A positive message about future of Cryptocurrency as a new category of asset.

To all veterans and newcomers (I don't like to use the word "noob" as we were all new once upon a time), people interested in new technology and whoever will be reading this article I salute you comrades.

I hope you will find this article useful, reliable and entertaining.

Here we go, fire in the hole !

1. KING BTC IS STILL ALIVE

1.A. BTC PRICE, NO NEED TO PANIC.

For those of you who landed in Cryptoworld in Q4 2017/Q1 2018, your portfolio value has probably melted as fast as snow in the Sahara desert.

The great new is that "NO, Crypto is not dead" !

How many times Bitcoin was declared dead by the media ? We should be used to that brainwash and level of FUD by now.

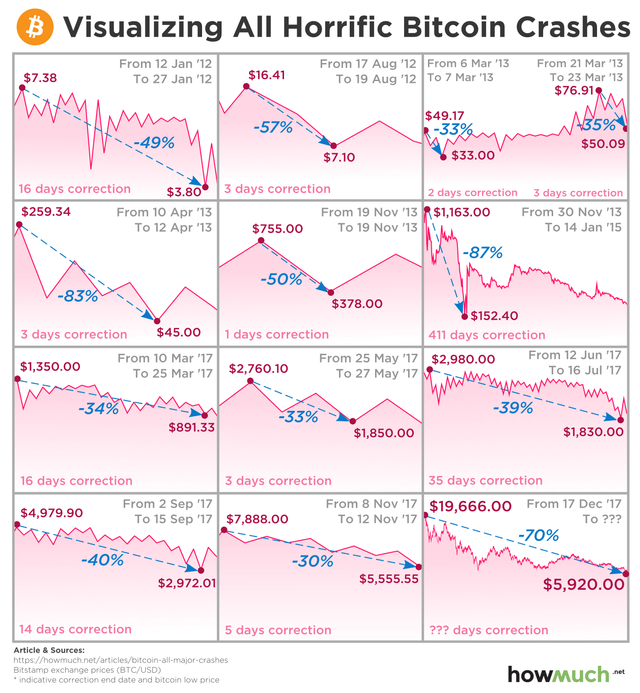

Zoom out, it is not the first time BTC is having a major correction, not BTC first rodeo.

January 12, 2012 – January 27, 2012, -30%, 16 Days

August 17, 2012 – August 19, 2012, -57%, 3 Days

March 6, 2013 – March 7, 2013, -33%. 2 Days

March 21, 2013 – March 23, 2013, -35%, 3 Days

April 10, 2013 – April 12, 2013, -83%, 3 Days

November 19, 2013 – November 19, 2013, -50%, 1 Day

November 30, 2013 – January 14, 2015, -87%, 411 Days

March 10, 2017 – March 25, 2017, -34%, 16 Days

May 25, 2017 – May 27, 2017, -33%, 3 Day

June 12, 2017 – July 16, 2017, -39%, 35 Days

September 2, 2017 – September 15, 2017, -40%, 14 Days

November 8, 2017 – November 12, 2017, -30%, 5 Days

December 17, 2017 – ???, -70%, ??? Days

Just a quick joke, when BTC decides to go for a run Altcoins are suffering. I only have love for Alts !

By now you heard that price will go up after Chinese new year, after Wall Street traders bonuses, after tax season in USA, after Consensus event in May, after the ETF launch by CBOE subsequent to the SEC's approval.

The plain truth is that nobody can predict the future, especially not BTC future price.

On the other hand, the only sure thing is that everyday brings us closer to the next BTC halving in 2020.

Right now 1800 BTC are generated/day and some miners are selling everyday at market price. This number will drop to 900 BTC/day.

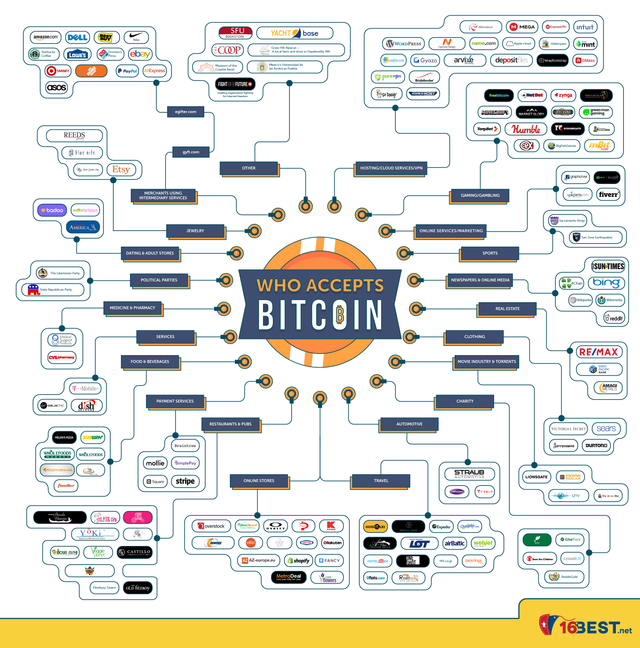

Supply vs demand, do the maths.

Meanwhile billionaires such as Bill Gates, Richard Branson, Chamath Palihapitiya... announced publicly BTC potential, Facebook lifted their ban on cryptocurrency ads, OTC volume on the rise, Coinbase forming a political action committee, more and more traditional VCs investing in ICOs, centralized exchanges having to suspend registration for new accounts due to overwhelming demand, media exposure keeps rising (Hello to our lovely CNBC Fast Money reversal indicator), application from CBOE for a Bitcoin ETF licence, banks statement from "not interested" to creation of crypto desks, attention of large asset managers such as Blackrock, Mastercard patent to link cryptocurrencies with fiat accounts, Amazon buying domain names related to crypto, Samsung offering cryptocurrency payment methods, more and more companies accepting crypto payments and the list goes on...

1.B. OVERALL MARKET CAPITALIZATION.

Total market cap for Cryptocurrency is nothing compared to other assets, upward potential is there.

On 27th of July 2018 Facebook lost $123.4 billion in value overnight, which represent today more than 1/3 of total Cryptocurrency market capitalization. Ok, I hear you, it has revenues from its business activities. But who can put a price on what blockchain technology is going to bring to the world ?

Think long term, lighting network on its way. Do some Netflix and chill, BTC will still be there.

Spend some quality times with your loved one, don't touch your cold wallet and reassess your BTC value in a couple of years.

1 BTC will always be = 1 BTC.

Some people clearly failed to look at value blockchain technology is going to bring to the world and they are using the term bubble for Cryptocurrency.

Let's have a closer look.

NO, you are not blind !

Overall Cryptocurrency market capitalization is so small compare to other assets. It is a new category of asset growing years after years.

Total market cap of crypto in July :

- 2013 $ 1.2 billion

- 2014 - $ 8.3 billion

- 2015 - $ 4.8 billion

- 2016 - $ 12.8 billion

- 2017 - $ 90 billion

- 2018 - $ 299 billion

Mt. Gox you are the real party pooper for ruining that growth !

Anyway, demand for Crypto is growing as well as world acceptance.

Hyperbitcoinization will take some time, patience.

2. ICO MARKET

2. A. ICO MARKET IN 2018.

ICO stands for Initial Coin Offering.

It allows you to invest in a project/startup at a very early stage, often compared to Initial Public Offering.

Main differences are that you will receive tokens instead of shares and that in most cases you will not need to be an accredited investor to invest (aka the rich get richer).

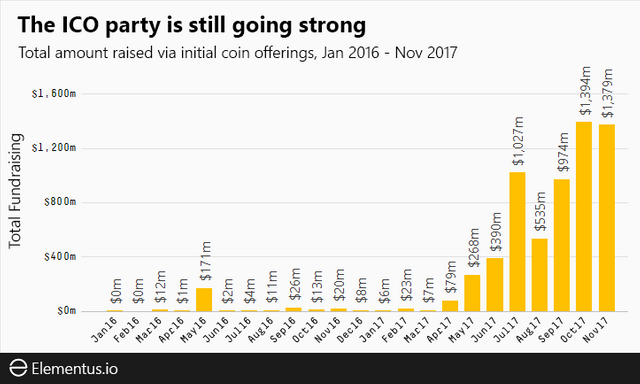

The ICO Craze in 2017 was just insane.

873 ICOs have raised a total of 6.13 billion $ in 2017 and already 6.23 billion in first 5 months of 2018. I bet you 1 DOGE this number will be easily above 10 billion by EOY.

Some entreprenors saw in ICOs a way to raise quick bucks in a short period of time surfing on the blockchain train, releasing a token with no real use case, not delivering their product, or even worst : exit scam (BitConeeeeect Hey Hey Hey !, FOMO coin).

At the end of February 2018, Bitcoin.com published a report : 46% of 902 blockchain projects that conducted Token Sales in 2017 subsequently failed.

Have you heard about UET ICO ?

Useless Ethereum Token, who managed to raise 40 000 $ in 3 days. Just an example to show that investors are throwing their money left and right without Due Diligence.

2.B. TRENDS.

The beauty of ICOs are that it allows average Joes to invest in something they do believe in at the same price as whales, at least until 2018.

- TREND 1 : ICOs with big potential or simply with transient hype are selling everything in private to "strategic partners" or Venture Capital (VC), and do a peanut airdrop to create a pseudo community hoping airdrop holders will look further into the project and buy more tokens. RIP decentralization.

- TREND 2 : Some "strategic partners" tend to sell their allocation at a premium price to pools but still at a lower price than crowdsale and dump rest of their position post listing to secure their initial investment.

- TREND 3 : Lack of transparency. Some ICOs are doing non disclosed seed round to friends and family. Pure joke in that case = GET REKT AND BUY MY MUM'S AND DOG'S BAGS !

- TREND 4 : High number of TX/S. Who will be interested in your 1 million TX/S if it comes with a poor security level ?

Answer : in the short term, maybe a few people following blindly signals from cryptochillers masters dumping on you. In the long term, nobody. - TREND 5 : Pump of Telegram channel using bots, airdrops, POS (Proof Of Shill) or POIWA. You might be wondering what is POIWA ? "Proof Of I Want an Allocation" !

2.C. HOW TO SPOT A GOOD ICO AND QUESTIONS TO ASK YOURSELF WHEN INVESTING.

With ICOs popping up like mushrooms it is harder and harder to spot a real gem.

Wake up !

It is not 2017 anymore where you could have closed your eyes, throw some ETH at any random ICO and see a good ROI. Those times are behind us, as well as 200 % daily token price growth on Poloniex (I miss you buddy!).

I am dreaming of a big purge of all those pseudo ICOs with no real use case leaving only solid projects behind with an organic growth.

After a basic research looking at token metrics, team and advisors background and of course after having read whitepaper, you should do a deeper research.

To help you out here is a list of questions you should ask yourself if you are thinking about investing :

- QUESTION 1 : Does this startup really needs blockchain ?

- QUESTION 2 : What will be token use case ?

- QUESTION 3 : How many people will use that token ?

- QUESTION 4 : Who will use that token ?

- QUESTION 5 : How solid is their tech ?

- QUESTION 6 : How solid is their team and advisors ?

- QUESTION 7 : Ability to have solid partnerships ?

- QUESTION 8 : Will team be able to deliver ?

- QUESTION 9 : What are the chances to see mass adoption ?

- QUESTION 10: What are the incentives to hold or use that token ?

A list of major questions to help you to DYOR (Do Your Own Research).

Here is a list of things to look at when you are digging into ICO World :

| WHAT TO LOOK AT | EXAMPLE |

|---|---|

| Impact on Space | Huge, above average, average, poor |

| Type of ICO | Infrastructure, platform, currency... |

| Roadmap info | Progress : MVP (Minimum Viable Product), Proto, Alpha, Beta |

| Roadmap in general | Major milestones |

| Idea | What can it bring to the world |

| Real use cases | How many people will need and use this token |

| ICO Team | Legit or not. Will they be able to execute their vision |

| Advisors | Check connections |

| Whitepaper | How solid is their tech |

| Market Cap | Nobody need $30 M to create an app |

| Number of tokens kept by the team | Decentralization or not |

| Maximum supply | No scarcity with a 1OO billion supply |

| Price/token | If seed round, private sale... compare it to crowdsale price |

| Token lock up period | If no lock up on bonuses it will create a selling pressure |

| What if unsold tokens | Will they be burned, kept by the team, distributed to investors |

| VCs investment | To have strong VCs in ICO stage is a sign of future strong development |

| Partnerships | To have stong partnerships in ICO stage is a sign of credibility |

| Code | Quality of the code if available on GitHub |

| Close from community | Weekly newsletter, frequent update on social networks |

| Business model | Excellent, average, poor |

Only tokens with solid fundamentals are likely to succeed in that Wild West of ICOs and those ICOs are as hard to spot as a unicorn.

Edenchain caught my attention as it fulfills many of those criteria and after looking deeply into it, this beauty could be THE one !

3. A CLOSER LOOK TO EDENCHAIN, "ETHEREUM FOR ENTERPRISES."

3.A. WHAT IS EDENCHAIN ?

Edenchain is a blockchain 3.0. Bitcoin is 1.0, Ethereum is 2.0.

Edenchain is a global permissioned blockchain with its main office in South Korea, an office in Singapore, a R&D center in Vietnam and a clear plan to set up regional offices in San Francisco, New York, Mexico, London, Dubai, Moscow, Malaysia, Australia, China and Japon.

A programmable economy platform technology to capitalize and trade tangible assets (stock, inssurance, gold, real estate...) and intangible assets (service, time, follower, education...) as tokens. Adios interference and costs associated to middleman !

Private blockchains are too expensive and public blockchain are too slow and not flexible enough to respond to enterprises's needs.

- A permissioned blockchain is a hybrid between a fully public and a fully private blockchain. It balances out between the need to have privacy, performance, security and scalability while sacrificing some decentralization. It is the ideal middle ground that corporations are looking for to adopt blockchain technology.

- A permissioned blockchain allows enterprises to work in a trusted environment allowing them to have a certain degree of control and privacy with performance and scalability needed.

- A permissioned blockchain is greatly needed to answer enterprises's needs.

Eden will have numerous use cases : from reverse ICOs on HelloEden to P2P, B2B, IoT, Shared Economy Platforms, Gaming...

Eden is solving scalability issue and offers high security and low transaction costs.

Hyper deflation has been removed from the mechanism. They were advised that a token burn would make Edenchain a security token. Tokens that were meant to be burnt, will be given to masternodes instead. Once again everything is well thought out.

We don't see a global blockchain of this caliber everyday.

No wonder why they were oversubscribed by 40 times, with a solid back up of 20 VCs around the globe (same ones who invested in Zilliqa, Vechain, EOS, Tezos...), 20 partnerships before their token sale and a crowdsale sold out in 1 minute 52 seconds.

However they decided to give a 1 ETH guaranteed allocation with no gas war to all their whitelisted members with successful KYC, respect amigo !

To see that 50 % of 24 Million $ funds received during their ICO will go to tech development shows team wants to progress and develop quickly.

Talking about the team it is definitively one of Eden's biggest strengths. Not simply strong academic background but also a solid experience with blockchain, cloud and big data.

Team is as solid and legit as it could possibly be. To that list you can add 15 senior blockchain staff and other team members not mentioned on their website.

As the team, all star advisors well established in Korean society and in other countries. Advisors carefully chosen covering a wide variety of businesses with multiple discplinary, well connected in businesses, governments, enterprises.

Interesting to note some advisors are also Eden's partners which means more real use cases for EDN from their companies.

Do you start to see the bigger picture or not yet ?!

We don't need to have Einstein IQ to realize Eden long term potential. Everything is well thought out with a long term vision to build Eden ecosystem, from their roadmap having technical and business milestones, the way they allocate their tokens around the globe to achieve their strategic blue ocean market approach of the enterprise segment, their numerous partnerships pre ICO, to their MOU signed with startup accelerators such as ROA Invention Lab and Accross Asia Alliance (780 traditional startups).

What do you think will happen when South Korea will lift its ICO Ban ? HelloEden, bright future ahead !

CLEAR GOAL : Offer high performance and a secured connectivity to see mass adoption from enterprises : existing companies with real business and revenues, not some whitepaper companies.

3.B. FEATURES OF EDN TOKEN.

Here is the most important part which makes Edenchain unique. Their tech is just great and without a doubt copy/paste pale replicas of Eden will show up. Easy to copy on a paper, less easy to reproduce a unique tech, reason why only a part of their code or no code at all will be available on GitHub.

3 layers architecture : Distributed Ledger Layer/Validation Layer/Bridge Layer.

- Distributed Ledger layer : a place where data used on the blockchain are separately stored and only data of transactions agreed to in the validation layer are processed. Distributed ledger data can be added through transactions and only validate data can enter the distributed ledger. It is based on Linux Foundation's open source project : Hyperledger Sawtooth.

- Validation Layer : it is where a transaction is executed and verified, which includes the Ethereum Virtual Machine.

- Bridge Layer for a secure interoperability : E-Bridge architecture adopting Median Voter Theorem consensus for E-Oracles transactions, Intel's Software Guard Extensions Enclave (for secure transaction processing), and use of HTTPS and ECC-TC cryptography (for encryption of data and a reliable communication between nodes) allow zero knowledge connectivity where smart contracts can securely interact in on-chain and off-chain.

Image source

- Low transaction and processing fees : guaranteed execution of all transactions using a FIFO (First In First Out) transaction model and Proof-Of-Elapsed Time (PoET) consensus algorythm which is energy efficient compared to Proof Of Work (PoW) and Proof Of Stake (PoS).

- High number of TX/S : using Radix Merckle tree for fast validations of block and parallel execution using Namespace technology for increased throughput. Each namespace can proceed up to 1000 TX/S.

The theoretical maximum number of namespaces is 2^16 (because of data structure) => maximum number of TPS is 2^16x1000 = 65,536,000 TPS. Not bad ! - Developer friendly, using RESTful APIs to reduce development costs. Most developers from enterprises are already comfortable using APIs = great enticing for enterprises to adopt Edenchain. Eden is providing a all in solution with a developer portal (E-Edge).

- Proven technology based on Hyperledger Sawtooth, improved and turned into a permissioned blockchain.

- Masternodes.

- Broad language support, support of Solidity, most popular programming language to write smart contracts.

Not an easy task to summarize a 44 pages Whitepaper in a few sentences.

3.C. WHAT TO LIKE ABOUT EDENCHAIN AND WHAT TO EXPECT ?

- Global blockchain

- Solving real problems

- Solid team with experience able to execute

- Solid advisors

- Unique tech

- Strong community

- 20 strong partnerships early on, at ICO stage which is very rare. More partners on the way and core partnerships not announced yet

- No help required from expensive 3rd party to manage their community during ICO (Hello Amazix !)

- EDN tokens got numerous use cases and applications for enterprises, individuals, app developers

- Numerous uses for EDN token which will give everyone from VCs, corporate users, node operator and individuals a solid reason to own and use EDN (users must stake EDNs to reserve 1 or more namespace for their use, transaction fees when users are interacting with smart contracts, exchange fees when users are trading on Eden DEX, ICOs fund-raising EDN instead of ETH)

- Masternodes

- HelloEden ICOs platform

- Edenchain decentralized exchange to trade tokens released on HelloEden

- 20 % vesting period for EDN. Natural selection at its best leaving flippers on the side vs investors who saw Eden potential and who did not mind having their funds locked for a certain period.

- They did not rush post ICO to be listed for a classical pump and dump, instead they chose a strategic time after making sure market makers were in place

- Agressive roadmap

- Ambassador program which will lead to more exposure

- Training program in cities such as Dubai and Hong Kong to respond to enterprises massive demand

- Their business approach and long term vision. Solid business plan to encourage enterprise adoption of blockchain technology

- Possibility to build DApps on Edenchain

- Strong security and secured connectivity

- Member of Hyperledger community, already adopted by over 200 enterprises

- Clear communication with their community with a weekly newsletter

- All milestones achieved so far

4. CONCLUSION

4.A. TO CONCLUDE :

Regarding BTC price a lot of uncertainty due to legislations coming but 1 BTC will always be equal to 1 BTC.

Blockchain technology got no chance to see mass adoption by enterprises as long as we will see some scalability issue. Do you remember Cryptokitties causing Ethereum network congestion ?

Privacy concern as well as costs associated to blockchain are some major enterprises's concerns.

As a permissionned blockchain Edenchain got high chances to see mass adoption thanks to their tech offering privacy, high security, a trusted environment, low transaction cost and a high number of TX/Second, but also to their team who got a global and long term vision with ability to execute. A true contender to disrupt top ranking on coinmarketcap.

Bear market or not be very picky. It is important to invest in tokens with solid fundamental features and numerous use cases.

Do not let your love for other tokens blind you.

Edenchain was just my example of what I consider to be a very solid ICO, a true unicorn. Do not listen to anyone on THE Internet, including this article. You should always DYOR and do your DD. By doing so you might find YOUR unicorn !

To have hype is good. To have hype, a solid team and advisors, a unique tech and a token with many use cases is even better.

Mass adoption could take a bit longer than a Bittrex support ticket with media propaganda comparing for years now Bitcoin to Tulip mania in 1637. Forgive them dear Satoshi. They are the same sceptical people who still don't know BTC got a 21 Million max supply and 1 BTC = 100 000 000 Million Satoshis.

Would you rather believe in Mathematics or in governments printing money day and night ?

To those people I will say one thing : before talking about a subject you know nothing about, kindly spend some time to educate yourself with baby steps starting with "blockchain definition" on google. You might open your eyes.

Totally understandable than banks, Western Union, Paypal and Co are not happy to see a technology allowing population to transfer money anywhere in the world at a lower cost and much faster than them.

TOO LATE, fact is that Cryptocurrency asset can no longer be ignored as a new category of asset. Fact is that blockchain brings more transparency and productivity gains, who in the world will not be interested in that ?

It is just a matter of time before main phone manufacturers will integrate crypto wallets in their phones and 2018/2019 will be the time for regulations to come into the cryptosphere.

First they ignore you, then they laugh at you, then they fight you, then you win.

4.B. ABOUT ME.

First of all, English not being my first language I apologize for any grammatical or conjugation mistakes. I gave it my best shot.

Secondly I hope that you had a good time reading this article, learning some new things at the same time. Hoping my method to dig into ICOs will be helpful to you.

Thirdly I don't think Satoshi image at the top is a reliable information. I tried to find him to verify but he is not an easy man to find !

If you see him say Hi, if you see J. Dimon just don't.

Always remember there are 4 types of wealth :

- Financial wealth

- Social Health

- Time Health

- Physical Health

And no point to have first 3 if you don't have the last one so take care of your mind and body first.

Time with your loved ones, exercice, good nutrition and some sleep are vitals. Sleeping can be seen as a loss of opportunity, I see it more as a vital thing not to fat finger on DEX !

May the force be with you in years to come and may your hands not become weak.

Really cool if you could share my content. Depending of your motivation feel also free to Upvote, Resteem, Comment... Muchas gracias, Merci, Thank You.

Have a nice day wherever you are in the world at the moment.

Great article, good point!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank You ritxi. The future is bright for Crypto as a new category of asset.

Next BTC halving Tick-Tock, Tick-T... !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What do you think will have the halving impact on BTC price?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It could be a catalyst/trigger to push BTC price to the North, Supply VS Demand.

Adding to the fact electricity price tend to increase around the world due to inflation.

Question is : will miners increase their computing power through halving event with the expectation BTC price will soar ?

I hope so.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Short term sad to see OTC volume is not taken into consideration on coinmarketcap...

Everytime BTC reaches a support Day traders are looking at those websites as a reference to check volume. And they are thinking : "low volume, support will not hold, time to short."

Sight :(

How is Crypto market in Czech Republic, gaining some traction or lack of interest from population ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Here was the big interest, as everywhere, between November and January. Those times there jumped Bitcoin on you from TV and even other mainstream media, but nowadays due to the bear market, nobody cares. But this will change, the awarenes is already here!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @nexthalving! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit