As two millennials living out our comfortable and perfectly ordinary lives in a developed nation, it’s questionable how much life wisdom we will be able to offer up during the course of this blog.

Nevertheless…

During the course of the first 5 blog posts, we have spent a significant amount of time talking about the world altering potential of blockchain technology and the significant investment opportunity that exists in this space. Today we’re going to have a look at some counter-arguments to that narrative. These counter arguments can be broken down into three different categories:

The rate of blockchain adoption will be significantly slower than what most blockchain enthusiasts think

Blockchain will not have a significant impact on the world

Investing in cryptocurrency and dApps have more cons than pros

Note. these are not arguments against Bitcoin or any other specific blockchain but rather arguments against blockchain technology and cryptocurrency in general.

Lets have a closer look at each of these three counter arguments:

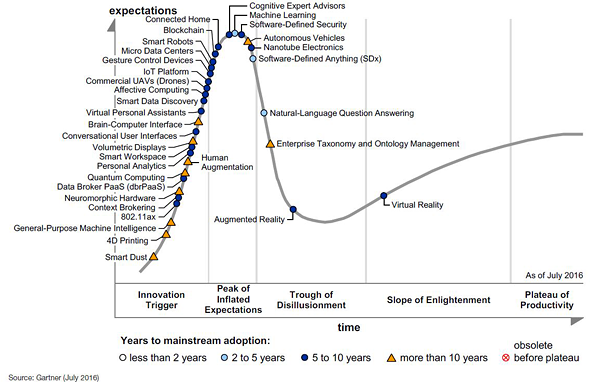

Blockchain Adoption Rate

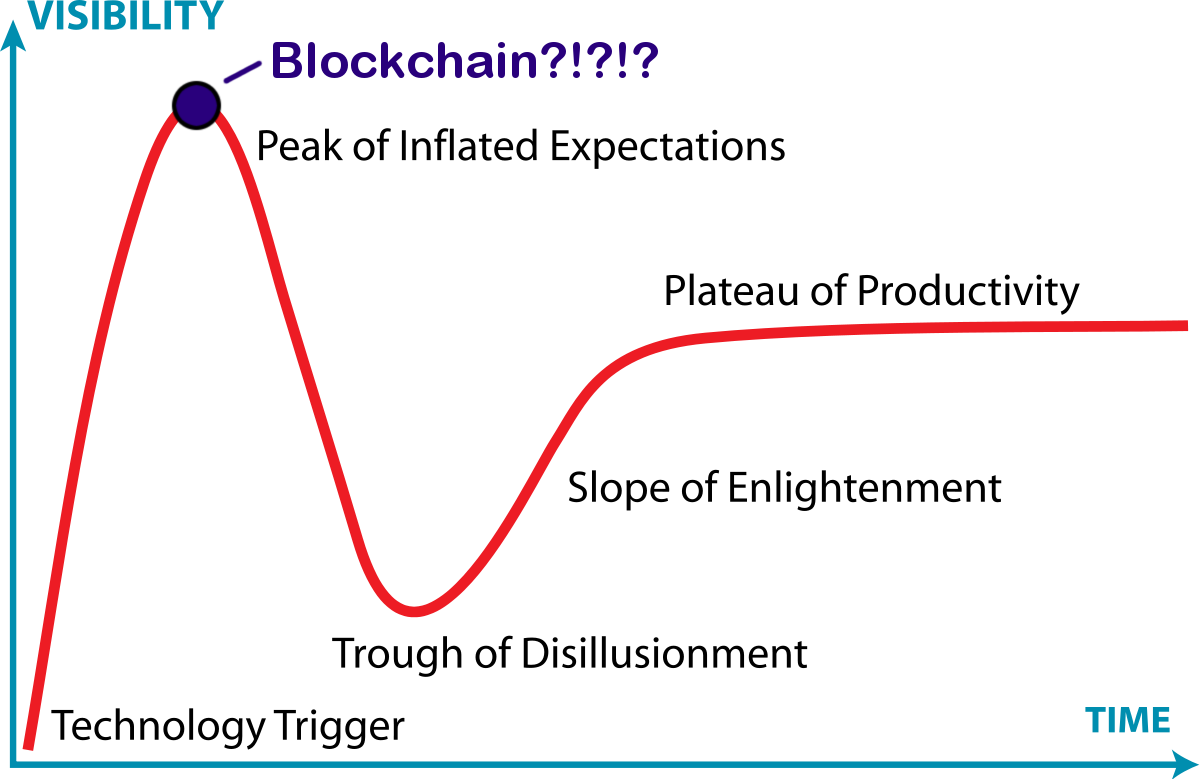

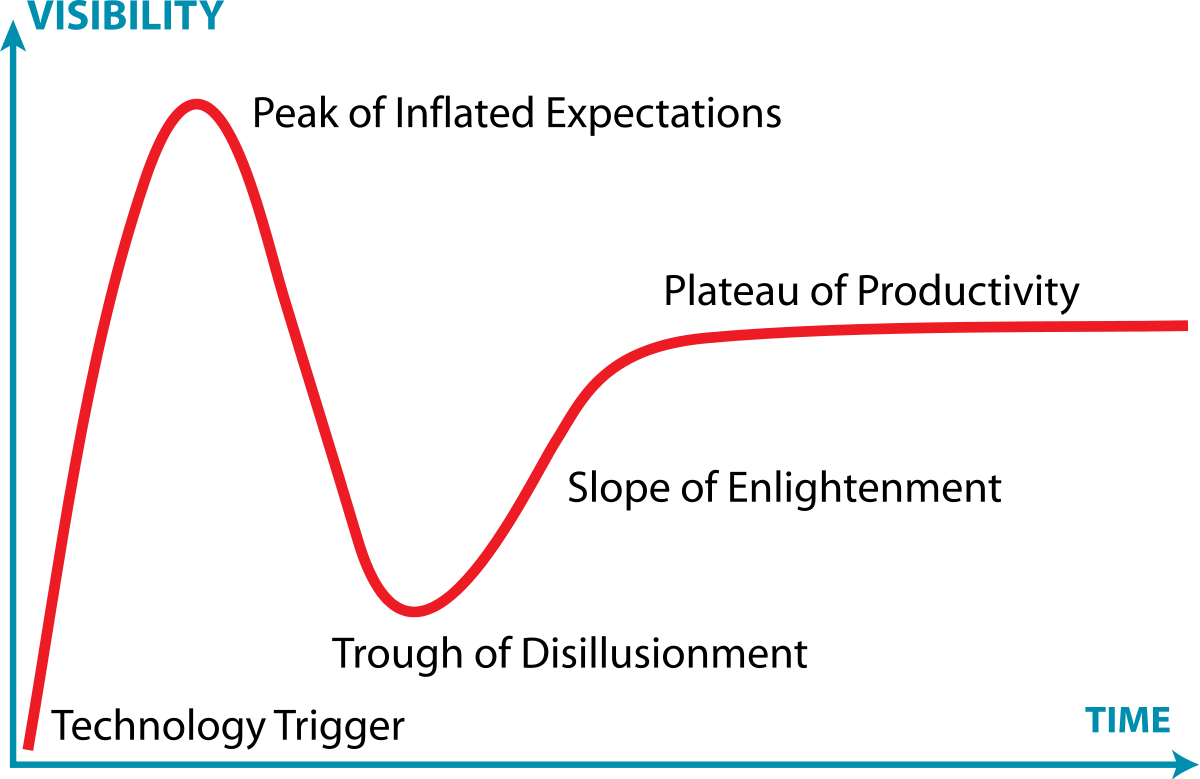

If you google 'blockchain potential’, you’ll find article upon article touting blockchain technology’s disruptive properties and world-altering potential. There is no doubt that plenty of people are hugely excited about blockchain technology. It is important to remember however, that excitement is easier to muster than skepticism. Human beings have a bias towards excitement. As a result, we tend to overestimate the short-term impacts, and underestimate the long-term impacts of technological advances. This is perhaps best described by Gartner’s famous Hype Cycle.

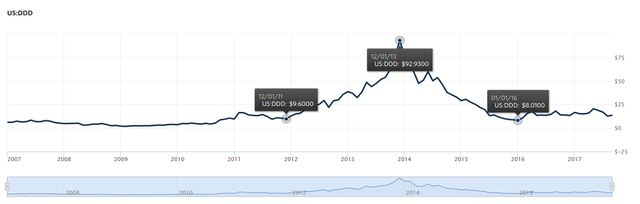

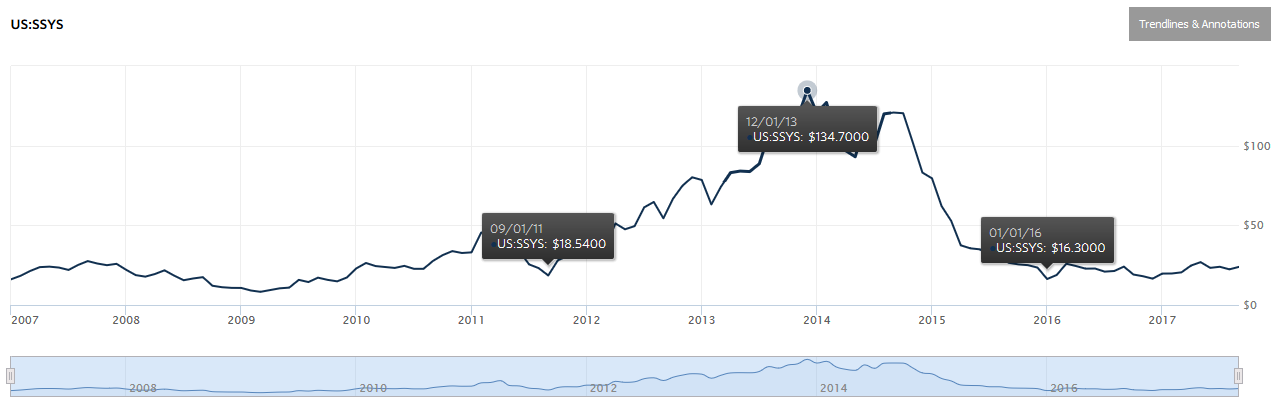

Gartner’s hype cycle has its critics and the belief that every new technology passes through a predictable pattern is a bit too simplistic for our liking. Nevertheless, virtual reality, 3D printing, biometric authentication and artificial intelligence are all examples of recent technologies whose short-term impact was greatly over-estimated. In publicly listed companies, this is frequently reflected in a company's stock price. Google any 3D printing stock and you’ll see something similar to this:

3D Systems Corporation (DDD) and Stratasys (SSYS), like almost all 3D printing companies, saw a massive spike in their share price through 2013 coinciding with news coverage about how transformational 3D printing would be for the manufacturing industry. This was followed by a relatively sharp drop caused by slow user adoption and lower than expected revenue streams. The news media (and investors) weren’t wrong to think that 3D printing will dramatically change manufacturing as we know it (it will), they simple overestimated how quickly it would happen.

Gartner certainly seems to think so. They actually added Blockchain to their 2016 hype cycle of emerging technologies.

In fact, they have been quite outspoken about this for the past year (Gartner 1, Gartner 2) Don’t get us wrong, Gartner are actually openly enthusiastic about the potential of blockchain technology. Unlike many of us however, they believe that current prices are over-inflated and that it will take many years before mass adoption occurs.

We don’t completely disagree with Gartner, however our assessment differs in two significant ways:

- We believe there will be a fundamental difference between the rate of corporate/government adoption and the rate of public adoption

- For both cases, we believe that blockchain technology is still far from the peak of inflated expectations

When it comes to large institutions such as banks or governments, it is probably reasonable not to be overly optimistic about their rate of adoption. Some immediate barriers which industry leaders have already pointed out include:

Regional regulatory consistency: If a large firm wants to store information on a blockchain, how do they ensure they comply with regulations in every region where information is stored (i.e. everywhere the blockchain has a node) (BBVA)

Lack of legal recognition immutability: Many corporate use cases require corporations to prove to regulators that information is correct. As of now, there is little to no legal recognition of the accuracy of information just because it is stored on a blockchain (BBVA)

Immutability: Often hailed as a positive, immutability is actually a concern for many industries as control of information is limited. What happens if an employee makes a mistake? There are no takesies backsies in blockchain so the company would just have to live with it. Private/permissioned blockchains are a potential solution to this problem (Deloitte)

Integration: Anyone who has worked for a large organization such as a government or a multi-national corporation knows how slow change can be. Blockchain is a technology that could fundamentally change how a company does business. Adapting to such a change carries inherent risk and many companies would rather sit on the sidelines and let the technology mature before making the transition (Deloitte)

The above challenges should be taken into account before investing in any company that claims to be on the verge of fundamentally changing the way large corporations or governments work.

When it comes to the general public however, we are a more bullish on the potential rate of mass adoption. Our reasons for this are threefold:

Cryptocurrency and dApps can be seamlessly integrated with existing technology (i.e. the internet).

dApps have the potential to offer the same services as normal applications at a fraction of the cost. Hence there will be a significant driver for user adoption.

The number of dApps are likely to increase exponentially over the next few years as the barrier to entry for developers is reduced.

Given these three factors, we think it’s likely that one or more dApps will capture significant market share (or invent a brand new market) at some point over the next two to three years. There is one important caveat to this assumption. Two major user barriers to entry will need to be removed before mass adoption of any dApp can take place; UI that enables seamless interaction with blockchains via your mobile phone or internet browser; removing the need to go through exchanges to purchase cryptocurrency and tokens.

Blockchain Impact

While plenty of people have doubts about blockchain’s rate of adoption or one or more of its specific use cases, it is rare to find articles with detailed arguments against the overall potential of the technology. The most coherent and detailed article we came across in our research was written by Zack Korman, co-founder at Awesome Power Inc. In his article, Korman makes the following points:

Most dApps “solve” a problem that can be solved more efficiently without blockchain technology

Decentralization is a disadvantage for consumers in many applications

Intermediaries serve a useful function

Lets look at each of the above points in more detail

Most dApps “solve” a problem that can be solved more efficiently without blockchain technology

There is some truth to this statement. Gideon Greenspan, the CEO of MultiChain, a ‘Build-your-own-blockchain’ service for companies, wrote an article a few years ago describing a set of conditions that need to be true for a project to benefit from the use of blockchain technology. Gideon’s recommendation boils down to the following: For blockchain technology to be a useful solution, you need to have a problem that requires a database with multiple, non-trusting writers for which there are clear benefits/efficiencies in removing intermediaries. Finally, if the information in the blockchain refers to non-digital assets, there needs to be a trusted, central authority to guarantee the owners access to those assets (if a blockchain says I own a piece of property, it doesn’t matter unless the government agrees that the information in the blockchain is correct and therefore backs my ownership of said property).

While we agree with the statements in the above paragraph, we think there are countless use cases that actually do fulfill all of the above conditions. Some of which have the potential to impact the world in a drastic way. The challenging for blockchain investors is separating those that do from those that don’t.

Decentralization is a disadvantage for consumers in many applications

The argument here is that the immutable nature of blockchains make them poor instruments for keeping track of information where users would benefit from some level centralized control. If someone posts an embarrassing or defamatory picture of you on Facebook, their centralized control give them the ability to take it down on your request. On a decentralized social network, this would be much more difficult if not impossible.

Hence each application of blockchain technology needs to consider both the cons and pros of decentralization. If the cons outweigh the pros, a permissioned/private blockchain may be a better solution if it still offers significant efficiencies compared to traditional ways of managing information.

Intermediaries serve a useful function

Intermediaries do serve a useful function, and that function is to establish trust between two otherwise untrusting parties. The beauty of blockchain is that it allows untrusting parties to interact with each other without requiring trust to be established. Out of the three arguments against blockchain potential, this is the weakest one in our opinion. Having said that, it is important to consider the actual cost of intermediaries within a specific use case when evaluating the potential of a blockchain application. If this cost is near-zero, it will be more difficult to convince people and organizations to make the switch to a blockchain based application.

In conclusion, nothing we read during our research convinced us that the long-term potential of blockchain technology is overhyped. It did however shed light on some of the potential pitfalls of blockchain applications. This will no doubt enable us to more accurately assess potential investment opportunities in the future.

Note. if you're not familiar with the Clever Octopod and other aquatic block characters you may want to go back to Post 3 and familiarize yourself with the blockchain ecosystem.

Blockchain Investment Potential

The cornerstone of this argument is that while blockchain technology may have some potential, it is not worthwhile investing in cryptocurrency like Bitcoin for one or more reasons (The Motley Fool, Time). This is argument is not saying you're bound to lose your money if you do, but rather that cryptocurrency have certain features that make them undesirable as investment prospects. Some of the common arguments for not investing in cryptocurrency are:

- Volatility: Cryptocurrency is notoriously volatile. If this is enough to put you off an investment then cryptocurrency is not for you at this stage. It is important to remember however that volatility by itself does not pose a significant risk for long term investors as long they are willing to hold through bear markets. In fact, if you play your cards right and trade like a clever octopus, you can benefit from this volatility by buying in or increasing your investment during bear runs.

Be fearful when others are greedy and greedy when others are fearful

— Warren Buffett, Berkshire Hathaway 2004 Annual Shareholder Letter

Security concerns: While this is a valid point, it can be mostly eliminated by taking the right precautions during the purchase and storage of your coins. Having said that, we completely understand if someone does not feel comfortable investing their money in cryptocurrency due to security concerns. Hopefully the cryptocurrency community will continue to develop safer and more accessible ways to invest as this seems to be one of the main turn-offs for most people looking to invest medium to large amounts of capital.

Regulatory risk: Regulatory risk refers to the risk of governments trying to restrict your access to Bitcoin due to concerns regarding its anonymity or lack of regulation. We have already seen this happen in China (Bloomberg) and it is certainly not outside of the limits of possibility that it could happen in other countries too. If it does, it will have a negative impact on price. Having said that, Bitcoin’s reputation has vastly improved over the past 3 years and most governments around the world have a permissive attitude towards it (Crypto Compare). Our belief is that most open governments around the world will remain positive towards cryptocurrency and continue to develop policy that regulates the market without restricting people’s access to it. This has certainly been the direction most governments have headed in over the past few years (The Telegraph, Brave New Coin, CNBC).

If the above arguments are enough to stop you from investing in cryptocurrency that is completely fine. Any investment decision needs to take into account both the risks and potential rewards and we all have different levels of risk tolerance. Our personal opinion is that the upside of cryptocurrency investment greatly outweighs the risk.

Conclusion

After spending a week researching arguments against blockchain, we actually found ourselves more bullish on the overall potential of the technology. Coherent articles with sensible arguments against blockchain are few and far between and the overall sentiment of the technology sector seems to be very positive. Despite the huge potential of the technology, it is important to remain skeptical when assessing individual use cases as blockchain technology is not the solution to every problem in the world. What are your thoughts? Are there any arguments against blockchain technology that we did not cover? We would love to hear from you on our message board below! Our next few blog posts will discuss various aspects of cryptocurrency investment, starting with a closer look at ICOs next week. Hope to see you there!

Really fascinating and interesting post. You've done a great job here. This the first of the 6 i've seen, but will definitely check out the rest! I've upvoted, resteemed and followed. @alexmavor and I put together our own Steemit series which looks at the hottest topics of the week. I'm just about to resteem it. Would love for you to check it out and hear your thoughts!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the resteem Anton! Just read through your latest post on the recent Ethereum developments. Excellent stuff! Consider yourself followed and we'll see you around the comment boards :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've not actually managed to resteem the post yet, as my friend @alexmavor is the one currently uploading it. Once I get it up, I'll share the link with you, but I appreciate the follow!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey @myblochainblog here's the latest episode in the series. Would love to hear your thoughts and hear any questions you might have on the subject!

https://steemit.com/ethereum/@alexmavor/time-to-believe-the-hype-what-is-ethereum-and-is-it-ready-for-eos-crypto-nights-episode-3

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @myblockchainblog! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i am a strong fan of your blog ,,, please keep it up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your good posts, I followed you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @myblockchainblog! You have received a personal award!

Click on the badge to view your Board of Honor.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @myblockchainblog! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit