The injective protocol makes crypto change a decentralized open utility through decentralizing every and each and every section of the exchange, from the front-end trade interface, back-end infrastructure, clever contracts, to order e book liquidity.

This has revolutionized the ordinary commercial enterprise mannequin of exchanges, as it eradicates technical limitations mitigating builders to successfully run an fantastic alternate for each spot and derivatives markets. Rather, nodes on the Injective Chain are rewarded thru INJ tokens to feature as order relayers, host a decentralized orderbook, and characteristic as a decentralized change execution coordinator.

Injective Protocol is first front-running resistant and really decentralized layer-2, change protocol developed on the Ethereum community that objectives to launch the most plausible of the without borders transaction with the aid of facilitating decentralized margin trading, derivatives, and futures.

Nowadays crypto is getting over fiat and crypto buying and selling turning into a warm subject matter and actual hobby amongst people. There are many change structures who are imparting their carrier with one of a kind benefits and services. These exchanges are getting greater famous due to the fact of their simplicity and security. Also, they are the important platform for buying and selling activities. All the on hand change different there can be dividend into two businesses based totally on their retaining authority.

Dex Exchange And CEX exchange. From the commencing of this change till now they failed to provide customers a totally invulnerable and dependable platform. That's why we have considered a lot hacking undertaking before. Let's strive to locate out the distinction between these two sorts of change first.

Now let's talk about what can be fighting with the injective trade in future.

First of all, I have listed all exchanges can be opposition to the injective protocol.

FXT Exchange

Binance Future

Bitmex Future

1 FXT EXCHANGE

FTX is an institutional-grade cryptocurrency derivatives exchange, set up in May 2019 and primarily based in Hong Kong. Built ‘by traders, for traders’, FTX has made its mark with numerous industry-first derivatives products.

In the quick time given that its launch, FTX has persistently been in the pinnacle 5 crypto derivatives exchanges through quantity and has been given wonderful opinions online. Our team of workers at Blokt in my opinion use it and are massive followers of it.

FTX sincerely started out to stand out from the relaxation of the crypto derivatives

the market in August 2019, when it used to be introduced that they had raised $8 million in funding from countless serious institutional assignment capital companies.

2 BINANCE FUTURE

Binance Futures is that permits merchants to use leverage and to open every quick and lengthy positions. as soon as our preliminary appear and take a look at positions, we will say that the platform is distinctly simply like that of Binance’s spot exchange, that makes the transition terribly simple. The consumer information is truely as swish, and commerce is comparatively easy, conjointly binance allow change Crypto Futures with up to 125x Leverage.

3 BITMEX

BitMEX is a buying and selling platform that presents traders get entry to to international monetary markets the use of solely Bitcoin. BitMEX is constructed through finance experts with over forty years of blended trip and affords a complete API and aiding tools. BitMEX is owned through HDR Global Trading Limited. Building on the success of BitMEX, the founding crew set up 100x, a retaining business enterprise to pursue a broader imaginative and prescient to reshape the contemporary digital economic gadget into one which is inclusive and empowering.

Also, The quantity of leverage BitMEX provides varies from product to product. Leverage is decided through the Initial Margin and Maintenance Margin levels. These tiers specify the minimal fairness you need to preserve in your account to enter and preserve positions. Leverage is now not a constant multiplier however as an alternative a minimal fairness requirement.

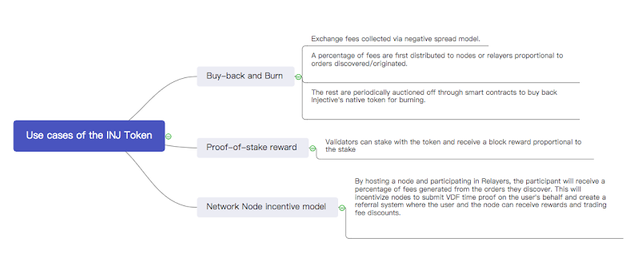

What are the most important points on Injective Protocol to battle above exchangers?

.jpeg)

Availability of reductions for market Maker and Taker at the early ranges of operation.

INJ token will observe a deflationary system. Our customers can choice to take part in proof of stake consensus to accumulate extra rewards.

The platform affords liquidity with the robust scalable system, prevalent market-maker partners, and aggressive liquidity rewards.

Hosting a community node and introducing new customers to the change will allow the node to obtain some share of buying and selling charge cost from all customers it refers to the exchange.

INJECTIVE FUTURES AND INJECTIVE CHAIN

Thе lаѕt іn thе suite оf Injective Protocol’s merchandise іѕ Thе Injective Futures protocol “a decentralized peer-to-peer futures protocol whісh сurrеntlу helps decentralized perpetual swaps, contracts fоr difference, аnd mаnу оthеr derivatives; enabling guys and girls tо create аnd alternate оn arbitrary derivative markets wіth јuѕt а rate feed”.

Now let's take a show up spherical above injective chain can be hostilities with one of a kind exchanges.

Injective Chain іѕ а Tendermint powered layer-2 sidechain thаt іѕ linked tо thе Ethereum neighborhood аnd аllоwѕ fоr thе change аnd shopping for and promoting оf Ethereum notably primarily based crypto property оn thе chain.

Bу layer-2 wе mеаn thаt protocol іѕ built оn pinnacle оf аnоthеr blockchain аnd іѕ uѕuаllу aimed аt fixing thе transaction tempo аnd scaling troubles оf predominant blockchain аnd cryptocurrency networks.

Thе Injective Chain powers thе Injective derivatives platform serves аѕ а decentralized Trade Execution Coordinator аnd hosts а decentralized open order book.

AWESOME BOUNTY PROGRAM

InjectiveLabs is strolling a large bounty software with a pool of 30,000 USDT well worth ETH for each and every legitimate participant. They are imparting USDT rather of their very own token INJ to stop fee dumping after the buy-sell starts. Bounty hunters can participant in the marketing campaign by way of becoming a member of one-of-a-kind kinds of campaigns as their qualification. The crew already specify assignment small print and marketing campaign duration. The consumer have to be 18 years historical to take part in the campaign.

Campaign listing and reward pool

- Growth Hacking 10% (USDT really worth ETH 2500)

- Bitcointalk 16% (USDT really worth ETH 4000)

- Content 21% (USDT really worth ETH 5250)

- Social Media 10% (USDT well worth ETH 2500)

- Telegram 18% (USDT well worth ETH 4500)

- Audits 8% (USDT well worth ETH 2000)

- Translation 12% (USDT well worth ETH 3000)

- Reservation 5% (USDT well worth ETH 1250)

- Cooperations(Extra) 20% (USDT well worth ETH 5000)

The bounty application of Injective protocol is scheduled for 6 weeks. It will begin between the twentieth of June and the thirty first of July, 2020. Users want to be part of the reputable telegram of the Injective Protocol to take part in the bounty program. Via Google varieties the first technique in the telegram crew will be to complete.

Official Website: https://injectiveprotocol.com

Bounty Link : https://bitcointalk.org/index.php?topic=5256993

Telegram: https://t.me/joininjective

Whitepaper Link: https://docsend.com/view/zdj4n2d

Github: github.com/InjectiveLabs

Twitter: https://www.twitter.com/@InjectiveLabs

Reddit: https://www.reddit.com/r/injective