Tackling Small Business Cash-stream Problems with Low Interest Financing.

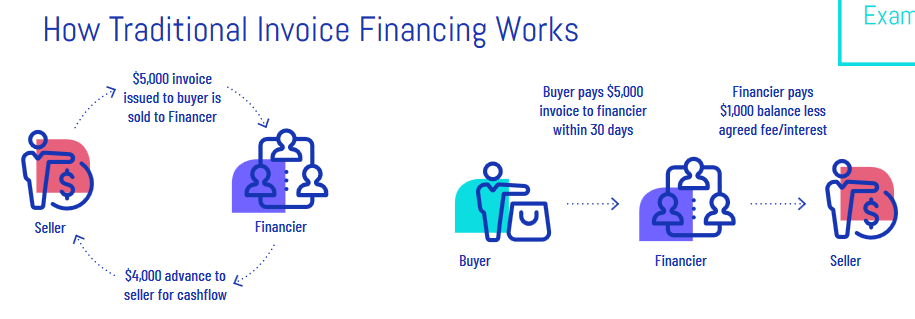

The customary receipt financing model does not make an immediate connection between the individual subsidizing a receipt and the individual paying that receipt. Our proposition is to make a decentralized stage which will interface all gatherings, appropriate data with more prominent adaptability, and lower the dangers of all included.

The conventional model opens the lender to impressive hazard and improves the probability of question. It's the ideal opportunity for a change.

Six Drawbacks of Traditional Invoice Financing

No immediate contact :-The lender does not have an association with the purchaser, which opens the agent to significant hazard.

Invalid solicitations :- The merchant may issue a receipt for an uncompleted administration or an item that doesn't meet necessities.

High legitimate expenses :- The planning and execution of authoritative reports is expensive and commonly includes outsider suppliers.

Cheating :- The vender and the purchaser may scheme to dupe the lender. Or then again the dealer may rupture their assention and demand an immediate installment.

The purchaser may question the installment risk and let alternate gatherings well enough alone for take, putting their notorieties at stake.

Bankruptcy : The purchaser may end up wiped out and unfit to pay for the solicitations, compelling alternate gatherings to endure the loss of assets.

OUR SOLUTION

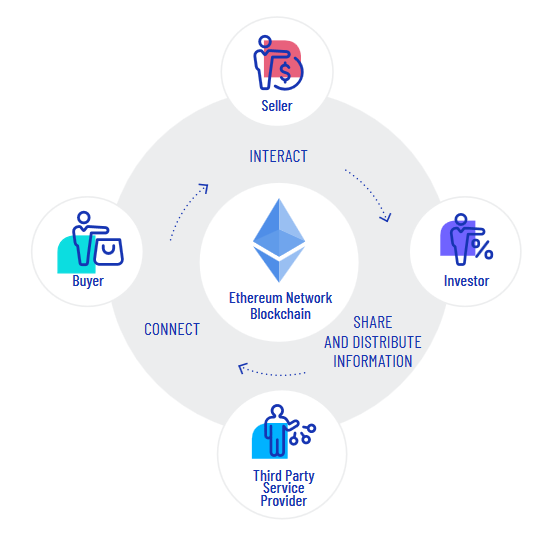

We're introducing another period of receipt financing by building a decentralized p2p stage where merchants, purchasers, and speculators are associated.

No Barriers:- Trust and straightforwardness between all gatherings are encouraged through permissioned access, checks and an in-constructed compensate framework.

Lower Rates for Sellers:- Sellers will have the capacity to get financing at bringing down loan costs than typically got from a conventional financer.

Assorted variety for Investors:- Investors will be allowed access to a speculation item that is for the most part just accessible to banks and fund organizations.

Dynamic Invoices:- Dynamic solicitations empower all gatherings to refresh receipt data progressively, guarantee changelessness and oversee delicate data get to.

Associating Sellers to Investors:- Sellers will have guide access to singular financial specialists. This new disseminated distributed loaning condition will profit the two merchants and the financial specialists.

Fractionalised Loans:- Invoice credits will be divided, enabling speculators to buy advances from a bigger pool, increment their enhancement and diminish their general hazard profile.

ROADMAP

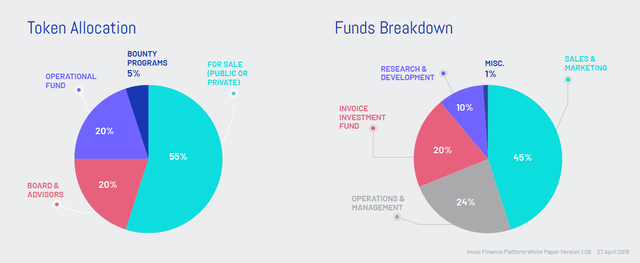

TOKEN ALLOCATION

FOR MORE INFORMATION PLEASE CONNECT WITH THE COMPANY BELOW:

WEBSITE | WHITEPAPER | TELEGRAM |

A review done by HOBISH |

Nice to see people writing in what they are passionate about

Great article. Have voted/followed, would love a vote/follow back :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great! sure will do that.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit