The European cryptocurrency exchange of trust for individual and institutional traders and investors.

Bitcoin introduces a platform on which you can run currency as an application on a network without any central points of control. A system completely decentralized like the internet itself. It is not money for the internet but the internet of money. — Andreas Antonopoulos

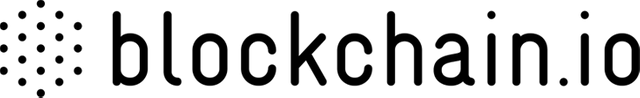

Welcome to the Internet of Value!

In the same way as the Internet redefined global communication, Bitcoin and other cryptocurrencies are now reinventing money and value transactions.

Before Bitcoin, money was defined by State sovereignty over a territory. From now on, any community can mint its own money in form of a cryptocurrency or digital token and start trading without any central supervising authority.

In 2017 alone, Initial Coin Offerings (ICOs) raised around $5 billion. Each project was financed by a community of token holders who became its ambassadors. There are now already tens of millions of token holders.

Digital tokens are like better, smarter cash. They are programmable money. Immediately liquid, indefinitely fragmentable, and instantly transferable, they can be programmed to meet the needs of particular assets, rights, goods, or services or of specific communities. The coming years will see a multitude of cryptocurrencies. New cryptographic developments and payment applications will allow us to transact in all these currencies, with the traditional "fiat" currencies retaining their role as price anchors.

Exchanges will be the marketplaces where cryptocurrencies will be traded against each other and with fiat currencies. Cryptocurrency exchanges will be the bridges between blockchains powered by Bitcoin, Ether and other cryptographic protocols. We confidently expect the Internet of Value to gain mass adoption, just as the free peerto-peer networks that preceded it on the Internet, namely email and the Web, did.

The Internet of Value will trigger new waves of innovation in financial systems and beyond. It will bring financial inclusion to the billions of people who are still unbanked today.

The three pillars of Blockchain.io’s offering are:

1) Crypto-Exchange

Built on Paymium’s proven security and technological record. A high level of digital asset protection and safe record of transactions.

Crypto Exchanges' Problems that Blockchain.io Aims to Fix

- Security Breaches - High volume crypto-assets platforms are constantly attacked by hackers who seek to bring the systems down, typically through DDoS attacks. Fraudsters also try to break into accounts using social engineering to steal cryptocurrencies from users. Many high-volume platforms could not withstand these attacks and were forced to shut down. Case in point: In August 2016, a large platform acknowledged the loss of 120,000 BTCs (bitcoins) for a value, at the time, of USD 75 million. It is estimated that since 2011, at least three dozen major heists against cryptocurrency exchanges occurred. Close to 1 million BTCs were stolen.

- Non-compliance - Many users had their assets seized or frozen due to platforms’ lack of compliance with national and international laws and regulations. Case in point: An exchange had inadequate AML and KYC procedures. When the State of Washington decided to regulate Bitcoin exchanges, this platform chose to suspend the accounts of users from that State. Case in point: In September 2017, following a national ban by the Chinese (PRC) State, China’s largest exchange suspended its operations.

- Opacity - The management and operations of some exchanges are opaque. They have very poor customer service and do not respond to user enquiries. Users are exposed to high risk and uncertainty, which creates massive tension as stress quickly spreads in the community. Case in point: In July 2017, the U.S. government brought federal charges against a platform for money laundering and operating an "unlicensed monetary service." The platform was shut down and reopened only once the full inquiry was completed and a court decision was made. Some exchanges operate dark pools (OTC or Off-Exchange transactions) and don’t address price manipulations, therefore allowing some market participants to spoil others.

- Outages - Many platforms experience service outages in periods of high volatility. This obviously results in major losses for traders and investors. Case in point: In June 2017, a platform shut down for several hours causing a 25% decline in the price of both BTC and ETH. Case in point: In August 2017, following performance issues which caused a flash crash, a platform delisted tokens, suspended trading on currency pairs such as the ETH/GBP, and removed advanced functionalities such as its cryptocurrency borrowing facility and margin trading. After the outages, most exchanges simply try to resume operations as quickly as possible and seldom fix their accounting records or upgrade their server infrastructure.

2) Decentralized Settlement

Built on fair-exchange protocols enabling cryptocurrency atomic swaps to mitigate counter-part risk.

Combining a Centralized Exchange with Decentralized Settlement

Blockchain.io will be dedicated to exchanging cryptocurrencies against each other, a complementary offering to the founders’ fiat exchange, Paymium.

The Blockchain.io platform will combine the new-generation technology of a centralized custodial exchange with decentralized “trustless” cross-chain “fair exchange” settlement. The centralized cryptocurrency exchange will be a low-latency, full-featured exchange with custody services, centralized order booking, and efficient order matching. As Blockchain.io grows, it will add more functionalities such as margin trading, proprietary lending, and peer-to-peer lending.

The decentralized cross-chain settlement will be based on cross-chain atomic swaps, i.e. cryptographic protocols that allow users to settle transactions across heterogeneous blockchain networks without ‘trusted’ third-party and without counterparty risk. This will represent a big departure from traditional markets and a major step toward the Internet of Value.

3) Liquidity Services

Advisory and technology services to execute third-party ICOs. New listing and market making services to foster enhanced token liquidity.

Blockchain.io will jumpstart liquidity in three specific ways:

- ICO services offering to assist issuers with their ICO campaigns and ICO listings,

- Listing of other tokens (Non-ICO),

- Market making using Blockchain.io inventory,

- Custody and brokerage services for institutional clients,

- Incentive program for Paymium users to ensure the smooth and seamless transition of the community to the new services. The 170,000 accounts of Paymium will become the first community to access Blockchain.io services and the Internet of Value.

ESSENTIAL FEATURES

The main features of the cryptocurrency exchange Blockchain.io are:

Ultra-Secure & Decentralized

- The centralized part of the exchange offers highly secure custody services with cold storage and cryptographic proof of reserve.

- Cryptocurrencies are held in cold storage (offline) for at least 98% of reserves.

- A cold wallet access requires multiple signatures.

- A cold wallet private key is split and held in a number of different vaults in multiple locations.

- Other in-house security processes and technological features.

- Internal procedures protect the exchange from social engineering attacks. Periodic technical audits and timestamped logs allow detection of any tampering attempts in the accounting database

- Periodic financial audits verify that the inventory of coins (assets side) matches the records of liabilities with cryptographic proof. If the exchange’s customer balances are checked against a blockchain inventory of coins (utxos in Bitcoin language) every block interval, there is little or no room for a rogue intruder to alter database records with profit.

- Decentralized settlement relies on fair-exchange protocols allowing atomic swaps of cryptocurrencies to eliminate the counter-party risk inherent to a custodial exchange.

Fully Compliant & Transparent

- Exhaustive accounting records are audited by independent professional auditors to ensure the integrity of the trading platform.

- The exchange aims to comply with all current applicable EU regulations, ensuring that assets never get seized or frozen.

- Customer balances on the liability side must match exactly the inventory of coins held by the exchange. Blockchain.io aims to perform such balance check and to publish its cryptographic proof at every block interval.

Reliable Infrastructure

- Minimal downtime, typically restricted to server maintenance, application upgrades, or database migration.

- Resilience under high volume, heavy traffic conditions, or DDoS attacks.

- No technical debt: exchanges that quickly add new altcoins or new features without proper testing or careful software design accumulate technical debt by taking shortcuts. Technical debt translates into applications that are harder to maintain and prone to bugs and security holes.

- Blockchain.io will attract high volume traders with specific features such as a FIX API and a borrowing facility, but also with the high level of availability of the trading platform.

- Processing capacity in the first phase will be of up to 2 million orders per day.

Select Digital Currencies

- Cryptocurrencies will be listed on the trading platform following a strict vetting process (sustainability, technical, and deep protocol review) by our team of blockchain experts

- Regular updates and publications will inform platform stakeholders and the community through altcoin technical reviews and financial analyses.

ICO Execution & Token Listing

- Blockchain.io will provide ICO campaign support and token listing services to assist entrepreneurs and technologists in the planning and execution of their fundraising campaigns.

- Following the ICO campaigns, Blockchain.io will ensure that newly created tokens are listed on Blockchain.io to provide liquidity to investors and traders.

- In addition, Blockchain.io will create Token liquidity through:

- Market making using Blockchain.io’s inventory

- Incentive program for Paymium users.

Catering to Retail and Institutional Investors

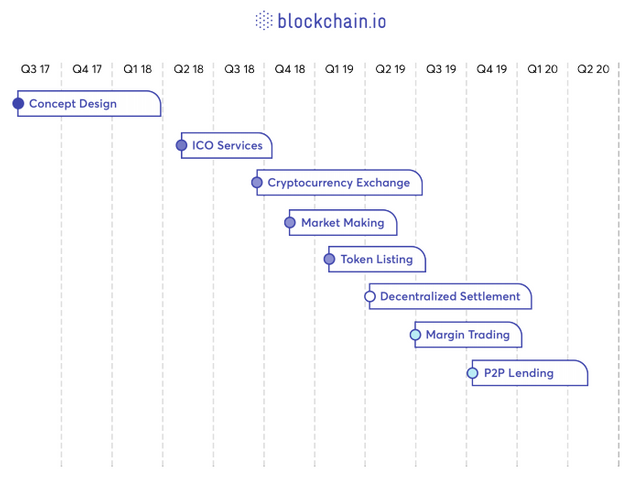

Blockchain.io Roadmap

Blockchain.io will progressively roll out new features over the next 18 months, starting with liquidity services and centralized custodial cryptocurrency exchange functionalities in 2018. Decentralized settlement and lending capabilities will follow in early 2019.

Team

Advisors