Changes since yesterday's analysis:

-Stellar surpasses Litecoin to become 6th largest cryptocurrency

-NEO surpasses EOS and NEM to become 8th largest cryptocurrency

-EOS surpasses NEM to become 9th largest cryptocurrency

Here is my analysis of the top 10 cryptocurrencies as of 1/24/18

(All chart times are in UTC time, the RSI is based on the closing price of the previous day and the RSI projection is based on current UTC time)

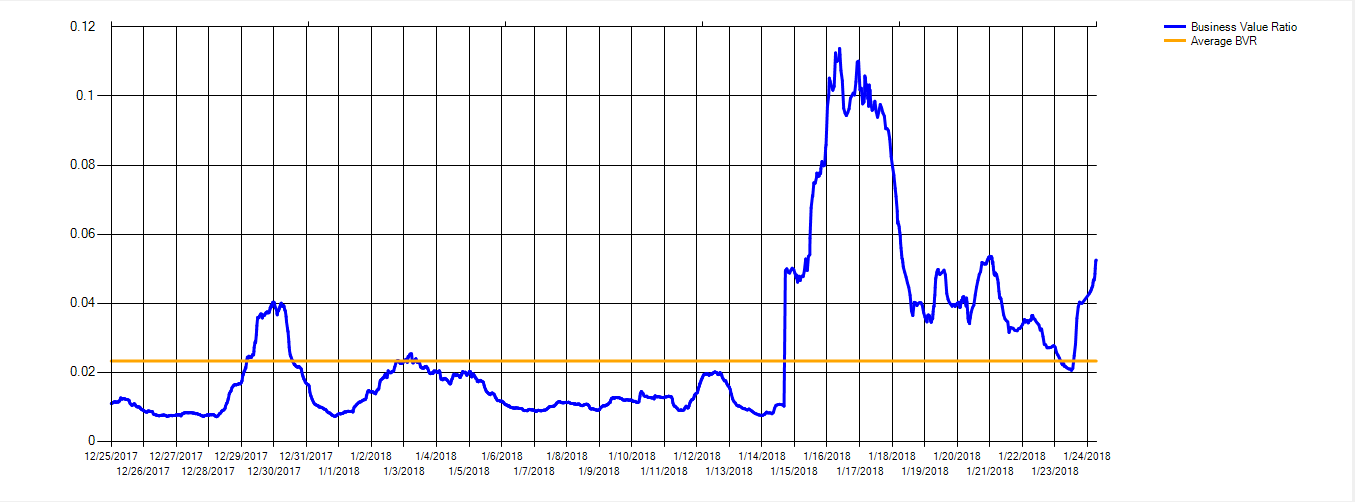

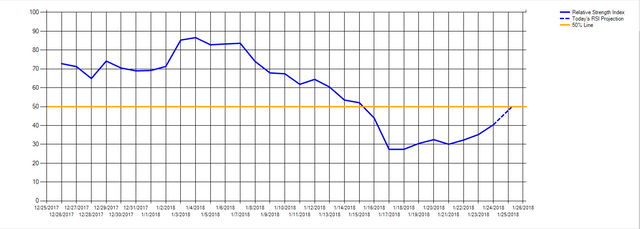

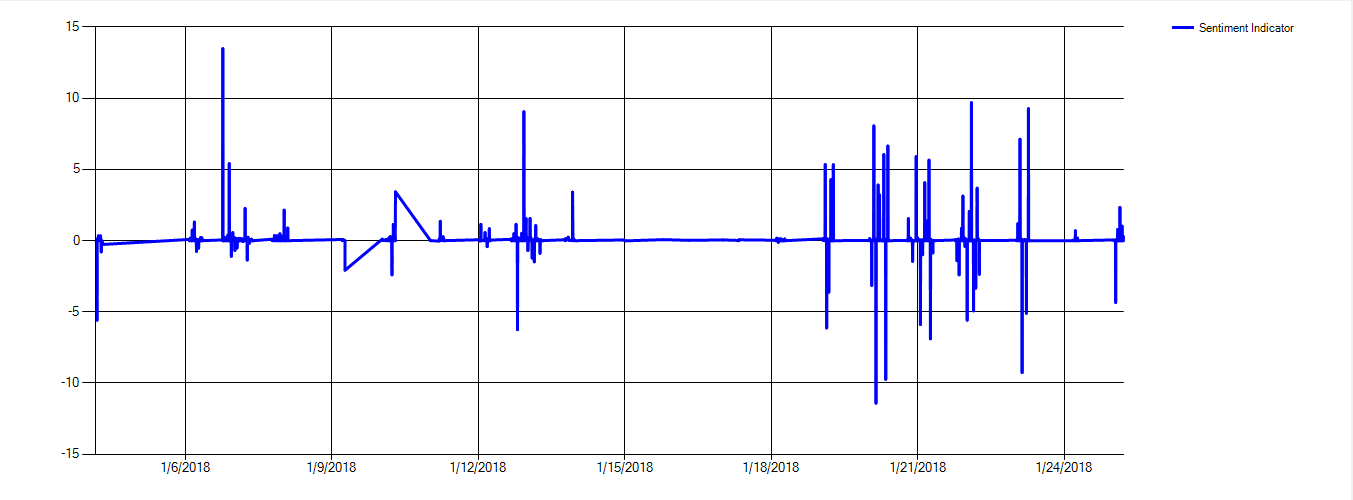

Bitcoin

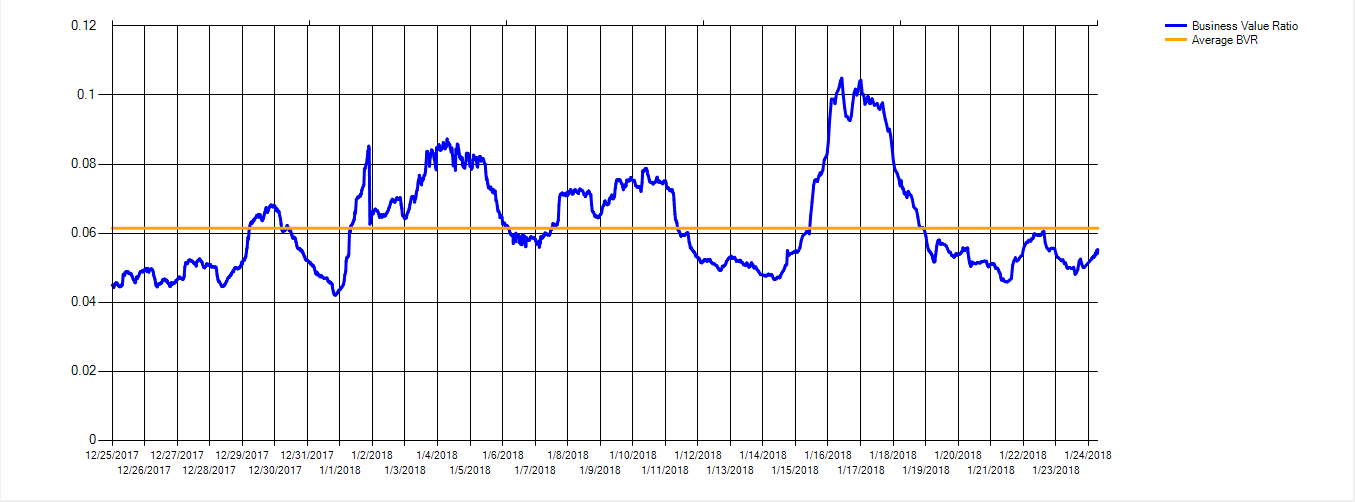

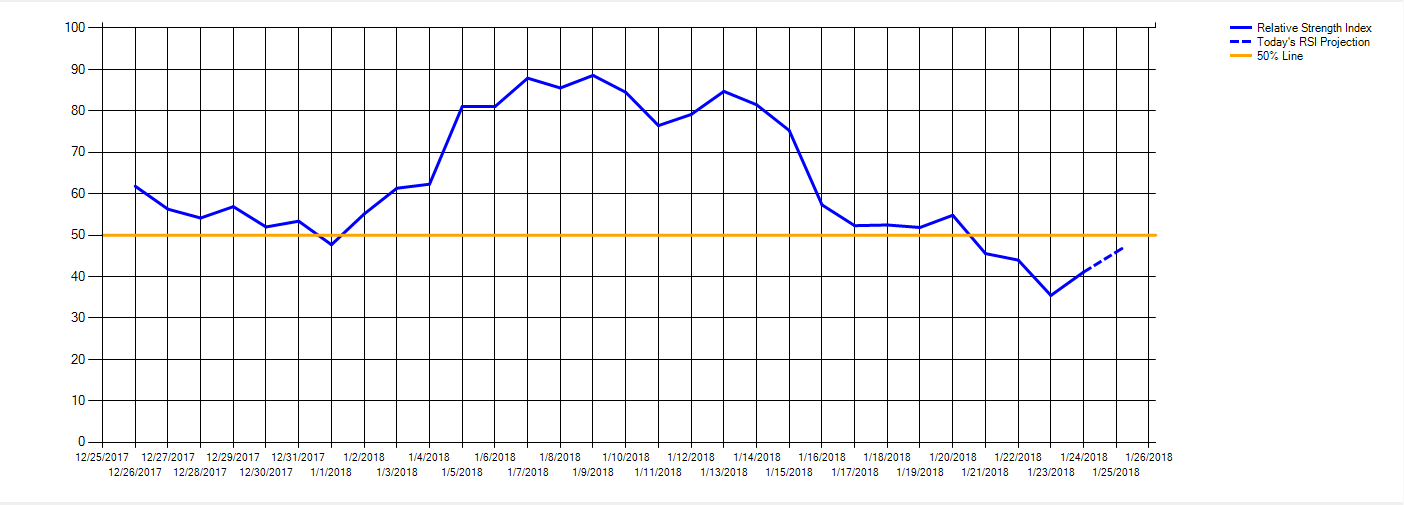

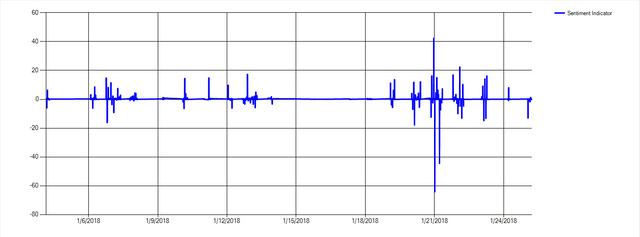

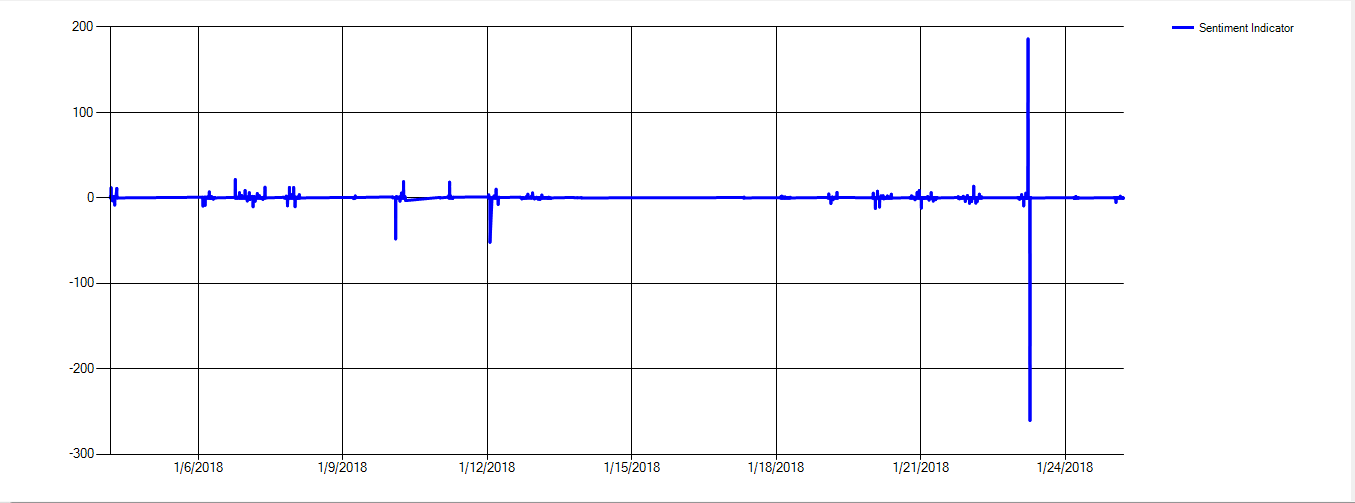

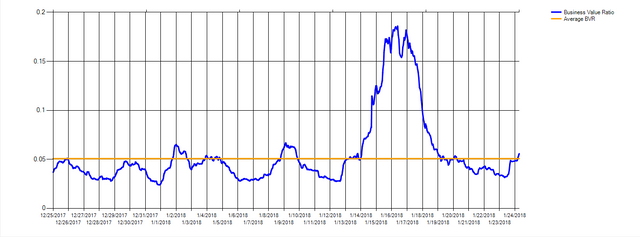

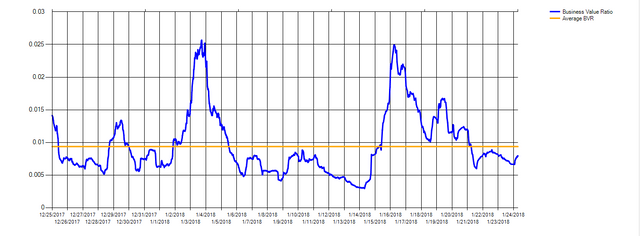

Business Value Ratio

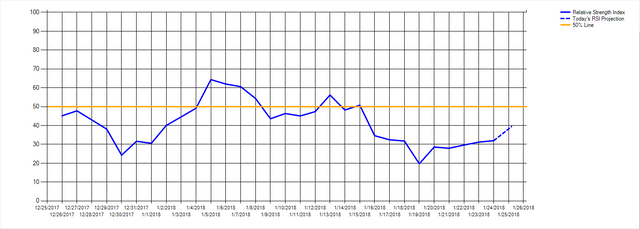

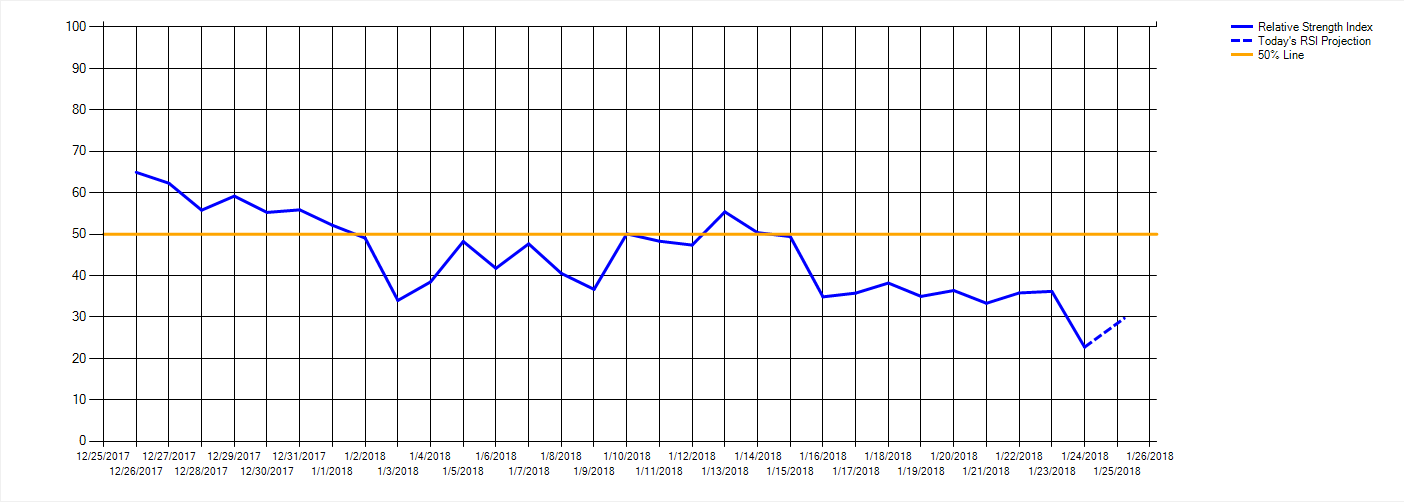

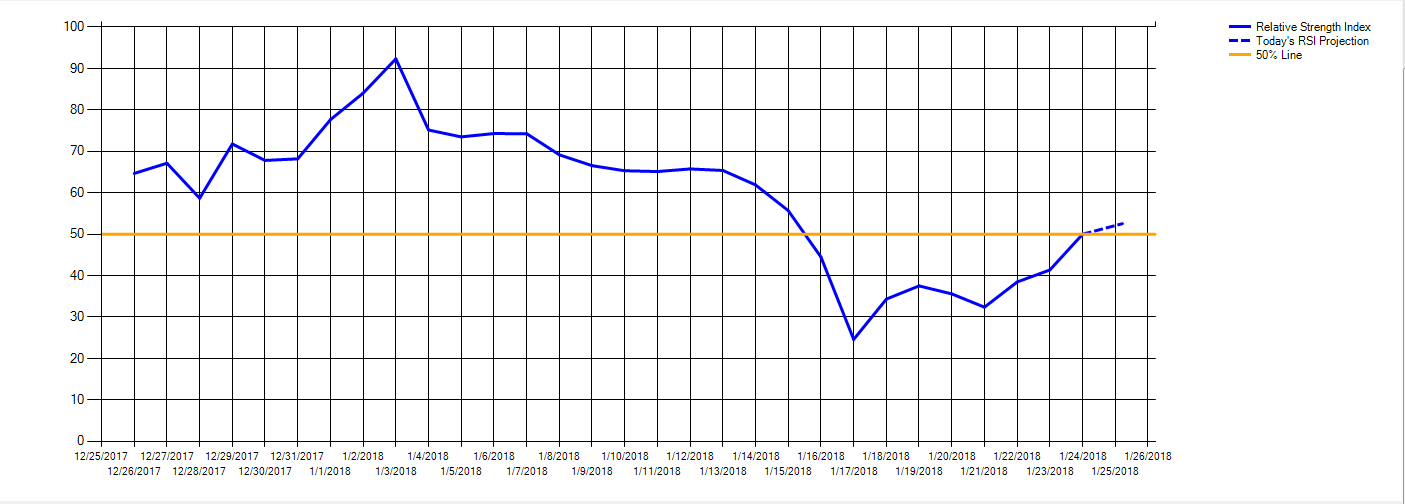

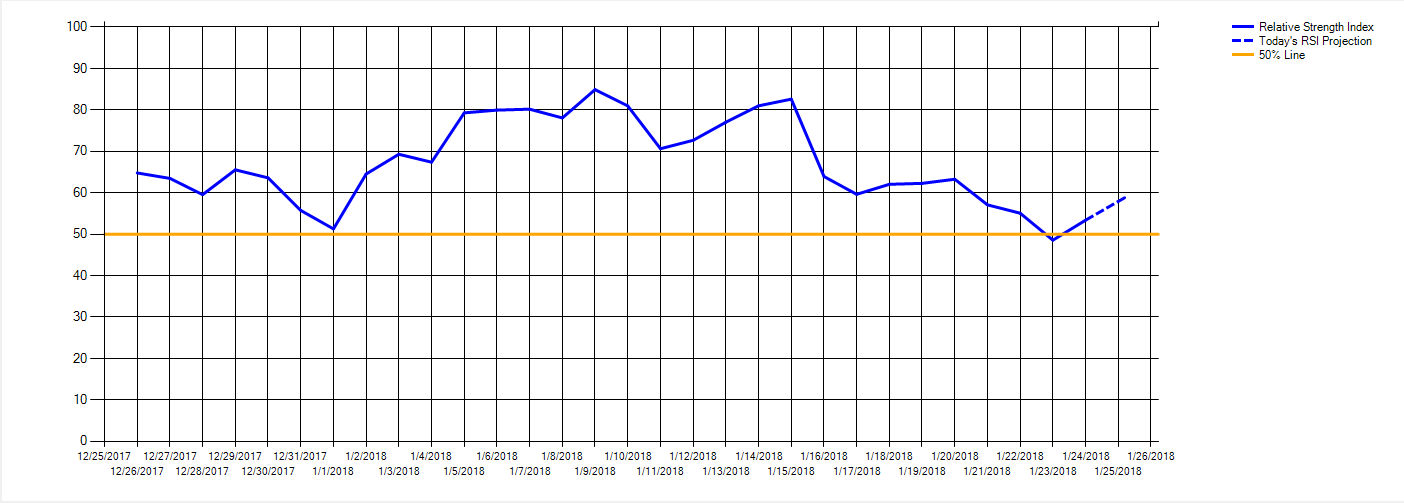

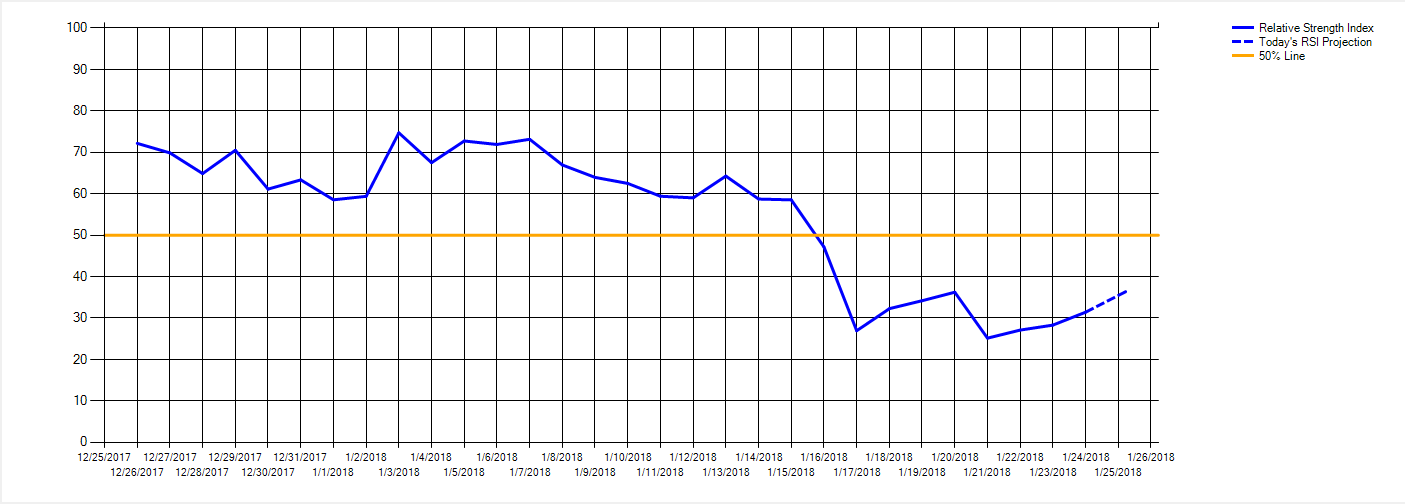

Relative Strength Index

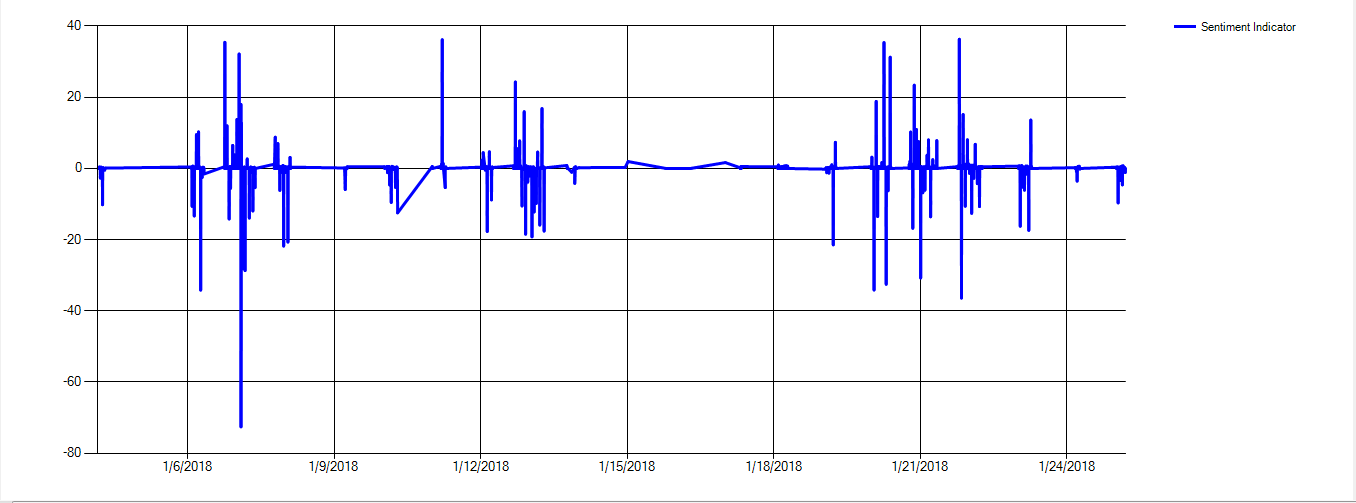

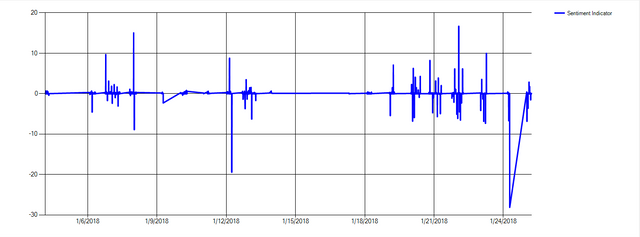

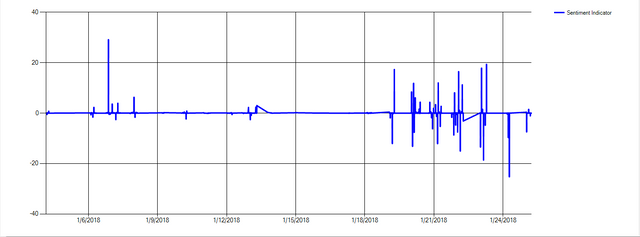

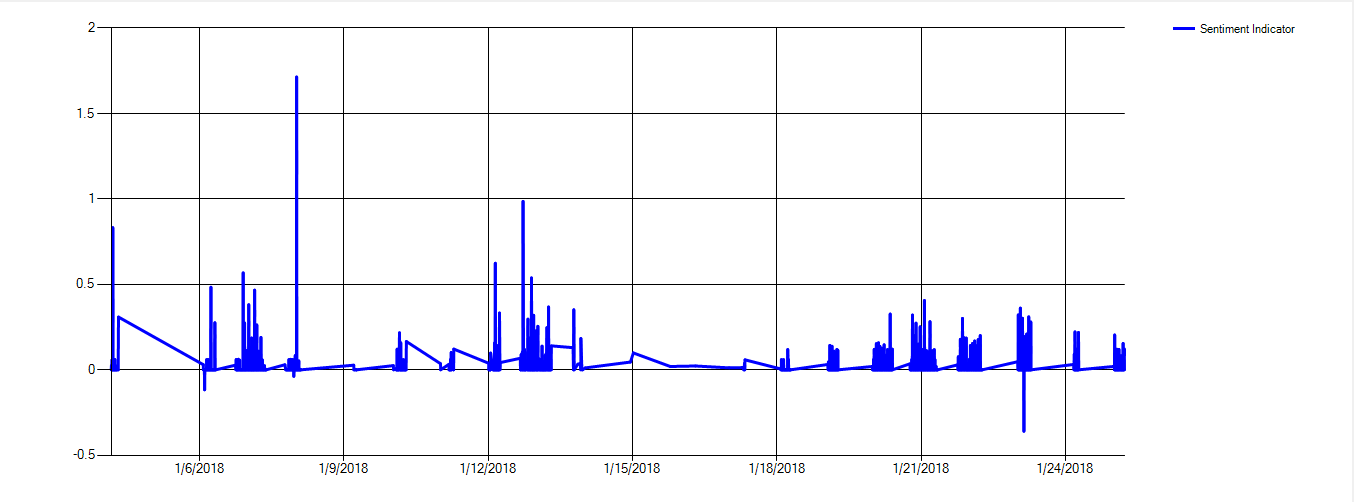

Sentiment Indicator

Analysis

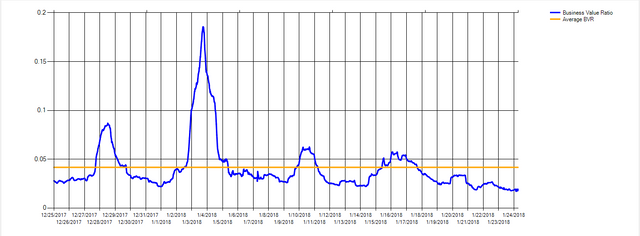

Currently, the BVR is below the average, the RSI projection is below 50 but may be beginning to rise and the highest sentiment spike in the past 30 days was a few days ago. Based on this, the price could be starting to rise. However, there is a bit of negative sentiment still so we use caution. Also, once the RSI projection is above 50 and the BVR is below the average, then we should buy more bitcoin.

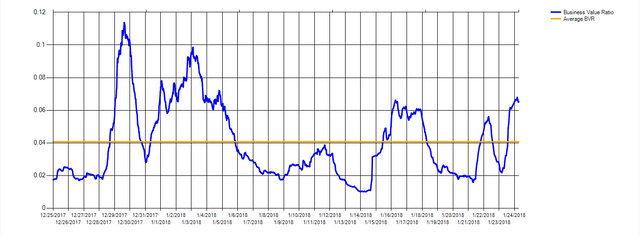

Ethereum

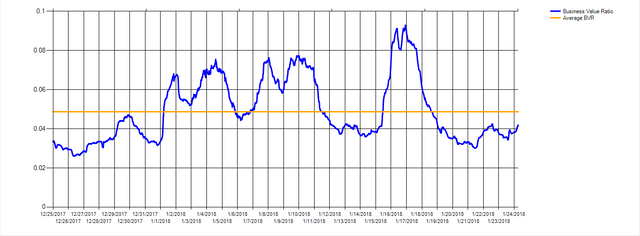

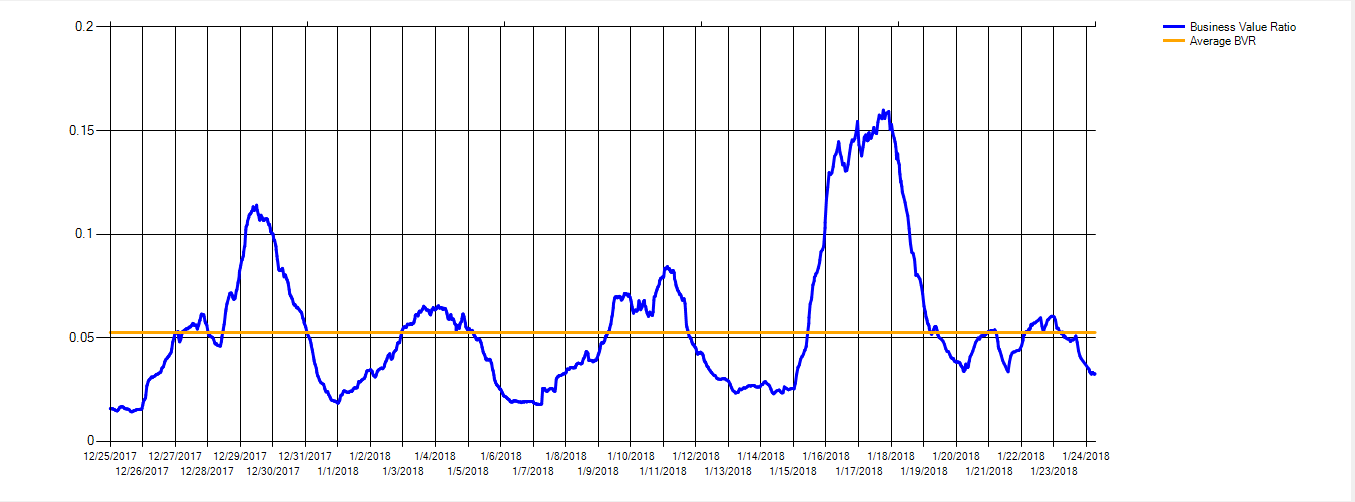

Business Value Ratio

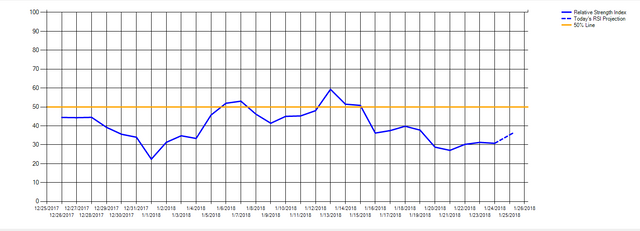

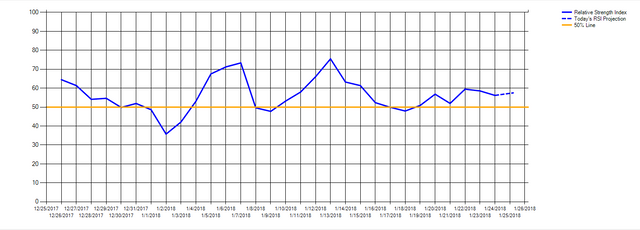

Relative Strength Index

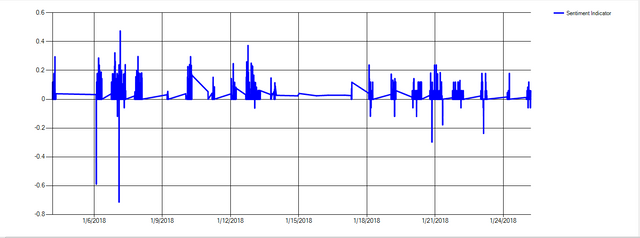

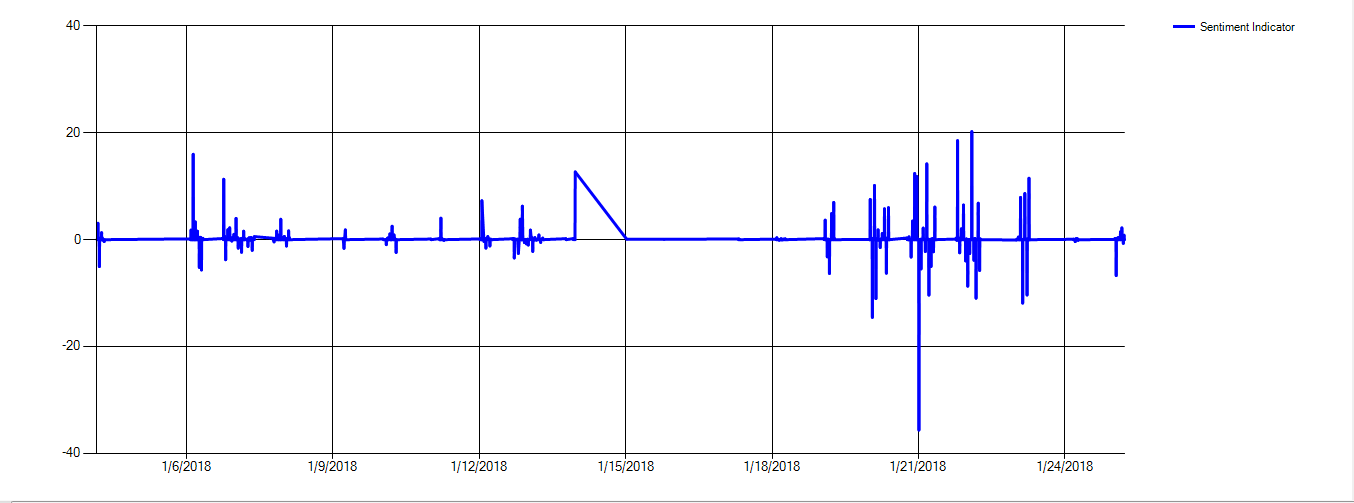

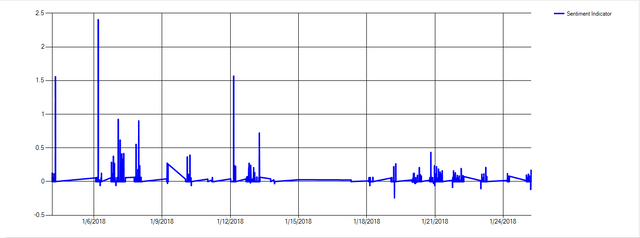

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is below 50 but rising and there was a recent sentiment spike. Based on this, the price looks like it is starting to rise. Caution should be taken however since there is still some negative sentiment involved with this. We should wait until the RSI projection is above 50 to buy more Ethereum.

Ripple

Business Value Ratio

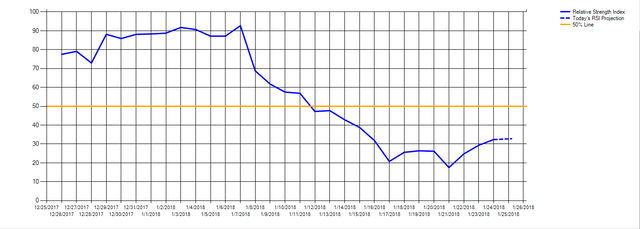

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is below 50 but appears to be stabilizing and there was a recent sentiment spike, however there was a negative sentiment spike shortly after. Based on this, the price might be stabilizing but this is an early projection so it is too early to tell. We should wait for the RSI to reach 50 before buying more.

Bitcoin Cash

Business Value Ratio

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is below 50 but could be rising and there haven't been any high sentiment spikes. Based on this, the price might be rising again, but the RSI is an early projection so we should wait until later to find out a more accurate projection. There has been a lot of positive sentiment however. We should wait for the RSI to reach 50 before buying more.

Cardano

Business Value Ratio

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is above the average, the RSI projection appears to be right at 50 but appears to be rising and the highest sentiment spike was a few weeks ago. There have been a lot of sentiment spikes in the past number of days but also some negative spikes as well. Things look good for Candano from a strength standpoint but we should wait for the sentiment to go higher as well as the BVR to go below the average before buying more.

Stellar

Business Value Ratio

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is above the average, the RSI projection above 50 while appearing to stabilize and the highest sentiment spike was recently but there is also some negative sentiment to balance it out. Since the RSI is now above 50, we should wait for the RSI to go above 70 and then fall below 70 to sell the Stellar.

Litecoin

Business Value Ratio

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is below 50 but appears to be rising and the highest sentiment spike was recently but there is also a bit of negative sentiment to balance it out so we should use caution. We should wait for the RSI to reach 50 before buying more.

NEO

Business Value Ratio

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is slightly above the average, the RSI projection is very slightly above 50 and the highest sentiment spike was a few weeks ago. This indicates that the price is rising, but there was no recent sentiment peak. Before selling, we should wait for the RSI projection to go above 70 and then fall below 70.

EOS

Business Value Ratio

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is slightly above the average, the RSI projection is above 50 and somewhat stable and the highest sentiment spike was a few weeks ago. There has been a lot of positive sentiment and the price could continue to rise.

Before selling any of this, we should wait for the RSI to be above 70 and the projection to be below 70.

NEM

Business Value Ratio

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is below 50 but slowly rising and the highest sentiment spike was a few weeks ago. We should wait for another sentiment spike as well as RSI to reach 50 before buying more.

Thank you for checking out my cryptocurrency analysis!

You should check out Cointracking Portfolio Manager.

It has

For details of how to use these features checkout this post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow this site is great! Thanks for sending me to this!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit