TurboTax officially announced that they are offering support for Bitcoin and cryptocurrency tax reporting as a result of their partnership with crypto tax software company, CryptoTrader.Tax. This means that the premier, premier-live, self-employed, or self-employed live packages all have the ability to handle the crypto side of your taxes. This is a big deal for consumers who trade and transact with cryptocurrency as the tax reporting process for the digital asset can be very difficult.

This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax.

Getting Started

Head over to TurboTax and select either the premier or self-employed packages as these are the ones that come with the cryptocurrency feature.

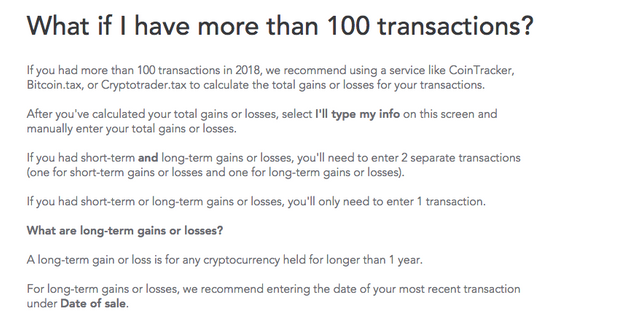

(Note - this import method will only work for users that have less than 250 transactions as this is the current limit TurboTax imposes. If you have more than 250 transactions, please see our alternative method article here).

After creating your account, you will enter the TurboTax live app.

TurboTax Cryptocurrency

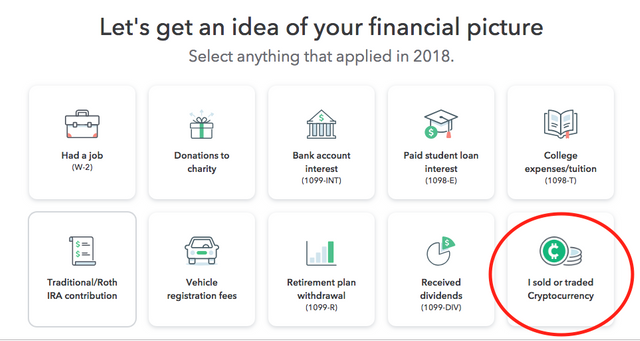

Within the app, you will answer a number of prompts. On one of the early prompts, you will be asked to “get an idea of your financial picture”. Select all that apply to you, and make sure “I sold or traded cryptocurrency” is also selected.

Continue to fill out your tax profile within TurboTax.

The Cryptocurrency Section

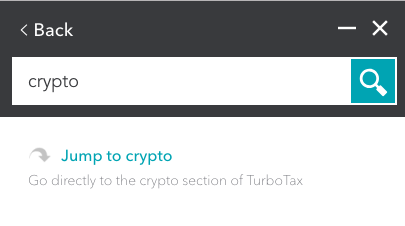

Once you have filled out the initial prompts, you are able to jump to the crypto section by typing in “crypto” within the search bar and then selecting “jump to crypto”.

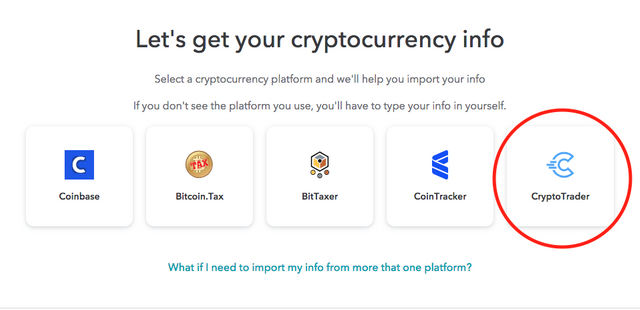

Within the cryptocurrency section, you are able to select the Crypto Tax platform that you used to prepare your crypto data.

If you have not built out your cryptocurrency tax report with CryptoTrader.Tax yet, this is where you should pause to create your report. Keep in mind, TurboTax will not aggregate all of your crypto data for you. If you traded on multiple exchanges and had many transactions, you will need to build out your report and crypto tax profile with CryptoTrader.Tax.

View this article on how to create your crypto tax report with CryptoTrader.Tax.

Importing your data into TurboTax

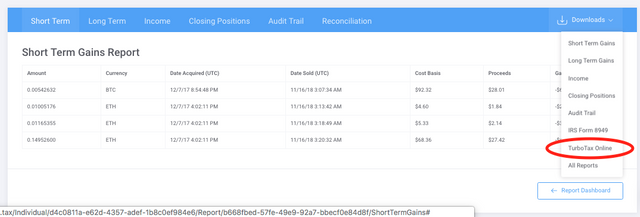

Okay so you completed your crypto tax report on the CryptoTrader.Tax platform, now you need to get this data into TurboTax. To do so, simply download the TurboTax CSV that CryptoTrader.Tax exports with every report package.

After downloading your file, head back over to TurboTax and upload this CSV file.

After importing your CSV, you should see all of your transactions appear within TurboTax. Keep in mind, TurboTax has a limit of 250 transactions being imported into the platform. Do NOT try to import your CSV if you have more than 250 transactions as this may cause the TurboTax app to freeze. If you have more than 250 transactions, you will not be able to import your CSV. If you have more than 250 transactions and still want to use TurboTax Online, please follow our guide.

You should “select all” transactions as taxable within the app. CryptoTrader.Tax exports your taxable transactions, so you don’t need to sift through each one in TurboTax. Simply select all of them.

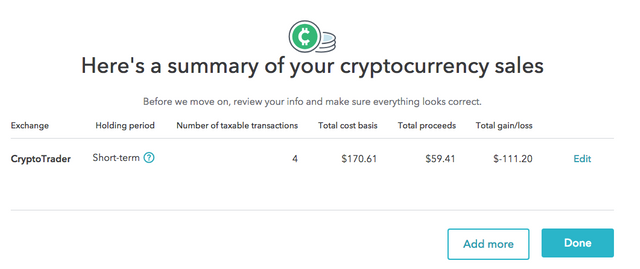

Once you finish, click 'complete' and you will see a summary of your cryptocurrency transactions within TurboTax.

And there you have it! Now all of your taxable crypto transactions will be included with your year-end tax return that TurboTax files for you!

Learn More About Cryptocurrency Taxes:

How to Handle Your Bitcoin and Crypto Losses for Tax Purposes

The Complete Trader's Guide to Cryptocurrency Taxes

Source

Copying/Pasting full or partial texts without adding anything original is frowned upon by the community. Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.cryptotrader.tax/blog/how-to-file-your-cryptocurrency-taxes-with-turbotax

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @lucaswyland! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @lucaswyland! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @lucaswyland! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit