In computer science, a cryptocurrency, crypto-currency, or crypto is a digital currency that does not rely on any central authority to uphold or maintain it.[2] Instead, transaction and ownership data is stored in a digital ledger[3][4][5] using distributed ledger technology, typically a blockchain. However, when a cryptocurrency is issued by a single issuer or minted or created prior to issuance, it is generally considered centralized.

![Bitcoin.svg.png]

( )

)

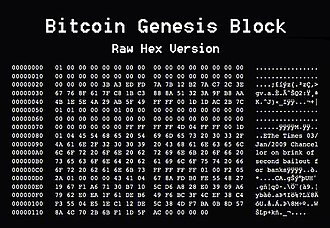

The genesis block of the Bitcoin blockchain, with a note containing The Times newspaper headline. This note has been interpreted as a comment on the instability caused by fractional-reserve banking.[1]: 18

Despite the name, cryptocurrencies are not considered to be currencies in the traditional sense and while varying treatments have been applied to them, including classification as commodities, securities, as well as currencies, cryptocurrencies are generally viewed as a distinct asset class in practice.[6][7][8] Unlike paper money, cryptocurrency does not exist in physical form and is typically not issued by a central authority. Cryptocurrencies typically use decentralized control as opposed to a central bank digital currency (CBDC).[9] Traditional asset classes like currencies, commodities, and stocks, as well as macroeconomic factors, have modest exposures to cryptocurrency returns.[10]

The first modern cryptocurrency was Bitcoin, which first released as open-source software in 2009. As of March 2022[needs update], there were more than 9,000 other cryptocurrencies in the marketplace, of which more than 70 had a market capitalization exceeding $1 billion.[11]

History

In 1983, American cryptographer David Chaum conceived of a type of cryptographic electronic money called ecash.[12][13] Later, in 1995, he implemented it through Digicash,[14] an early form of cryptographic electronic payments. Digicash required user software in order to withdraw notes from a bank and designate specific encrypted keys before it can be sent to a recipient. This allowed the digital currency to be untraceable by a third party.

In 1996, the National Security Agency published a paper entitled How to Make a Mint: the Cryptography of Anonymous Electronic Cash, describing a cryptocurrency system. The paper was first published in an MIT mailing list[15] and later in 1997 in The American Law Review.[16]

In the 1997 book The Sovereign Individual, the authors, William Rees-Mogg and James Dale Davidson, predict that the currency used in the information age would be using "mathematical algorithms that have no physical existence",[17] which has led some in the cryptocurrency community to call the book's claim a "prophecy".[18]

In 1998, Wei Dai described "b-money", an anonymous, distributed electronic cash system.[19] Shortly thereafter, Nick Szabo described bit gold.[20] Like Bitcoin and other cryptocurrencies that would follow it, bit gold (not to be confused with the later gold-based exchange BitGold) was described as an electronic currency system which required users to complete a proof of work function with solutions being cryptographically put together and published.

In January 2009, Bitcoin was created by pseudonymous developer Satoshi Nakamoto. It used SHA-256, a cryptographic hash function, in its proof-of-work scheme.[21][22] In April 2011, Namecoin was created as an attempt at forming a decentralized DNS. In October 2011, Litecoin was released which used scrypt as its hash function instead of SHA-256. Peercoin, created in August 2012, used a hybrid of proof-of-work and proof-of-stake.[23]

On 6 August 2014, the UK announced its Treasury had commissioned a study of cryptocurrencies, and what role, if any, they could play in the UK economy. The study was also to report on whether regulation should be considered.[24] Its final report was published in 2018,[25] and it issued a consultation on cryptoassets and stablecoins in January 2021.[26]

In June 2021, El Salvador became the first country to accept Bitcoin as legal tender, after the Legislative Assembly had voted 62–22 to pass a bill submitted by President Nayib Bukele classifying the cryptocurrency as such.[27]

In August 2021, Cuba followed with Resolution 215 to recognize and regulate cryptocurrencies such as Bitcoin.[28]

In September 2021, the government of China, the single largest market for cryptocurrency, declared all cryptocurrency transactions illegal. This completed a crackdown on cryptocurrency that had previously banned the operation of intermediaries and miners within China.[29]

Formal definition

1.The system does not require a central authority; its state is maintained through distributed consensus.

2.The system keeps an overview of cryptocurrency units and their ownership.

The system defines whether new cryptocurrency units can be created. If new cryptocurrency units can be created, the system defines the circumstances of their origin and how to determine the ownership of these new units.

4.Ownership of cryptocurrency units can be proved exclusively cryptographically.

5.The system allows transactions to be performed in which ownership of the cryptographic units is changed. A transaction statement can only be issued by an entity proving the current ownership of these units.

6.If two different instructions for changing the ownership of the same cryptographic units are simultaneously entered, the system performs at most one of them.

In March 2018, the word cryptocurrency was added to the Merriam-Webster Dictionary.[31]

Altcoins

Tokens, cryptocurrencies, and other digital assets other than Bitcoin are collectively known as alternative cryptocurrencies,[32][33][34] typically shortened to "altcoins" or "alt coins",[35][36] or disparagingly "shitcoins".[37] Paul Vigna of The Wall Street Journal also described altcoins as "alternative versions of Bitcoin"[38] given its role as the model protocol for altcoin designers.

![Ethereum_Background.jpg]

( )

)

Altcoins often have underlying differences when compared to Bitcoin. For example, Litecoin aims to process a block every 2.5 minutes, rather than Bitcoin's 10 minutes, which allows Litecoin to confirm transactions faster than Bitcoin.[39] Another example is Ethereum, which has smart contract functionality that allows decentralized applications to be run on its blockchain.[40] Ethereum was the most used blockchain in 2020, according to Bloomberg News.[41] In 2016, it had the largest "following" of any altcoin, according to the New York Times.[42]

Significant rallies across altcoin markets are often referred to as an "altseason".[43][44]

Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable level of purchasing power.[45] Notably, these designs are not foolproof, as a number of stablecoins have crashed or lost their peg. For example, on 11 May 2022, Terra's stablecoin UST fell from $1 to 26 cents.[46][47]

Architecture

Cryptocurrency is produced by an entire cryptocurrency system collectively, at a rate which is defined when the system is created and which is publicly stated. In centralized banking and economic systems such as the US Federal Reserve System, corporate boards or governments control the supply of currency.[citation needed] In the case of cryptocurrency, companies or governments cannot produce new units, and have not so far provided backing for other firms, banks or corporate entities which hold asset value measured in it. The underlying technical system upon which cryptocurrencies are based was created by Satoshi Nakamoto.[48]

Within a proof-of-work system such as Bitcoin, the safety, integrity and balance of ledgers is maintained by a community of mutually distrustful parties referred to as miners. Miners use their computers to help validate and timestamp transactions, adding them to the ledger in accordance with a particular timestamping scheme.[21] In a proof-of-stake blockchain, transactions are validated by holders of the associated cryptocurrency, sometimes grouped together in stake pools.

Most cryptocurrencies are designed to gradually decrease the production of that currency, placing a cap on the total amount of that currency that will ever be in circulation.[49] Compared with ordinary currencies held by financial institutions or kept as cash on hand, cryptocurrencies can be more difficult for seizure by law enforcement.[3]

Blockchain

The validity of each cryptocurrency's coins is provided by a blockchain. A blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography.[48][50] Each block typically contains a hash pointer as a link to a previous block,[50] a timestamp and transaction data.[51] By design, blockchains are inherently resistant to modification of the data. It is "an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way".[52] For use as a distributed ledger, a blockchain is typically managed by a peer-to-peer network collectively adhering to a protocol for validating new blocks. Once recorded, the data in any given block cannot be altered retroactively without the alteration of all subsequent blocks, which requires collusion of the network majority.

Blockchains are secure by design and are an example of a distributed computing system with high Byzantine fault tolerance. Decentralized consensus has therefore been achieved with a blockchain.[53]

Reshared your post👍 Thanks for growing Crypto Culture🔥

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit