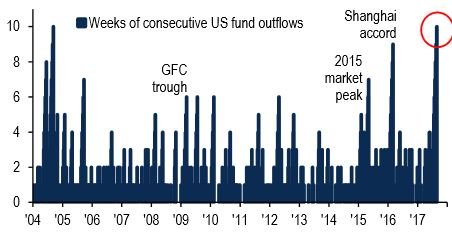

According to Bank of America Merrill Lynch, investors have pulled more than $30 Billion from U.S. Stock Funds over the past 10 weeks.

This latest week of outflows marks the 10th straight week of outflows, the longest streak of outflows since 2004.

Keep in mind that this isn't the largest number of outflows since 2004, but it is the longest consecutive streak.

Internal positioning within the market also suggests that investors are becoming increasingly more defensive.

This is all going on while the stock market reached a record high on August 8th.

What is going on?

In my opinion there are couple interesting things to note.

For one, August through October are traditionally some of the worst months for the U.S. Stock Market. This could simply be a case where investors are up a lot of money year to date and don't want to risk giving it back with a bad month or two.

Secondly, there has been a large inflow of funds to European and Japanese Stocks over this same time period. An inflow of roughly $36 Billion, which more than offsets the outflows from U.S. Stocks.

However, there is more to the story that just those two items of note...

Money is getting more defensive.

Not only have their been outflows for 10 straight weeks, but it looks like money that remains in the market is positioning itself from more risky investments to more conservative ones.

The defensive utilities sector as well as U.S. Treasury bonds were some of the few areas to see net inflows of funds over the past couple weeks while technology and growth stocks experienced some of the largest outflows.

So yes, it looks like money is getting more defensive and slightly more cautious with seasonal headwinds coming up as well as a market that is near all time highs.

However, there is one thing that is interesting to me...

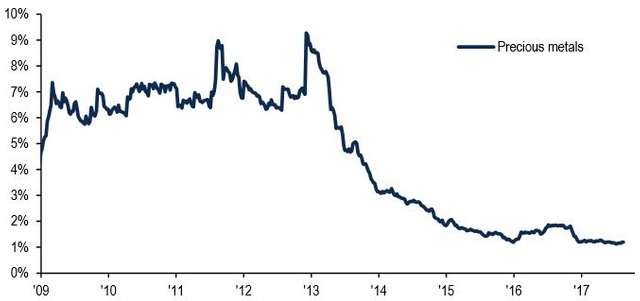

Check out the % allocation to precious metals:

Traditionally, precious metals are an area that money flocks to in times of uncertainty.

As you can see the percent allocated to metals stayed elevated from 2009 through 2013. It has been trending downwards ever since.

I would imagine QE has a lot to do wit that, however, QE is has been over for a while now and we just hit a record low this week.

Why is that significant?

Here is why I think that is interesting:

Money is clearly looking for more defensive place to go. It is looking for a store of value with the U.S Stock Market at an all time high.

Where does it go?

Check out this chart:

That is a chart of Bitcoin over the last couple months. As you can see it has been on a tear.

Now check out this chart:

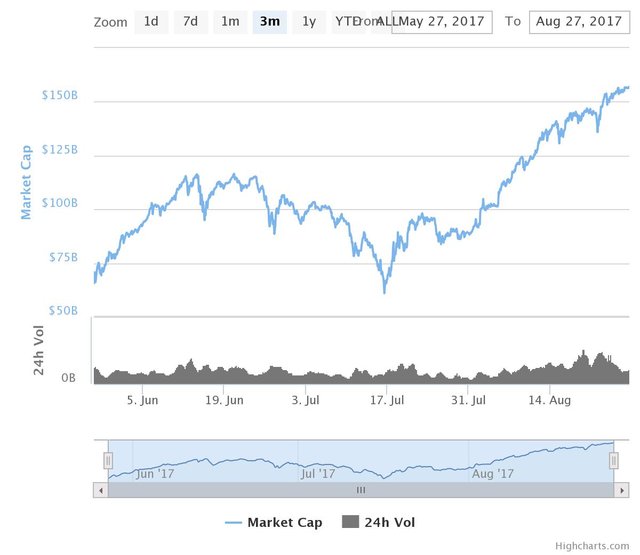

That is a chart of the entire cryptocurrency market cap over the last 3 months.

As you can see a couple months back it hit a low around $60 Billion in total capitalization. Since that time it is up almost $100 Billion to get to it's current level of almost $160 Billion USD.

What is most interesting is that money that is looking for a store of value is finding it's way into Bitcoin and the cryptocurrency markets instead of the more traditional stores of value, like gold.

This could be the start of something major...

In conclusion:

Yes, we have seen money leaving the U.S. Stock Market and yes we have seen a lot of that money going into European and Japanese Stocks as well as U.S. Treasuries, and also getting more defensive within the U.S. Stock market, but that's not the whole story...

The cryptocurrency total market cap has increased by $100 Billion over that same time period, which means a good portion of those funds have also likely found their way into Bitcoin and other cryptocurrencies.

This is happening while percent allocations to the traditional safe haven gold and other precious metals are hitting record lows.

At some point we will experience a great migration of money leaving traditional investments and finding it's way into crypto, and this is just the very early stages of it.

Stay informed my friends.

Sources:

Image Sources:

https://www.linkedin.com/pulse/understanding-financial-migration-part-2-christo-w-meyer-cfp-ctep

https://www.cryptocompare.com/coins/btc/charts/USD?p=3M

Follow me: @jrcornel

Crypto for future, crypto for freedom

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Amen

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Definitely believe this reasoning has weight too it. More and more people and funds are allocating a percentage of a portfolio to crypto. The money has to rotate from somewhere for that.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes it does. Even if all these major funds allocated just 2% to Crypto, it would mean hundreds of billions of dollars coming in...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Some are saying there will be $1T entering the crypto realm in 2018.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes and if the cryto market reach $1T then our holdings will increase 6x

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm always amazed that people still think that Treasuries are safe. When the bond bubble bursts, so many lives will be destroyed. The reset is coming, and it will be ugly.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ugly for those who did not invest in Bitcoin

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Just makes sense to diversify more out of US assets as they are on such a bull run and many factors can cause some disruption in the markets. Although I do believe US markets are the best place to hold assets. While US is prospering undervalued economies start to make big head way and are fantastic growth vehicles.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes I think so as well. The most interesting part is that money seems to be leaving the more traditional store or values and moving towards others...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes interesting. Technology shift?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh wait!

Is everyone making money on Control Finance like i am?

I am becoming suspicious of where all this money they

give on affiliate program comes from,I have withdrawn

several times without problems to my Bitcoin wallet.

It is high time i recomend Control Finance to everyone

willing to start earning like me on daily payouts and affiliate program

with just a minimum of $10 deposit.Join my team through this link

https://control-finance.com/?ref=FrancisMudenda and contact

me on [email protected],i will send you screenshots of how

i have been doing on Control Finance.Don't miss this

golden opportunity.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed, when you get a gain it makes sense to take profit. In this case use your strong dollars to buy non dollar assets. For instance emerging markets. I made roughly 20% on that trade last year.

Where you from man?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

11 COINS FAUCET FREE EVERY DAY

FULL WALLET FUNCTIONALITY

https://goo.gl/aCKaJ4 Qoin

START WITH FREE COINS

Signup and we will credit your Qoin wallet everyday with:

0.00000250 BitCoin

0.00007671 LiteCoin

0.00604838 FeatherCoin

0.24640460 Virtacoin

0.00056826 PeerCoin

0.00004063 Dash

0.00025130 Neo

Trusted 2014 - 2017

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't think all of the money from the stock market is making it into crypto, I think some of the outflows are also because of the 2 reasons you mentioned, but I do think a significant amount is coming to crypto, which is very good.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Loved this post! More and more people are realizing this phenomenon. This is only the beginning of crypto as an asset class. Gold bugs and Wall Street traders are finally capitulating and diversifying into crypto. The potencial for growth, just from precious metals inflows is about 50x for crypto assets

https://steemit.com/bitcoin/@cryptoeagle/crypto-is-siphoning-off-gold-s-market-cap-bitcoin-could-increase-50x-in-price-by-stealing-gold-s-thunder

Also, the number of users can only grow from now on, take a look at this analysis comparing its growth to Facebook's:

https://steemit.com/bitcoin/@cryptoeagle/cryptocurrency-wallet-users-vs-facebook-users-where-are-we-now-making-the-case-for-the-million-dollar-coin

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

$1T possibly entering this market in 2018.

Lots of cash available to enter from the institutions. We are only seeing the beginning.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's interesting to note the market outflows. As you point out with the European and Japanese increases I don't think it is easy to correlate where the money is going at this point. People are definitely worried about an Autumn crash in the stock market. A lot of money could be held in banks right now for a short term wait and see. Some of it definitely moved into crypto but with the BTC market cap currently at 72.4 billion it is still dwarfed by the world's stock markets which weigh in at 66.8 Trillion. A good question to ask is what percentage of that can Bitcoin handle if there is a mass migration? Is the infrastructure already in place able to handle it?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Another great post and very true. The other factor is that history ALWAYS repeats itself. Unfortunately the banking system was never corrected they only found new ways to line their pockets like fractional lending on corporate debt. I'm guessing you are from the US. At least you don't have a child like, only worry about doing selfies prime minister that we have in Canada. I look forward to more of your posts :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Many people seem to think that the bull run is coming to an end and that we are entering a bear market. That or everyone is liquidating to invest in crypto!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The way donald trump has acted in the past months everybody is terrified to lose their money in case a war breaks out or the country unstablises in some other way, so it is logical that people are not ready to take a lot of risks right now because how uncertain the situation is right now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for this valuable information.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

j this is really well done.. money flow analysis is super important. Its possible that the money being pulled from precious metals and stocks are coming into crypto.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm a new beginner knowing a bit about Bitcoin and cryptocurrency. Its rapid development make me more interested in digging informatiob about Bitcoin and cryptocurrency! Thank you for sharing infor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's a great news for crypto-currency maket. In U.S.A more peoples are going to adopt Bitcoin and crypto-currencies and leave the U.S Stock Market. This is boom to crypto-currency market. Thanks for the wonderful news.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very Very interesting stuff @jrcornel.

I have my assessment meeting next week with my friend and financial advisor and will be bringing him this post on my tablet for conversation.

You always post quality material, I'm only sorry I don't have time to visit here often enough to keep up with it.

Thank You!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

your writing is very interesting, this is a valuable science for the present.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upboat is a friendly half-human, half-robot which hopes to help promote the better posts of Steemit by trying to ensure they get the recognition they deserve.

@UPBOAT looks for numerous signals before deciding on who to UPBOAT and is likely to summon our robot friends to share some robot love with you to show affection.

I'VE BEEN AT SEA FOR 4 DAYS AND HAVE GIVEN 224 UPBOATS! PLEASE HELP @UPBOAT STAY AFLOAT ON THE STEEMIAN SEAS BY DELEGATING SPARE SP OR PATCH WATER LEAKS BY UPBOATING.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

it's so strange that's why get so many upvote, I wish we could give a upvote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Which country does not know that the US is a very advanced country with a very good economy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Go Crypto!!!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yet another example that Crypto is "mainstreming" and we are all very clever people... Well you guys are. I'm still a "noob".

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wall Street has finally started to trust crypto a little bit, which is good... I am still in the dark about what the consequences will be, if a big chunk of the Wall Street-money would flow into crypto... When this will happen, it will happen fast and boy will it change everything as we know it... Banks will get margin-called, people's USD will be used to bail-in the banks... etc... It will be pandemonium and it will hurt loads of normal people, which is never a good thing...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

:0 really?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post @jrcornel ! I saw this story as well. Good conclusions all around, especially the BTC angle which I hadn't considered.

One thing I would point out is the huge Baby Boomer wave. In 2002, Kiyosaki wrote that the stock market would crash in 2016 as the first wave of baby boomers began to hit 70 1/2 in 2016 and started taking required-by-law distributions from traditional individual retirement accounts.

We didn't see that crash, but as time moves forward more and more of them are withdrawing funds and they just happen to have the most money in the stock market.

Great read again glad to see some good content on here.

I write primarily finance oriented articles as well I think you might be interested!

Take it easy!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hard to belive big money would go into crypto vs gold. Big money doesnt like high beta. Crypto is garbanzo high beta.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It makes perfect sense. I'm glad i'm on boat already.

Get in! Buy crypto! And be the 9%, not 91% who will go down...

Great work. Up and follow :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

gold, crypto and pot. get some.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i think that is a move to invest more and more in bitcoin and altcoin

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Other interpretation is usually a good way to make money by watching inflows and outflows and realizing that most of the flows are mistimed.

So all the money that is flowing out of Precious Metals, could be the contra-indicator that Precious Metals are about to spike again.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent post! Thank you for laying it out as you did. I'm resteeming this ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's it I will diversify more of my assets! Great post ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@ jrcornel Totally agree. This is the kind of post that leaves you a bit smarter! Definitely following.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very technical staff about Migration. i like it very much. i will follow your account, please follow me at @babarrajo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think it's important to keep in mind that a lot of the value coming into crypto assets are coming from stock markets all over the world.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the evidence presented and your thoughts on it – it deserved my upvote!

However, let me add some thoughts. Personally, I wouldn't consider Bitcoin to be a safe haven (yet). The volatility is high and no-one can tell if Bitcoin will still exist in a couple of years. We should remember that Bitcoin only has its value thanks to people believing and continuously investing in it. If people lose their faith in BTC for whatever reason, its value might crash from 4'500$ down to say 1'000$ and much value would be destroyed – a thing that wouldn't happen with gold.

So I can't imagine that someone who's invested in gold (store of value), would take his money out of it and invest it in BTC instead (speculation)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I get your point regarding volatility but look at the volatility of gold... it actually is one of the more volatile assets out there, especially over the last 2 decades. It is priced very similar to a bitcoin, mostly based on it's popularity. If all the sudden everyone decided they didn't want gold any more, it's value would plummet, in the same way Bitcoin's would if no one wanted it anymore. There isn't really any intrinsic value backing it... it's possible, in an extreme example, a loaf of bread could be more valuable than a bar of gold.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A comprehensive insight into market movements, thank you for your detailed analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Eso parece una manada

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting! Is Gold going to be worth less soon? OMG!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great analysis here @jrcornel and this statement below is worth reading several times.

It seems more people are beginning to believe in crypto,which is good.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit