**Disclaimer - I'm just some guy. I'm not a financial advisor, not a market guru, not a whale, not a large scale investor. What I'm sharing here is what I've learned over the years, and seems sensible to me. Take it with a grain of salt. I may have no idea what I'm talking about.

Diversification Based on Market Cap

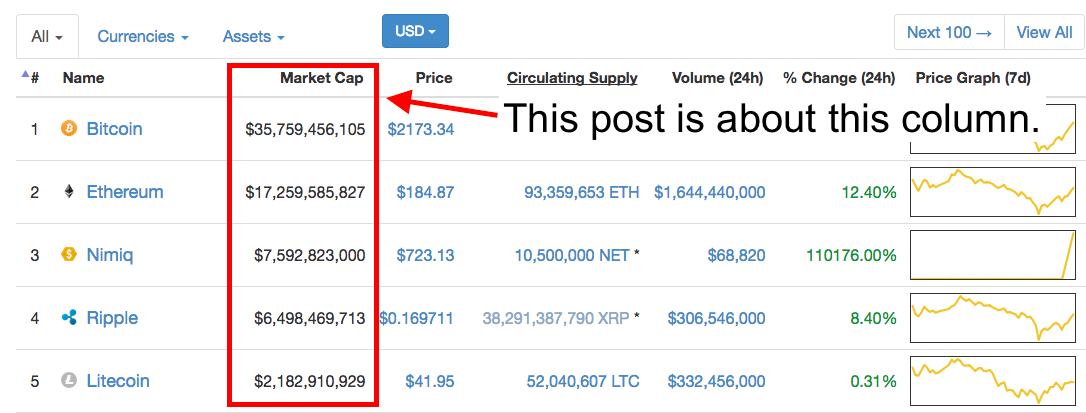

Market cap (short for market capitalization) can be defined as the value of an asset, calculated by multiplying the total number of units of investment available by the unit price. Diversifying based on market cap is a strategy that is widely used when investing in the stock market. Since stocks are directly tied to companies, the relative size of a company can have a bearing on risk, growth, and rate of return. Larger companies tend to be a safer investment, but may have lower returns, while smaller companies tend to be more volatile, but have more room to grow.

In cryptocurrency, market cap can also be calculated, and is a useful tool for making decisions. One great resource for market cap information is coinmarketcap.com, which lists the market cap of almost 1000 cryptocurrencies, sorted by default from largest to smallest. The concepts related to market cap used by investors in the stock market can also be applied to crypto. Coins with a larger market cap are generally more well established, more widely traded, and therefore theoretically less risky; coins with a smaller market cap usually don't have a huge following and have lower trading volumes, but have more growth potential.

As an example, let's look at Ethereum alongside a hypothetical coin with a very small market cap. Let's say it has the 734th highest market cap on a given day (we'll call this 734Coin). Ethereum is well established, it has a proven track record of gaining value, and it's traded in many different places. The odds that it will suddenly fold and become worthless are small compared to our fake friend 734Coin. 734 could stop development, get hacked, or just churn in obscurity for years before slowing fading away.

But on the other hand, 734 has the potential to make much larger gains than Ethereum. As of this moment, Ethereum's market cap is just north of $16B, whereas our friend 734Coin is likely under $10K. If Ethereum's market cap doubles to $32B, and with it comes a doubling of the price, you will have made yourself a 100% profit. Not too shabby. However, if 734Coin puts out some quality code, promotes themselves on steemit, partners with a large tech giant, and raises their market cap to $1M (which is very achievable in this market), you will have made a profit of 9900%. To gain the same percentage increase, Ethereum's market cap would have to rise to $1.6 trillion; certainly possible, but not likely any time soon.

Maybe you're thinking that taking a long shot on a super low market cap coin like 734Coin is more risk than you are willing to take on, and you'd like to just stick to some of the top coins. I think you're still going to be ok in terms of achieving portfolio diversity. Within the top coins there is a pretty wide variance in market cap. Based on current figures, I would think you could draw some rough groupings as follows:

- Very Large Market Cap: $15B and up

- Large Market Cap: $1B - $15B

- Medium Market Cap: $100M - $1B

- Small Market Cap: $10M - $100M

- Very Small Market Cap: Under $10M

My personal advice would be to hold a bit from at least the top 3 categories, more skewed toward the large end the more averse to risk you are. Include some coins from the Small and Very Small categories only if you're willing to take on a fair bit of risk in exchange for a potentially huge payout in the future. The possibility that you could lose everything becomes more real the further down in market cap you go.

One word of caution on diversifying based solely on market cap: Even in the top 20 cryptocurrencies there are examples of coins that have only been active a short time. In crypto it is not necessarily true that sticking to top coins means you have coins with a proven record of success. This may change if the current culture around ICOs changes, but for now, as always, do your research. Learn what the coin is for, what its plans are for the future, and how long it's been around.

Of course, all of the scenarios outlined have a possibility of happening, but some are much more likely than others. Remember, one of the main goals of diversification is risk mitigation. You're trying to prevent economic catastrophe by balancing risk and reward. Spreading out your investments across cryptos of varying market caps, will help protect you from rapid fluctuations on either end of this spectrum. However, it should be noted that cryptocurrency in general seems to be more volatile than traditional investment vehicles, so by investing in crypto, you're already taking on more risk than you otherwise would be. This should be factored in to your overall decision making process when deciding where to invest your resources.