Can you make significantly more money by rebalancing your crypto portfolio? How often should you do it? Read on to find out.

What is Rebalancing?

Asset rebalancing is a simple portfolio management strategy. If you have a portfolio of investments in different ratios, as time goes by some investments will perform better than others and the ratios will change. If this is undesirable to you, every so often you can rebalance your portfolio by selling some of your investments and buying others until your portfolio ratios are back to where you want them to be.

The first benefit of this strategy is its simplicity. Rebalancing to a pre-defined ratio is a fully-defined mathematical operation. It does not rely on any predictions or guesswork about where the market will go, and it can be easily accomplished by a computer.

Most investment strategies other than passive hodling rely on being able to predict future market movements (or merely believing you can). Rebalancing, however, supposedly offers some benefit without any prognostication at all. Therefore, it is supposedly useful even in a purely efficient market (i.e. a market where all information about the future is instantly priced into the market and research-based trading is impossible). The theory goes that by forcing you to sell your overweight assets and buy your underweight assets at predefined points, in a volatile market you will end up selling high and buying low over the long run and earn more profit.

In this post I will investigate the benefits of rebalancing in simple portfolios of cryptocurrencies.

Does Rebalancing Work?

Let's consider a simple portfolio of two cryptocurrencies. I used Bitcoin and Litecoin because they are the oldest and have the most data. Let's say you want to make a portfolio of these two assets. Do you believe that one of these assets will significantly outperform the other in the future? If so, you should just put all of the portfolio in that one asset. If not, or if you are unsure, let's assume that the expected value of the two assets are equal at their current prices. This is a reasonable assumption: the current prices are, by definition, the points at which the market believes on average the expected future growth is equal. If everyone in the market believed that the LTC/BTC ratio will be twice as high in a week, no one would be willing to trade LTC for BTC at the current price, and the market would quickly settle to the predicted exchange rate.

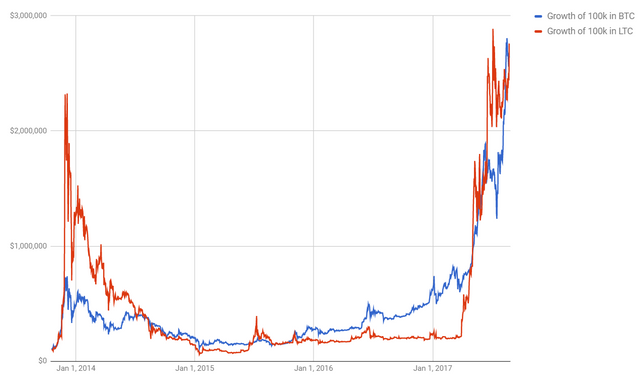

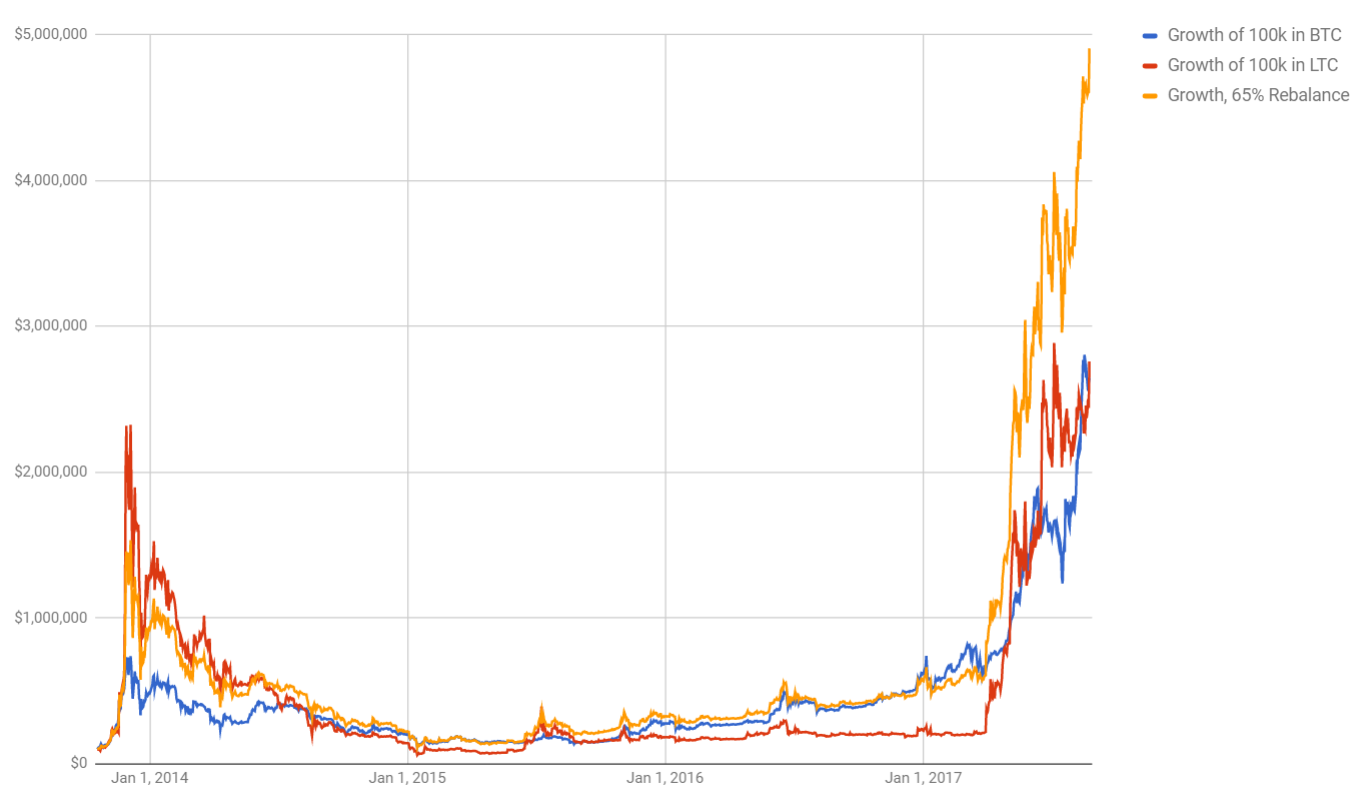

To simulate this equal expected value assumption, I used daily USD/BTC and USD/LTC opening prices for the time frame of 10/19/13 to 8/24/17, because the LTC/BTC ratio was about the same on both of these days. If you had invested $100,000 USD in either Bitcoin or Litecoin on 10/19/13, your portfolio would be worth about $2,700,000 on 8/24/17.

Let's compare that to a simple asset rebalancing strategy: Start with 50% of your $100k in each coin, and every day rebalance back to 50/50. (I assumed a 0.25% exchange fee.)

Impressive! An incredibly simple rebalancing strategy beats the pure strategies by 1.6x, and leaves you with an ending balance of $4,300,000.

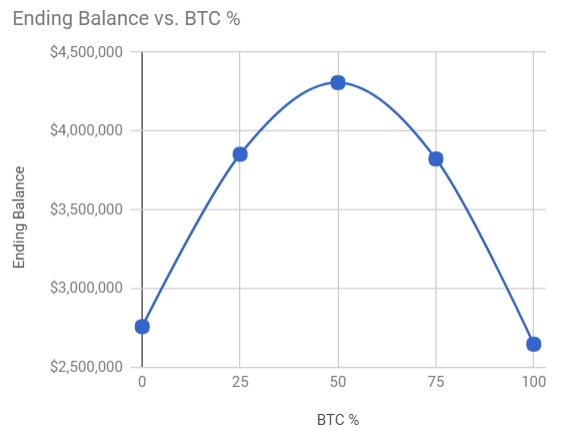

What if You Try Different Ratios?

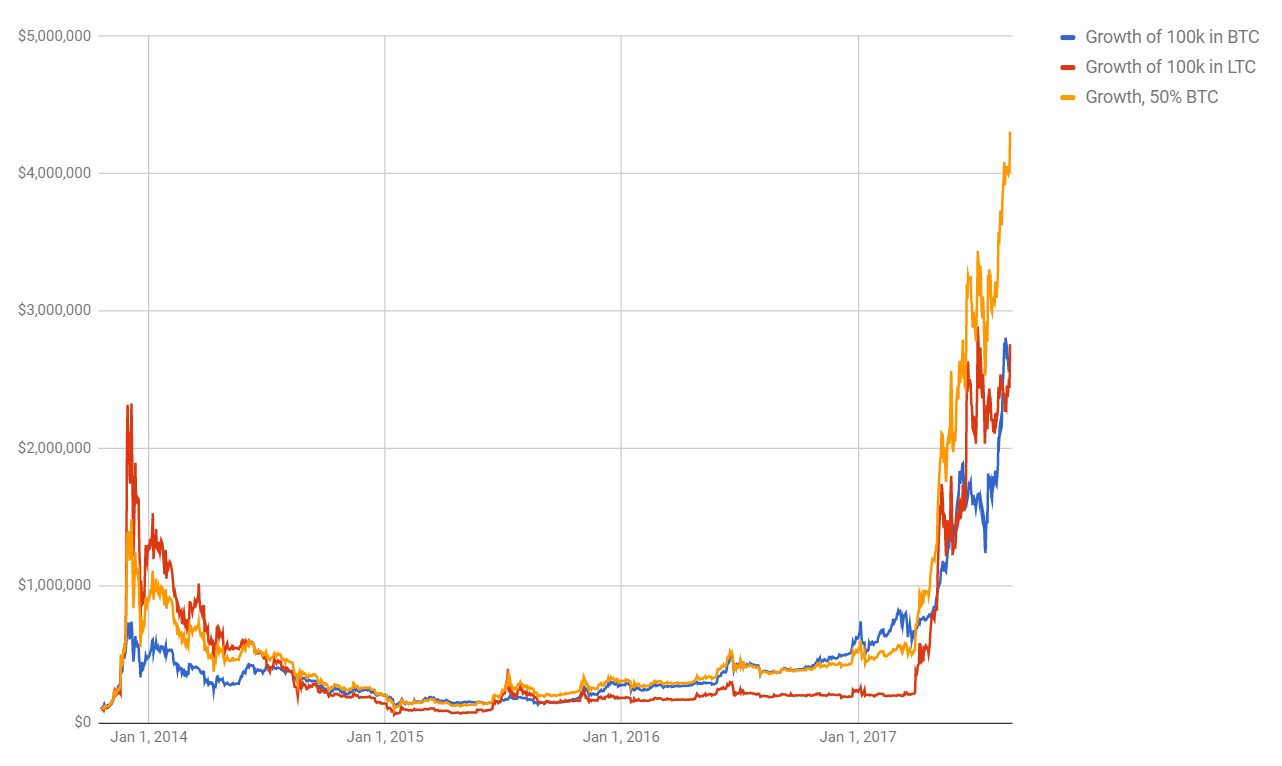

Let's try simulating portfolios of 25% BTC and 75% BTC with daily rebalancing as well.

They both end with a balance of $3,800,000. Not as good as the 50/50 portfolio, but interestingly, they are much closer to the 50/50 results than the pure portfolios' results. This suggests that the benefits of rebalancing are roughly quadratic.

What if You Change the Rebalancing Period?

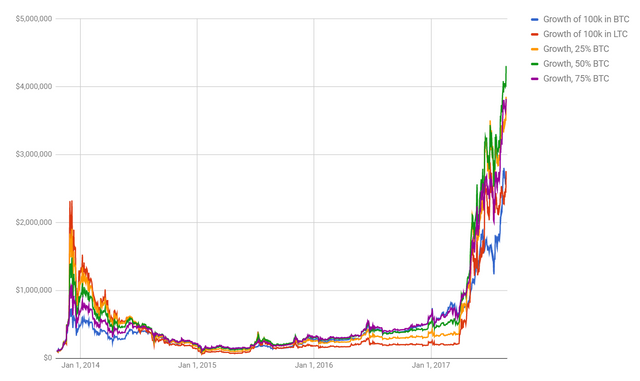

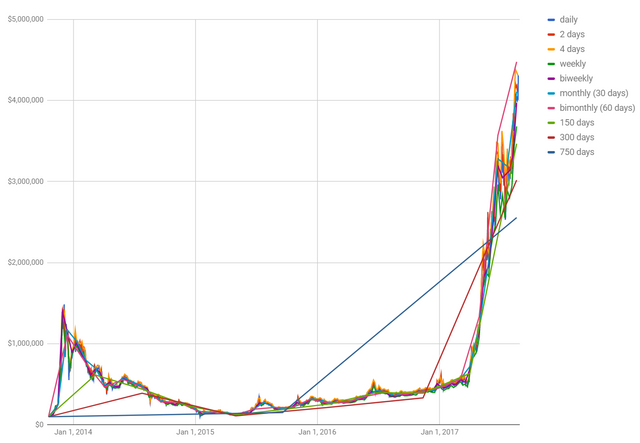

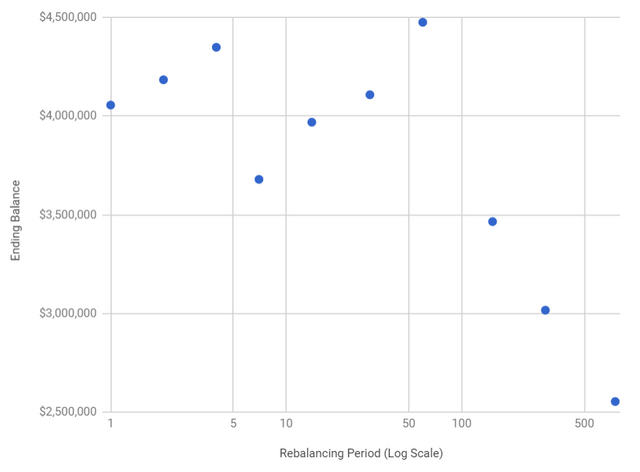

I simulated the 50/50 BTC/LTC portfolio with rebalancing periods of 1, 2, 4, 7, 14, 30, 60, 150, 300, and 750 days. Here are the results.

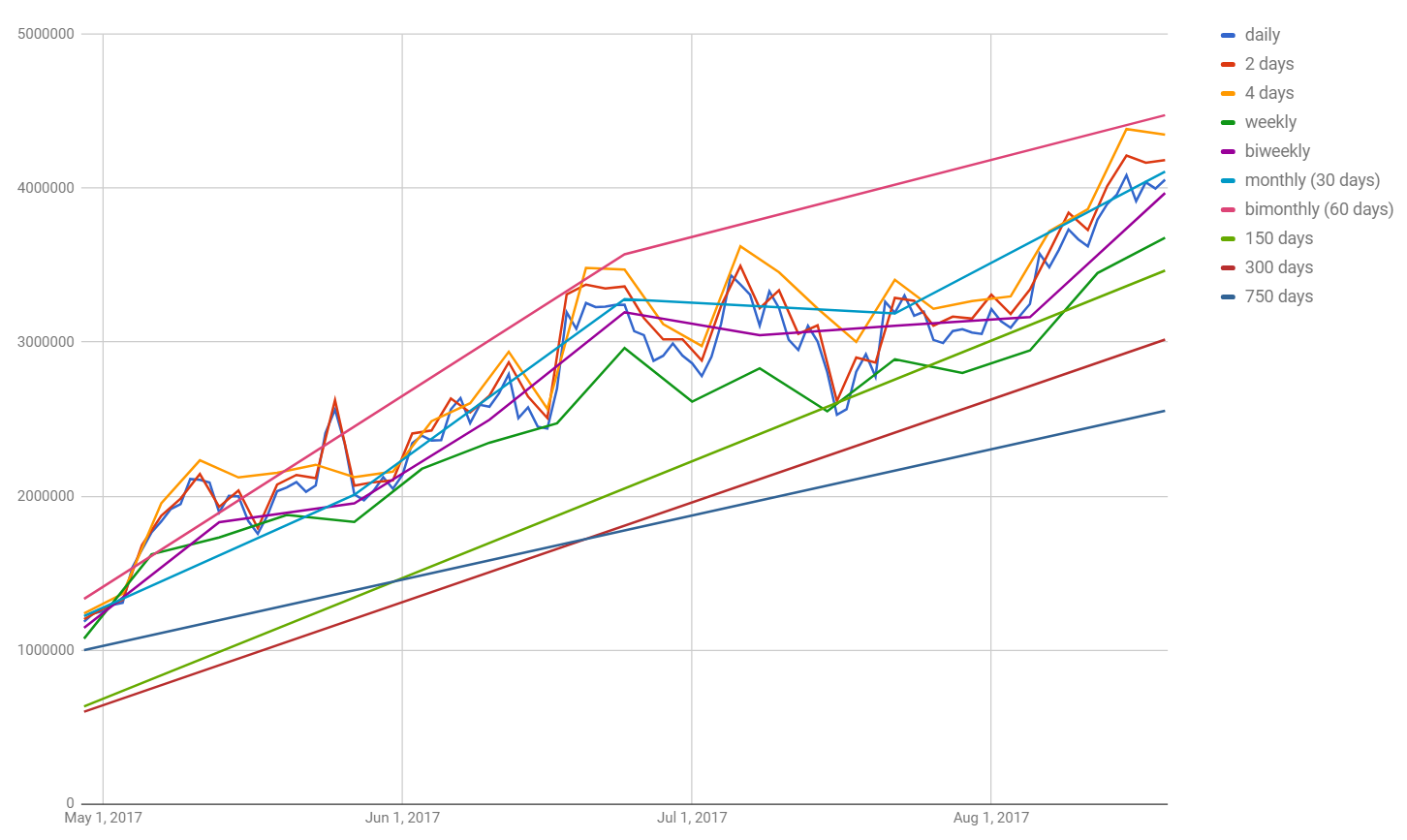

This chart is pretty hard to read, so let's zoom in on the last four months.

There is some variation in results, but it seems that profit is uncorrelated with timescale below 60 days. After 60 days, profit seems to fall off, indicating we are rebalancing too infrequently to get the full benefit.

My conclusion would be that you can safely save on transaction fees and effort by rebalancing every 60 days instead of every day, but go longer than that and you start to lose the rebalancing benefit.

Algorithmic Rebalancing

Instead of blindly rebalancing every x days, you could choose to rebalance only when your portfolio is sufficiently out of whack. For example, let's try rebalancing our 50/50 BTC/LTC portfolio every time one cryptocurrency rises to more than 65% of the portfolio.

This gives us an ending balance of $4,900,000, which is better than any of our period-based portfolios! Furthermore, in 4 years the portfolio only hit the imbalance trigger 9 times. That's pretty incredible: We earned two million dollars more than a 50/50 portfolio with no rebalancing by trading only 9 times, in a way that was completely algorithmically predetermined.

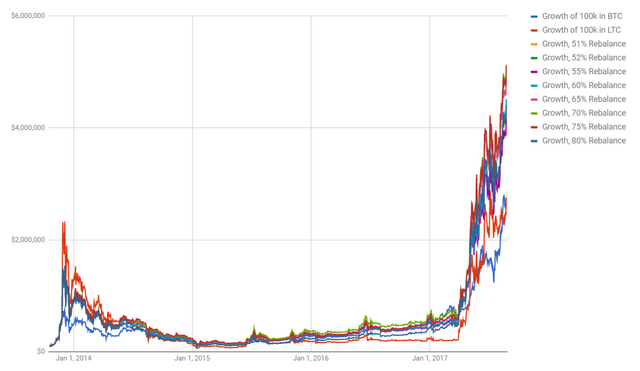

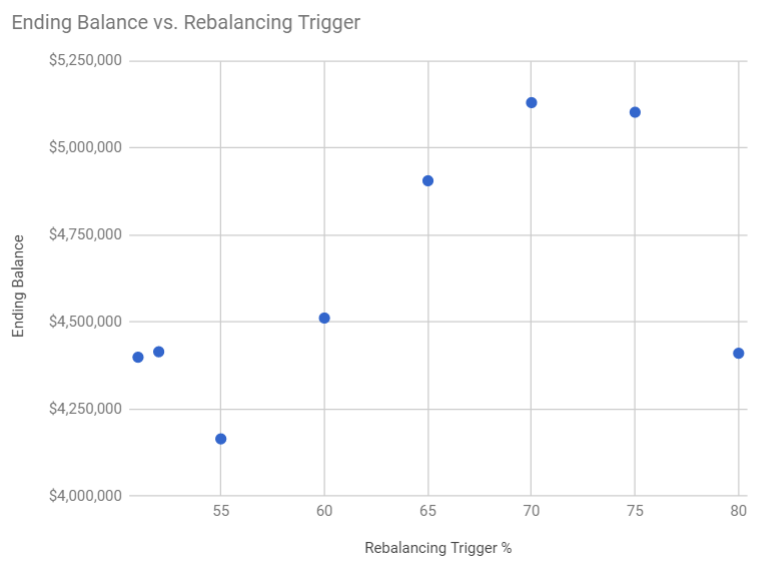

I chose the 65%/35% rebalancing trigger in the above graph at random. What is the optimal rebalancing trigger ratio to use? Here are the results of portfolios with rebalancing triggers at 51%, 52%, 55%, 60%, 65%, 70%, 75%, and 80%.

The best ending balance, of $5,100,000, occurs at a 70%/30% rebalancing trigger:

But it seems like anywhere in the 70%-75% range is pretty good.

Conclusion

If you have a portfolio of cryptocurrencies that you believe have approximately equal expected future performance (based on current prices), and you are planning on passively holding them for the long term and not trading based on news and future predictions, then you can improve your expected performance by rebalancing your portfolio. Rebalance at least every two months, or better yet, pay attention to your portfolio and rebalance whenever any of your assets is less than 50% or more than 150% of the target percentage.

Thanks for reading!

Thank you for your analysis. Very nice. May I ask what backtest tool you use? I would like to try it with 2,3 and more assets and also with assets with varying degrees of inverse correlation. Thanks, zm

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great analysis! Thanks. I was thinking about hourly rebalancing but i am now gonna try the trigger method.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a little bit older, but it directly cut across this one (but both say rebalancing is better than hodl) :

https://www.shrimpy.io/backtest?c=EAAIAAAAAA==&p=1w&r=25

Now, whats the truth?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @marsgrins! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit