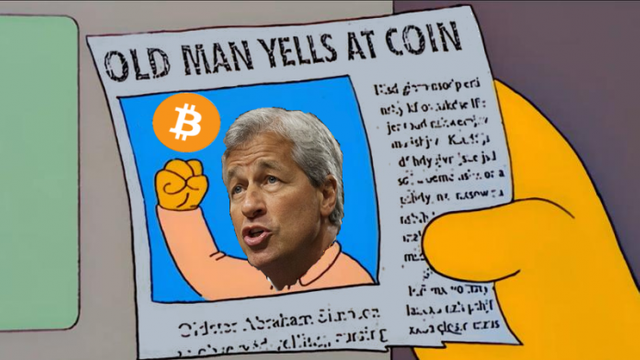

Perhaps cryptocurrency’s largest institutional nemesis is JP Morgan Chase. Led by the ever-belligerent Jamie Dimon, it and he have taken numerous opportunities to sandbag bitcoin and its spawn. Theories about why have long circled, but now there appears to be proof the legacy bank is threatened by decentralized currency in digital form, according to an internal annual report.

JP Morgan Chase Once Chastised Bitcoiners

In fractional satisfaction of its trustee obligation, JP Morgan Chase documented an Annual Report for 2017, Form 10-K: Annual report as per Section 13 or 15(d) of the Securities Exchange Act of 1934. It's a thorough report generally important to investors. This year, be that as it may, it contained strange knowledge into the institutional outlook of the United States' biggest bank.

Under the rubric Competition, somewhere down in the report, the bank stresses so anyone might hear: "The monetary administrations industry is very aggressive, and JPMorgan Chase's consequences of tasks will endure on the off chance that it isn't a solid and viable contender. JPMorgan Chase works in a very aggressive condition, and expects that opposition in the U.S. what's more, worldwide budgetary administrations industry will keep on being extraordinary."

Where rivalry appeared to be most outlandish, as per CEO Jamie Dimon, was in the zone of cryptos, for example, bitcoin. Broadly, Mr. Dimon chastised the individuals who held or exchanged bitcoin as "dumb." Indeed, the very idea, he kept up, was a "fake." He'd additionally assault his own particular workers who may set out fiddle as taking a chance with their exceptionally work accordingly. In spite of the fact that he'd later fallen off some of those comments a bit, strolling them back and nearly apologizing, the reality of the situation may be more in accordance with taking a page from the Niccolò Machiavelli playbook: criticize your rival with an end goal to limit his notoriety, knowing very well indeed that enemy might one be able to day have your lunch.

The Annual Report seems to reveal insight into the issue. It lists the standard suspects of different banks and organizations as contenders, cautioning forebodingly how "JPMorgan Chase can't give affirmation that the noteworthy rivalry in the monetary administrations industry won't tangibly and antagonistically influence its future consequences of tasks." This appears, in any event to a limited extent, because of the reality "New contenders have risen."

Disrupted by Technologies

After fast lines about the development of web based business, the Report at last turns out with it. "These advances have additionally enabled monetary establishments and different organizations to give electronic and web based money related arrangements, including electronic securities exchanging, installment preparing and online computerized algorithmic-based venture counsel. Besides, both money related organizations and their non-managing an account contenders confront the hazard that installment preparing and different administrations could be disturbed by advancements, for example, digital forms of money, that require no intermediation. New advances have required and could require JPMorgan Chase to spend more to alter or adjust its items to draw in and hold customers and clients or to coordinate items and administrations offered by its rivals, including innovation organizations."

What's more, "intermediation" is Wall Street talk for banks. Digital forms of money can have the possible effect of putting "descending weight on costs and charges for JPMorgan Chase's items and benefits or may cause JPMorgan Chase to lose piece of the overall industry," the bank uncovered.

What this essentially implies for the short and long haul with respect to the bank and crypto is impossible to say, however the accompanying appears to give a fairly expansive indication: "Expanded rivalry likewise may require JPMorgan Chase to make extra capital interests in its organizations, or to broaden a greater amount of its capital for the benefit of its customers so as to stay focused." at the end of the, prior day it can beat crypto, it could possibly need to join crypto.

The change is coming... it's better them be prepared!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think so

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit