Pundits, of all ages and stripes have weighed in on the wisdom of Crypto. As you have heard, there are a few great grey eminences that are concerned about these crazy kids storming the bank. Fintech companies have always been burdened by their twin identities. Great financial firms need to be Clark Kent in the light of Fin and Superman in tech. The DC original made it look easy, it is not easy. Born on and of technologically advanced Krypton, it is hard to fit in on earth. So it is for technologically advanced cyrptos that have taken flight.

What you almost certainly have not heard is that there is some of that “ back to wholesome basics” in the Crypto movement. We see this angle pretty clearly hiding in plain view in an unexpected corner of the opportunity landscape, the security token space. What? Well as tokens capture mindshare and begin to demonstrate value, we are seeing a movement to incorporate best practices from a few different eras and asset types. Of course, these are early days and there are many different Crypto offerings or varying type and quality.

There is a real appetite among retail investors to find and enter areas where there is a perception of level playing field. Of equal important to many is the desire to know what you are buying, know what you own and be involved. Involved as a user and a little bit of a partner with the company. This is not so new or exotic. If you look at old ads for shares, or talk to older investors, this was a part of the investment story for ordinary folks in the not-so- distant past.

Everyday Americans used to buy stock in companies they knew and liked as users of

goods and services. Think the popularity of railroad stocks, AT&T and Coke. They

invested to be and to feel, invested. Regular dividend payments were part of the deal

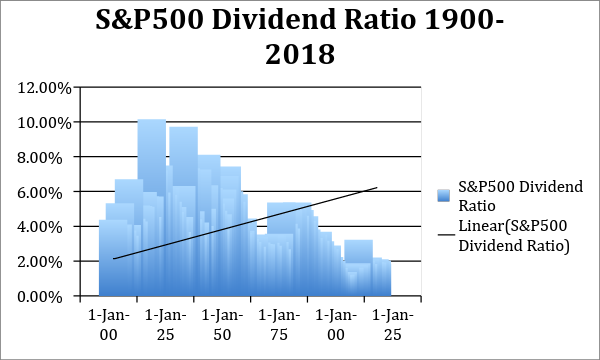

as well. You might have the sense that as you spent on telephone services, rail transport or a bottle of Cola, you were on both sides of the trade. Dividends were a real reason to buy and hold shares — generally the idea was you would hold the shares and leave them to the next generation. Thus, capital gains were a distant concern. Dividends and being part of the story made sense and motivated decision. This has faded. In no small part the fading has resulted from less and less dividend pay out. See below the dividends paid divided by the price paid for the shares in S&P500 index. It is not hard t make out the trend there. Ironically, the knock on Crypto is that it is motivated for capital gains only. Looks like that lesson was taught by the equity market?

The wave of Crypto investors is large and diverse. It is pretty clear that some people are buying in to use the currencies and protocols and even share in the incomes generated. Like old time equity buyers, they like the goods and services being offered and want to write themselves into the stories they are living as customers and investors. As the above makes painfully clear, that offer is not really to strong for traditional US equity buyers today.

A portion of the security token buying looks motivated by a very wholesome and historical desire to be part of the story of what you invest in — income and use. Maybe some commentators are confused about who is wholesome?