For those who don’t know, Crypto20 (C20) is a tokenized cryptocurrency index fund. Each token represents a small basket of the top 20 coins by market cap and is theoretically redeemable for the value of its underlying assets.

As a closed fund, they have a fixed supply of tokens and have not issued any more tokens since their ICO. However, C20 is freely trade-able on select exchanges.

While I think their indexing methodology is legitimate, there are hidden risks in C20’s token model that are dangerous to investors. I want to make these hidden risks clear to investors in the name of transparency and investor protection.

C20 enables investors to speculate and trade the token at a market premium relative to its underlying assets.

From the C20 white paper:

“ The liquidation option offers a price floor protection — this ensures the price never drops below that of the underlying assets because of market manipulation. Prices are, however, free to increase as speculative value is created by the high demand for a low-cost, diversified and automated cryptocurrency portfolio that can be held as a single token.”

A true index fund should trade as closely as possible to its underlying assets. A proper index eliminates the speculative risk of betting on a single asset by diversifying risk across the entire asset class.

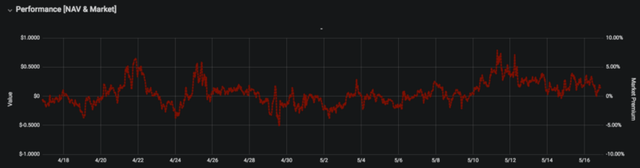

C20 is different. On its most exuberant day, C20 traded 45.6% above the fund’s net asset value (NAV). A few months later, C20 traded at a -4.3% discount to NAV.

C20 exposes investors to layer of unnecessary speculation that ranges 50% from peak to trough.

In their Discord channel, I found complaints from C20 buyers who bought in at a high premium but could no longer sell at the same premium.

I do not fault any of the users for their inaccurate predictions because making correct price predictions is hard. I fault the allure of the market premium for luring investors into a speculative trap.

In equity markets, exchange traded funds (ETFs) typically arbitrage away market premiums by buying up underlying assets and issuing additional ETF shares on the open market — thereby increasing the supply and pushing down the price. C20 has no mechanism to reduce longstanding market premiums.

Even if their intentions were innocent, their naiveté has undoubtedly hurt a lot of early investors, investors who were tantalized by the the idea of a tokenized index fund and did not realize that the 40% premium they paid would soon be erased. That’s no way to reward your early-adopters.

C20 claims to never trade below NAV- but it frequently does

If you remember, the C20 white paper promised that “the price never drops below that of the underlying assets”.

Well, that’s simply not true.

Over the the last month, C20 has traded below NAV on at least 8 different days.

You can verify it yourself here via a tool C20 built themselves.

Here’s how C20 promises to ensure price stays above NAV:

C20 offers a liquidation option to token holders. When investors submit a withdrawal request, they receive ETH for the NAV value of their tokens.

When prices go below NAV, C20 relies on arbitrageurs to buy up tokens and liquidate them — therefore reducing supply and increasing demand for C20 on exchanges.

Although this sounds good in theory, it has not worked in practice. Sometimes C20 trades at a discount for days at a time.

Here’s one explanation that the C20 team offers: bots and irrational investors who trade C20 are ignorant to its NAV and liquidation option.

I propose a different explanation.

A rational investor discounts C20 because the liquidation option is horrendously inefficient.

Here are a few reasons why:

A 1% trading fee is applied to all liquidations

“Investors submit a withdraw request to the smart contract which then enables them to withdraw the ether amount corresponding to their tokens’ net-asset value (less a 1% trading fee).” (Crypto20 FAQ)

- Withdraw requests are only fulfilled once every hour

When investors submit a withdraw request, they have to wait up to one hour for it to be redeemed. This is a long wait for investors who want to flee into fiat. If time is of the essence, investors may sell C20 at a discount and make liquidation someone else’s problem.

- The NAV price is determined after requests are submitted

“The realized withdrawal price is based on a forward pricing policy. This means that the Ether withdrawal amount will be calculated based on the next published NAV price.” (Crypto20 FAQ)

If the market heads down, investors do not want their exit to be forward-priced. Taking the next hour’s price is a surefire way to lock yourself into a bigger loss. During a market collapse, selling C20 at a discount is much more tolerable than taking the liquidation option.

- Faulty connection to the liquidation smart contract via the C20 portal

If people can’t connect to the liquidation smart contract, they can’t take the withdraw option.

When prices fall below NAV for a prolonged period, C20 needs subsidize the difference between what C20 believes the token is worth vs. what the market is actually willing to pay for it. And to do that, they must have a large reserve of ETH on hand.

Yet the smart contract that holds ETH to “guarantee” liquidation has less than 0.1% of the total fund value at any given moment.

As I write this (May 16, 3 PM EST), C20 has $492,810 in their smart contract. Compared to the $60 million NAV this is peanuts (0.08%). You can check the ETH available in the smart contract here.

Topping off the contract every hour with a tiny fractional amount is not enough. Only a few requests are required to completely eat through the ETH reserve. Once withdraw requests fail and investors lose confidence in C20’s price protection, there is nothing to stop token prices from crashing hard.

Consider the positive feedback loop that forms: withdraw requests fail and investors go back on exchanges to sell their C20 at a discount. Selling at a discount pushes the token price further below NAV which sparks even more withdraw requests.

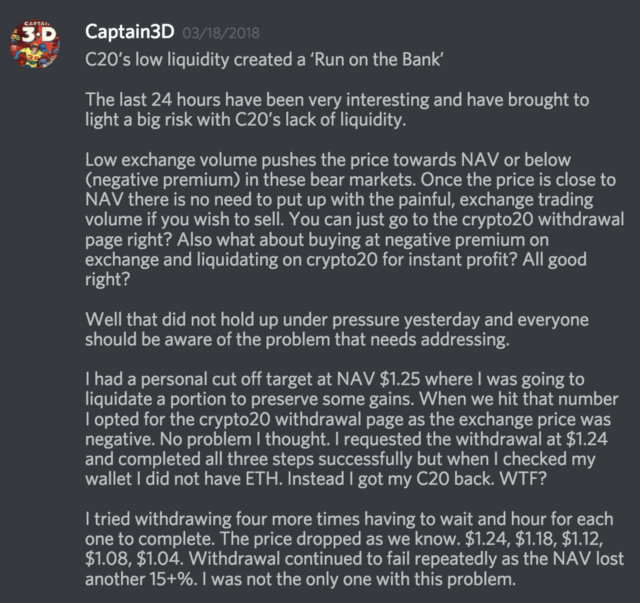

Scary right? Well this already happened.

On 3/17/2018, the smart contract was empty for 11 hours as C20’s fell by 15%. Investors who submitted withdraw requests were sent back their tokens. The liquidation smart contract rejected all withdrawal attempts due to insufficient funds.

Captain3D from C20’s Discord channel described this incident as a “run on the bank”.

I applaud Captain3D’s clarity of thought. It is difficult to fight against mob mentality.

If C20 continues using ETH as collateral, I recommend that they hold a lot more ETH on hand. Even a 1:1 NAV to ETH collateral ratio is too low. Consider the unlikely but possible event where the NAV of C20 goes up, but the price of ETH goes down. To protect against that risk, C20 needs to over-collateralize over the hilt.

C20 can’t liquidate the underlying assets fast enough

Liquidating the underlying assets requires sending the underlying coins from cold storage to exchanges, where they can be consolidated and sold. After they are sold, then and only then can users receive their payout.

Not only is selling that much volume for ETH problematic in illiquid markets, but the entire process would surely take a long time. As I mentioned before, investors don’t want to wait when the market is tumbling.

C20 does not have any underlying blockchain transparency — there is no on-chain proof that the underlying assets exist

My last gripe with C20 is their acclaimed “full blockchain transparency”.

My initial impression of this was that the underlying assets could be verified on-chain. Instead, the team claims that they hide wallet addresses intentionally to prevent front-running.

What about C20 is transparent on the blockchain ? That the ERC20 token exists ? This is some very misleading marketing.

Imagine USDT claiming to have full blockchain transparency because you can verify the token themselves exist on chain even though you can’t verify that the underlying USD is there.

C20 has zero blockchain transparency. They can be called a tokenized asset the same way USDT can be. But that does not prove that the underlying assets are actually there.

Just like USDT, C20 relies on annual audits to prove that they own what they say they own. A lot can change in a year.

Parting Thoughts

Again, my goal isn’t to shame C20 and promote HodlBot. There are hidden risks in complex token models like C20 that most investors are not privy to. I want to make these hidden risks clear in the name of transparency and investor protection.

When we made the HODL 20 index, we purposely chose to build a simple way for investors to hold the underlying assets themselves.

We know our product is not a perfect solution. We don’t claim to be — we’re a young company that’s still figuring out the kinks.

But there are some significant advantages to our model:

Users are literally holding NAV and never have to worry about the speculative value of a container

Users can liquidate their assets on an exchange at any time. Exchanges like Binance have very high liquidity.

Users are rebalanced according to their own reschedule. Because HodlBot does not group rebalances together, we mitigate market front-running and price slippage.

Users can personalize their portfolio however they want. Closed funds are one size fits all. HodlBot is not.

Here are a reasons why our model isn’t perfect:

Exchange risk — exchanges like Binance have proven to be reliable but not infallible. It is better to move cryptocurrencies to cold storage. (we have a plan to support that soon)

Trust in HodlBot — although we strive to be reliable, users still may not trust us. In the upcoming month, we will be giving users the ability to store API keys on their own computer/browser so they can personally control their own security.

Traditionally, the container model worked because it was too costly to hold each underlying asset yourself. But as blockchain scalability improves, micro-transfers will become more and more economically feasible. And as decentralized exchanges improve, users will have an improved way to securely trade cryptocurrencies and verify transactions on-chain.

When these forces come together, I think we will see the death of the container model. Instead of picking what fund to put money into, more and more investors will choose to hold the underlying assets themselves and manage them via intelligent software.

It will be interesting to see how cryptocurrency revolutionizes the retail investing industry and changes the conventional way we’ve thought about funds and portfolio management.

Hi, thank you for contributing to Steemit!

I upvoted and followed you; follow back and we can help each other succeed :)

P.S.: My Recent Post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit