Everyone is well aware of the current scenario of trade finance industry. On any day, there are around $43 trillion of accounts receivable or accounts payable on the books of businesses. SO what is trade finance? It is a system where Global and local banks support international trade via products t help handle international risks and payments. These trade finances usually come with short-term maturities

That said, there are also a lot of misalignment in terms of the demand for trade-related credit and the liquidity of funds provided. These arise mainly due to Limited transparency due to a lack of reliable data points, Absence of trust and cooperation between banks, Limited Cash Liquidity in the markets and higher spreads, Bureaucracy and endless paperwork.

The ecosystem

Traxia aims to create an ecosystem that will be open and decentralized network to help users to improve trade finance globally. They do this by merging the power of blockchain and an open, connected IT architecture to create their ecosystem.They have implemented Internet of Things (IoT) to further track and validate their goods. The ecosystem also comes with an inherent feature of blockchain technology- that is the trust and transparency factor which is further validated with smart contracts.

Traxia focuses on Securitization and Standardization to attract both bank and non-bank investors. Additionally, Traxia will decentralized trade finance technology and will work closely with international regulators to make such an open market possible. The actors in the ecosystem are Seller,- A company that is offering a product for sale, Buyer- Could be a company that is offering a product for sale. Investors are those who invest money into the financial products, assets, etc. Issuing Provider, Listing Providers- marketplace that matches investors of securities with listed and unlisted securities, Loan Warehousing- it is the initial process of acquiring debt from various sources.

The smart contracts that they have deployed will take care of volume and duration of an underlying trade, while also becoming interoperable with existing Enterprise Resource Planning (ERP) Systems. In addition, they will be making use of the scientific model suggested by Hans-Christian Pfohl and Moritz Gomm to create a structure using a qualitative approach, to improve cash allocation into trade- related financial products. Hence, the B2B trade intermediaries such as buyers and sellers automatically become a part of the financial trade system.

The token ecosystem and ICO

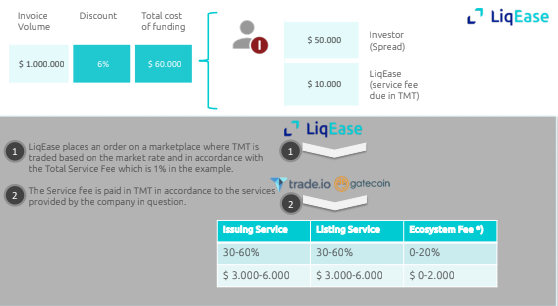

They have a simple user interface and a basic system for users who are accessing the ecosystem. It can be done via Issuing and Listing services and membership fee on a per transaction basis to be settled in Traxia Membership Token.

The token is denoted by the symbol TMT. They will issue a fixed amount of max. 1,000,000,000 Tokens. The token distribution is in the following manner:

• 70% of the tokens will be eventually allocated amongst the community. Distributed in the following order 30% + 30% + 5% + 5%

• 20% will be allocated to the foundation creation, development team, early backers.

• 10% will be allocated to the treasury with the purpose of providing TMT Liquidity if necessary as well as being a contingency fund.

Do check out their website for further information.

Website:https://www.traxia.co/

Whitepaper:https://docs.wixstatic.com/ugd/baba69_30f719c55f344ab7ae44715a4d287811.pdf

Telegram:https://t.me/traxiafoundation

Btalk ANN:https://bitcointalk.org/index.php?topic=3019695

Published By:karanj

Btalk Profile:https://bitcointalk.org/index.php?action=profile;u=1030341