CRYPCORE

The Future Of Crypto Currency Is Here

(Crypcore Coin Is Collateralized With Bitcoin And Other Leading Crypto Assets)

Crypto Asset Exchange You Can Trust

(Trade Crypcore Coin. Core Token And More Crypto Assets Instantly)

What exactly Cypcore is?

Crypcore is one of a special stable coin, Price of crypcore will switch every once in a while depending on economic positions, dissimilar to conventional stable coins crypcore will not be pegged. Crypcore biological system is collected in a manner that anticipates feral swings in the price of Crypcore.

What is the purpose of Crypcore?

Stable coins were created to solve the problem of volatility because the adoption of the cryptocurrency is experiencing obstacles around price stability. Stable coins have carry out well since unite the cryptocurrency space but there are still numerous improvements to be done. Especially in the crypto coin collateralized area. This paper discusses the possibility of making collateralized crypto stable coins that combine pure crypto exchange, solvency systems and Cryptonote protocols. Crypcore is regarding creating crypto holding that enforce a solvency structure that eliminates wild price changes, while giving Crypcore an opportunity to grow. Crypcore is primarily a mixture of crypto digital assets guaranteed by a solvency structure to ensure price stability.

Problems and Solutions

Too much power on the part of the publisher: Stable coins can be effectively removed from circulation at any time by the issuing organization. For example, the Omni Protocol from tether can give and revoke tokens that are represented on the blockchain. With Crypcore this is not feasible because of technology built on Crypcore.

Over-issuance: The big problem with the most stable coins is that coins are issued in the same way that central banks spend money, making them vulnerable to over-issuance and vulnerable to inflation. Crypcore will not experience this problem because the amount circulated is determined by the emission logic of the Cryptonote protocol, and can be seen by all.

Unstable Virtual Collateral: Virtual Collateral itself is unstable so using it to support stable coins is difficult and confusing. At the finishing of this paper you will perceive how Crypcore hopes to solve this problem.

Highly Regulated: Stable coins set by Fiat are highly regulated and limited by the old banking system.

Expensive, slow liquidation & purchases: Liquidating stable coins can be slow because with the most stable coin provider you need to transfer money to your account that will incur bank charges. Purchases can also be slow because you sometimes have to go through the KYC procedure and transfer money which sometimes takes days.

Smart Contracts System: For crypto digital assets that are promised like Maker Dai there is a issues of understanding. For everyday common users, the term might seem intricated. Crypcore will apply a very simple solvency equation system with easy-to-understand equations and parameters.

How does Crypcore work?

Crypcore is grasp from Monero which is based on cryptonote protocol which is cryptographically guarded and entirely anonymous, Crypcore ecosystem integrates solvency equations, pure crypto exchange and Cryptonote protocol to make coins that have stable prices with price stability achieved with average increase in collateral with price fluctuations.

For this consequences Crypcore is a stable coin that utilize in a fundamentally different methods from traditional stable coins, we will call it Dynamic Stable Coin (DSC). Crypcore will get a guarantee of the fees charged on the Crypcore exchange, this fee will be added to the Crypcore coin guarantee so that it always increases the guarantee & keep going the stability of the Crypcore Price. Crypcore is not seen as a stable coin of traditional cryptocurrencies, but rather a new and innovative approach to achieving price stability in the cryptocurrency space.

Cryptonote Protocol

The Cryptonote Protocol is an application layer protocol created to solve problems related to the bitcoin protocol. Cryptonote first came in to sight in 2012 & a white paper step forward was issued on October 17, 2013, the greatest well liked coins based on the Cryptonote the official procedure of system rules are Monero (Crypcore grasp from Monero) and bytecoin. Cryptonote is based on the cryptographic work "Traceable signature rings" made by E. Fujisaki and K. Suzuki.

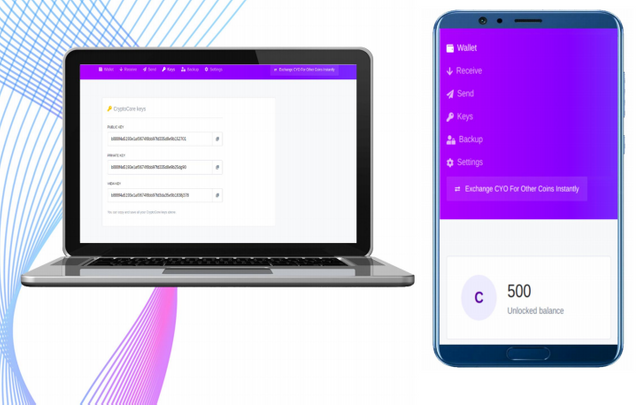

Crypcore wallet

No alt text provided for this image

Crypcore focus to be easy going even to non-technical users, wallets will be provided for diverse platforms. There will be desktop wallets, command line wallets, hardware wallets and web wallets. After completion, the development of Web Wallet for Android and iPhone wallets will begin. The web wallet is presently under development.

Crypcore Exchange

Crypcore exchange would play a very main role in managing the cost of Crypcore. To this, Crypcore Exchange should do things in an unconventional way. A very simple solvency equation will determine the price of Crypt. In common stable coins tokens are provided by the important organization but the Crypcore exchange would not be able to build tokens, but rather each and every coin is mined. This is because the privacy and security of our users is very important. In order for Cryps to keep going its value, the beginning money supply is mined and held by the Crypcore exchange. Crypts grasp by exchanges would not be considered outstanding.

Developer Documentation

Crypcore is diverging (forked) from monero & uses the same API, The Daemon RPC & Wallet RPC are at hand, the biggest dissimilarity between Crypcore & Monero are the units, the little unit of Crypcore is the nanocryp which is 10^-9 unalike Monero which is piconero at 10^-12

Dynamic Price Stability System (DPSS)

This is what the system that Crypcore employs to keep going a stable price. 30% of revenue is put on to the collateral & 20% is set aside in the Collateral Stabilization pool (CSP). Collateral Stabilization pool is conduct into play when the cost of Crypcore drops by further than 10% within a specific time frame. It functions by adding the crypto currency collateral in this pool to the main pool to maintain a fixed price.

Limitations of current stable coin models

Presently stable coins are conception of in the wrong methods, the standard thinking among stable coin originators is that a earmark price must be maintained, the opinion is that if minimal price switch is successfully bring by a mechanism then the asset is solid. But this is not true, stability must not be viewed as keep going a target price but rather stability must be a function of demand, supply & value

ROADMAP

Q2 2019 - Idea Realisation and Research

$50,000 private funding

Q3 2019 - Architecture Design and Whitepaper publication

Q4 2019 - Launch Crypcore Instant Exchange

Launch block Explorer

Start trading crypcore in exchanges

Q1 2020 - Launch Web Wallet

Q2 2020 - Launch Mobile Wallet

Q3 2020 - Launch New features of Crypcore Exchange

For More Info Go To Below Links of CrypCore

https://crypcore.com/

https://crypcore.com/crypcore_whitepaper_version_1.pdf

https://www.facebook.com/Crypcore-106479097438958

https://twitter.com/crypcore1

https://www.reddit.com/user/crypcore

https://t.me/crypcore_group

https://t.me/https://t.me/Crypcore_bounty

author : masattar191

Bitcointalk username : masattar191

Bitcointalk profile : https://bitcointalk.org/index.php?action=profile;u=1780985