bound ICOs), you want to make sure what might happen if the amount raised is too small. Some ICOs completely shut down and refund investors. Obvious scammers just disappear with the money.

Hard Cap - Ideally not more than $30M, depending on other factors.

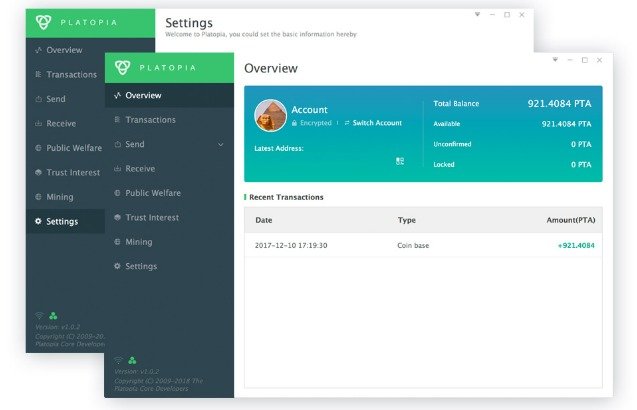

Most token data are found on the ICOs website. Some data analysts actually share their spreadsheets. You want to study and understand how they work and the formulae that they use. Try to learn the basics of Microsoft Excel online if you haven’t used it before. This way, you are your own financial advisor.

Please be back later this week and we'll discuss a couple of examples of tokens that made millions shortly after launch. We will analyze some data and see how they succeeded.

Please upvote, resteem and follow me. Thank you.

very interesting @hiroyamagishi

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

really liked your post man...👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great info bro...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. I will post the second part soon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

waiting for that

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

would you like to do some public welfare through blockchain project. please give me an eye, thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I always go for the token's usability, and which community will be using it. The most profitable token in the ico stage at the moment is the next XRP or Ripple. Many factors should really be considered. The overrated for ads now and top commissioned advisers now is PecunIO. I guess that's also a great factor to consider.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

although I am against for high supply coins, however, I save XRP Ripple from other high supply coins because of the real world use cases of this blockchain. I must have mention it on my blog, btw great comment @fycee

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @hiroyamagishi. High supply means it must have been really in good use. A steady flow of internal and external exchange should always be checked if the community really uses and trades it. Yes, I'll be checking your blogs from now on as I have really seen a great mind for this technology that is set to be the future of payments.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very informative

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

wow you are so beautiful my dear.And your post are best becuse the post are easly knows any information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit