Obtaining loan can be a very tedious process. Even if such a loan is approved, the amount that you receive is extremely low and may not be of much help. But obtaining the same by using a car as a collateral simplifies the process.

The market for loans secured by car titles in 2016 amounted to more than $ 30 billion and is on a constant growth. This has opened my door for startups such as SHIFT.cash to create a platform for the issuance of quick loans secured by vehicle title loans with the help of blockchain technology. They have made the process of obtaining loans as simple and straightforward as it can be made.

HOW IT WORKS

The company has opened new opportunities for obtaining quick loans through access to global finance to provide the most reasonable rates. The prerequisites for the borrower are that the user only needs a loan secured by his car.

For investors, this platform opens doors for new opportunities to make money in the credit market with the lowest risk involved. This has been made possible due to the growing credit market and the disruption of blockchain technologies and tokenization of collateral.

Technology

The platform works on the architecture of Ethereum Smart-Contracts. The architecture of the platform works in such a way that it effectively manages the number of property that was put up as collateral. At the same time, it also calculates the amount of the loan secured to increase the limit on investing for investors.

The SHIFT.cash system keeps 10% of interest payments on loans. The internal currency for the borrowing and instant transfers in called SCASH, which is a cryptocurrency. In terms of functionalities, they have built a mobile application platform and a stationary desktop version. They have a verification unit to handle the security aspects of the transaction and Blockchain scoring unit to checks the collateral for any potential obstructions region wise and acceptance of the collateral if it passes the test.

They have enabled the quick and easy transfer of funds by using internal cryptocurrency as their medium of exchange. The investors also have the opportunity to invest using both in the cryptocurrency and in ordinary fiat currencies, however, the internal movement of the funds will only happen via cryptocurrency.

TOKENIZATION and SHIFT.cash TOKEN

Their internal cryptocurrency is denoted by the symbol SCASH. The value of the token SCASH = 1$, where they plan on the primary sale of 100% SСASH tokens. For the presale, there will be a 33% bonus. The ICO calendar is as below-

• Total Pre-Sale Hard CAP is fixed at 500 ETH

• ICO Hard Cap 10700 ETH

• Total ICO Hard Cap 11200 ETH

• Total supply - 7 946 730 SCASH

Summary

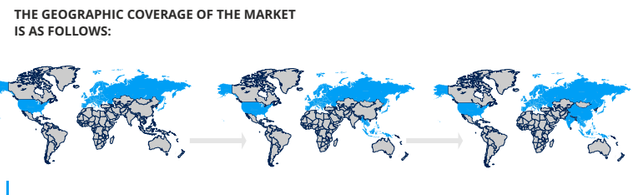

SHIFT.Cash was developed in 2015 by CEO – Тomas Novak – and his team. Over the years of creating CRM platforms, they have gathered amass of knowledge and experience to revolutionize how the lending market works. In less than three years, they are already seeingthe rapid growth of the market coverage.

They are expecting to gather 15% share of the current volume and 30% of the market share over the next few years which only reflects on how strong their mission is.

For more details visit:

Website : https://shift.cash/

Whitepaper : https://shift.cash/wp/shiftcash.en.pdf

Published By: karanj

Btalk profile: https://bitcointalk.org/index.php?action=profile;u=1030341