Bitconnect: 3 important investing lessons from the HYPE 💰

Was Bitconnect a scam?

Kevin here.

Originally posted here on Refugee Hustle.com.

Do you remember those YouTube ads, where people talked about how they made thousands *without *taking any risk or putting any money in?

Seriously. After the 10th ad, I wanted to buy YouTube Red. That shit was annoying AF.

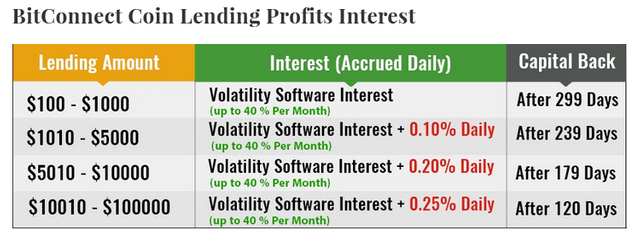

If you clicked on the ad, it would typically be an affiliate link for Bitconnect, a cryptocurrency lending platform that promised a minimum of 1% interest daily. Think your bank account on steroids.

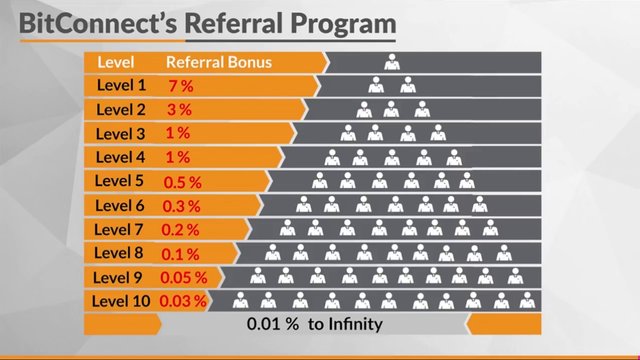

With more affiliates under you, the moreinterest you could get.

Does this look familiar… like a pyramid? Many people said ponzi scheme.

No lie. It was like watching a cult. I watched the back and forth and read things like… “If you think Bitconnect is a scam, then you don’t really understand it or cryptocurrency!”

A lot of YouTube channels promoted it too, including some of my friends. Unfortunately, they got shit for it when bitconnect shit the bed.

On January 16, 2018, Bitconnect ended it’s lending platform, plummeting the Bitconnect coin from $435 to $7.11 per coin.

People who went balls deep ended up losing their lives to Bitconnect.

The point of this article isn’t to make people feel bad, but it’s about how to make better investing decisions going forward. History will repeat itself. Will there be another Bitconnect? You bet, but there will also be real investing opportunities too.

Today I will cover how not to get fucked over going forward and strategies to mitigate your losses… even if you invest into another bitconnect.

Ready? LET’S GO!

From a long term strategy, FOMO will cost you

*Ever feel like missing out on an opportunity? *

Back in college,“froyo” was the new hype. I know. Boston hit the froyo trend wicked late. Froyo was great when you were too broke to afford a real meal, but still wanted to hang out with your friends in the middle of the day.

One time I went to this place called Mixx. My friends were talking about how ballin we would be if we had our own joint.* *Seven years later, I come back to Boston and Mixx, along with other froyo joints, closed down.

The same thing happened with fidget spinners, vapes, and everything else that was trending in LA.

Just like with cryptocurrency, there’s always going to be new opportunities popping up. And when you see the ROI, we get tempted by the numbers. Even I've bought into the hype sometimes.

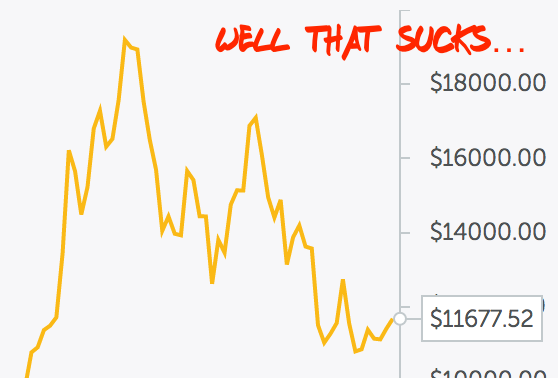

For example, one of my friends was telling me… “Kevin it’s a good time to buy Bitcoin right now. It’s at $19,000. People are saying it’ll be at $100,000 by the end of the year!”

At the time of this writing, bitcoin is at $11,000. FML. There’s supposed to be another zero. You can’t always be a winner. Luckily I didn’t go YOLO, throw my life savings, invest it all at one time.

That’s why it’s so important to avoid hype the plague. Instead, buy dips in the market. Or even better dollar cost average… assuming it is a sound investment.

But how do you know if it’s a good investment? Try asking…

Does this actually solve a real problem?

Do people care enough to actually pay for it?

Bitconnect fails this test. Why?

Even though people are willing to pay for bitconnect, bitconnect doesn’t solve any real problems… other than just making money. If a company only talks about the money being made, that’s a red flag.

Conversely Litecoin actually fixes real problems. What are two big problems with Bitcoin? It’s expensive and slow ass fuck. Litecoin solves those problems. And if they actually merge with Monero, a privacy coin, then that solves another problem as well.

Key takeaway? Discipline isn’t only about taking action. You also need to say no sometimes to the new sexy shiny objects in life too.

Stop, think, and ask… Is it true?

Back in college, I thought I was a great boyfriend because I had great communication in a relationship… *but was I really? *Being the super nerd I am, I asked for honest feedback from my ex-girlfriends. This is what they said…

I still held grudges against my other ex’s during the relationship

I hold things in that bothered me and blow up later

Instead of facing arguments head on, I avoided and ran away from tough conversations

**Well…That sucked. That's why you need to ground yourself with reality, especially with investing. If you believe bullshit blindly, it will cost you.

When Bitconnect came out, they promised…

“This all adds up to a guaranteed 127.25%+ guaranteed, risk-free interest per year, not even counting reinvesting your interest.” -TheGrinder

**Real talk. How duh mudda ass are they going to promise you a return of 127.25% per year… plus an additional 480% from your referrals? **

Not going to lie. It’s easy to look back now and say “this was a scam”, but it was too good to be true.

Especially when there is so much hype and feeling that you’re missing out every second you wait, taking the time to stop and think isn’t fun or sexy. It’s like trying to write your senior thesis… while you’re at EDC popping mollies.

So what’s the most time efficient way to find whether something is true or not?

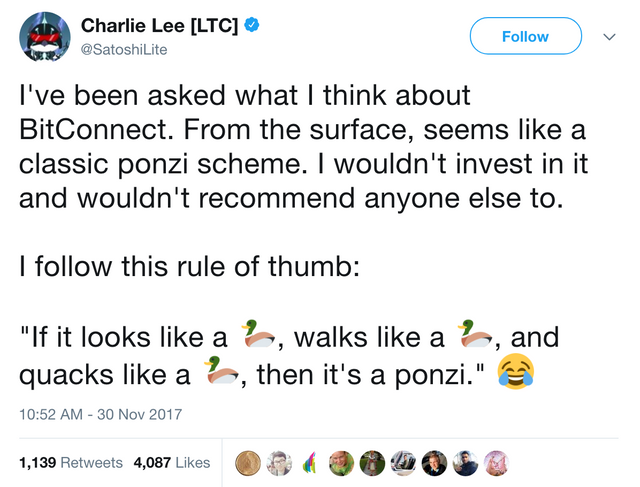

Ideally you would want to talk with experts. But what’s the next best thing? See what are the other “experts” in the industry saying.

My favorite quote was from my friend Charlie Lee…

Use their opinions as a guide. Don’t take their word like it’s the bible. Understand their thinking and ask questions.

Why does Charlie think this way?

If everything with Bitconnect was true, how would we really know?

Key takeaway? Ask more questions so you can seek better realistic answers.

Rather than going balls deep, create a portfolio.

Repeat after me. You will never, ever sell your house no matter how sexy an investment might be… unless you’re ballin with multiple houses that you don’t GAF about.

No lie. It breaks my heart hearing that some people sold their houses and children’s college funds on this.

People can lie, especially when there’s money involved. Even if they’re telling the truth, shit happens. Your exchange or brokerage can get hacked.

So what do you do? Create a portfolio rather than go balls deep with one investment. Diversify your exchanges and investments.

Sure. It’s not as sexy as getting rich overnight. You’ll reap some of the benefits rather than none. And shit… it’s always better than losing 98% of your money.

And that’s the thing. Getting rich over time isn’t sexy, until you’re actually rich. Investing into a 401K or Roth IRA isn’t sexy, but it’s a proven way to let compound interest do it’s magic.

If you want to invest in riskier investments, that’s fine. Just make sure you have a foundation. Most of my money is in index funds and ETFs. I have 5% in stock and about 10-15% of my total portfolio in cryptocurrency. And most of all be prepared to lose it all.

Key takeaway? Have your safe and risky investments so you can have the best of both worlds.

Finally stop blaming others for your financial decisions

The truth is I never invested in Bitconnect, but I joined two multilevel marketing schemes back in high school. The dream of quick money tempted me like an asian baby girl (ABG).

Just like bitconnect, the more people I got into my “tree”, the more money I could make. So I tried it and got three of my friends to join me.

No lie. The worst part wasn’t even losing the money.

The part that sucked was pulling my friends in. At the end of the day, it was their decision, but I was responsible because they trusted me.

At that point, I could of blamed the MLM company, but you can’t grow unless you take responsibility for your own actions.

Ultimately you’re responsible for your own investment decisions. If you want to grow as an investor, you can’t blame others.

If you got burned by bitconnect, read this.

Everyone fucks up. Before you blame the YouTuber/friend/affiliate for “tricking” you, look at yourself first.

They didn’t hold the gun to your head or make you signup. I know. These words might suck, but I’ve been through it before too.

Take these growing pains as lessons. Yes it sucks. Some lessons are more costly than others, but it’s the best way to learn. How can you ever learn if you don’t take responsibility?

The real reason why I didn’t invest or promote in Bitconnect was because I remembered the lessons from my MLM days. Don’t believe the hype without questioning it.

If you ever got burned by bitconnect or a ponzi scheme, feel free to let me know in the comments or privately at [email protected]. You can also send me a DM on my Instagram too.\

I know it sucks, but either way I’m there for you.

Kevin Yee

Like my content? Follow my social media!

Website: http://refugeehustle.com

YouTube: https://www.youtube.com/c/kevinyeethepharmd

Instagram: https://www.instagram.com/kevin_the_refugee/

Snapchat: https://www.snapchat.com/add/aznhakgui

Great point and a great article. As long as there will be people, ponzi schemes will thrive. There is a saying, a new sucker is born every second. There will always be fresh meat to send to slaughter house.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

So true. Unfortunately the best life in lessons are the mistakes we make. Hopefully people don't bet their lives on it and can recover and learn from it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great first post. Told us quite a bit about you without writing about you.

It feels a bit like 1999 prior to the dot com crash. Funny thing people were not talking then about ponzi schemes even though the term was invented years before. Lots of half baked ideas with a dot com name skimming people's cash.

I am not a big believer in diversifying but I do agree one has to diversify the risky and unproven assets in a portfolio. I have done that with my coins (STEEM aside that is which is somewhat concentrated)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the comment!

It's pretty crazy how history repeats itself. I remember back when I first got convinced with my first "MLM", they always focused on being the next "hype thing".

Being the high schooler I was, I didn't want to miss out. But you know, I think you grow wiser as you get older.

That's why I have a lot of respect for older investors (like you) and definitely agree with your view on "over diversifying".

Hopefully I can get a bunch of STEEM as well using this platform. 😂

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Disclaimer: I am just a bot trying to be helpful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @kevinyee! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey Kevin, I came here from the RH newsletters/blog posts - love your content (works as a great reminder to keep hustling) and it's great to see you on Steemit, I'm pretty new too but plan on creating my own blog posts soon too :)

Man the comparisons to MLM takes me back I remember when a lot of my friends got into Vemma and damn was it hard resisting that the way these MLMs used to target kids by promising these extravagant lifestyles was shady AF. I think one of the ways to avoid getting sucked into these scams is to run it past the people who are close to you to see what they think. I probably would've bought into Vemma if I didn't speak to my parents about it and at 15 y/o back then the startup costs were a fortune themselves 😅

Finally just wanted to give my condolences about the loss of your father, hope you and your family find the strength to get through these tough times which I'm sure you will 🙏

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit