Referred to as "Tears of the Sun" by the Incas, gold finds its place in the history as early as 40,000 B.C. From the ancient times, gold has been associated with wealth, status, and beauty. Earlier gold was not used as bartering tool but for social status and as an offering for gods. It was the Kingdom of Lydia, an ancient civilization in Turkey, where gold was first used as a currency. In 1792, United States congress under the Mint and Coinage act fixed the price of gold to the US dollar which made gold as a legal tender with exchange value.

The two world war lead to massive destruction and to rebuild the economies there was the need of external aid which came from the US for Western Europe and Japan. In order have this monetary relation there had to be an exchange rate and Bretton Woods system came into place wherein price of gold was fixed to the US dollar. This landmark decision is the reason why US is the superpower we see it today. Later gold standard was abolished and as gold was no longer pegged to a fixed exchange rate, the price of gold skyrocketed. The relative scarcity, versatility and aesthetic attributes of this yellow metal drive its demand and makes it an effective tool for wealth storage.

GoldMint: A blockchain based solution to make gold trading easy and secure

Gold has always been difficult to store, transfer or trade and there is always the fear of it being taken away by antisocial elements. People tend to store it in safe deposit vaults which further decreases mobility and leads to overheads in holding gold. GoldMint aims to overcome this problem by proving a novel solution. It combines the best of both world—blockchain's features such as transparency, fast transaction, and the ability of cross border transfer with the value and safe haven properties of gold.

Introducing GOLD, A Cryptoasset Backed by 100% Real Gold

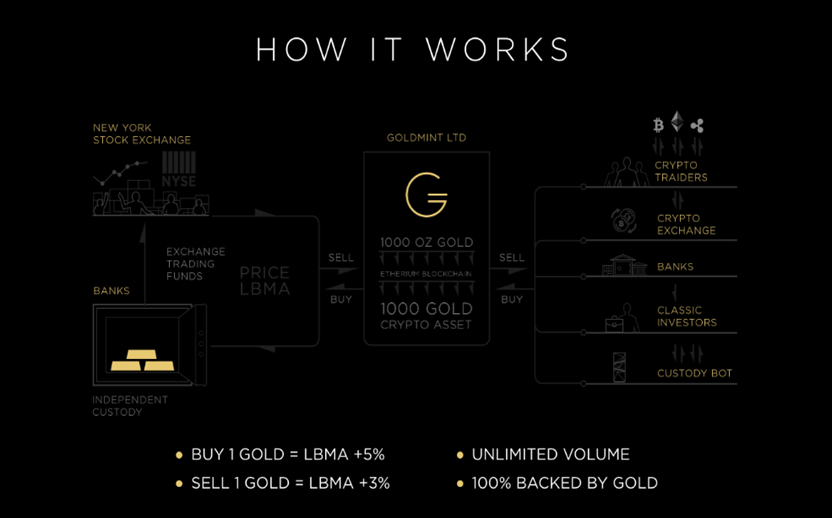

GoldMint solves the problem of physical movement of gold by tokenizing gold into a cryptoasset i.e. GOLD. This GOLD can be easily transferred across borders and is 100% backed by real gold. 1 GOLD cryptoasset is equal to one ounce of 999 physical gold on LBMA. GOLD cryptoasset can be used as a collateral for loans, as a payment means or as a means to invest and earn. It can help you easily convert your stored gold bullion into a trading asset. So just do not hold gold bullion and wait for the price to increase in future but convert that idle gold into GOLD which can be used for multiple purposes. According to World Gold Council, it is estimated that Indian household holds over 23kT of gold in jewelry, coins and gold bars. Imagine if only 10% of this gold is monetized via GoldMint the quantum of gold released in the system would almost equal to the gold reserves of France.

Deciphering the Enigma of GoldMint

Goldmint is based on a private blockchain known as Graphene. Graphene delivers better performance that first or second generation Bitcoin derived systems. They transcend the Bitcoin 2.0 systems and provide better transparency and are virtually incorruptibility. The high security provided by Graphene is no less than any security features offered by modern security systems.

GoldMint uses Custody Bots to deposit physical gold. Custody Bot can accept gold coin, jewelry, or bars and provide GOLD, the cryptoasset to the depositor. The weighing, purity check and storage is an automated process involving zero human intervention. Cutting edge technologies like spectroscopy, hydrostatic weighing etc. are done to ascertain the purity and weight of deposited physical gold. Once the authenticity of deposited gold is determined the purity, weight and other data is saved on the blockchain which can be viewed by everyone. The depositor gets the value of their deposited gold in form of GOLD the cryptoasset. In future, if the depositor wishes to retrieve his gold asset they can surrender the GOLD with GoldMint and withdraw their assets.

GoldMint aims to get hold of 10% of the global gold in supply pegged at over USD 100 billion. This will be done in three stages. Firstly they will target pawn shops across the globe to deposit physical gold in Custody Bot. Secondly they will move to popular locations such as shopping centers and install Custody Bot in malls so as to attract gold deposits. Thirdly they will be developing a special version of Custody Bot which would help them to popularize and increase deposits.

GOLD Cryptoasset Use Case

- GOLD can be used a long term investment which is as stable as physical gold and as liquid as fiat currency. Users can surrender their GOLD and receive payments in fiat currency or any major cryptocurrency they prefer.

- Fiat currency loans can be secured from GoldMint PTE LTD keeping GOLD as a collateral. There are multiple options offered by GoldMint to service the debt, in a case if the debtor defaults GOLD assets are forfeited.

- GOLD can be used for cross border movement of the asset. One can deposit physical gold in custody bot and convert it to GOLD. This GOLD can be easily converted to physical gold by surrendering your GOLD at a custody bot.

- ICOs generally raise capital in Bitcoin or Ethereum which are prone to market volatilities. If the capital raised is in form of GOLD it will be far more stable and will provide guaranteed capital.

- GOLD can be used to gain investment returns via pawnshops or as a hedge against risk due to its inherent nature being backed by physical gold. The relative stability of gold will provide a cushion to investors facing a severe downturn.

One of a kind: GoldMint

There are multiple projects such as Digix or LAToken which can be used to tokenize gold into cryptoassets but nothing comes at par with the features offered by GoldMint. GoldMint uses its own blockchain Graphene which makes it more secure than its peers. The use of Proof-of-stake makes transactions on GoldMint uber fast, and economical than Proof-of work. Digix and LAToken are based on Ethereum which makes them less secure as well as slower compared to GoldMint. While GoldMint offers tokenization of physical gold held by an investor via Custody Bot through an automated process there is no such facility provided by Digix or LAToken. At any particular instance of time, GoldMint's gold reserves can be viewed which is available on the blockchain, this level of transparency is not offered by its peers. GoldMint in its endeavor to make the transaction fast and reliable buys ETFs to maintain the required liquidity on its platform. Lastly, GoldMint allows you to monetize idle gold which one is holding which is not provided by any blockchain startup in this ecosystem.

If you fall in one of these categories it is imperative you be a part of GoldMint

- Cryptocurrency Traders deal with a lot of volatility which tends to eat away their profits. As cryptocurrency markets operate 24*7*365 it is almost impossible for traders to keep a track of all the positions. Using GOLD to hedge positions is an elixir for crypto traders.

- Investors who generally purchase physical gold should make the transition to cryptoasset GOLD. This will not only help them in investing in a very stable asset class but will also keep their investment liquid. The added liquidity is a boon as it allows the investor to instantly convert the asset to fiat currency in times of distress.

- Digital payments are fast and hassle-free. Individuals who use e-commerce platforms a lot can use GOLD to make payments. The security and transparency of blockchain coupled with the low volatility of gold makes it a serious substitute for the fiat currency.

- Currently, banks charge a commission of over 5% for all cryptocurrency transactions. If banks partner with GoldMint under the partner program it can charge fewer transaction fees on GOLD cryptoasset transaction. This will eventually lead to the higher transaction via banks as most of the investors will switch from underground exchange to legitimate banks.

Fuel of GoldMint Platform: MNT tokens

The MNT tokens are the native altcoin of the GoldMint platform. It is for PoS consensus algorithm. A higher number of MNTs will allow a miner to have more blocks to confirm and earn more MNT tokens. The Miner who fails to fulfill his duties is blacklisted from the pool of reliable miners and his work is given to another miner. Total number of MNTs in circulation would be 10 million and will be pegged at a USD 7 to a MNT at the time of ICO. 75% of all the proceeds from GOLD commission on GoldMint will be distributed among the MNT holders. Rest of the 25 % commission are used for GoldMint's maintenance needs and charity purposes. In this way, GoldMint also fulfills its corporate social responsibility by giving back to the society.

The Verdict

The strong leadership of Dmitry Pluschevsky and Konstantin Romanov who have run successful previous ventures in this domain, is a great plus point for the project. The project tackles some of the greatest limitations of trading in physical gold. Features such as Custody Bot, loans on GOLD, ICO on GOLD will definitely gain traction in the market making GoldMint a well-known name in the investment and hedging world.

To know more about this project visit

Website : https://goldmint.io/

Whitepaper : https://goldmint.io/white-paper

Bitcoin talk Thread: https://bitcointalk.org/index.php?topic=2091726.0![]