Although cryptocurrencies are a new asset class and are behind the potential disruptive technology of blockchain, when it comes to investing there are a number of key strategies that should be used due to the way financial markets function. One of the most fundamental strategies is called Dollar Cost Averaging. Dollar Cost Averaging is the strategy of buying an particular asset on a periodic basis for a prolonged period of time. You should also use around the same amount of funds on each purchase. This allows you to scale into a position that averages to a cost basis around the longer term movement of that particular assets. It acts as a hedge against price action going against your investment immediately after purchasing it.

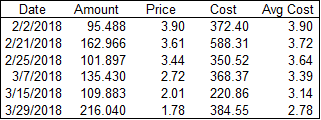

To show how this works, I will share my #STEEM purchases during the first quarter of 2018:

As we know, the price action was lower which made me purchase at lower prices on the way down. However, you can quickly realize how this strategy could potentially be helpful. My overall average cost is $2.78 per #STEEM. If I use a current price of $3.55, you can see that my position is up about 28%. However, if I would have invested my full amount of fiat at the first purchase (at $3.90), I would have a 9% loss at this moment. Clearly a worst position than I am in right now.

Another perspective is what would have happened if the price would have went up. Certainly, investing more at a starting point when at asset goes up in price represents the best option but from a risk management perspective, by dollar cost averaging you could still participate in rising prices. So there is an opportunity cost in the case an asset goes up in prices. However, given the volatility seen in cryptocurrencies, risk management strategies should always be the best option.

Another example to show the benefits of dollar cost averaging is that it stabilizes your average cost basis to protect against volatility. So, in a declining market it would make your breakeven closer to reach if the price goes back up and in a rising market, it will make the breakeven higher. To see as an example, see my purchases from above in a chart from coinmarketcap.com:

As you can see, given the declining prices in Q1 2018, my average cost is $2.78. This shows that my breakeven is lower now than if I would have only purchased at the first price point of $3.90. Instead of needing a higher percentage increase to get to breakeven, I am actually positive now. Much better from my perspective.

As you can see from above, the value of the strategy is that as an investor you do not need to worry about investing at the top of the market or trying to decide when to get in or out of the market. Remember, it is virtually impossible to really time the market so strategies that work around timing work best; particularly when in an asset class that is so volatile.

What are your thoughts of this strategy? Does it convince you as a good risk management approach? Please let me know your thoughts. I look forward to engaging with you on this subject.

Follow me on Twitter: @NAICrypto

Don’t forget to vote, comment, follow, resteem and browse my channel for more information!

If you are like me and interested in continued personal growth, invest in yourself and lets help each other out by leveraging the resources they provide by using my referral link:

https://www.minnowbooster.com/referral/530636

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.

I love how you used a real world example to explain the dollar cost avg. I think it's a good concept to deploy if you have a long term view. However, I don't agree with deploying it if price just keeps dropping and dropping and dropping because if you have $1.00 and losses $0.50, it has to gain 100% just to get back to break even.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agreed! That is why I used the example with STEEM as I believe in it for the long term. It could also be used for retirement accounts which are meant to be long term positions and not trading. A devaluing asset is never a good investment no matter how much you put into it (like a car or a boat). Thanks for your thoughts!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sorry I couldn't quite follow your method, maybe it's just a language / terminology difference. Are you laddering in ? ie as the price falls you buy more and more at ever cheaper prices ?

For me and the type of trading I do that's account suicide. What if it went to zero ? I only ladder in when prices are rising, ie I buy more and more as the price goes up and up, multiplying the profit.

I'm not saying your wrong, I know buying into failure works for a lot of people, just not me. This guy here is very successful at it @quickfingersluc

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is laddering in or scaling in but not because the price goes down; rather, it is trying to buy the same dollar amount every so often, no matter the price. As long as you believe in the project and the long term value you should not be worried about the price you buy it at. I have continued to buy #STEEM as I believe in it. I try to buy at least one time a month. It was coincidence that the Q1 2018 purchases were always lower than the prior but that was due to the market downturn we have had. I have bought 2 more time since then at higher prices because of the run up. The important point is that this methodology averages your cost as your ladder into the position which is better risk management than making a bet on the price at any given time since nobody can truly time the market. Hope this helps clarify!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks, perfect explanation, I understand now :-)

I only trade very short term and on margin, so I can't hold a loss for very long as it would wipe me out. I can see the sense of a long term hold though if you're confident in the asset. It does seem like a risky strategy but you have to speculate to accumulate !

Do you have an 'exit plan' in place ? if it moved hard against you for a long time, would you take a loss and get out or ride it to the end ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not for Steem. I believe in the potential long term and since we benefit from passive income by staking and participating, I do not have an exit plan. I could choose to skip a deposit or reduce a purchase if plans of the project or the overall market sentiment changes but it would have to be dramatic. I also put in what I can afford to lose given it it still early in this industry.

For other assets, stop losses are a good idea to limit your risks. I also never use margin as it reduces the flexibility when trying to grow a position. Large whales tend to know the pivotal price points and will bet against smaller investors so their margins get called and implode. Be careful there.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I trade for a living full time, I'm the person buying everyones stops... :-)

I can get behind something like Steem, good long term growth potential because it actually 'does' something, unlike the other 1500+ shitcoins that do nothing. Can't go wrong as long as the platform continues.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Just a friendly reminder to use the #investorsclub tag to qualify for the member upvote.

Upvoted ($0.13) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sorry! Forgot about that! Done!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The incredible power of the Dollar Cost Averaging strategy!! So simple and effective yet overlooked by many investors in our Crypto space 👀 Definitely upvoted! Keep up with the great content my guy 😁👍🏼

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good work as always..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit