Authors note: I own holdings in most of the larger and some small-cap privacy coins.

More than Darknet Convenience

People really don't get to the bottom of why privacy cryptocurrency is so very important. I've read so many opinion pieces on privacy coins that are little more than cut and paste reviews of the old same coins, or at worst blatant shilling. Hodl tight though, I'm going to artfully incorporate such blatant shilling while also addressing why I believe privacy coins are truly important and can be a potentially life-changing technology for a huge portion of the world. A portion who are currently being either exploited, oppressed, or both. That's right readers, we don't have to employ libertarian rhetoric to justify why privacy crypto is valuable to the world anymore. Don't worry though, this won't stop millennials buying molly and shrooms on the darknet.

Privacy of course, is a state where you are not being observed or disturbed by anyone else. Unfortunately, if you use the internet nearly every service operator has made it their raison d'être to use your freely provided information to make money. Facebook, Google, CafèMom.com - all the usual suspects track and profile you, predict, test, and refine how to sell you products and services. They monetise your behaviours, preferences, and propensities. Some of us think it's gross and a misuse of information that was gathered unwillingly, unknowingly or begrudgingly (does anyone voluntarily use anything other than Gmail?). Some of us (as these companies do) see it as the implicit cost to use these services. In any case when you opt-in you're hoping that these companies will use the not insignificant volumes of data your very existence produces in a responsible way.

In a shocking twist that none of us saw coming, it turns out they don't (ahem, Facebook, Google, Google, Google, and the rest).

These companies and the people who use their products and services have effectively arrived at the following conclusion: Privacy must be compromised for convenience. This is a loathsome idea. And it's simply not true. The fact is high volumes of profiled user data just creates duplication, unnecessarily identifiable, and irrelevant knowledge (because that's what it is - knowledge of you - once it's been analysed, catalogued and utilised) that is being kept for no other reason than to keep advertising costs low, and marketers lazy. It's unnecessary and has the potential to embarrass you if it were exposed, and it stinks to high heaven that you could be monetised for just wanting an email address.

Of course, it's probably safer to be surveilled by a company compared to say, a government. Because where Acxiom, Corelogic, and Mark Zuckerberg want sell you to advertisers, when governments misuse information, they can and will; vilify you, imprison you, seize your assets, persecute you, or in some cases, KILL YOU. And it's very hard to protect yourself when your government wants to arrest you, bankrupt you, or irradiate your sushi. They act with near impunity, total authority, and legitimacy (because they are self-legitimising).

Governments are powerful but unfortunately, they also make poor decisions. Time after time even the most generally benevolent governments can't help but break some eggs while making their social omelettes. They have countries to run and must balance the interests of many different groups.

Of course, we find governments on a spectrum of benevolence, through misguided but most likely well-meaning, all the way to ruthless, violent and exploitative. Many, many governments around the world, whether for these misguided or ruthless reasons undertake invasive and encompassing surveillance on particular groups, on each other, and on their citizens. This surveillance is invariably justified in the name of public safety from crime, terrorism, infidels, or furrys. But as we now know, the surveillance apparatus in many states has become a machine that frequently both oversteps its bounds and is subject to abuse. These percipient agencies aren't satisfied with data they can collect themselves, they drag the companies that produce, manage, and keep user knowledge into privacy's data fuelled funeral pyre.

This brings me to my second key point; these governments have decided on our behalf that privacy must be compromised for safety. Which is patently untrue. As well as deeply flawed.

Sooner later we need to realise that privacy is something you can sell, but you can't buy back. And whether it was for freedom, or "likes", or new emojis we've sold ours for pennies on the dollar. Make no mistake, both governments and corporates know what you do, what you like, how much money you have and what you do with it. They even collect, and I'm serious now, if you have ever bought novelty Elvis memorabilia.

But it shouldn't be this way. It's not necessary for either convenience or safety. In fact, the opposite is true - privacy is supposed to protect us from meddling. It's so important that privacy is enshrined in international human rights law. The Universal Declaration of Human Rights (Article 12, 1948) states:

"No one shall be subjected to arbitrary interference with his privacy, family, home or correspondence, nor to attacks upon his honour and reputation. Everyone has the right to the protection of the law against such interference or attacks."

Sure, the world has changed since 1948. You can't avoid the internet and the wide swath of free insight you create while using it. Unfortunately, this has enabled exactly the kind of arbitrary interference into our privacy the UN declaration sought to prevent. Now here's where I think the real case for privacy coins is. For when people whose rights are consistently trampled by governments and the situations they're forced to live in turn the screws even further.

Global Remittances are Ripe for Exploitation

Imagine you are a South Asian migrant worker in Bahrain (if you are this person, I'm so sorry that you're a living example of the toilet fire that is global remittance - it's honestly regrettable). You send money home to your family. At least as much as you can afford every month after paying for your bed in a 12 person dorm, your food and transport, repaying what you had to borrow to get to Bahrain in the first place, and assuming your employer hasn't withheld your wages for some petty reason. You transfer back whatever you have left to your family. At least after Western Union takes their ten percent for the privilege. Or if you and your family are lucky enough to have bank accounts in both countries, then SWIFT charge a transfer fee. Or a black market agent charges up to a 110 percent premium because of exchange controls on your currency, or international sanctions against your state, or because you just live in a kleptocracy. Global remittance is a USD 600 billion market, which is largely comprised of the poorest among us looking for opportunities to support their families by working overseas and the remittance market screws them utterly.

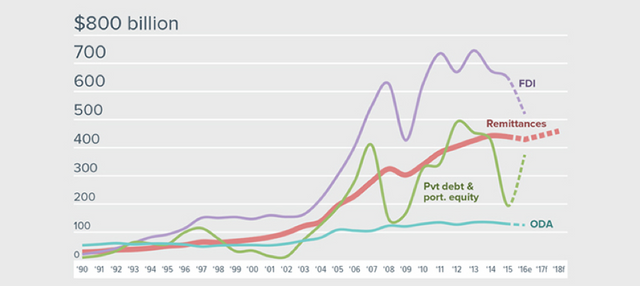

A remittance is the transfer of money by a worker in a foreign country back to their own country. Remittances make-up a large proportion of global capital flows to developing countries nearly tripling since 2000, to more than USD $582 Billion in 2015. This figure is expected to reach USD $640 billion by 2019. In fact, remittances are due to take over from Foreign Direct Investment (FDI) as the largest flows of capital into developing countries. These kinds of payments sit within the wider peer to peer payments market which is itself valued at a total of USD $1 Trillion per year. Developing countries, Led by India and China, see the vast majority of these remittances. In fact, these flows are so significant to some countries' economies that they comprise up to 41 percent of total GDP.

Remittances to developing countries, FDI, Debt, Equity and ODA

Source: World Bank 2016

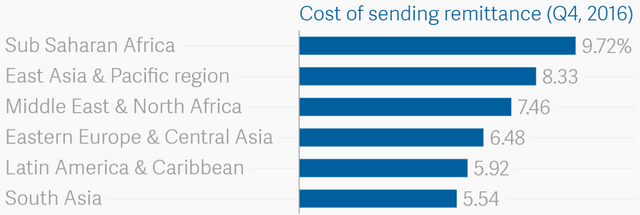

Despite the large global market for, and substantial flows of, capital, it still costs an average of 7.09% of the total remittance to send these funds. In Africa, the average cost to send USD200 is fifty dollars. It's a huge and significant market and is run by for-profit companies with near monopolies, backed up by black-marketeers who in turn monopolise desperation in countries where exchange controls, sanctions, or other factors limit personal capital flows are in place.

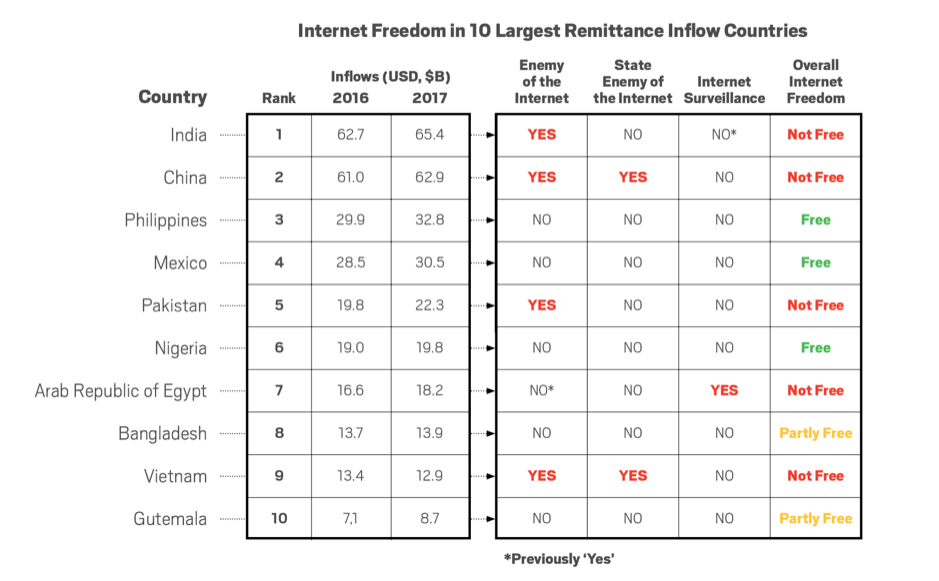

Coincidence or no, the countries with the highest volumes of inbound remittance also tend to be some of the worst governments for exactly the kind of abuses of their citizens I've outlined above. In fact, here's a handy table that lines up the highest remittance receiving countries, to the kind of invasive surveillance that governments engage in.

Table: Countries with the largest flows of remittance vs controls over internet freedom

The sources for these remittances aren't much better - the United States is the largest source, sending $56.3 billion in 2016. Naturally, due to pervasive surveillance, the US is listed as an enemy of the internet by Reporters without Borders.

Saudi Arabia, Russia, United Arab Emirates, United Kingdom, France, and Bahrain, all significant sources of remittance, all are either past or present offenders of internet and privacy freedoms.

Notably as well, a number of these countries are either trying to, or have succeeded in blocking Tor and/or have banned the use of VPNs which are used to protect internet users from scrutiny online.

Just to add insult to injury, our remittance sending and receiving countries tend to cut a swath through the most corrupt parts of the world and the governments most prone economically oppressing their citizens. Economic oppression is a means by which governments can exert control over its public. This allows for a dominant social group to maintain and maximise its wealth through the intentional exploitation of economically inferior subordinates. Governments have particular capacity to enact this type of oppression due to their control over currencies, policy and law enforcement. Countries that exhibit measures of economic oppression include: North Korea: which often intercepts grey-market remittances and may divert them towards military uses. China, which restricts individuals from sending money out of the country. While Russia has been described as a kleptocracy where organised criminals and corrupt systems of bribery act like a parallel tax system.

The fact is, if you are one of the millions of migrant workers around the world who wish to send money home, you're more than likely being watched and if either your host or home countries wish to intercept, tax, or confiscate your hard earned yet meagre earnings, you're shit out of luck. This kind of oppression is occurring in all major remittance corridors. Donald Trump wants to seize remittances to Mexico. In Africa, Nigeria changed their international transfer policies to cut off illegitimate channels of remittance, and ended up revoking the licences of most IMTOs (international money transfer organisations). This left an oligopoly of large global players who are doing their best to make sure Africa is the most expensive place to send money to. The result was a skyrocketing black market rate for the naira.

Average costs of remittance by region

Migrant workers collectively send developing nations their second largest capital flows. Despite these people being subject to poor public policy, conditions, and low wages, high debt, and either being at risk of or currently under oppression, an average of seven percent of their remittances are taken by third parties that are institutionally corrupt, subject to political tampering and influence, and under constant surveillance by foreign governments.

Taking Little Payments Back from the Big Man

This is where the real use case for privacy coins is. Cryptocurrencies offer a means of transacting that's decentralised - meaning we don't have to put our trust in a central authority, it's far harder to censor, and there is no central point of failure. The owner of the keys to a wallet owns the currency in them and those keys can be stored securely, either digitally or physically or both. They're hard to confiscate in that way because you can take precautions to secure them to everyone but yourself. Blockchains are transparent too. If you want you could look back at every transaction that's ever been made using bitcoin, ethereum, or any number of coins. That transparency is core to their value - it's what makes it a trustless system. But that transparency has its downside too, if you are being persecuted, surveilled, or economically oppressed by a government that wields its power inappropriately, then transparency becomes a liability. It's already well established that your activities on the bitcoin blockchain can be traced using a range of means.

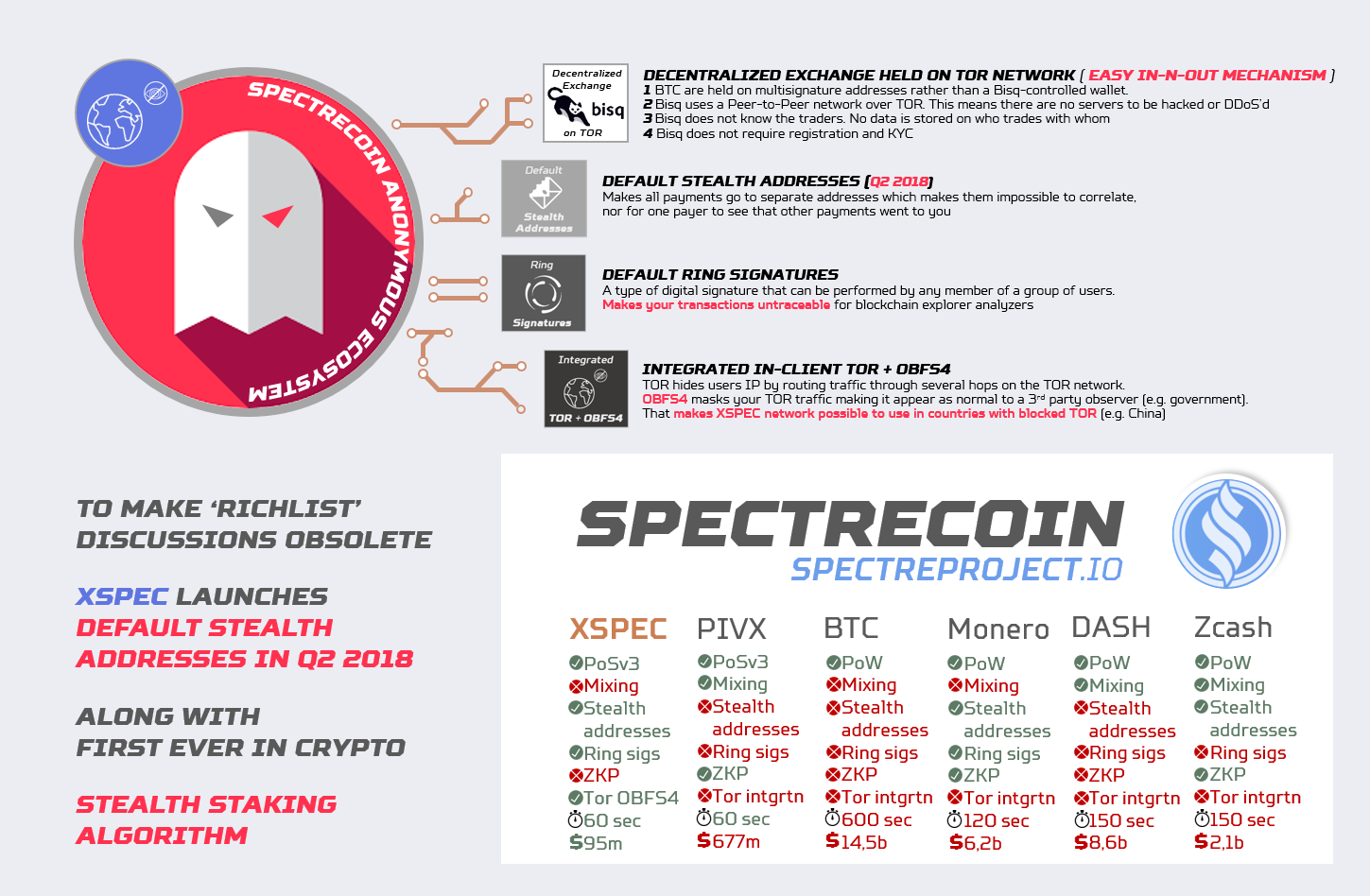

Privacy coins on the other hand utilise a number of technologies for disguising, anonymising, and obfuscating the range of unique identifiers that comprise blockchain transactions. These include your IP address, wallet address, transaction hash, amounts transacted, etc. This anonymisation can be implemented in a range of ways including the use of stealth addresses, mixing, ring signatures and CTs, and Zero Knowledge proofs. There's plenty of information available if you want to know more about these. But the takeaway here, is that currencies with these privacy features offer users the benefits of cryptocurrencies: low fees, fast transactions, and a trustless system, without exposing them to the potential scrutiny of the global surveillance apparatus. When you're at risk of the loss, scalping, or appropriation of your money for simply trying to support your family this becomes a huge and potentially lifesaving benefit. Privacy coins enable the poorest and those with an urgent need to circumvent embargos that harm populations, curtailing the knock-on effects of poor public policy, and protecting citizens from the oppression of inept, authoritarian, corrupt, and thieving governments.

SpectreCoin as the Solution

Here comes the shilling. Now as I say above, I own holdings in many of the available privacy coins. And the reason I think they're important is because the scale and scope of surveillance has forced an imperative on us to wrest control of our privacy from the powers that be. ZCash, Monero, and PIVX are all good, privacy-oriented cryptocurrencies with a range of useful measure to protect transactional obscurity. But for small peer-to-peer remittances with the lowest risk of deobfuscation and best anonymity, I think SpectreCoin (XSPEC) has the strongest value proposition.

The key reason is its use of OBFS4 over Tor. While other privacy coins (and other coins in general) integrate Tor for privacy, as outlined above, a number of governments have previously succeeded in blocking it and even more are implementing deep packet inspection to identify and filter Tor traffic. OBFS4 masks Tor traffic to third parties making it look like a uniformly random stream of data - that is, it looks like normal web browsing. XSPEC also has its own protocol for small remittances - SpectreCash coming soon which will further improve the ease of transacting small peer to peer payments. Combine this with an upcoming localspectrecoins.com service for cash and eWallet exchanges, XSPEC will be more accessible to the unbanked masses.

It's also a proof of stake currency, so instead of being mined by people who can afford to buy and run rigs of graphics cards, holders can earn an annual five percent return for simply having a wallet and keeping coins. When you have saved an average of seven percent on your remittance and can earn a further five on your principle, you are all of a sudden opening new sources and volumes of wealth to the developing world.

I have said above, the value of privacy coins is in their capacity to mediate the forces of oppression, and the better equipped they are to do that, the more valuable they are. When that also places more wealth in the hands of its users that value has a multiplier effect. The features of XSPEC as a platform for privacy and remittance place it at the nexus of accessibility and functionality for a huge volume of global flows of capital and for creating value and wealth for users. Utilising it as a payments mechanism for small remittances is a solution to privacy concerns that means there is no compromise on either convenience or safety.

At the time I wrote this the cryptocurrency market was in the early stages of a recovery after the January 2018 dip. On the morning of the 26th of February 2018, Coinmarketcap puts the total market at $435 billion. This is about $175 billion (thirty five percent) smaller than the value of the global small remittances market. Privacy coins only need to claim a small portion of the value of that market to add substantially to their own capitalizations and the value of crypto as a whole. This is why I think privacy coins are a win-win for investors, speculators, and for the senders of small remittance. We need to create channels where remittances are private between sender and receiver, costs to send are mitigated, and institutional senders can no longer price gauge the poorest and most vulnerable peer to peer transfers of funds.

Privacy coins, led by XSPEC, fill that niche, stymie surveillance and quite possibly save lives.

Very nice article

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted ☝ Have a great day!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i also hold xspec. have a $0.01 up vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @honeybeesquad! You received a personal award!

Happy Birthday! - You are on the Steem blockchain for 1 year!

Click here to view your Board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @honeybeesquad! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit