With the emergence of bitcoin and crypto currencies and tokens of many kinds that could put financial securities, commodities and other assets on the blockcahin there is growing talk and speculation about what role bitcoin will take in the emerging crypto space or economy. I have heard people say that bitcoin will become like gold as it will always be rare, digitally precious and with no real world utility which means it won't be consumed much like gold. We can't forget that one of the important qualities of money is that it is a commodity or asset that is not consumed as it needs to serve as a store of wealth. The fact that, at least for gold, the above ground stock of gold changes very gradually is what has made its value so stable and immune to supply shocks over many centuries and one of the reasons why when asked what gold was J.P. Morgan said: "it's money and everything else is credit".

I am personally not sure what the future holds even though I think the blockcahin and bitcoin are here to stay. The price of bitcoin might very well still go up substantially versus national fiat currencies but if bitcoin is to become like gold or an anchor to other crypto assets than I think the market capitalization of bitcoin could very well be a fraction of all other crypto assets combined. John Exter https://en.wikipedia.org/wiki/John_Exter was a banker and central banker back in the post war period. He helped with the set up and also headed the central bank of Ceylon or Sri Lanka from 1950 to 1953, he worked for the Federal Reserve Bank of New York from 1954 to 1959 and then finished his career at the First National City Bank the predecessor of Citigroup.

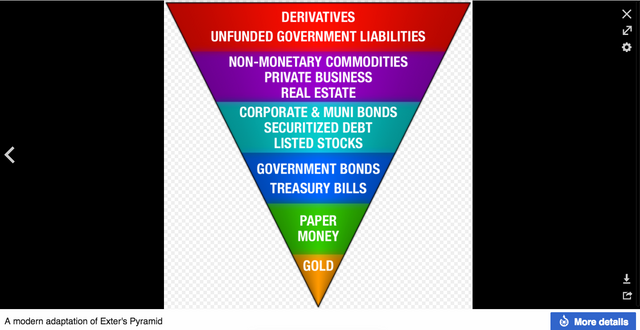

John Exter was part of the establishment but he believed in sound money and the importance of gold in the monetary system and actually made a fortune after he retired in the 1960's by betting against the bankers by buying gold and mining stocks well into the 1970s gold bull market. Exter understood that gold was the anchor of the monetary system and that if you unanchored the system like President Nixon did by closing the gold window that the credit system above the gold anchor would inflate and one day also deflate spectacularly. He explained this through his inverted pyramid.

Money or gold, silver and even fiat or paper money is at the bottom of the pyramid and everything above it is basically a credit instrument or asset of some kind and denominated in the monetary numeraire of choice. The higher up the inverted pyramid the riskier the asset is. So is it possible that if bitcoin and the crypto currency ecosystem grows that we could see the same evolution that we have seen in the "old world" system and actually have to update John Exter's inverted pyramid? Will gold and silver still be at the bottom of the pyramid with bitcoin? To be honest I do not know as things are evolving so quickly and I am sure the powers that be might have a thing or two to say about how the monetary system evolves. My conclusion is that bitcoin might still go up significantly in value but that one should also focus on the levels of the pyramid above bitcoin as there will be countless opportunities as we are already seeing now in that space.

Mario Innecco aka maneco64

I don't think bitcoin will become like gold. Bitcoin is a pure technology solution and by it's nature it will quickly become obsolete, as will the blockchain (hashgraph anyone?). I think what will emerge is a viable crypto-gold solution that uses crypto to drive transactions and redeemable gold to store value, probably based on a hashgraph type solution to ensure fast transactions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is important to note that very often when someone is talking about Bitcoin they are talking about the entire crypto currency space. The Blockchain is now a proven technology in that once you get your transaction onto the blockchain, it's there forever and incorruptible. The original Bitcoin is going to fall out of use because it cannot handle the volume of transactions and those tranactions are getting too expensive. I recently had to use a transaction accelerator service to get a Bitcoin transaction confirmed because my wallet had not allowed a big enough fee. All this took two and a half days to complete.

The problem is that nothing was put into Bitcoin's technology to stop the miners cherry picking the transactions with highest fees. The transactions should be processed first come first served; no cherry picking allowed. There are newer technologies which improve on the Blockchain concept such as Hashgraph and Tangle, but these are as yet untested to the same degree as Blockchain has been tested.

In contrast I have never had any trouble with Dash, another prominent crypto currency.

Ultimately the crypto currencies that provide ease of use and privacy are the ones that will be most popular. Reliability and cost will be the factors that guide the general public in there inevitable use of crypto currencies day to day.

Currently to use crypto currencies it is necessary to convert to fiat local currency to spent it. This entails losses through exchange costs. The real benefits will come when retailers accept crypto currencies directly and this is being worked on currently.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting. Where do you think cryptos would slot in the pryamid? Wouldn't it fit the cashless push and replace paper money?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@oldman28 It depends. As I said bitcoin would be near the bottom along with gold and silver. We could even have the whole pyramid above eventually become all crypto and include some of the old style assets on the blockchain. I think the process will take a while but will happen.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit