Staying on track with our goal of being more focused on technical analysis, our team has been scouring charts for signs of harmonic patterns indicative of future price action movements. Sometimes, as we did, you’ll find the beginning formations of a pattern...

Here is what looks like the bat pattern forming on the 4-hour chart for Tron (TRX).

Based on the rules necessary for a bat pattern to be validated we feel as though Tron is in the process of completing the patterns “D” leg.

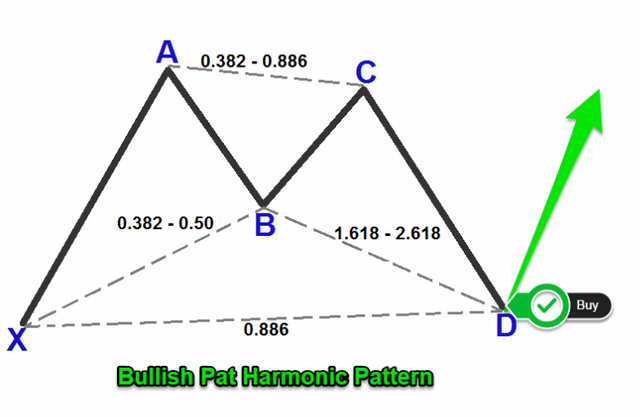

According to this trading strategy guide the following 3 Fibonacci rules must be met for the bat pattern to form properly.

1. AB= minimum 38.2% and maximum 50% Fibonacci retracement of XA leg;

2. BC= minimum 38.2% and maximum 88.6% Fibonacci retracement of AB leg;

3. CD= 88.6% Fibonacci retracement of XA leg or between 1.618% – 2.618 Fibonacci extension of AB leg.

Once completed, the pattern should look similar to this.

(Image Credit)

For now, we’ll be watching Tron closely as price action either validates or invalidates this analysis. To do the same, follow this chart here. Should the bat pattern become validated point “D” is certainly looking like a healthy place to buy however when doing this analysis we did notice a potential, shorter term Gartley pattern forming-which would put a healthy buy-in at a much higher point.

Do either of these scenarios seem likely to you based on your own analysis? Feel free to share any you may have done yourself or ask us questions about ours.

As always it’s been a pleasure!

°Br¡tT^N¥° (@TheJadeCrow on Twitter)

#NotFinancialAdvice

Hopefully won't dip that much!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit