Second Post -

Episode "Blockchain and the digital gold"

?why? Is it important to watch the coin market daily and understand development progress.

First. There is a huge mass media manipulation (I know I am repeating myself),

but check ChainCoin (CHC) pump, if you made the decision to put money in it,

this is not reasonable by innovation or functionality...

It is just a third party controlled way

to generally increase or at least hold the market capital (volume) high.

Is this important for the life-time of bitcoin (BTC),

YES because the shift of values is right now happening

and with analysis you have the right time to join the market with low volume.

Do I mean shorting, NO

just do some research and you will see, e.g. check the indicator of Future trading

(not yet existing coin)

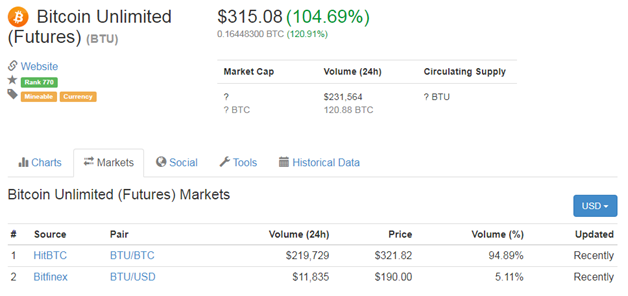

Figure 1: coinmarketcap @ 16.7.2017 2:00pm UTC+1 and two trading markets for BTU*.

This *Future is like a bet on the failing Segwit (segregated witness),

meaning the holders assume hard fork and BTC split,

resulting in unlimited competition of mining/using the right coin

(right meaning, to be on the side of longest blockchain).

If they are right, the risked capital is like a price guarantee,

if not they dumped some investment.

So

?what? does split mean for BTC and ?how? to be on longest blockchain

?when? will this happen, furthermore ?where? to store money meanwhile.

Answer: Do your reasearch! Read from several sources not only bitcointalk forum.

Try to get in contact with top traders through slack, twitter and so on.

Ask direct detailed questions which result out of your own experience

- Haha, yes it is the same argument like previous post,

but hopefully it is working out for you :-D

Now to show you what I mean, below you find a small overview

for life-time of BTC, LTC and BitcoinUnlimited, whereby BTU

could be replaced through Segwit2x (also included in the table):

In the short comparison you only get a rough view

about the complexity of the blockchain development,

but if you use this for more detailed research it will help for ordering facts.

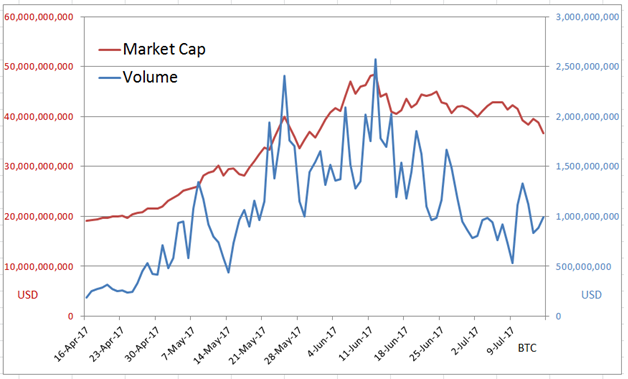

In recent BTC market development you can see some interesting circumstances (Figure 2).

Market Cap meaning the size is stagnant and volume goes down. No growth on the other

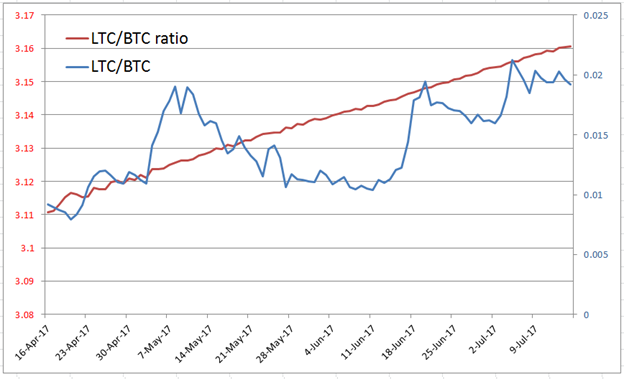

hand LTC is constantly moving up in stair way graph (Figure 3).

Figure 2: RAW BTC historical data from coinmarketcap for the last three months.

Keep heads up in this cyptocurrency bloodbath and look for your trading spot to bring in

your money for some returns -.- Best wishes and as little spoiler for next 3rd post

the topic will be ETH, ETC and the Iceage PoS overkill.

BTW the more up votes the more time I can spend for writing detailed explanations.

Figure 3: As described in 1st post the ratio is price normalized by BTC value.