Do you want to invest in gold or silver but there are too many barriers that you have to pass before you can invest in it successfully? Or, what about other assets such as stocks, bonds, or commodities that are likely to become a major asset in the future? You can invest in any of that, as long as you fulfill the requirements. The bad news is, most of us can't. There are a lot and high barriers that limit the regular user to invest in real assets. But, maybe it won't last any longer, because Virtuse aims to help you to enter the world of real assets and cryptocurrency. With Virtuse, you're promised with the ability to trade and own those assets securely and as quickly as possible.

Bridging Traditional and Cryptocurrencies Market & Technology

The Face of Traditional Market

Virtuse won't be there if there is no problem in the current status quo. So before we dig in deeper into Virtuse, you must understand several problems in our current digital or real asset exchange such as stocks, bonds, or commodities and also cryptocurrency exchange. We've talked a lot about this in my previous articles, don't forget to drop by to read it.

So, when we look at the traditional exchange, which becomes the major market or place to buy and sell traditional assets such as the S&P Index or Gold, there are at least three issues. First, there is a high barrier to enter the market for regular users. Second, it favors traders with big money and trading volume (or institutional traders/investor) and the last one is that the market is too centralized into some exchanges.

The stock market illustration. Source: USNews

According to Virtuse Whitepaper, in the current status quo, not everybody can join the market. Most of the time, it happens because they don't have the necessary requirements to register and join the markets. Thus, the stock market becomes an exclusive market where in order to join them, you have to become rich first (or have those requirements). Well, aren't you trading to make money?

Virtuse will solve this problem by removing those barriers, making registering in their exchange as easy as you wish it to be. Of course, in order to make a decent profit, you have to learn about trading and practice a lot, there's no way you can get x100 return if you don't understand even a little bit about candlesticks. However, your life will be a lot easier because Virtuse allows you to trade a different kind of assets with the necessary tools to do your trading decision, such as technical analysis indicators, news feed and so on.

The next problem is there is a clear tendency to make big players or institutional investor (especially if they have a connection to the exchange) enjoy more benefits when they're using the exchange. This happens because exchange wanted to have high liquidity, but in turn, this makes a low-budget trader can't get profits as much as they wanted to. The big discount and facilities are owned by big traders, while the small fish got the burden of paying more while getting less than they should be.

In order to solve this problem, then every trader can use the VIRT token to access the discount up to 25 percent, that will decrease and then everybody will have the same fees for every trade that they make. This means the fees that you pay will be proportional to how many trades that you make, therefore, the case of small trader pay more to get less while the big player pays less to get more won't happen.

The other problems are market centralization. Almost 90% of the global market cap for stock exchanges come from only 16 exchange. This centralization could results in high risk of price manipulation by an exchange or players on that exchange, that has been described by this article which explains clearly how the big players manipulate the stock market. To put it simply, those 16 exchanges can acts as a cartel who control the price of every asset on the market if they wanted to. The risk is big, and that's why we have to decentralize it, or at the very least, to make sure that every transaction that happens on the exchanges is transparent to the public. In fact, there's an analysis by someone on the internet that Bitcoin price is manipulated just like gold.

Embracing Crypto Development

On the other hand, cryptocurrencies are now being recognized as one of the digital assets or currencies that you can "invest" on. The blockchain technology and cryptocurrencies are still new, but there is a lot of promise from them if we can get it right. There is a lot of business that tries to move into the blockchain space now and start to run an ICO/ITO.

Unlike traditional assets, cryptocurrencies have many exchanges that you can use and it is not limited to a regional or countries. Almost everybody as long as their government allows them to use crypto can join the market. But as always, there are several problems (outlined in the whitepaper of Virtuse Exchange too) in the current cryptocurrencies exchanges.

First and foremost, most of them have a weak infrastructure. The majority of cryptocurrencies exchange are prone to hack, crashes, and many other problems. It happens because there is no strong infrastructure behind them, as most of those exchange uses low-budget infrastructure services, bad website coding, slow order processing engine that can't handle thousands of transactions per second and so on. Those make trading experiences on crypto exchanges more or less a pain in the ass and there is a high risk of loss of fund due to hack which has happened many times too. If this can't be solved, then cryptocurrencies exchange (and probably crypto in general) won't survive much longer.

Source: CCN

The only way to solve this problem and decrease the risk of crypto exchange hack is to build an exchange with a strong infrastructure, high-quality security layer, and coding, with dedicated and professional coder behind it. This is what Virtuse aims to do in order to stay competitive with the current exchange that exists on the market and to increase customer trust in cryptocurrency future.

Second, the majority of the exchange have high spread and low liquidity. A high spread cause price can change way too much in a short amount of time, therefore increasing the risk of trading in such a place. A trader won't enter this market when they're experienced enough, and therefore cause low liquidity on the market. In turn, there won't be that much activity for the assets and a professional investor will likely choose other assets to trade, unless they're very confident that those cryptos will turn out to be a good product later on.

From what I can see, Virtuse aims to ensure that there is always enough liquidity and little spread from the market, by using some measures such as acting as the buyer/seller on specific assets such as DACTs (which we'll get into it below). But this won't be a problem for too long, as long as the number of users grows, liquidity and spread will come in place. Because of that, Virtuse needs to spread more word about them.

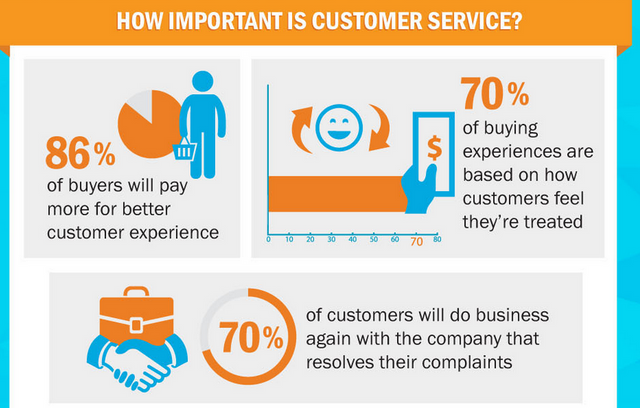

Third, most cryptocurrency exchanges have poor customer support and lack of multilingual communication support. This is probably one of the worst problems that happen in the cryptocurrency industry. Almost every exchange has this problem. The customer might suffer from slow response, or inadequate help from the customer support as they don't understand the problem correctly and need to forward it to another team that understands about the problem, however, this cause slow and fragmented communication for the customer.

Source: Forbes

Not only that, most exchanges only support one or probably two languages, which could limit their abilities to communicate with the customer coming from another country or who can't communicate in English fluently. This can make it hard for both parties to understand each other, or it is difficult for the customer to say what they really wanted to say.

Virtuse will solve this problem by preparing a dedicated support team who can speak multiple languages to help users from many countries. It would be better if they also can give some insurance or guarantee that every support request can be solved or responded as soon as possible, without repeating the same response. I've really a bad experience with many exchanges mainly because their customer support can't response quite fast and not only that, my problems are still there after weeks. Hopefully, Virtuse can change this!

The New Asset-Backed Tokens: DACTs and DAFs

Virtuse comes with a brand new product, that never exists previously on traditional or cryptocurrencies exchange, though the idea is not entirely new. That idea is DACTs and DAFs. By using these two products, Virtuse will "convert" the world of the traditional asset to the digital, blockchain based, smart contract powered cryptocurrency assets.

DACTs or Digital Asset Collateralized Tokens is simply a tokenization of assets which is backed by actual assets such as gold. The value of DACTs represents the value or price of actual assets, with a mechanism of "price stabilization" when the price of the token is much more lower or higher than the real assets that will be done by the platform. To put it simply, if the price is higher, the platform will sell some of the tokens and assets to push the price down, and will buy-back the tokens to increase the price when it is much lower than the actual price.

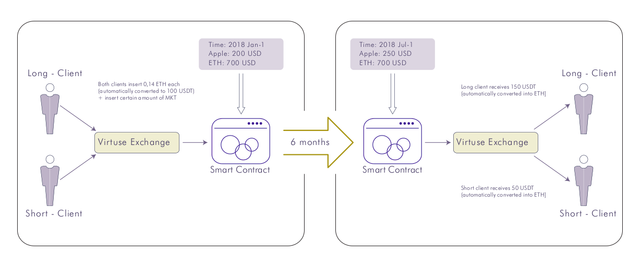

DACTs trading. Source: Virtuse Whitepaper

Traders can trade DACTs with each other, which works just like trading futures. One side act as a short buyer and the other as the long buyer. The results of the "contract" will be determined at the end of the expiration date, either the short got the profits or the long got the profits, and so on. The funds to trade will be converted to USDT in order to make sure that volatility doesn't affect the amount of money being put on the "contract". However, unlike futures, the tokens are backed with real assets, therefore, creations of the DACTs will be directly connected to the number of assets being owned by the platform.

DAFs or Digital Asset Funds is another product that customer can trade on Virtuse. In my opinion, this is like an index fund on regular stocks market, which is simply a portfolio consisting of several units of investment into one. You can define DAFs as a unit that represents a portfolio of several coins/tokens/assets. Buying DAFs has some benefits like buying a regular index fund, which has a relatively low volatility because your portfolio is automatically distributed to several coins. But of course, you can choose to buy a DAFs which focus on getting a high return with high risk because the portfolio will consist of coins/tokens/asset that is likely very volatile.

After the platform is running, Virtuse will allow other trusted third-parties to create or provide a lot of DAFs. This means that users or customer can enjoy a different kind of products that are not possible when they trade on traditional or cryptocurrency exchange. Even though the providers is likely limited, but I think this is necessary because there must be a requirement for DAFs creator to make sure the product can deliver what they wanted for the customer. Just like when ICO fails if the team is bad, DAFs will fail if the creator doesn't have the credibility and skills required.

There are several kinds of DAFs or DACTs that will be offered by Virtuse on the first launch, such as a pre-set of a portfolio on major Emission Allowances markets. If you really want to invest in this major market but have difficulties entering them, then Virtuse Exchange is a good option that you can take. Less barrier to enter, many assets to trade, and the most important thing are that they have their own unique product.

The VIRT Token

Just like many cryptocurrencies exchange out there, Virtuse will also issue their own utility tokens called the VIRT token. VIRT token is mainly a utility token to use the exchange. There will be only 1 billion tokens created, and it will never increase. When the token sale started, you can buy the token with Ethereum (details on the white paper at the moment I'm writing this article, it might change, don't forget to double check the whitepaper before you buy).

Virtuse platform demo

VIRT token mainly functions as a "fee token", which give benefits of lower fees when you withdraw, make transaction, list and do any other kind of transaction on the platform. There will be a buy-back program that aims to decrease the number of VIRT token into 500 million, therefore creating more scarcity of the VIRT token. I think it will be great if every token or some percentage of it that is used to "fuel" a transaction will get burned so that it will dramatically decrease the number of tokens regularly or create a deflationary model.

Another benefit of holding VIRT token is the ability to vote in the platform-related voting, such as selecting a service operator. But for the majority of people, the tokens will mainly be used a lot in transactions that are happening on the network, and probably it will be the only token acceptable as fees when you trade on the platform, which will increase the demand of the tokens too. The choice is in your hands, so choose wisely.

Bottom Line

The cryptocurrencies exchange and traditional assets exchange have their own plus and minus. But, if you can combine those two and removing all the flaws, you'll get a new platform that can serve a lot of people interest, with the ability to invest and trade on both assets at the same time. Virtuse will likely be the first to do it, and therefore, will be the pioneer of this kind of exchange. How will they turn out? Don't forget to follow the development of Virtuse exchange.

Some important links that you should check out:

Virtuse Website: https://virtuse.com

Virtuse Whitepaper: https://virtuse.com/public/pdf/whitepaper.pdf

Virtuse Bounty Thread: https://bitcointalk.org/index.php?topic=5025842.0

This article is not a financial recommendation. The author, Virtuse and other parties mentioned in this article is a separate entity. The author writes this article based on his own understanding of Virtuse. Readers should read the original document of Virtuse by themselves. The author shouldn't be responsible for any actions taken by the readers, including but not limited to: joining the Virtuse bounty program, participate in the Virtuse token sale, and etc.