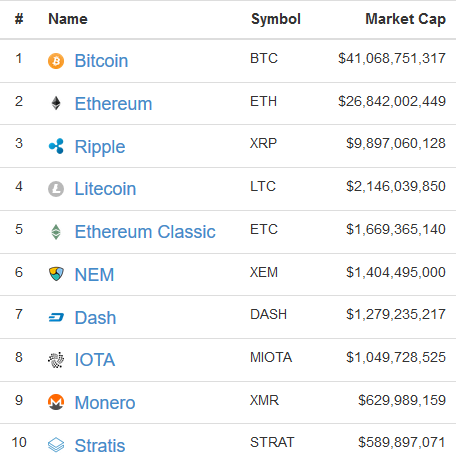

We all know that the cryptocurrency market is growing exponentially with an ever increasing market capitalization. At the time of writing this post the total market cap is more than $102 billion US dollars with a 24 hour trading volume of around $5.429 billion

Here is a snap of the top 10 currencies market cap.

The market has really taken off since March 2017 and there are more than 760 cryptocurrencies trading in the market. And more are being introduced. According to an estimate, there will be more than 3000 cryptocurrencies by the end of 2018.

Personally I think this is quite a conservative estimate and the number could be way higher than this. This increasing number of currency on the one hand shows a positive movement in the crypto business, it is also making it extremely difficult for newbies to make an informed choice.

So, the big question is how you can spot a potential currency so you can buy and sell or just buy and hold for a profit in the future.

Here are 7 steps that you will help you make an informed decision before jumping into invest your valuable money.

1. Go to Coinmarketcap.com

This is a kind of portal site that lists all major currencies traded on the crypto exchanges. Currently there are 801 cryptocurrencies listed on coinmarketcap.com.

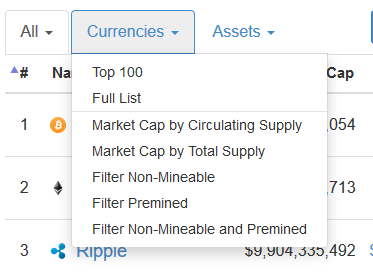

This is an incredibly useful site. You can see 100 currencies per page or if you wish you can click the view all button and see all the currencies on one page.

You can then scroll down and simply click on the currency you want to know more about it and you are taken to the relevant page.

You can reorder all the currencies by selecting different criteria. For instance on the trading volume tab you can order them by 24 hour trading volume, or 24 hour exchange trading volume or monthly trading volume. This gives you a good idea about how active a particular currency is.

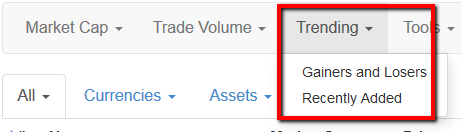

Another great feature is to order them by trend. Just go to the trending table and click losers and gainers and you will see all the currencies arranged in order of gain or loss. This is really a cool feature for further digging a particular currency.

From the trending tab, you can also click on the “Recently added” and it will show you all the recently added currencies.

Another super cool feature of the coinmarketcap.com is its search function. Just type any currency and it will show you all about that particular currency.

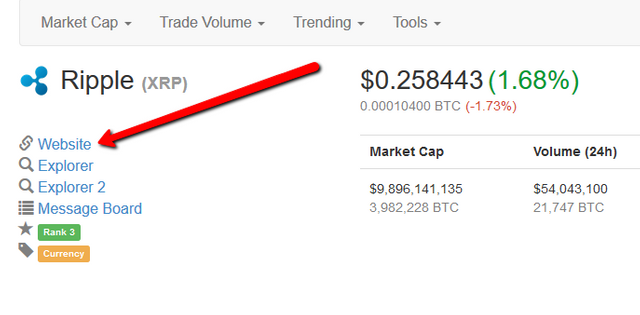

2. Check its website

Any business in this digital day and age should have a professional website where customers can get further information. This is even truer in case of cryptocurrencies.

Just go to the website of the currency you want and browse. Just look for the following

• Is the website professional looking?

• Or is it just a crappy site with poor design?

• Does the website contain useful content?

• Is there further information available?

• Who are the developers?

• Are they open to the public or hide behind computers?

• What is the roadmap?

• Is the site update regularly?

Check the blog and see if they keep posting regularly and there have been some latest updates or postings.

If you find positive answers to all these questions, it is a good indication that the people behind the currency are serious and most probably it is going to stay in the market.

On the other if there is no website, or the website is poor in terms of content or design. Or there are no further information then chances are the currency is crap.

3. Social Presence

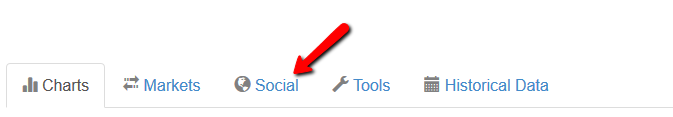

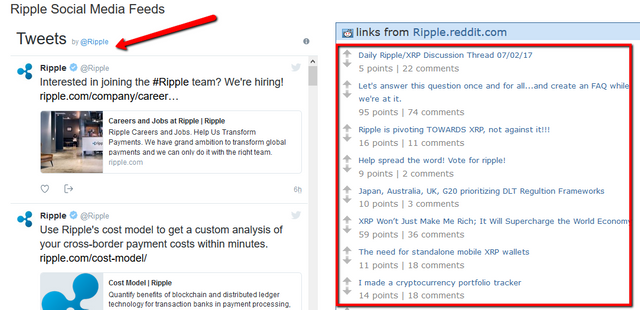

This is another great way to see whether a currency has future potential and will stay in the market. We know this is the age of social media and people form communities who interact with one another and discuss the topic they are interested in.

Any real cryptocurrency should have an active community in the social media such as Facebook, Instagram, Twitter, YouTube, Reddit, bitcointalk.org etc.

Just head over to https://www.coinmarketcap.com and search for the currency you want to know about. Click on the social icon and you will see if there is any active community behind it. You may also google its Facebook page and see if people are actively discussing it and that the developers are responding.

A scam or non-potential currency would either no social media presence or no active.

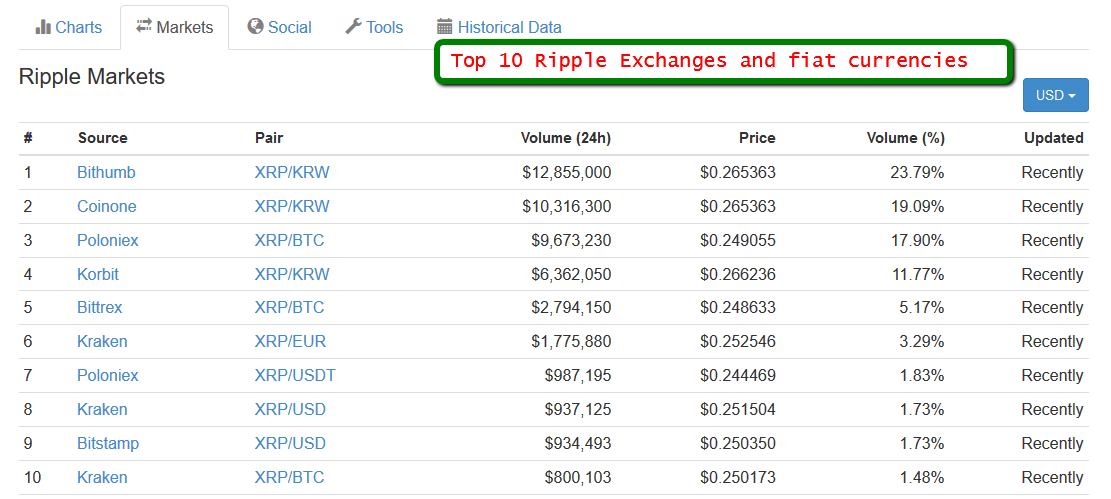

4. Exchanges

How many exchanges the currency is listed on? Is it listed at all or not? Some scam currencies like One Coin and S-Coin have been promoting Ponzi schemes without being listed on any exchange.

It is not enough, if a currency is just listed on an unknown exchange. Personally, I only deal in currencies listed in one or more of the following trusted exchanges.

• Poloneix

• Kraken

• Coinbase

• Bittrex

• Coinexchange.io

The more exchanges the better it is.

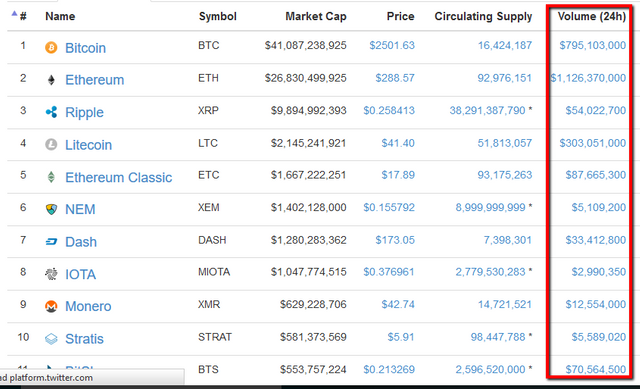

5. 24 Hour Trading volume

This refers to the total sale/purchase within a 24 hour period times. A good currency should have people actively trading on daily basis. Although there is no set 24 hour volume trading, but relatively it should there should be some trading.

For instance look at some of the top currencies and check their volume

Now look for some of the unknown ones and see how they are doing on their 24 hour trading volume.

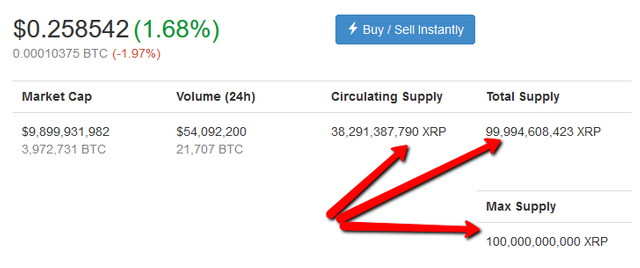

6. Total Supply

Every currency has a set amount of supply that has either been released or would be released in the future. The supply that has already been releases is called circulating supply which means that total number of coins available for trade in the market. While a currency may have total supply which means the total number of coins that will be able for trading in the future.

Currencies with very high supply are generally not very profitable at least in the shot and medium term.

For instance, Doge has more than 1 trillion total supply. That means to reach $1 value, its market cap must be at least a trillion dollar! Now the total current market cap for all currencies is just around $100 billion. So you can imagine how long will it take Doge to achieve that landmark?

On other hand currencies with low supply volume and a good market cap are likely to soar high in a short amount of time.

7. Historical Charts

Analysis. Analysis. Analysis. This is your key to success. Just looking at the historical charts simply would give you a good indication of where the currency stands in the trading market. To analyse a currency historically, you can see the charts either at coinmarketcap.com or coingecke.com

Comments and opinions

Follow @kadarkhan

Just follow and resteem this post if your steem.power is zero i will upvote your one post

upvote this post then comment your post link which you want should I upvote it

If you not following me you should follow me then do it

https://steemit.com/upvote/@crypto-booster/upvoting-started-followers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for your post. Very useful (Y)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit