Recently, I read a very interesting article from the Virtuse Medium blog. It has a nice cover pic, a big and giant elephant, walking alone in the middle of a jungle. It creates an impression that the elephant is powerful and scary, enough to give me a chill. Interestingly, the topic of that article is also about the elephant, specifically, the elephant in the crypto industry.

Do we really have something like that?

The Elephant Syndrome & Cryptocurrency Industry

The CEO of Virtuse who wrote that article gave a very great definition about the elephant syndrome. To put it simply, an elephant syndrome is a psychological syndrome when someone believes they can't break free from something, or the "invisible chains". Like it or not, they have to follow and succumb to it, believing that they won't ever be able to break free and reach another level of health/wealth/anything if they don't follow where that chain goes.

It is called an elephant syndrome because the behavior of somebody who has this syndrome is similar to an elephant in a circus. Logically speaking, an elephant has enough power to break free and run from the show. He literally can break the stage if he wanted to, but what makes him stop doing that, even try a little? The reason is that he had many experiences of failure when he tries to break free from the chains over his neck or body when he's still young. The memory of those failures and pains cause a baby elephant to believe that he'd never be able to break free from the chains, and therefore gave up to do anything. Hence, let's welcome the elephant syndrome.

The Elephant, taken from the Virtuse Medium blog. Source: Virtuse Medium Blog

So, what is this elephant syndrome in cryptocurrency, or finance in general and how Virtuse is related to them?

Well, first and foremost, I'm gonna talk about something different from what has been mentioned in the article from Virtuse above. You can say that this is a complementary opinion for that article, and obviously not a financial recommendation or some sort. Because of that, you must do your own due diligence.

So, first thing first, if you're gonna read in detail about the elephant syndrome in the world of cryptocurrency, then I suggest you read the article above. Why? Because I'm gonna outline some "chains" on the traditional markets that lead to the birth of Virtuse Exchange. These "chains" are actually connected to the cryptocurrency world, that already lasts for more than centuries.

The first chain is the belief that only expert can invest and access the luxury of stocks, bonds, or other commodities. You can replace "expert" with "rich", "has connection with the business", or "the descendants of the richest people", which legitimates that regular people, those who can't produce more than $200,000 should not invest or access any market which could give them a wealth boost over the next years.

The second chain is the belief that investing is too risky for regular people, and they should avoid it at all cost and should never try to invest in anything. Not only that, investment is costly, complex, and difficult to do because there are too many regulations that need to be followed and it's kinda hard to do for regular people. In another word, investment or other markets such as stocks, gold and etc, should not allow regular people to join.

Those two chains, in return, cause the stocks, bonds or other markets to be very centralized in favor to big investor/accredited investor which is less than 5% of the society. It limits the opportunities for regular people to access the market and believes that those aren't meant for them. The same thing happens to cryptocurrency, which in turn limits the potential of this market to grow and bring innovation for the worlds. This needs to stop, we have to break the chains.

Breaking the Chains with Virtuse Exchange

So, we realize there is a problem. But how to solve that? How to make sure that people realize everybody can join and contribute to the growth of cryptocurrency or traditional markets in general? How can we help them to break free from the chains that entangle their necks? One solution that might work is to provide a platform that is easy to use, provide the necessary tools to be used by everybody, and empower them with education and assets that has a relatively low risk.

If you wanted to read in detail about Virtuse, you can find it in my other article here. For the sake of this article, we'll gonna review and discuss it directly in relation to the elephant syndrome that we've discussed above. However, you're very welcomed to read about Virtuse in detail via their whitepaper too.

So, the core problem is the belief that investment is not suitable for a regular user, and on top of that, it is difficult to access it. Virtuse aims to break this belief and empower regular user or even expert to participate in traditional and cryptocurrency market at the same time, by providing the necessary platform to do so. Unlike traditional market where registration is long and time-consuming Virtuse aims to provide a platform where everybody can register anytime, anywhere. A single registration allows them to access both traditional markets such as stocks or bond and cryptocurrency at the same time.

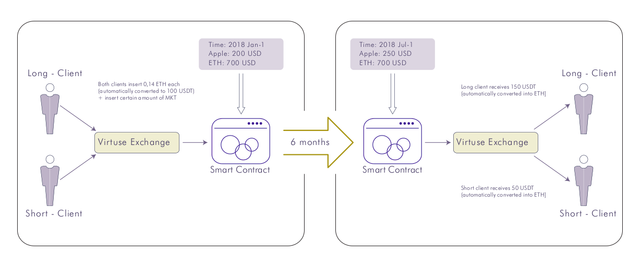

DACTs trading. Source: Virtuse Whitepaper

There is no minimum money to invest or buy assets on Virtuse. You can literally buy from $1. By doing this, Virtuse opens up access for everyone with any economic background. Of course, they have to learn about assets and crypto in general, but you don't have to be an expert to participate in this market. The golden rule of don't invest/use the money you can't afford to lose is the golden rule here. So, don't stop learning guys.

The introduction of DACTs and DAFs will also increase the flexibility to buy a different kind of assets. Just like a regular index fund, you can buy a single fund easily and then own the underlying assets of that fund. For example, you can buy a gold index, silver index and so on, without requiring yourself store the gold directly. Of course, you'd have to trust the maintainer of the assets, and with proper audit, I think you won't have any problem with doing this.

So, what do we have here? With the platform and products from Virtuse, everybody can buy or sell, contribute, invest or manage their assets from their home, their own country, without any long and time-consuming registration process and other limitations. So, Virtuse can definitely help a regular user to break free from their belief that they can't buy or invest in any assets just like those top 1% people in their country.

Virtuse Exchange Demo

With a solid infrastructure, incredible customer support, professional management, and high-level security, Virtuse could be the best choice for everybody to participate in cryptocurrency and traditional market. The elephant syndrome should begone when Virtuse successfully delivers their promises.

Bottom Line

Elephant syndrome might only be psychological problems, but we have to provide tangible solutions that could help people to fight this problem. Virtuse might be that long-awaited solution for people who wanted to explore more opportunities in their life.

Be sure to check these links below to know more about Virtuse:

Virtuse Website: https://virtuse.com

Virtuse Whitepaper: https://virtuse.com/public/pdf/whitepaper.pdf

Virtuse Bounty Thread: https://bitcointalk.org/index.php?topic=5025842.0

This article is not a financial recommendation. The author, Virtuse and other parties mentioned in this article is a separate entity. The author writes this article based on his own understanding of Virtuse. Readers should read the original document of Virtuse by themselves. The author shouldn't be responsible for any actions taken by the readers, including but not limited to: joining the Virtuse bounty program, participate in the Virtuse token sale, and etc.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit