Premiums

Investors in the South Korean cryptocurrency market are driving the price of Ripple and Monero up, given that nearly every cryptocurrency in the local market are being traded with high premiums. Ripple and Monero are two of the few cryptocurrencies that are heavily concentrated in the South Korean market in terms of daily trading volume.

Bithumb alone, the second largest global cryptocurrency exchange based in South Korea, accounts for more than 35 percent of the market share of both cryptocurrencies. Korbit and Coinone, also process 10 percent of global Ripple trades, increasing the market share of the BTC-to-KRW trading pair in the global Ripple market to nearly 50 percent.

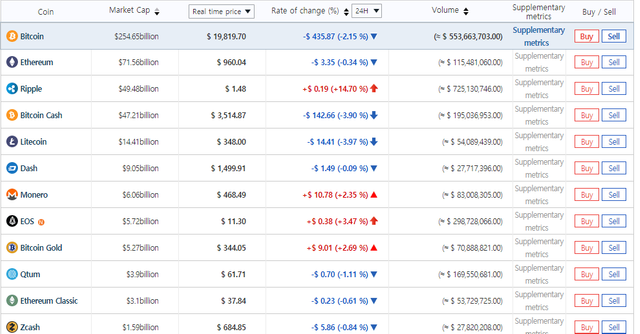

Currently, on both Bithumb and Korbit, Ripple is being traded at 1,592 KRW or $1.48. Given that the global average price of Ripple is $1.29, it is a premium of over $12.83. On Bithumb, Monero is being traded at $467, higher than the global average price of $391, with a 16 percent premium.

Because of the substantial premiums on South Korean exchanges caused by a lack of supply, cryptocurrencies with trading volumes concentrated in the South Korean market tend to surge by larger margins and decline at a slower rate relative to other cryptocurrencies.

Ripple for instance, barely declined on December 23, when the entire cryptocurrency market plunged in value, with bitcoin, Ethereum, and Bitcoin Cash all experiencing over 30 percent drop in prices. While other cryptocurrencies fell drastically, Ripple declined by around 3 percent, remaining above $1.

As CCN previously reported, Litecoin creator and former Coinbase executive Charlie Lee stated that the South Korean cryptocurrency market has been pushing the price of bitcoin and cryptocurrencies like Ripple up for many months. Even bitcoin is being traded at $19,700 in the South Korean market, with a $4,000 premium over the global average price.

“I think increased regulation will help to reduce the volatility of the coin. A lot of the recent gains have had a lot to do with countries like (South) Korea and Japan really getting into the cryptocurrency space. Ever since China banned the bitcoin exchanges, (South) Korea has really taken up the mantle. There is a lot of frenzy in (South) Korea right now and I think that’s driving up the price,” said Lee.

Why are Premiums so High?

Cryptocurrency exchanges based in South Korea are very cautious in regards to the cryptocurrencies integrated on the platforms. Qtum for instance, underwent a rigorous process of market evaluation before the Bithumb development team came to a consensus to implement support for the cryptocurrency.

As such, Bithumb, Korbit, and Coinone, three of the largest cryptocurrency exchanges in South Korea, only support a handful of cryptocurrencies, and the cryptocurrencies that the three exchanges support are often traded with high premiums.

The demand for cryptocurrencies in South Korea is higher than any other regulated markets like the US and Japan, primarily due to the tendency of investors in the South Korean finance market to all-in on an asset which others are either invested in or is trending. The South Korean prime minister Lee Nak-yeon described such surge in demand for bitcoin as “cryptocurrency mania.”

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://theonlinetech.org/2017/12/27/south-korea-pushes-monero-and-ripple-price-up-while-other-cryptocurrencies-fall/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit