In order to truly gauge whether or not crypto is looking “Bubblicious”, we have to examine several different factors; some of which I will be unable to get to in this post, but will cover in subsequent posts.

First and foremost, the amount of money entering the space is staggering. Coinbase just signed up 1 million new users in a month’s time!

Most people would point to this as a bullish development. I have my reservations, mainly because I am not convinced the quality of this money is high-grade. It seems to me that money is rushing into the space out of FOMO and this is amongst one of the worst emotions to bring to the table in the investing world.

FOMO generally lends itself to those who buy at the top, and sell near the bottom. FOMO investors buy into an asset expecting another price surge, and when this surge turns into a short-term correction, they inevitably sell out of fear and a lack of understanding for the market in which they are dealing.

While I remain skeptical of the quality of the money entering the space and the velocity at which its entering, at the very same time, I think that the staggering number of people flooding into the space illustrates the power of crypto's narrative. This is undoubtedly bullish because the asset class as a whole is becoming accessible to a much larger audience.

Many people are not properly educated on what goes into a cryptocurrency, nor are they engaging in learning about them, and as such, they are generally investing via a group-think approach. This is why we experience certain cryptos suddenly blow up on any given day. Yet, they seem to come right back down after things cool off and the herd goes to graze upon other grasslands.

The group-thinkers seem to be living by the mantra: “Buy the rumor, sell the news”.

ICO’s

Folks, the easy money in this space has been made. To those of you who made this money, congratulations. To everyone else, tamper your expectations a bit. ICO’s are the reason the crypto market is being compared to the dot-com bubble, and for good reason. There are entire threads, profiles, and traders who have dedicated extensive amounts of time towards perfecting their ICO-picking approach. Quite frankly, I am shocked I have not seen an investment newsletter promoting an ICO picking service as their newest newsletter “minting millionaires” on demand.

Is an ICO picker as successful as his techniques and framework, or is he simply the lucky recipient of being invested in a select market prior to a bull market? Meaning, is ICO picking really a sophisticated process, or were early ICO investors simply in the right place at the right time? Judging by the popularity of the carpet-bombing approach to ICO investing, it seems the latter may be more accurate.

With carpet-bombing, I am referring to the strategy of entering small positions (i.e. $100) into a large basket of ICO’s and hoping you catch a winner.

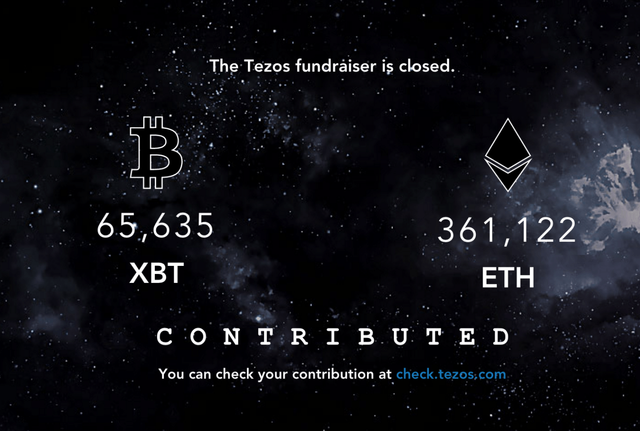

What seems to have happened this past year in the ICO markets is that early Bitcoin/Ethereum holders were greatly rewarded for being timely holders of these coins as prices surged. These well-rewarded holders skimmed profits from this huge rise in price and rather than sell out to fiat, they directed them into every new ICO to hit the block.

Each new, hot ICO went on to raise more money than the previous and in less time. Does this stand to reason that each new ICO had a better idea than the previous with a better roadmap and directed by a more experienced team? Not necessarily. In fact, you could argue the opposite.

Do you truly believe that everyone who invested in these extremely speculative ICO’s took the time to fully analyze each detail, understand the team, contemplate the market, estimate returns, etc? My bet is that these people realized they were being given a second chance to make another early adopter of bitcoin-like return by being the first to enter these new ICO tokens at cheap prices before floods of capital entered the space.

Essentially, these early adopters of Bitcoin and Ethereum had the means and methods to be the first adopters of the new ICO’s while everyone else was still figuring out how to buy Bitcoin and Ethereum. They were the ones with the opportunity to access these ICO’s before all others, and they took advantage of that opportunity.

By sending such large amounts of money into these ICO’s, these investors created a self-fulfilling prophecy of value and hence the valuations rose along with their holdings. That is why nearly every company in the space is valued at hundreds of millions of dollars already, even though some do not have any prototypes, roadmaps, established market segments, or even a proper whitepaper.

Think about that for a second. Think about some of the business owners and established brands you interact with daily, and think about how long it took them to develop a business with that kind of valuation. These ICO's garnered rich market caps overnight due to liquidity being taken from Bitcoin/Ethereum profits and rolled over into the ICO’s token.

This, in turn, created a pump for the crypto and demand continued to grow. When prices are rising, it is pretty easy for an investor to rationalize that it is still undervalued and the price will continue to rise. The thing many fail to notice is that they are not necessarily following smart money into an ICO. Large portions of ICO funds were simply an efficient way for Bitcoin/Ethereum winners to diversify their profits.

So do I think the whole space is primed for a bubble burst?

No. However, I do see the nonsense cryptos being wiped out in a relatively short period. This liquidity will likely flow back into the reserve currency cryptos and the established players in the space.

Well then, what about the possibility of the reserve currencies being in a bubble?

Folks, if I may I would like to point you in the direction of my previous posts on the current state of the bond market and the equity market.

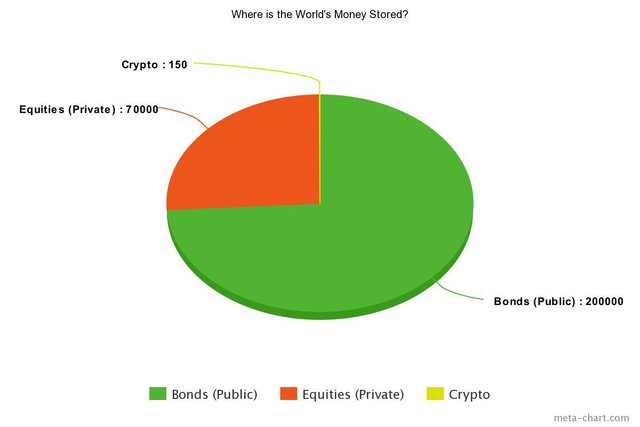

I pay especially close attention to the bond market. Why? Because bond markets are where the majority of global wealth are stored, transported, and monitored. It pays to pay attention to the bond market. This is where the central banks determine the fate of the world’s money. As we stand, the Fed is aiming to taper off its manipulation of bond markets by reducing QE-fueled bond buybacks and purchases. This will likely lead to uncertainty in the bond market which will carry over into all other assets.

What about equities then? Are they overvalued? I have written about it already, but in short, most conventional equity investments also seem overvalued. You really have to dig deep in order to find a classic “value” investment. Equities are the second largest store of wealth in the world, so I also pay extremely close attention to equities.

So, while conventional wisdom tells us that nearly every asset in the world is currently overvalued (primarily due to QE), does it make sense that cryptos also enter overvalued territory?

It seems well within reason to reach artificial valuation level in the world of crypto because the cost of capital is virtually free. Loan rates are extremely low across the board, so overextension on real estate, on bonds, on equities, on cryptos are not such a scary prospect when one can take out a loan to cover losses, if needed.

Mistakes are covered for cheap these days, and so it seems to me that while the bubble talk on cryptos is warranted, it is just about time cryptos enter a so-called bubble so that they can compete with some of the actual "bubbles" of our day: you know, bonds, equities, real estate, corporate debt, consumer debt (i.e. subprime auto loans, student debt, credit cards). Bubbles that have some serious consequences should they pop.

With all of this in mind, some fellow skeptics may be asking: “Well just because bonds and equities are overvalued, this does not mean a correction is anywhere in sight. And if bonds/equities experiencing a correction and capital flowing into crypto is your basis for being bullish on the crypto market then you may be waiting for quite some time.”

I am not saying that bond markets and equity markets are due for a collapse, but perhaps a correction. In fact, I have previously written about the possibility of any correction in the bond market leading to huge gains in the equity market, amongst other scenarios that could possibly play out.

My reason for being bullish on crypto, regardless of market correlation, fundamentals, or regulations is that it currently represents 0.1% of global wealth store of value. That's correct, only 0.1%.

That is the single most important reason I have to be bullish on crypto. Should capital need to reshuffle itself from bond markets, equities, real estate, or in general, ANY other asset class, cryptocurrencies are poised to catch this fleeting capital in the droves. Sure, this will happen rapidly should a market correction occur, but what I see more likely, is larger institutions and investors gradually reweighting their portfolios to include small allocations to crypto.

Summary

While I do see a purge coming for the crypto markets, it seems inevitable that the cryptos to survive this purge will expand in value and grow at exponential rates as serious capital inflows occur over the coming years. Am I projecting a moon-landing? Perhaps, for a select few. Some will experience serious gains that compete with the likes of early investments in Amazon, Facebook, and Google. Others will expire worthless. Do your homework, and do not allow FOMO or lack of effort to be the reasons for why your investments are not successful. Have patience and read!

"Nothing in the world raises prices like an excess of demand over supply." -- Howard Marks

DISCLAIMER : This content is for informational, educational and research purposes only. This post is not to be taken as personalized investment advice.