The cryptocurrency market is doing pretty well right now, so we are in a holding pattern until we get some more sell or buy signals...

Changes since last analysis: No changes this time!

Here is my analysis of the top 10 cryptocurrencies as of 2/18/18

(All chart times are in UTC time, the RSI is based on the closing price of the previous day and the RSI projection is based on current UTC time)

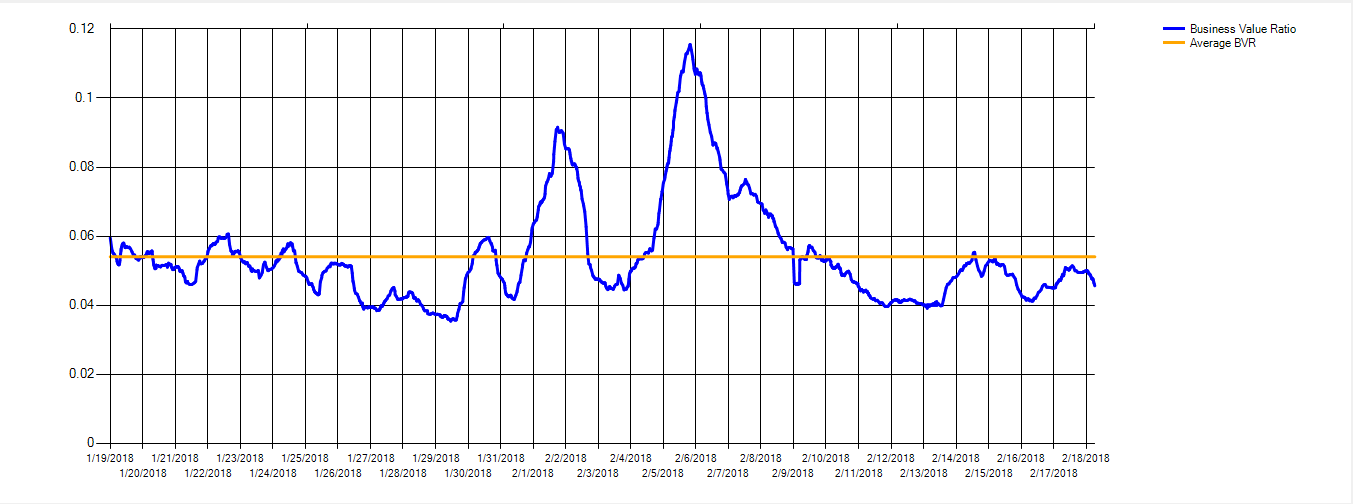

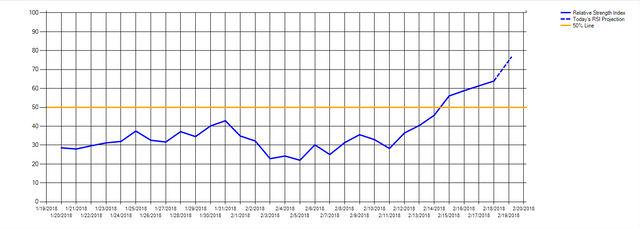

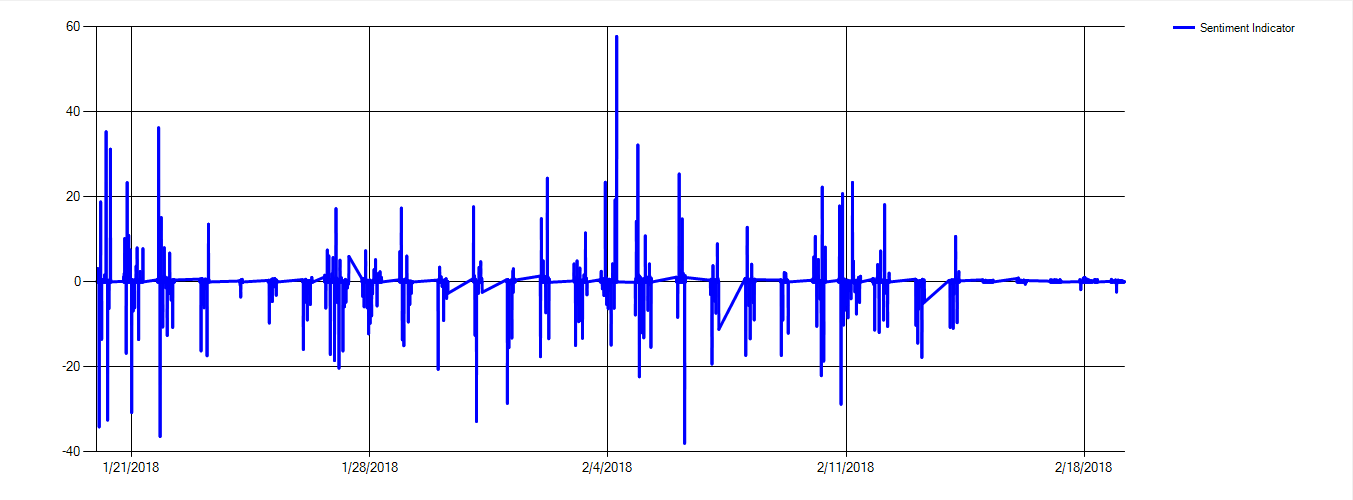

Bitcoin

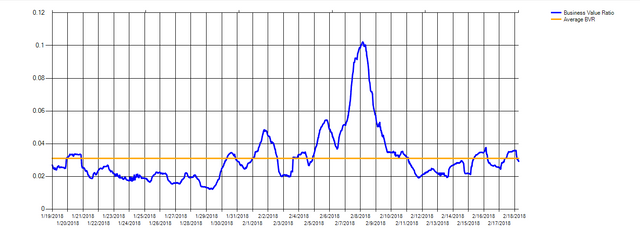

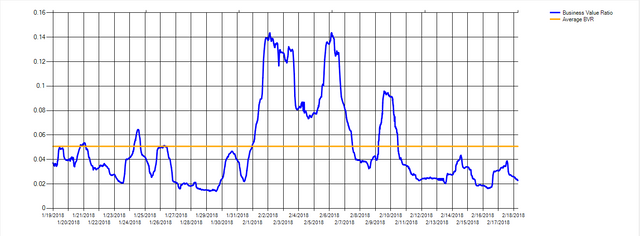

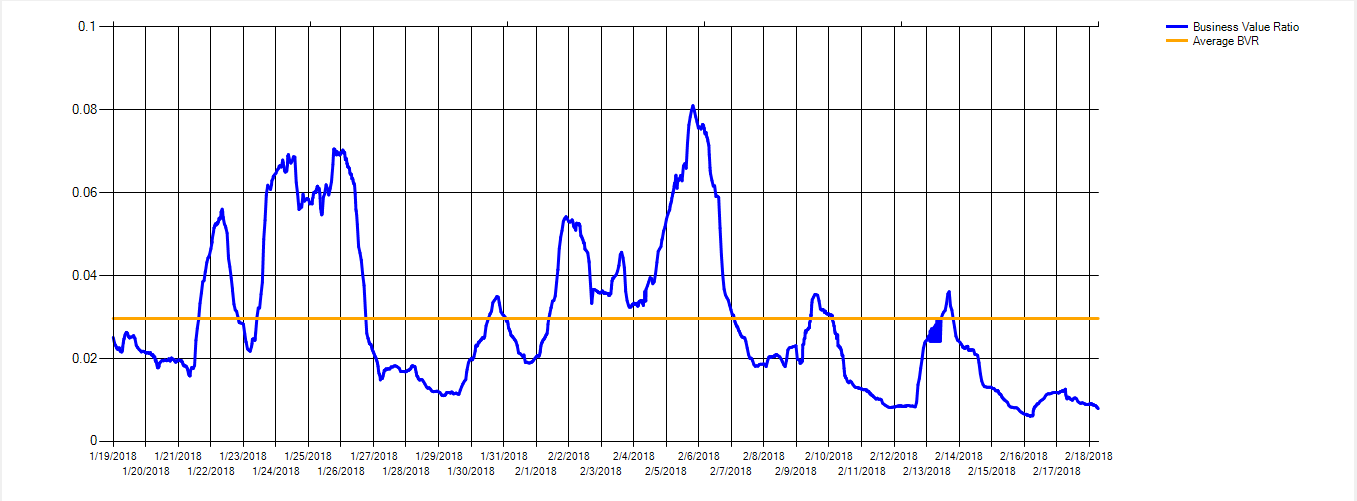

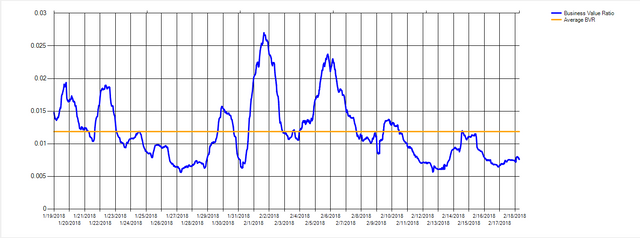

Business Value Ratio

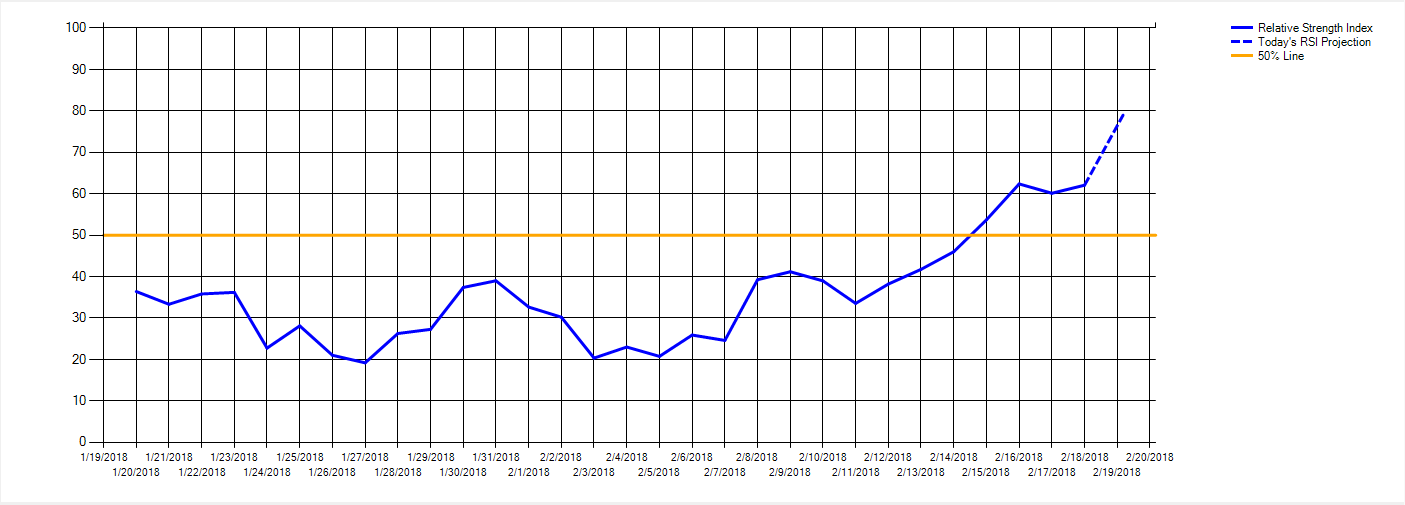

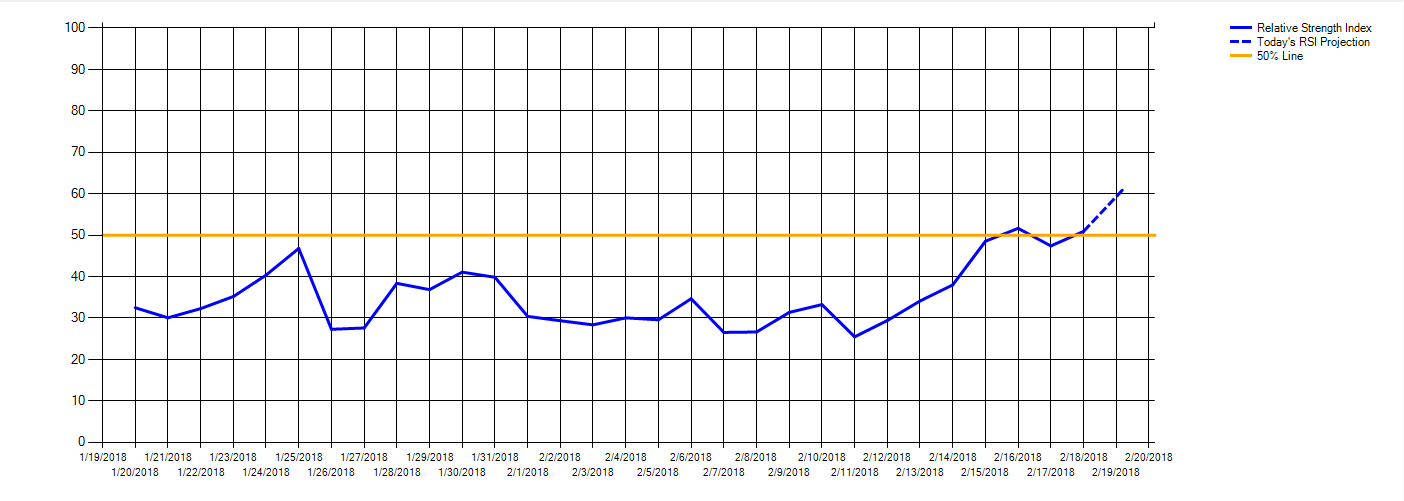

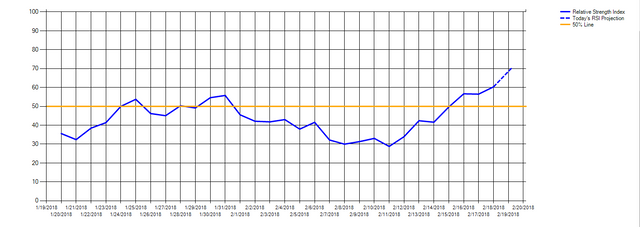

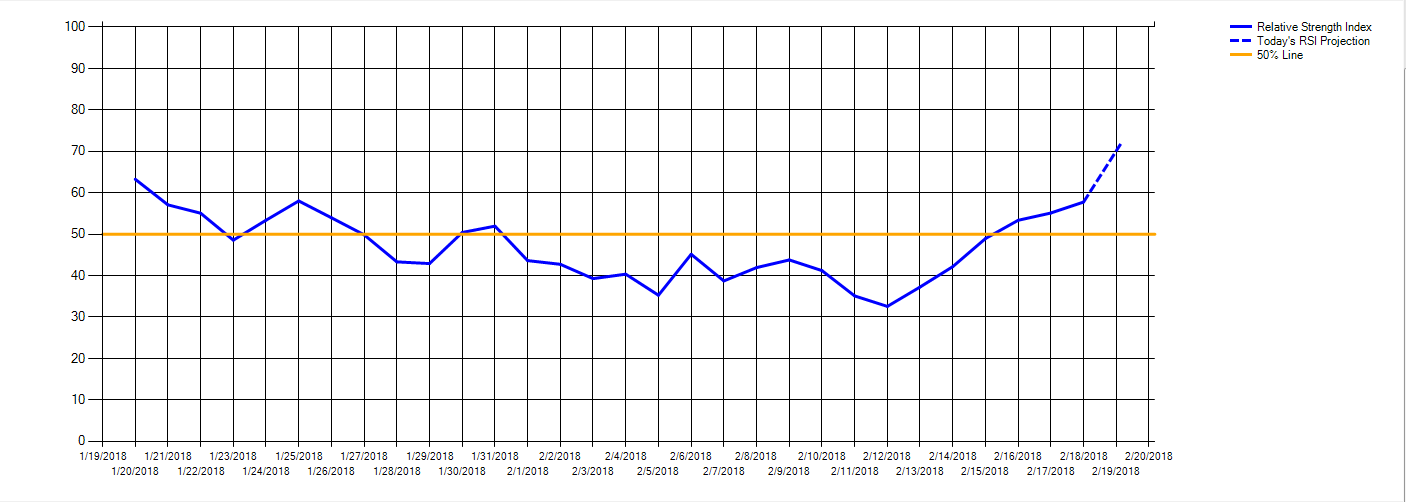

Relative Strength Index

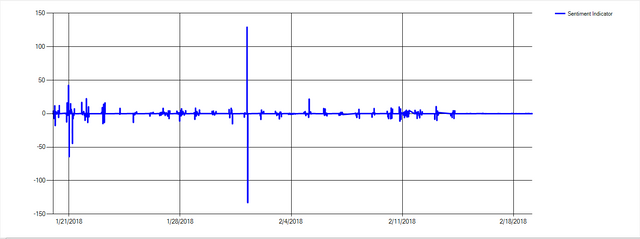

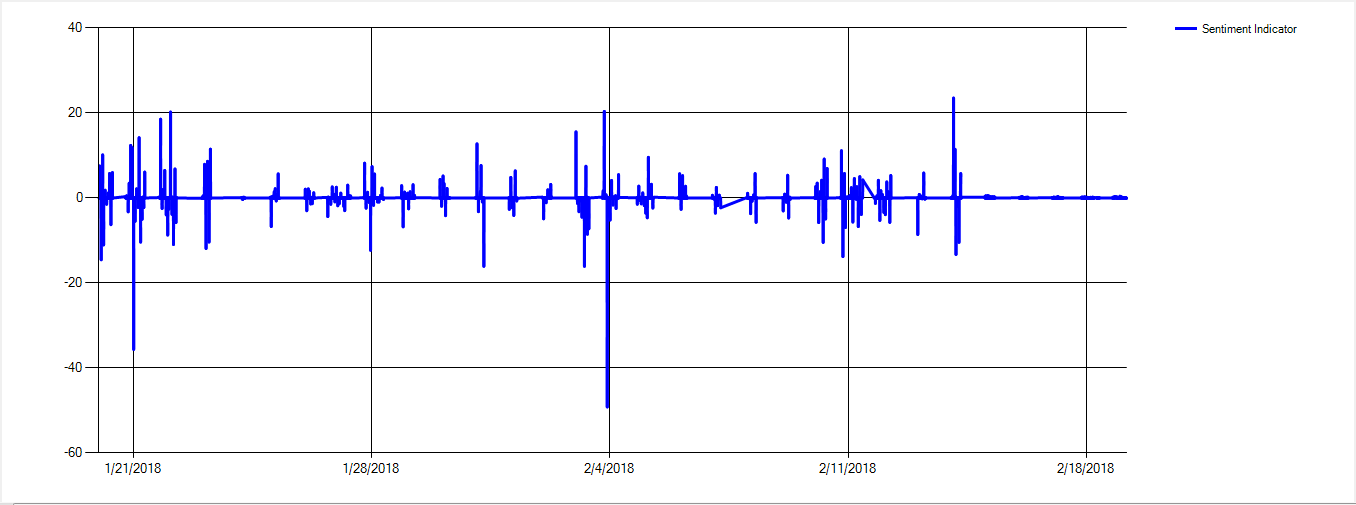

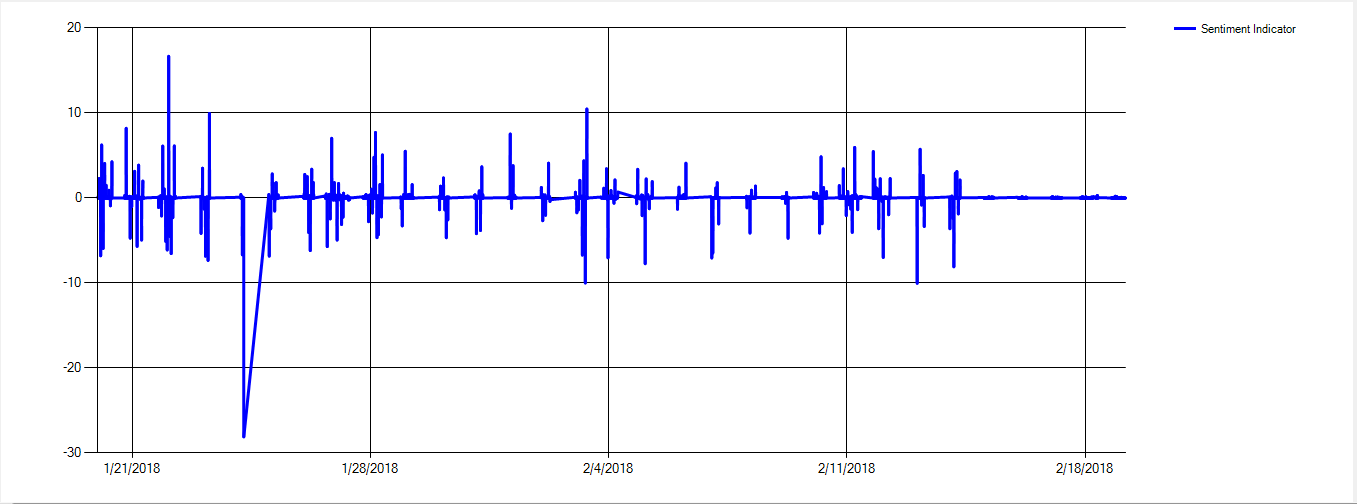

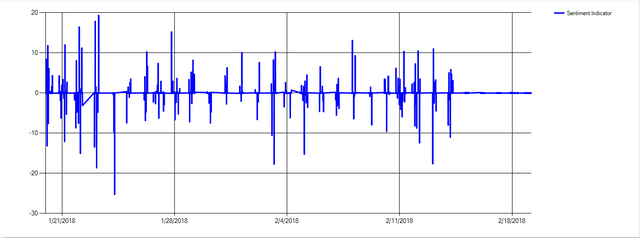

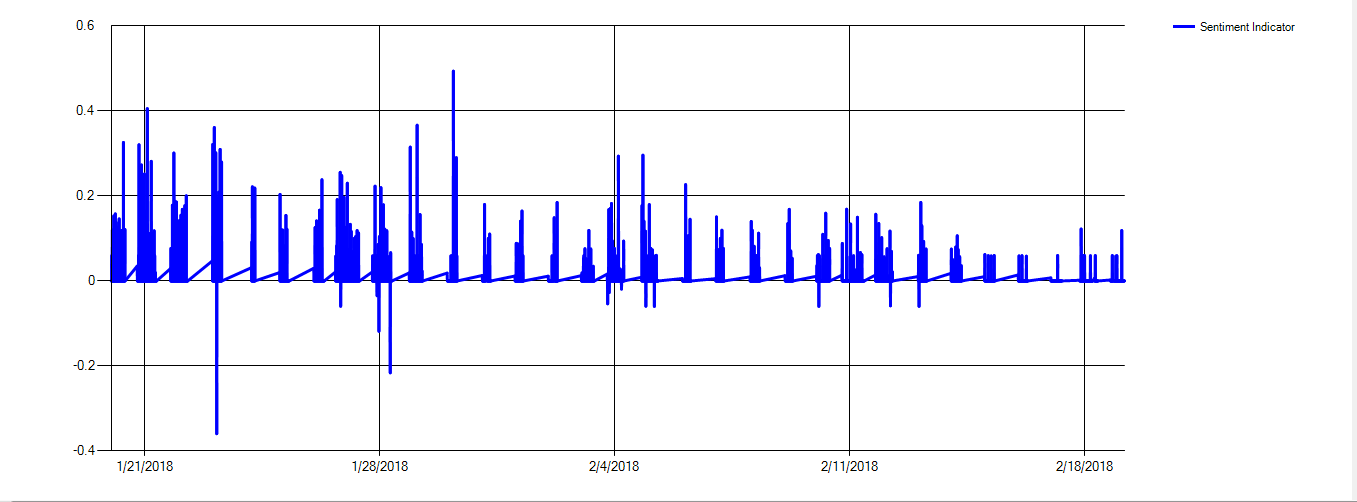

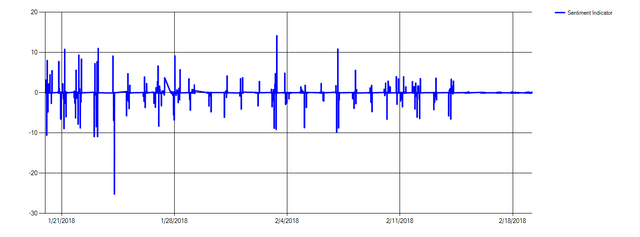

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is above 50 and the highest sentiment spike in the past 30 days was a while ago. Let's hold our Bitcoin until the current RSI either goes below 50 or above 70.

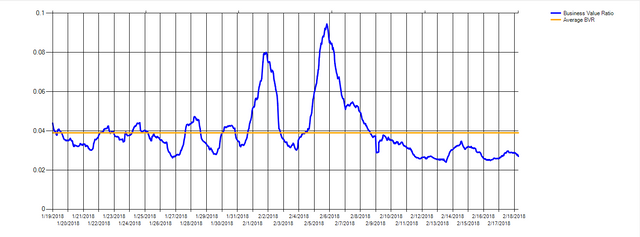

Ethereum

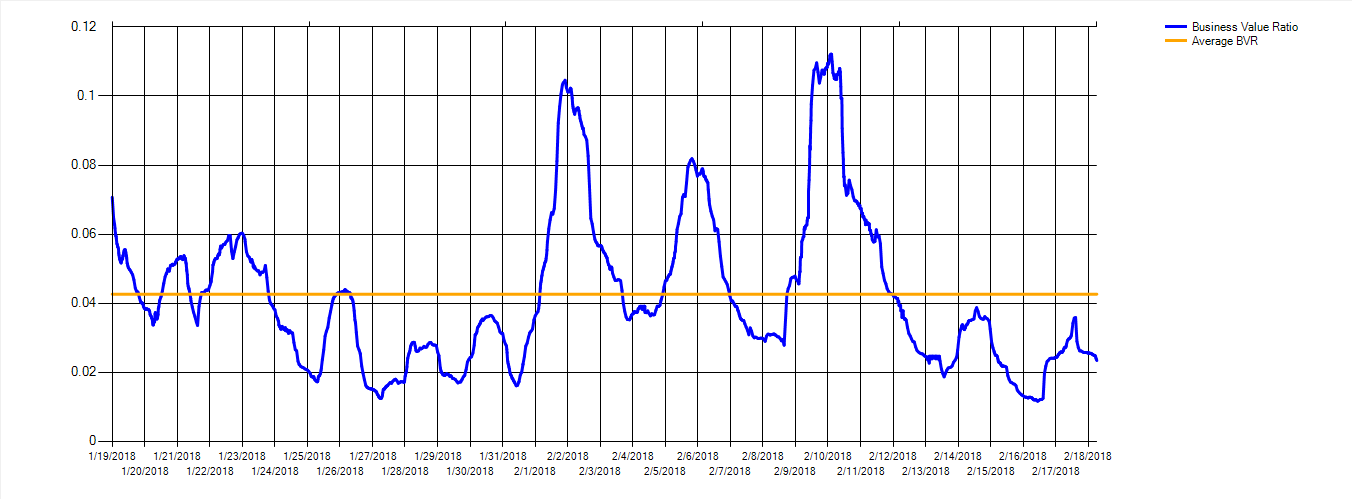

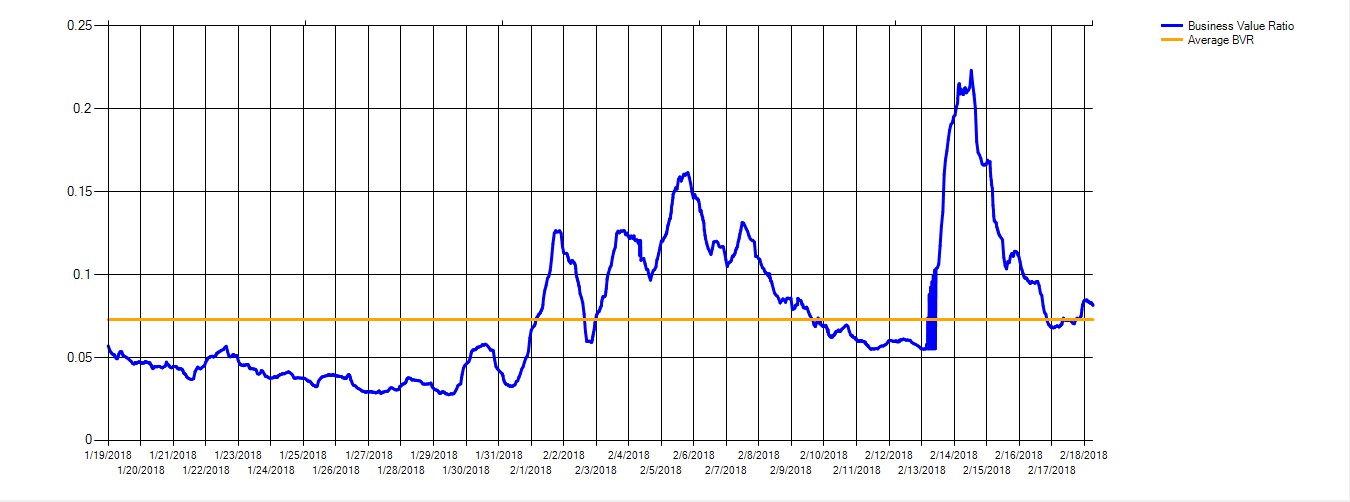

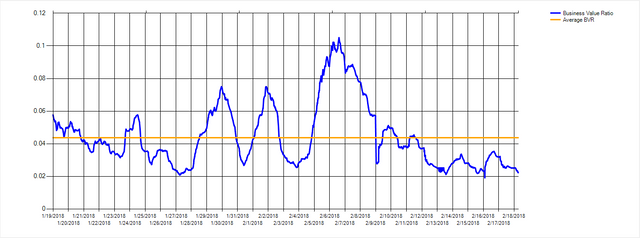

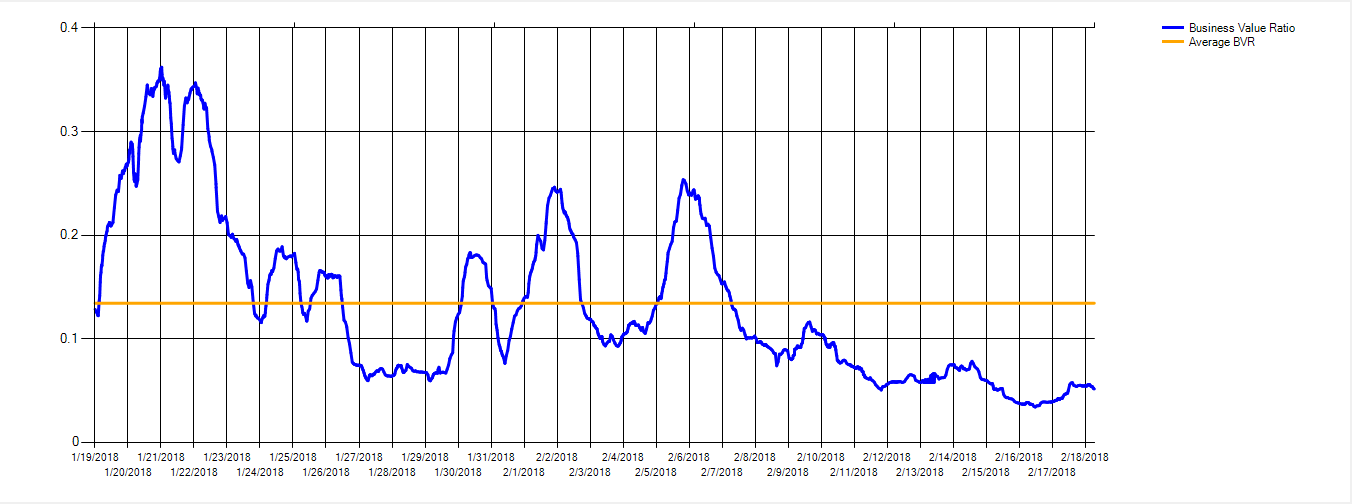

Business Value Ratio

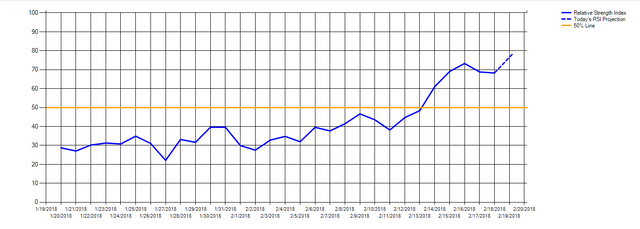

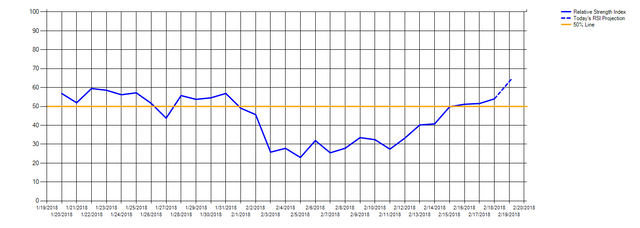

Relative Strength Index

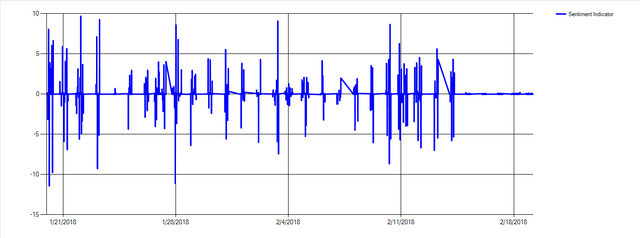

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is above 50 and the largest sentiment spike was a while ago. We should hold our Ethereum until the RSI goes above 70 or below 50.

Ripple

Business Value Ratio

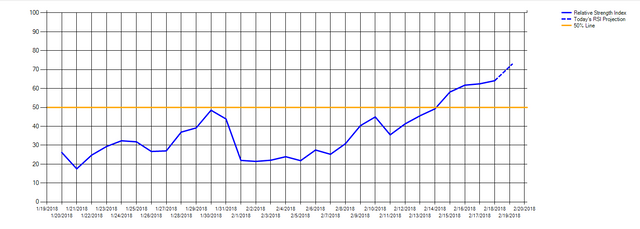

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is above 50 and the last sentiment spike was a while ago. Let's hold our ripple until the RSI goes above 70 or below 50.

Bitcoin Cash

Business Value Ratio

Relative Strength Index

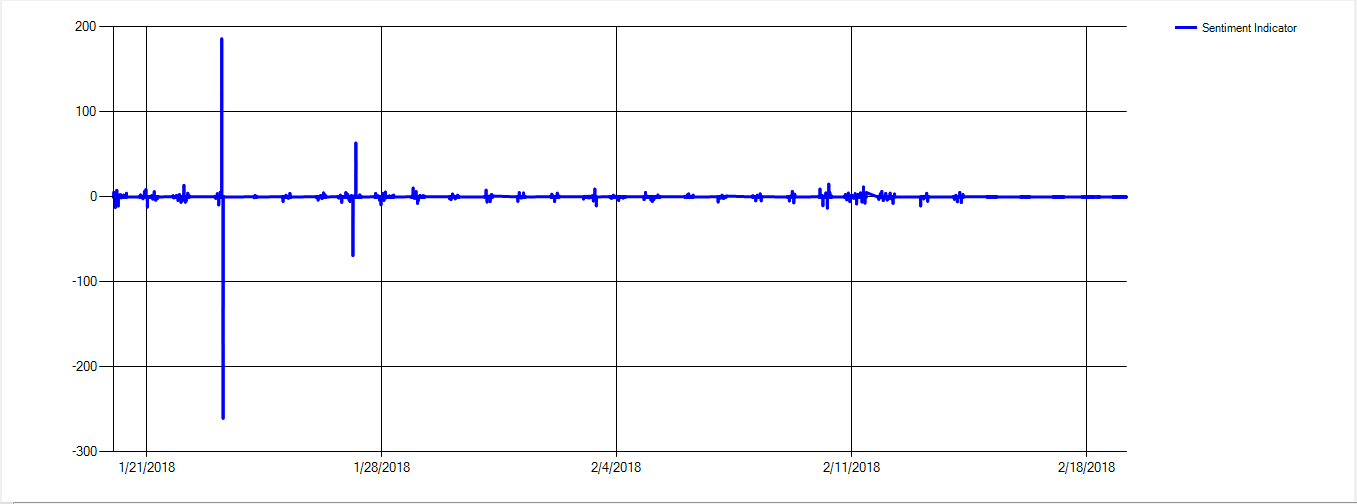

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is above 50 and the last sentiment spike was a while ago. Let's hold until the RSI is above 70 or below 50.

Litecoin

Business Value Ratio

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is above the average, the RSI projection is above 50 and the highest sentiment spike was recently. We should hold our Litecoin until the RSI is above 70 or below 50.

Cardano

Business Value Ratio

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is above 50 and there hasn't been a sentiment spike for a while. Let's hold Cardano until the RSI is above 70 or below 50.

Stellar

Business Value Ratio

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is above 50 and the highest sentiment spike was a while ago. Lets hold our Stellar until the RSI is above 70 or below 50.

NEO

Business Value Ratio

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is above 50 and the highest sentiment spike was a while ago. Lets hold our NEO until the RSI is above 70 or below 50.

EOS

Business Value Ratio

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is above and the highest sentiment spike was a while ago.

Let's hold our EOS until the RSI is above 70 or below 50.

IOTA

Business Value Ratio

Relative Strength Index

Sentiment Indicator

Analysis

Currently, the BVR is below the average, the RSI projection is above 50 and the highest sentiment spike was a while ago. We should hold our IOTA until the RSI is above 70 or below 50.

Thank you for checking out my cryptocurrency analysis! The market isn't that exciting right now in terms of trades, but at least it is recovering! Stay tuned :)

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.fxstreet.com/technical-analysis/sentiment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the killer data - excited to see future posts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

No problem man! If you want to check out how I get my data you can look at my cryptocurrency tracker application that I made... its in one of my previous posts :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit