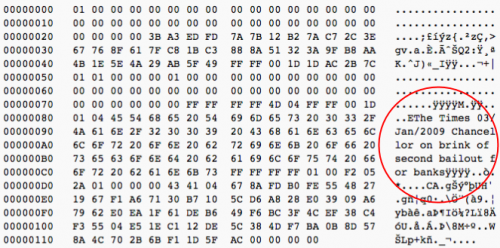

On January 3, 2009, Satoshi Nakamoto fired the shot heard round cyberspace. The message was clear: Let us create money that no nation-state or bank can control.

It turns out that there were millions of people that wanted the same, but nobody knew how to do it. Then Satoshi dropped a 7 page whitepaper on the Internet.

The rest is history. Today each Bitcoin is worth over $7000. Over $5 billion is transacted daily.

But why does Bitcoin really matter? Why do we need money that can't be controlled by nation-states?

Nation-states can do tremendous good for society. They protect us against threats, from within our land and from ones far away. They allow us to organize at massive scale. Nation-states with institutions that have withstood the tests of corruption, authoritarianism, and gross incompetence over time perhaps deserve our trust. But this is a first-world luxury.

The very power with which we entrust nation-states can also be used to do bad. Less-developed nations do not enjoy the benefits of robust institutions. Their more fragile political structures and economic systems experience far more volatility, the cost of which is often borne by its citizens.

The nation-state emerged as the dominant political structure in a world of scarcity. The Industrial Revolution created the conditions to coordinate massive workforces with production capital to generate more wealth than ever before. The increased returns to violence incentivized the rise of large, powerful nation-states to protect what was theirs and take what wasn't.

The internet shifts us from a world of scarcity increasingly to one of abundance. Permissionless publishing pushed down the cost of distribution of digital goods to zero. Much of what's on the internet is just data, and data is infinitely replicable. Abundance reduces the returns to violence and thus the incentive to form nation-states.

Much of our intuition about money comes from living in a physical world of scarcity. While credit has existed for much of our history, precious metals and scarce collectible resources were the dominant forms of money for our most primitive to most civilized societies. Until 1971, every single US dollar was backed by an equivalent amount of gold.

It turns out, however, that money, like most of our core institutions, is simply a story that we collectively believe. A network of people that share common knowledge about money can in fact create it. All that's required for something to function as money is for me and you, and preferably a few other people, to believe it is money.

Bitcoin is a pure manifestation of this idea. A network of people around the world that believe in a shared set of rules have created a system of money controlled by and beholden to no nation-state. Money that is non-sovereign, entirely digital and provably scarce is an innovation that cannot be understated.

My belief is that cryptocurrencies will develop into a market substitute for the now monopolized systems of money of nation-states. I think it's unlikely they will replace them entirely, as they don't offer a significant improvement over many first-world systems. Yet, more than 50% of the world is still without the Internet, most of whom live outside of the first world.

Incompetence, corruption, and greed have emerged as dominant behaviors in many developing nation-states, to the detriment of its citizens. The internet reduces the power of the nation-state to control communication and collaboration. Permissionless cryptocurrencies enabled by the Internet reduce the power of the nation-state to control commerce. Imagine if via the Internet, you could opt-out of a hyper-inflating monetary system.

Yet the Internet in many parts of the world is still permissioned. The Great Firewall still looms large. The incentives of the web make privacy a second-order priority instead of a human right. The Venezuelan government has hyper-inflated its money supply at an annualized rate of 16000%, confiscated bitcoin mining equipment from citizens, and begun to mine Bitcoin itself as a way to avoid economic sanctions. We are thus faced with a moral dilemma familiar to new technology: a force intended for good has instead been exploited by those who wish to do bad. It's clear the Internet and cryptocurrencies still have a ways to go before wishful imagination becomes reality.

Yet the digital revolution is happening before our eyes, and it's happening faster than any of the technological revolutions that came before it. Privatization of space continues to reduce the cost of commercial payloads, making the dream of a global satellite internet closer to reality every day. Even the much-reviled telecomm industry is on the cusp of major innovation, as most networks look to upgrade to 5G in the next few years. What happens to Internet-based innovation when 50% of the world comes online?

The grand vision of the internet is that of a world free of from the influence of nation-states. While perhaps too ambitious, the internet's promise to reduce the returns to violence suggests that this vision is directionally correct. A world less dominated by nation states is one of self-sovereignty. Perhaps the grander vision of the Internet, of cryptocurrencies, is that of individual freedom. Perhaps, like the publishing on the web or transacting on the Bitcoin network, this vision is unstoppable.

Cryptocurrencies and Blockchain Platforms are going to radically change the world over the next few years. Looking forward to the ride and the new decentralized smart economy!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit