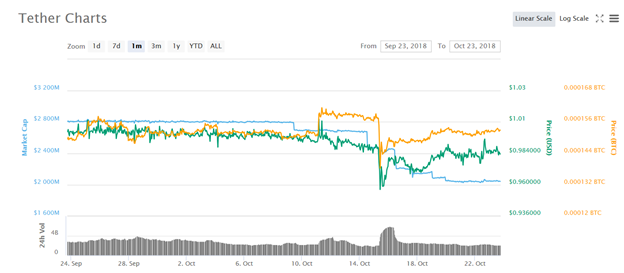

The introduction of Tether as the first stable coin, into the cryptocurrency ecosystem was meant to bridge the cryptocurrency world and the legacy financial system by offering a digital token with stable value. The idea behind stablecoins is fairly simple, to create non-volatile digital tokens pegged to the USD and backed by fiat in a bank account; as such they can and should be redeemable on a 1:1 basis on demand. Unsurprisingly, Tether’s first mover advantage affords it a unique status, perhaps too important, in the crypto ecosystem; being used as one of the base currencies along with Bitcoin and Ethereum in today’s exchanges. Tether has an infamous history of controversy ranging from its relationship with Bitfinex to its lack of transparency of its audit. For a while, FUD about Tether has been highlighted only until the next big story or market movement that captures the market’s attention. The recent chapter in Tether’s shady history, Tether’s insolvency, led to Tether value dropping to as low as $0.84 and creating a premium on some exchanges such as Bitfinex. The market reaction to this black swan event : traders moving their funds from Tether(which is the preferred base currency in cryptocurrency bear markets due to its price stability) to Bitcoin and other cryptocurrencies, fearing imminent Tether implosion, causing a temporary price spike across the markets.

Today the power of fake news is stronger than ever, and even if the allegations might be untrue, the damage can be severe. Despite the smoke on Tether clearing with the price stabilizing, this time there has been a long overdue response in action from various industry stakeholders. The recent influx of regulatory approved Tether alternatives such as Gemini Dollar, Pax, True USD promise more transparency and stability and also bring to the fore shadowed earlier alternatives such as DAI.

In a collaborative show of unity, most of the top exchanges including Huobi, Binance and OKEX have promptly listed these stablecoins and offer them as trading pairs. This shows commitment to customer safety first, thereby improving traders’ confidence.

TrueUSD (TUSD) will be listed on Huobi on Oct 19th. TrueUSD has been providing traders with a regulated fiat-backed stablecoin option for the last 7+ months, and we are thrilled that more exchanges are recognizing the benefits of our stablecoin model. #trueusd https://t.co/1SBuLjxfsB

— TrustToken (@TrustToken) October 16, 2018

HUSD

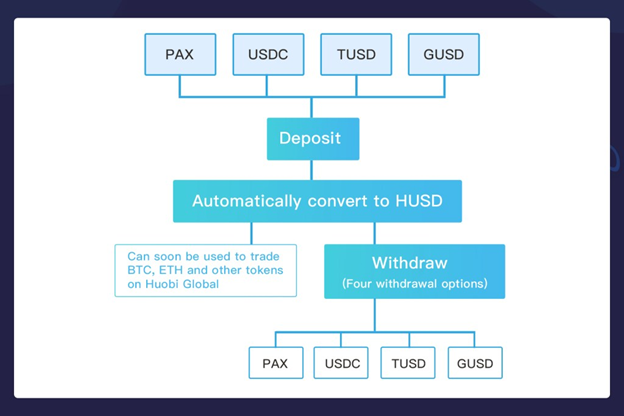

Too many options might be a mouthful for investors, that is why Huobi Pro has gone a step further to offer a universal stablecoin solution, HUSD. Most investors will be satisfied with a user-friendly HUSD that is backed by Huobi Pro, the leading global digital asset exchange. Huobi Pro has always taken the customer interests seriously with cold storage of assets and Huobi Security Reserve Fund to name a few.

The HUSD Model

As a trader, you can deposit any of the four recently listed stablecoins PAX, TUSD, USDC and GUSD. And while trading you no longer have to choose between multiple stablecoins. Likewise, you can also withdraw in the stable coin of your choice after your trading activity. This also saves costs over the long run.

The rollout of HUSD, will be in phases, according to the official Huobi announcement:

1. The deposit service of PAX, TUSD, USDC and GUSD will start at 16:00, October 19 (GMT+8 ).

2. USDT/HUSD trading pair will be listed at 10:00 AM, October 22 (GMT+8) on Huobi Global.

3. Transfer service of HUSD between Huobi OTC and Huobi Global will start at 10:00 AM, October 22 (GMT+8), and trading services of HUSD on Huobi OTC will start at 10:00, October 23 (GMT+8).

4. Huobi Global will commence BTC/HUSD and ETH/HUSD trading at another time after evaluating market conditions.

5. Huobi App will support the trading service of USDT/HUSD, and the deposit and withdrawal services of HUSD will be available in the next App version.

6. Huobi Global will start the withdrawal services of the stablecoins in one to two weeks. The specific time and date will be notified via a separate announcement.

Since the official announcement of HUSD launch, the news has received broad-ranging support from the projects Gemini USD, Pax and USDC who have also spread the news through their official Twitter platforms.

Watching from the sidelines, I believe that competition among stablecoins as future financial instruments is heating up and we will be able to determine their contribution to the cryptocurrency ecosystem only through looking back in retrospect. So in that regard, I believe HUSD's support of stablecoins is going to be an even important role, when we connect the dots in a few years or so. Whether or not this is the silver bullet to Tether woes remains to be seen, however, I believe it is a step in the right direction and also a good precedent for the whole industry in terms of consolidating to work for the common good. One thing is for sure, investors concerns about Tether have now been placated, with sound alternatives, and that is a big thing.

Congratulations @neferpitou!

Your post was mentioned in the Steemit Hit Parade for newcomers in the following category:

I also upvoted your post to increase its reward

If you like my work to promote newcomers and give them more visibility on Steemit, consider to vote for my witness!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit