Applications Protocols are the better investment here's why.

“the market cap of the protocol always grows faster than the combined value of the applications built on top, since the success of the application layer drives further speculation at the protocol layer.” — Joel Monegro

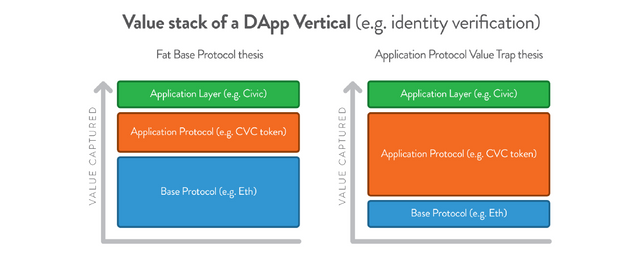

In Fat Protocols, Joel Monegro predicted that the blockchain will turn where internet value is captured on its head. He showed how in the current internet, HTTP or TCP/IP captured zero value, while FANG (Facebook, Amazon, Netflix, Google) made billions. However, in the new ‘blockchain’ internet, the protocols capture the majority of the value, while companies only capture a slither. Bitcoin is worth over $137 billion, while Coinbase, the most valuable Bitcoin company is only worth $1.6 billion. In fact, in 2015, had DFJ and others invested their $75 million equity investment directly into Bitcoin instead of Coinbase, it would have been worth $2.5 billion, much more than their undisclosed share of $1.6 billion. The Fat Protocol theory has caused many investors to believe ‘the lower the better’ and thus prioritise investing into ‘base protocol’ layer coins (Ethereum, EOS, Tezos, etc.) because this is where they believe major value will be captured.

However, protocols have evolved, this thesis is now outdated. Application Tokens are the Value Trap. This post will show why.

![Web 3.0 Value stack. (Inspiration)[http://www.usv.com/blog/fat-protocols]](https://steemitimages.com/DQmWYBhYF5rZS2yUi54iFUpU87XUF2r6cbz9KggfquZ4Bwn/image.png)

Layers of Protocols

The Web 3.0 or the new blockchain stack has projects with multiple layers of protocols. Very few projects have a single layer. One of the layers is the application protocol which encases the token economy of the decentralised application. For example, Civic has multiple layers. The ‘processing layer’, either Ethereum or RSK, a file storage layer (perhaps FileCoin in the future), other critical infrastructure layers (such as inter-protocol connectors) and finally the $CVC layer, which governs the crypto-economies surrounding the identity verification economy. All of these layers are protocols in their own right and will make up the identity verification value stack in this case.

The value stack is shown above. The question is what it will look like when the system is at scale? Does the base ‘processing layer’ capture the majority of the value or does the application protocol capture it or is it split? How can we tell?

One can answer these questions by applying aggregation theory. The theory states that “the value chain for any given consumer market is divided into three parts: suppliers, distributors, and consumers/users. The best way to make outsize profits in any of these markets is to either gain a horizontal monopoly in one of the three parts or to integrate two of the parts such that you have a competitive advantage in delivering a vertical solution.”

For the new blockchain age, it should be: “the economy for any given decentralised vertical is divided into three parts: base protocols, application protocols, and consumers/users. The best way to capture outsized value in any vertical is to either gain a horizontal monopoly in one of the three parts or to integrate two of the parts such that you have a competitive advantage in delivering a vertical solution.”

So, what does that mean? It means in this case that whichever protocol can aggregate two parts of the system or own an entire horizontal layer (e.g. processing smart contracts) will dominate. If it can dominate then it can extract more value and thus maximise its network value.

Let’s examine the first option, “horizontal monopoly in one of the three parts”. How likely is it that a base layer protocol will grow to dominate an entire horizontal? And even if it does, will this allow it to extract value? Let’s consider Ethereum in the smart contracts horizontal. Currently, Ethereum captures the ‘transactional volume’ or processing fees of smart contracts using it, which should grow in number. But, Ethereum is also implementing various scaling solutions, and so the fee required to process each transaction will drop. Scaling, coupled with competition from EOS, NEO and Tezos (class action lawsuits aside), should commoditize the ‘processing layer’ and may drive fees to near-zero. Secondly, the open-source nature of these network protocols allows for forking, which enables bespoke designs for niche use-cases and thus reduces the competitive advantage of ‘general’ base protocols. Lastly, projects like Cosmos, Polkadot and Blockstack are already virtualizing the blockchain by providing interoperability. This would further commoditize the processing layer, and in turn these interoperability layers could try and extract value by becoming the aggregator. Thus, it is unlikely that even a project like Ethereum, with its team of savants and current smart-contracting domination, can gain a horizontal monopoly; and even if it did, the current value proposition is likely to be commoditized away in the pursuit of ever-cheaper transactional capacity.

What about the second option “integrate two of the parts”. How likely is it that a protocol can be utilised by consumers and provide value? Application protocols should ‘own’ the end user because of their proximity. It is significantly easier for application protocols to aggregate end users than a base protocol. Users will share in the value captured by the economy of correctly designed application protocols through owning the tokens. This creates evangelist users who spread the application and its protocol and further increase use and value at the application protocol layer. These users will likely be completely unaware of the underlying processing protocol. Effective interoperability between application protocols and a myriad of base protocols in the stack below will further drive commoditization as applications simply search for the base protocol which optimizes a core mix of security, throughput and cost.

Two points worth emphasising. Firstly, the correct design of application protocols refers to the crypto-economic design and this is critical. An incorrectly designed system may suffer from hyper velocity, which would limit its ability to capture value. Conversely, a correctly designed economy ensures the application protocol is a Value Trap that captures the ‘transactional value’ or value of all transactions in the economy, within a vertical stack (i.e. identification verification). Secondly, not all application protocols have the correct economic design, or are even genuine projects. I.e Buyer Beware! In the short term, this creates trust and selection issues; however, the market is quickly correcting. Badly designed token economies (and scams) are less likely to raise significant capital than even two months ago.

But, wait, the internet was built out first with infrastructure and then applications! So won’t blockchain do the same?

I read internet comparisons all the time and they typically miss one key point — when the internet was built, there was no internet! This has two implications, modular decentralisation and historical lessons. 99% of the infrastructure needed for DApps already exists in a centralised manner. Yes, it is slowly going to be decentralised and in the future applications will be natively decentralised, but until then centralised systems work as valid substitutes (e.g. AWS vs. IPFS). So the question should rather be what do the current internet giants, FANG, have in common? The answer is aggregation of users. If I draw one comparison to the internet, it is that I think protocols which aggregate users will dominate in Web 3.0. After all, decentralisation is about removing the middleman to create trustless hyper-efficient markets (in any vertical).

But, why try pick the next big application protocol if I can just ‘buy the piping’ instead and derisk?

Picking the winning horse(s) out of a selection of base protocols is tantamount to picking winners in a selection of consumer-proximate protocols (from a diversification point of view). Application protocols project utilisation onto the base protocol layer below, not value, and the ‘base protocol investment thesis’ is investing without considering crypto-economics and the flow of value in a vertical stack. A well designed consumer facing application protocol that is able to bootstrap up to full functionality, given the infrastructure is already available (i.e. using AWS while Filecoin is rolled out), presents a highly attractive medium- to long-term investment thesis in order to capture the blockchain industries growth curves and first-mover advantage.

But, Bitcoin! It’s a base layer and its the most valuable?

In my view, bitcoin has aggregated the base layer and application layer. Bitcoin’s use case is limited but very powerful. Dan Morehead, of Pantera Capital, describes it as MoIP (money over IP). I believe the use case is actually GoIP (Gold over IP) for the time being. This limited use case means there are no application protocols which can be built on top of Bitcoin and commoditize it in the vertical it is currently dominating — government resistant money storage. Even though it has competitors for this vertical such as Bitcoin Cash, Litecoin, Monero etc, at this stage it is winning.

Conclusion

The ability of a protocol to aggregate the value stack will determine whether it captures the most value. According to aggregation theory, correctly designed application layer protocols should aggregate in their respective verticals. Furthermore, if these different verticals are adopted (because they are a killer use case of blockchain), then the value of transactions in the application protocol economy should exceed fees based off transactional volumes. In turn, this allows the application protocol to be the value trap. Thus, in the long run, thematic application layer investing in different verticals should outperform horizontal base layer investing.

Note: I didn’t mention the applications themselves. In truly decentralised systems, these are just glorified UX and will proportionally accrue very little value. (In Coinbase’s case, still over $1.6 billion! But still just 1.16% of the underlying bitcoin protocol). It’s still too early to tell if the captured value will typically be 1% or up to 10% of the overall value, but at this stage, the limited data indicates a very small percentage.

Do you agree with this post? Let me know your thoughts in the comments below or tweet me.

First posted on my Medium page November 21,2017

✅ @jameskilroe, congratulations on making your first post! I gave you a $.05 vote!

Will you give me a follow? I'll follow you back in return!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/newtown-partners/application-protocols-are-the-better-investment-heres-why-7a2efdde594e

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I gave you an up-vote. It would be great if you could return a favor. Please follow me if you like and we can share posts and up-votes and help build our profiles.

Thank you!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @jameskilroe! You have received a personal award!

Click on the badge to view your Board of Honor.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @jameskilroe! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit