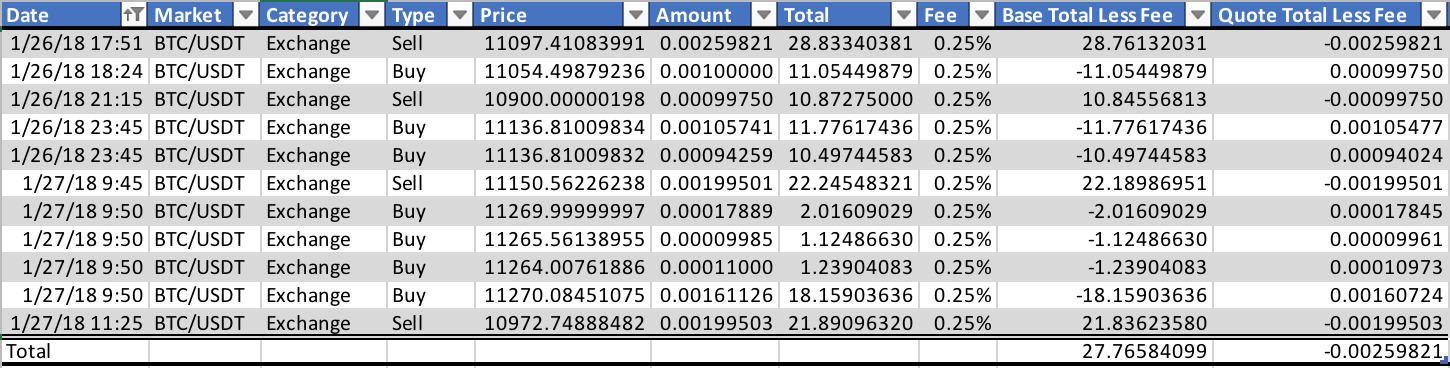

Okay... continuing from my previous post... I just completed a 24-hour test of the 55 EMA Strategy and I started with $28.76 USDT and ended up with $27.76 USDT. A loss of about $1.00. Here are all the orders generated by this bot:

So, what did I learn? Well, I learned that the 55 EMA Strategy works best on a 30 min time scale because it tends to HODL your longs in order to avoid large fluctuations in the price actions in smaller timescales. I chose to run this strategy on the same timescale as the MACDgen in order to get a good comparison. I do like that the losses were less, but I'm not sure if that's a safe comparison considering that it's not running against the same dataset as the MACDgen. I think bascktesting in Tradingview would be do a better job than what I have done here.

So, what's next? I think I will stay with the 55 EMA Strategy and change the timescale to 30 min and let it run for the long term. This will produce a lot less transactions and less chance in selling at a loss.