Since the start of 2018 Mid & Small-cap stocks/indices have been in a downward spiral and what has escalated matters is the jumping off ship by most of the ‘investors’ in an attempt to find a safe haven in well-known large-cap stocks. This, in turn, has driven the valuations to a new high whether that is backed by a proportionate growth in earnings is a whole different discussion but as of now whatever can save the market participants from this ‘lathicharge’ is welcome. Well, that has been the story of investors for decades now, where they switch to the shorter line with the hope to get ahead of others only to find that had they stayed the course, their turn would have come much faster and without the unnecessary effort of running between the lines. Mass redemptions from mid & small-cap mutual funds during the past few months is an example of the same .1 So much for long-term investing!

Both irrational exuberance and too much pessimism can be dangerous. For an astute observer, there will be clear signs that markets are euphoric. All one needs to do is to keep an eye on the broader markets. Somewhere in the madness have a sense of how the indices (Nifty, Sensex & smaller indices) and their earnings are trending. Have a sense of the optimism in people, gauge how a common man feels about the economy and the stock markets in general. Be on the lookout for when the masses start making money on small ticket stocks as they can’t help but boast about their phenomenal track record which like their investment horizon would be ranging anywhere from a few weeks to months if not days. Keep your ears open at the chai shops, during the uber rides, during visits to public offices etc. for the conversations will mostly start revolving around stock markets which might not be the case a few months back, be on your guard as the party might stop any moment and you should not be the one holding the ball when the music stops.

This phenomenon is as repetitive as parents telling their kids to study or politicians making empty promises before elections. It plays out exactly the same way every single time but it’s up to us to learn from the lessons of history, as the famous saying goes ‘History doesn't repeat itself but it often rhymes’. The music might play for a little while longer than you thought but it’s better to be safe than sorry.

This investor behaviour is universal, as it’s independent of the markets, countries and people. For the sake of quoting I can go way back in history but 'recency' is a strong concept as it’s hard to get rid of the biases attached to it. So some recent examples of the point being made here would be the cryptocurrency crash of December 2017 or the deep mid&small cap correction in the Indian market since Jan 2018.

Too much euphoria, too much froth is unsustainable. Ever since the start August 2017, Every sh***y company was going 2x,3x or even 5x within a few days to weeks or months, people wonder why the mid & small cap market has corrected so much but the sensible thing to ask would be why did it go up so much in the first place. The earnings can’t just go up 4 or 5x in a matter of few months and surely not in most companies as was reflected in the index values. The horrific balance sheets couldn’t possibly have transformed into pristine financials within a matter of six months and the management which had been ugly duckling for the last umpteen number of years couldn’t possibly have turned into beautiful swans overnight. Then why exactly did the Bse Smallcap index go from 15k in August 2017 to 20k by jan2018?

Money was being made left right and center but nothing can defy the laws of nature. Nature checks everything that is in excess and markets don’t fall out of its ambit. Just like when there is too much heat and humidity, it must rain as the weather becomes unsustainable similarly markets have, will and must correct or crash depending on the level of extremes it has reached at any given moment. The heat might sustain longer than usual at the whims of a few self-proclaimed weathermen like the Harshad Mehtas of the 90’s but even they could not withstand the brute force of nature trying to regain equilibrium be it for the global ecosystem or the financial system.

Right before the cryptocurrency crash of December 2017, money making had become so simple that everybody thought that the only way to make money was to jump onto the crypto bandwagon. The crypto market had started to discount the future value of blockchain projects so severely that certain projects which didn’t even have an office or a team yet were being valued at millions of dollars. Certain projects which had no functional product were being handed billions of dollars via initial coin offerings, just in the hope of a new technology revolutionizing our future. That sounds familiar doesn’t it for the people who have lived through the Internet bubble of late 90’s. The earnings multiple for these blockchain projects was ‘undefined’ as they had no earnings. Then one might ask why were the prices going 10x-20x across the board within weeks? Well, I am still wondering why. I will let you know when I find the answer but I am pretty sure no logical explanation exists. Binance was one Blockchain based company which I discovered was making truckloads of ‘real’ money but it being a cryptocurrency exchange is understandable, after all the house always wins right! Anyways more on Binance in another post. For now, let’s have a look at the broader crypto market trend over the last one year:

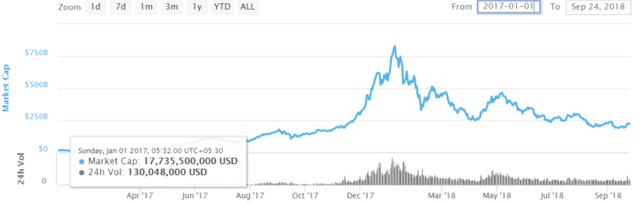

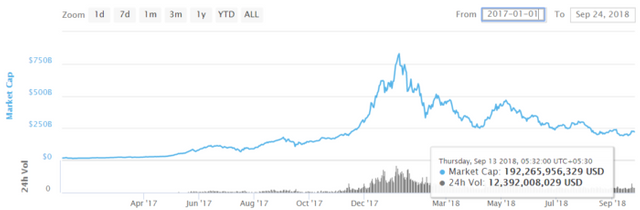

Source: Coinmarketcap.com

So here we are on 1st January 2017, the silence before the storm as the total market cap of all the listed blockchain projects in the world was roughly $18 Billion including Bitcoin. And if you haven’t been following this market what’s about to come will shake you off your seat.

Within one year the market cap of the same projects/with same fundamentals/ with no use case yet/with no earnings to show for swells to a whopping $828 Billion. That is a 46x jump within one year and if I take you through the price rise in some of the projects individually, it will blow your mind!

And as all excesses have to come to an end, the crypto market plummeted hitting a low of $192 Billion on 13th September 2018. And for the guys who were left holding the ball when the music stopped, let’s just say that they witnessed the worst crash in the history of any market in the world during any time period, with as much as 90-95% erosion of capital especially for the ones holding the low-quality coins of the blockchain world.

Basically, at the ground level, the technology was weak and it’s still evolving but the prices were discounting the future big-time and voila! We had a crash of epic proportions that followed taking the market down within a matter of a few months. A correction of that magnitude, we are yet to see in the stock markets ever.

So, young investors who had not experienced the stock market crash of 2008 would surely have gotten baptised if they had ventured into crypto in 2017-18. Rather 2017 in cryptocurrencies was a ‘crash course’ in investing as the whole cycle played out within one year compared to some of the maniacal stock market bull runs. Let’s just say, the frog boils faster in the crypto land!

During these times of extreme euphoria in the markets, you will find everybody ‘high’, be it market pundits, investment bankers, company management, mutual fund managers or retail investors. Everybody will be overly optimistic and the general belief would be that the markets can only go one way and that is up. The collapse of LTCM is a classic example of how even the masters of the trade can get carried away in such euphoric times.2

As an astute and contrarian investor, during times like these, you need to step out of this virtual circle of madness and observe the crowd objectively from a distance. You will see literally everybody disconnected from reality and that’s where your sanity has to prevail. As Ben Graham would say that’s where you differentiate yourself as an ‘Intelligent Investor’. Great book, by the way, a must read for anyone serious about investing.

The question arises how to objectively judge whether we have entered a dangerous phase. The first thing we need to do is to have one eye on the stock market Indices in general, FII activity, Mutual Fund activity and listen to what the soothsayers, as well as naysayers, are saying. Gather data points from everywhere but not opinions and ultimately remember these words of wisdom while making any decision in life and not just while investing:

‘BELIEVE NOTHING - No matter where you read it or who has said it, not even if I have said it unless it agrees with your own reason and your own common sense’ – Gautam Buddha

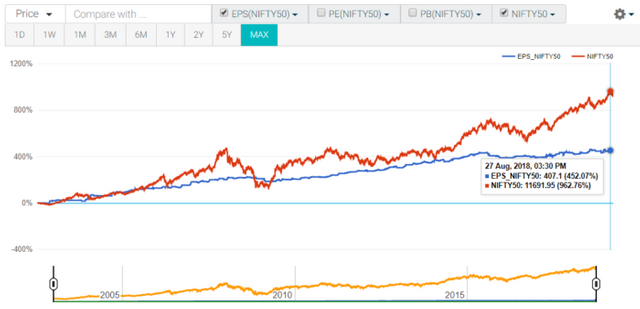

Nifty and Sensex are scaling new highs besides a few hiccups in the last few days but most would agree that India is going through a structural change backed by fundamentals. Definitely we are not amidst a hollow market rally like the one we witnessed in 1992-93 and fundamentals are even more promising than what we had at the start of the bull market of the early 2000s but let’s look at some charts to decipher whether the current peak is being backed by proportionate improvement in key financial parameters or not. Let’s also look at what history tells us about our market trends, let’s see how much is the fundamental contribution to these returns and how much is speculative during this rally.

Source: trendlyne.com

The above chart is a comparison between the movement of NIFTY 50 (in red) to the EPS Growth (in blue) of the NIFTY 50 stocks as a whole over the long term. A more recent divergence between the two is quite evident.

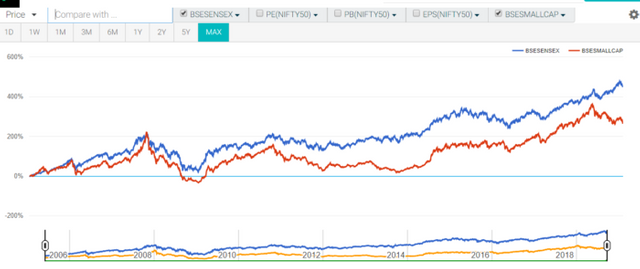

Normally, the two indices (large and smallcap) move in lockstep with each other and any divergences are corrected by one realigning itself with the other as it can be seen at multiple occasions in the past. A similar divergence can be seen happening now, what will happen next is anybody’s guess but ‘caution’ is the word during such times.

Besides getting an opportunity to play contrarian in times like these, another big advantage of being aware of the fact that markets are in a state of dissonance is that one can lighten up on his positions or gather some cash to make the most of the times when extreme pessimism prevails which is a given after a raging bull run, as markets are notorious for having excesses equally on both sides.

Underlying truth is that everybody wants a bubble because quick money is made in a bubble but what we underappreciate is that even greater money is lost in bubbles and much faster. Markets tend to become more and more efficient with every bubble and the crazy ups and downs you see today in the crypto markets or what you saw in the Indian bull market of the early 90s tend to flatten out over the years like we see in more mature financial markets but if one can learn to navigate these bubbles successfully there is a lot of prosperity on the other side in the long run. We just need to be more vigilant and avoid pitfalls, the opportunities will invariably present themselves. And if you don’t lose money in the markets, you will invariably make some.

In the Indian context more and more bull markets of the future will be based on fundamentals rather than speculation, so our job as intelligent investors is to protect and grow our capital so that we can participate in all those rallies and make the most of them.

Remember friends, nothing structural and sustainable in life ever grows in a parabolic fashion. But if due to a momentary ‘BRAIN-FADE’ of the masses, it does happen and you manage to make some quick money then take your butt out as soon as you can because that parabola will collapse soon. Markets walk up the stairs but come down in an elevator. And you don’t want to be standing underneath it when that happens, do you now?

I will leave you with a great quote from Howard Marks worth pondering over:

Thoughtful investors toil in obscurity, achieving solid gains in the good years and losing less than others in the bad. They avoid sharing in the riskiest behaviour because they’re so aware of how much they don’t know and because they have their ego in check. This, in my opinion, is the greatest formula for long-term wealth creation – but it doesn’t provide much ego gratification in the short run.

References:

https://economictimes.indiatimes.com/mf/mf-news/equity-mutual-funds-see-highest-redemptions-in-last-five-months/articleshow/65721176.cms

https://en.wikipedia.org/wiki/Long-Term_Capital_Management

Disclaimer: Non of the content on this blog should be construed as investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. All information is a point of view and is for educational and informational use only. The author accepts no liability for any interpretation of articles or comments on this blog being used for actual investments.

While we may talk about strategies or positions in the market, our intent is solely to showcase effective risk-management in dealing with financial instruments. This is purely an information service and any trading done on the basis of this information is at your own risk, sole risk.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@investorsingh.com/history-rhymes-d6b64b20ee2

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @investorsingh! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit