1. The misconception about money

What is money? Everyone seems to think they know what money is. Money is the dollar bill I am holding. Money is gold. Money is the number in my bank account — or Bitcoin wallet.

While these answers seem fine, I would argue that these concepts of what money is are at best partial and at worse deflect our attention away from money’s true significance. These conceptual problems arise when we think of money as a thing. This is analogous to using Newtonian physics to explain cosmology. The results would be partial and misleading, because they look at the question through the wrong filter.

The idea that money is a standard commodity originated in the hypothetical barter economy imagined by Adam Smith. He proposed a model that started with people making in-kind exchanges, and then naturally developed a commonly-shared commodity into a measure of value, such as gold and silver, historically. This understanding also underpins the foundations of economic science, which supposes that the most suitable commodity will naturally be chosen as “money” over the course of time.

If we follow this train of thought, we gravitate towards judging and comparing different forms of money based upon their commodity characteristics, which is misleading and damages our understanding of how economies work. Money should not be understood as a thing or a commodity, but as a technology to record value. In other words, money is a common technology adopted by a society to record who owns what. In this understanding, we should compare different money regimes by their technological characteristics instead, and in how they serve their societies in their designated functions.

2. Understanding money as a technology

Imagine what happens in a modern economy when you send money to a friend, likely using an online banking service or a digital wallet such as PayPal or Apple Pay. What is moving is not a “thing,” not a commodity, but rather a re-arrangement of some numbers in a database somewhere. The database, the banking service, and the number in your account are all parts of the modern form of money technology, the value of which has been agreed upon. Money technology has been evolving for thousands of years, and it is always much more than just a common commodity or currency.

a) This is the currency of the Yap Islands

The round stone with the hole in the middle is used as money on the Yap Islands. Each stone holds a certain value on the island, depending on its shape and size. Since the stone is so big and heavy, it is rarely moved, but the ownership of the stone is marked and changed upon agreement of the parties involved. In some cases, even when the stone is missing, the value and ownership of the stone is maintained and recognized by the people of the island.

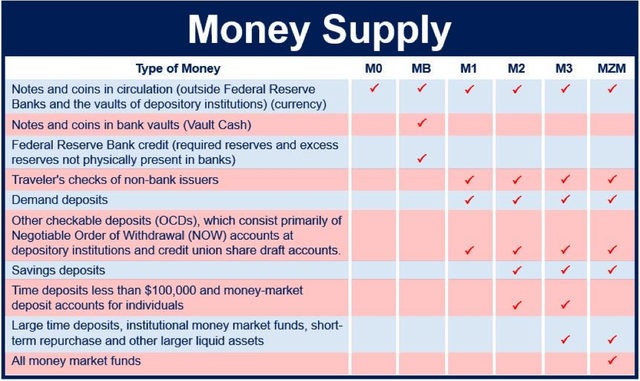

b) These are metrics from the Federal Reserve

The above pictures show the modern definition of money, and how money as a technology works in a modern economy such as the United States. The designations M0, M1, M2, and M3 correspond to different measures of the overall money supply, different currency mediums that people have adopted and the way they interact with financial institutions. Money in bank notes and coins is designated M0; this covers only a small part of the overall money supply, and only a small percentage of the total value people are paying with and sending to each other in modern societies. Chart 2 shows the growth of different levels of the overall money supply over time, and they do not all move together. When the economy collapsed in 2008, M1 was still expanding due to the expansionary monetary policies of the Federal Reserve. The private sector was contracting, however, and consequently M3 growth contracted.

These two charts help to illustrate the need for a more accurate understanding of money as a technology to record its actual value in a society. As a foundational technology, it evolves as society evolves, and its centrality grows as the economy grows. Multiple institutions were born over the course of history to support a particular technology and create the infrastructure for that technology to function smoothly. In its technological dimensions, “money” includes all these institutions and infrastructures, as well as the currency often used as the unit of value in that money technology.

3. The arrival of the Internet

People are connecting with each other much more easily than they did 30 years ago. Computing power is now cheaper and much more powerful. The amount of computing power in a single smartphone nowadays is many times that of a $16 million supercomputer from 30 years ago. Computing technology is now more open, with APIs and interfaces which make programming and automation much easier. Industries such as telecommunications, transportation, media, and retail have witnessed major disruptions — and other important social institutions like democracy and nation-states still await transformation. And this, it may be argued, only remains the case because the Internet has not yet penetrated their basic operations deeply enough.

In the Internet Age, we have also witnessed new inventions in the field of money technology — and if the Internet is one of the most important inventions in the history of humankind, then these innovations are possibly some of the most important in the history of money. It started eight years ago with the invention of Bitcoin, which was the fruit of a long struggle and collaboration to invent something new for the Internet Age. The invention of the Internet 40 years ago changed the course of human history. The world of today would not have been recognizable 40 years ago; the world 40 years from now will also change in unrecognizable ways due to the evolution of the Internet and the spread of cryptocurrency.

Even now, cryptocurrencies can already do several things better than other types of money. Everyone in the world can open a “bank account” and receive money in a public blockchain ledger such as Bitcoin’s or Ethereum’s. Millions of US dollars can be sent overseas in an instant, at minimal cost and in a secure and trustless manner — meaning that one does not need a “trusted” third party to track account debits and credits. Applications can be built on top of public blockchain ledgers in ways that are automatic and permissionless, and so different from the legacy banking system. Blockchain-based cryptocurrencies such as Bitcoin and Ethereum are global, immutable, decentralized public ledgers; as such, they hold the promise of being the best money technologies invented in human history

4. Comparing different money technologies

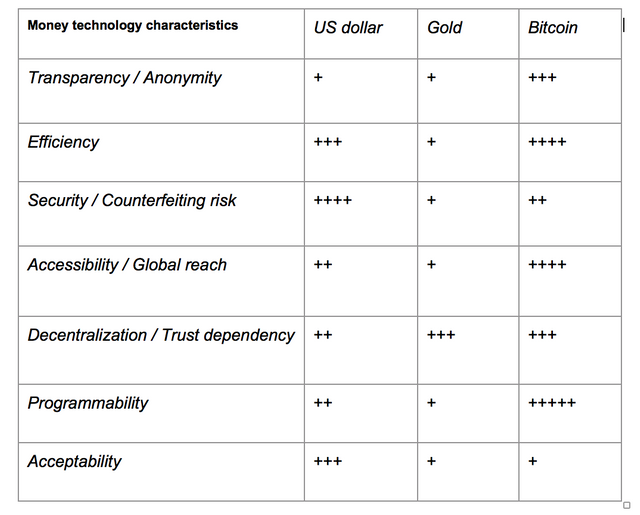

This section presents a comparison of different money technologies: between the US dollar, as a representative of modern, government-backed “fiat money” (which is only given value by government decree), and gold and Bitcoin as representatives of the class of blockchain-based money. The plus (+) indicates the author’s judgment on the relative strength of the money technology in the comparison, while the following discussion goes into more detail on the relative strengths and weaknesses of the respective money technologies. The main comparisons to be made are between the US dollar and Bitcoin, since one represents the current system while the other represents what the future may hold.

a) Transparency / Anonymity: In the early years and even now, the main misconception about Bitcoin has been that it is mostly a tool for criminals and money launderers due to its anonymous nature. But the reality is the exact opposite; the Bitcoin public ledger has the possibility to be the most transparent money system ever. Every transaction since the genesis block can be traced and audited, making the full ledger similar to a digital book in a public library that is open to anyone in the world 24 hours a day. It is its radical transparency that lends it to being the perfect record for public finances, not one suitable for illegal activities. The busts of Silk Road, Mt. Gox, and BTC-E were clear examples that for law enforcement, dealing with Bitcoin blockchain is much easier than was previously thought.

At the same time, individual privacy can be maintained adequately by using the public and private key cryptography techniques. If you don’t have a contact with a centralized exchange that requires personal identification, your identity can remain private within the Bitcoin blockchain ledger, in contrast with the fiat money system in which the average citizen does not have access to public finance details. Corruption, embezzlement, and other abuses of public finances so prevalent around the world can be deterred effectively with the use of a transparent public ledger, such as that employed by Bitcoin and Ethereum.

b) Efficiency: The dollar’s fiat money system has been supported by years of infrastructure building, at the cost of billions of US dollars. The primary utilities of financial players such as Visa, MasterCard, and Western Union — and a large part of the infrastructure of retail banking — are dedicated to moving this money around. In other words, these networks rearrange recorded values. This rearrangement could be done much more efficiently if participants in this system shared and used a public ledger such as Bitcoin’s.

While some people are conscious about the electricity cost of Bitcoin’s proof-of-work algorithm, this cost is still relatively small compared with the cost of equivalent maintenance in the modern finance system. Other cutting-edge solutions to reduce the electricity cost further are in development, such as proof-of-stake. When a new solution is proven secure, the cost of the whole network could be reduced further and made even more efficient versus its fiat money counterparts.

Other efficiency issues concern scalability and transaction cost, which deserve much longer and more detailed discussions. But just as computing power scaled up exponentially in the Internet Age, blockchain money should prove to be much more ready to scale than its fiat money counterparts, which were invented for the world of several hundred years ago. The tradeoff is between using more easily accessible computing power instead of the more accustomed counterpart of human labor.

c) Security / Counterfeiting risk: If a public ledger becomes the ultimate record of value for people, the security issue is of paramount importance. There are two aspects of security in these new money technologies. First, there is the security of the record of value itself, and second, there is the security of the ecosystem around the record of value — and also the security of individuals utilizing the record to measure their own worth.

On the first account, a blockchain as an immutable, global, decentralized public ledger is as safe as it can be — given that the still-hypothetical possibility of a “51% attack” (an attack on the blockchain by a group that controls a majority of its computing power) is avoided. In the eight-year history of Bitcoin, there has never been a breach of the core protocol’s security. The move to proof-of-stake could raise the safety threshold of the primary record even further, to the point at which it can be considered as safe as the Internet itself.

The security issues around Bitcoin and Ethereum mainly concern their ecosystems and the infrastructure around their blockchains. Centralized exchanges are hosts to multiple hacking attempts, and history has shown that the vulnerabilities of this layer are very high. The UX and security issues with individual wallets also have not yet been resolved, and present serious barriers for mainstream users in adopting cryptocurrencies. Security and user-friendliness are probably two of the biggest disadvantages of cryptocurrency compared to the fiat money system.

d) Accessibility / Global reach: If you can access the Internet, you can access public ledgers such as Bitcoin’s and Ethereum’s, open an account, and receive money instantly. That is the promise of cryptocurrencies for the two billion unbanked people around the globe. The fiat currency system was born with nation-states, and therefore is necessarily restricted to the boundaries of an issuing nation-state. Meanwhile, cryptocurrencies can be truly global, and reach anywhere with Internet access and beyond. The global level of accessibility of cryptocurrencies is unprecedented, and that accessibility is the first step towards global financial inclusion and the radical equalization of financial opportunities. When it reaches its full potential, the Internet of Value will be able to transform fundamental human institutions for the better.

e) Decentralization / Trust dependency: While Bitcoin is often celebrated as a trustless system, what is actually happening is that Bitcoin is using a different trust system: trust in its network mechanics and mathematics. But the ecosystem around cryptocurrencies still requires an old-fashioned trust in private businesses, such as centralized exchanges and centralized wallet providers. The decentralization issue is multifaceted, and discussed in more depth elsewhere.[5] What cryptocurrencies are capable of doing right now is counterbalancing the ability of nation-states to abuse their fiat money printing capabilities — less of the issue in some countries than in others.

f) Programmability: Every software engineer can download the whole Bitcoin and Ethereum codebases and start tweaking them today, and many are doing just that. Compare that to the fiat money system, where one would have to ask for the API of every single bank, a request that is unlikely to be granted. The accumulated experience and capability that comes with the continual tinkering of an open system of public ledgers will soon far outclass the decades of work that have been put into fiat money’s tightly guarded systems.

Furthermore, cutting-edge technologies such as machine-to-machine payments, VR and AR asset transfers, and autonomous decentralized systems can far more easily originate from a cryptocurrency’s open public ledger system than from the fiat money system. As the Internet penetrates the fabric of society more and more deeply and the percentage of value created from the Internet grows larger and larger, the Internet of Value will grow stronger, with a backbone based on public blockchains and cryptocurrency.

g) Acceptability: As of today, acceptability is probably the biggest weakness for the cryptocurrency. This lack of acceptance is occurring because a new technology of money is one of the most fundamental transformations that can happen to a human institution, and it takes time and patience for it to play out. The currency banking system is not suited to cryptocurrency, as its system is based on a private proprietary database with years of accumulated experiences instead of an open public ledger with radical properties of accessibility, transparency, and programmability. It is hard to change and even more difficult to unlearn what you have learned. So some people will not change; some will even attempt to block the changes. But the future of the Internet of Value will likely arrive at some point, as the mindshare and usage of cryptocurrency grows and the infrastructure of the Internet of Value becomes more ready for mainstream users.

5. Building the infrastructure of the Internet of Value

How is it going to happen? Will blockchain replace or exist alongside of the fiat money system as the primary technology of money?

There are two lenses to consider the coming changes through. The first is the technical side, the issues that occur when a new technology is placed in an old infrastructure, which will then gradually change to accommodate the new technology.[6] The second is the social aspect, and this will be quite far-reaching, as money is a technology used by all of society’s participants. In considering this aspect, we must ask, what future do we want to see 40 years from today? Will it be a similar world to the one we have now, one deeply divided among localized interests, with arbitrary rules and artificial borders preventing people from realizing their true potential? Or do we hope for the kind of future a universal money system might bring about, where the rules are based on market forces and mathematics; power is dispersed and decentralized; and knowledge, financial independence, and opportunities are accessible to everyone, everywhere?

On the consumer front, cryptocurrencies need to be more user-friendly and more secure, and their infrastructures need to be better developed than they are today. The last element is the key to all the rest, and it is showing signs of progress, with infrastructures such as exchanges, payment processors, private chain databases, and wallet providers being built at a rapid rate, maturing and getting better.

At some point, cryptocurrencies will be easy and safe to use, to the point that mainstream users will not even notice the difference between them and fiat money currencies. The first car was much worse than a horse as a means of transportation, and the first computer was much worse than a human in computation. This is the nature of technological progress, and it indicates that improvements in blockchain-based money will come as they are needed — and they will be needed thanks to the increasing importance of the Internet of Value.

As of now, this new system is not ready, though many are laying its groundwork: engineers are writing software and building its future infrastructure, writers and journalists are learning and writing more about its challenges and opportunities, and lawmakers are trying to understand its implications.

Even in these early stages, one thing is clear about the Internet of Value — everyone who wishes to can play a role.

6. Conclusion

In this paper, I argue for a better and more accurate understanding of money and why blockchain and cryptocurrency can be the best money technology in human history, and show my reasoning in the comparison to fiat money technology. While cryptocurrency is currently behind in safety, scalability, and acceptability, the combination of radical transparency, global accessibility, efficiency, and most importantly programmability indicates that the future of the Internet of Value will likely be based upon public blockchain and cryptocurrency.

References:

https://en.wikipedia.org/wiki/Rai_stones

http://www.businessinsider.com/the-myth-of-the-exploding-us-money-supply-2011-3

https://medium.com/@VitalikButerin/a-proof-of-stake-design-philosophy-506585978d51

http://unenumerated.blogspot.com/2017/02/money-blockchains-and-social-scalability.html

https://news.21.co/quantifying-decentralization-e39db233c28e

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hackernoon.com/a-vision-of-the-internet-of-value-ad187abf5826

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit