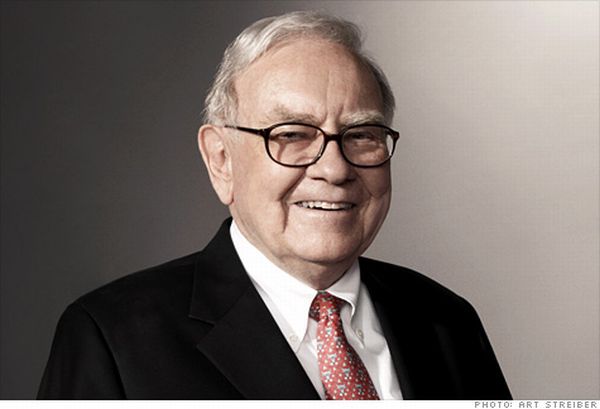

He is an inspirational stock trader, businessman stroke investor. He is seen as the most valuable and richest man in the world who bought his first stock at the age of 17 years old, and made his first $50,000 dollars, and now is worth an estimated $80 billion dollars. He invested in Coco Cola and the Bank of America, and never looked back. He loves fear when others are not investing and seeks value and knowledge in unprecedented ways by reading books and getting a lot of value from it. He is Warren Buffet. Here are is top 10 rules for trading success.

New revised version!

1- First rule- Always think, long term over short term. When you invest buy quality stocks that you can hold long-term rather than be selling short. His strategy is you can get a return over years rather than months in building your investment strategy.

2- Second Rule- Never sell- short of the market. If your stocks goes down try to HODL your position and think of it as long-term investment.

3- Third Rule- Always invest in quality of Stock and not junk. The stock should show the teams vision, over view and project which projects the quality of stock. Junk for Warren Buffet is like buying stock you don’t know at penny prices, if you see what am saying. Buy quality and stick with it. See the vision of the company.

4- Fourth Rule-Warren Buffet says in able to be successful in trading you don’t have to be right about thousands and thousands of companies just invest in the stock that you believe in and understand. That is key, to Warren Buffett.

5- Fifth Rule- Always like the price that is selling for. It is a strike when you do that, don’t buy at a high price or you will lose out! Buy low and spot the opportunity.

6- Sixth Rule-It is a terrible mistake to form an opinion on everything, only share an opinion on your best investment opportunities. He says make 4 or 5 decisions, is best in investing.

7- Seventh Rule- Yet again to reiterate to point 6, don’t have to form an opinion on everything- I can form an opinion on the stock I believe in. Believe in in the stock you study and stick with those projections for the long term. Remember Warren Buffet invested in many long term projects that brought in returns.

8- Eighth rule- Always show, your intelligence on the stocks that you see value.

9- Ninth Rule- Always spot success. See it before others flock in. Key to every worthwhile investor, Warren Buffet saw that- Spotting companies that have long term vision. That is how he formed an opinion on Bank of America and Coco Cola and bought in at low prices. Winner!

10- Last Rule- Always accept, your mistakes. And invest in yourself. Investing in you is a great way to go. Move 20% of your saving in stock and just try to HODL in the long term. And see what comes out of it.

Warren Buffet was a successful man in this area. He never used a computer and invested in stocks from the newspaper. This is by all means not financial advice but some of the videos I have watched and analyzed Warren Buffet views into these 10 rules, to share his financial understanding with you all. This is not exhaustive version by all means of his points, but some of the views he has shared with us. So many investors get it wrong and sell in panic when prices go down. Buffet worked opposite to this and saw it as an opportunity. We can learn all from it!

Dont be like the others! Be smart!

Like Warren Buffet :)

Credit of Picture goes to- Art Streiber

Nice

Select me friend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like "invest in the stock that you believe in" and "it's a mistake to form an opinion on everything" from this collection of rules.

Although it doesn't seem possible in crypto to do anything but pass judgement or buy everything... It all sounds so good, all of the time hehe.

Nice post though, thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit