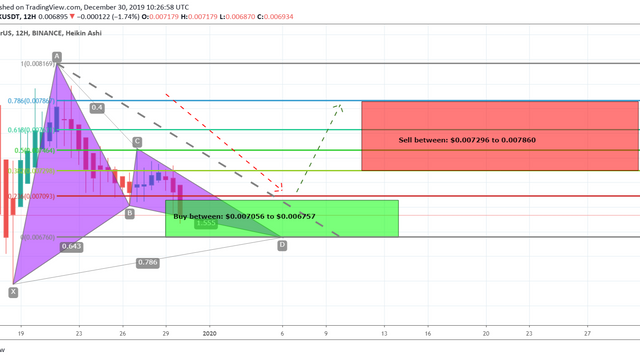

World's 464th ranked crypto token out of more than 2300 cryptocurrencies DOCK has formed bullish Gartley pattern and entered in potential reversal zone and ready for bullish reversal soon.

This potential reversal zone should be used as stop loss in case of complete candle stick closes below this zone.

Lets have a look at the dimensions of DOCK price action's move:

After initial leg (X to A) the A to B leg is retraced between 0.618 to 0.786 Fibonacci and then B to C leg is projected between 0.382 to 0.886 of A to B leg's Fibonacci projection and final (C to D) leg is retraced between 0.618 to 0.786 Fibonacci as perfectly required for Gartley pattern and now the price action is moving in potential reversal zone of this Gartley pattern, now we can expect bullish divergence at any time which will lead the priceline between 0.382 to 0.786 Fibonacci projection of A to D leg, but after this bullish divergence if the candles sticks will be closed above the 0.786 Fibonacci levels then it can also lead to the long term bullish move.

As per Fibonacci sequence method we can set our targets as below for mid term trade:

Buy between: $0.007056 to $0.006757

Sell between: $0.007296 to 0.007860

So this short term 12hr chart based trading idea has potential to give upto 16% gains.

Regards,

Atif Akbar (moon333)

The harmonic moves analysis involves hours of hard work and determination however the success of harmonic trading in fiat and cryptocurrencies is around 80% therefore it is always important that you follow any stop loss strategy while trading harmonic patterns I have also shared a stop loss idea in this article, the information in this article is for educational purpose only this is not an investment advice, I have tried my best to catch the harmonic moves as per predefined classical harmonic Gartley pattern if you find any flaw or you have any suggestion feel free to share with me in comments section.