Traders will be able to exchange bitcoin, ethereum, ripple and USDT(also known as Tether, a USD backed cryptocurrency).Using Flux, which will go live on July 15.

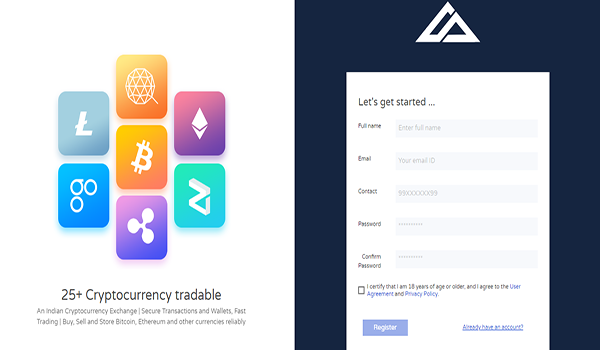

Coindelta, a Pune-based cryptocurrency exchange has joined the bandwagon of companies entering into peer to peer or P2P trading in order to bypass the Reserve Bank of India diktat which became effective last week. They also decided to launch a platform named Flux.

Shubham Yadav - the business head of Coindelta explained how Flux will work. A trader can sell his or her offer via the platform if they has already a wallet with the exchange and had cryptocurrencies stored in it. This will generate a link which can be seen by other traders on the platform.

If the deal is on, the buyer will need to transfer the amount to seller's account in a stipulated time. Once the deposit is confirmed by both the parties, Flux will transfer bitcoins from seller's wallet to the buyer's wallet.

In case there is disputes, the company has also built a dispute resolution system on the platform. Yadav said that, the system will try to resolve the disputes "swiftly".

The demerit of this is, if the trader decides to sell 10 bitcoins, it will not be able to use by the user until the sale is complete. It will be reserved by the system only.

Flux will have to compete against active players in the market and work on the same modus operandi. WazirX is one of the companies allowing users to buy and sell crypto for rupees directly with each other.

The buyer pays the seller in rupees and as soon as the seller confirms reciept of payment,WazirX releases the crypto to the buyer. The seller deposits the crypto with WazirX, which the brand escrows for safekeeping during the transaction.

Since the banks are no longer allowed to deal with cryptocurrencies, there are some concerns being raised about illegal trades using P2P which can be done through cash.

“It should be noted that government has not banned cryptocurrencies and it's trading. So, even if RBI comes down on P2P, people will still be able to file tax returns because they are disclosing their income from an asset which is not illegal in India. I don't see any problem with that at all. Even in case government bans it (in future), which will be really bad for the ecosystem, your returns will be from a period during which it was not illegal” Yadav said.

For enthusiastic traders, the P2P mode of trading could beat great way to circumnavigate the regulatory hurdles or the lack of any regulation itself since the uncertainty over the status of cryptocurrency lingers.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://sunnywebmoney.com/2018/07/10/pune-based-cryptocurrency-exchange-coindelta-to-launch-p2p-platform-flux/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit