It’s Easier to Open a Bank Account Than It Is to Participate in an ICO Last year, the U.S. Securities and Exchange Commission went after a number of ICOs for failing to perform due diligence to ensure their investors didn’t hail from the U.S. Spurred partially by a desire to avoid censure or shutdown from the SEC, ICOs have taken things to the opposite extreme, using Know Your Customer procedures to weed out investors from the U.S., China, and a handful of other countries. To date, all of 2018’s major crowdsales have required some sort of KYC in order to gain admittance to their whitelist, with many outsourcing the task to third parties that specialize in such matters.

To merely be considered for a token sale, it is now commonplace for an individual to have to submit a passport scan, bank statement, and various other documents and to answer a string of questions about their background and the origin of their cryptocurrency. Legolas, for example, requested that investors “Provide as much detail as possible about the origin of the BTC”. Being whitelisted for a token sale is no guarantee of participation either.

Oversubscribed ICOs such as Arcblock returned ether to hundreds of participants who had failed to contribute in time or who were deemed to have “cheated” by using over the prescribed gas limit. Twitter traders now encourage investors to submit KYC to as many promising ICOs as possible, just in case they later decide to participate.

A Data Leak In the Making

It’s Easier to Open a Bank Account Than It Is to Participate in an ICO

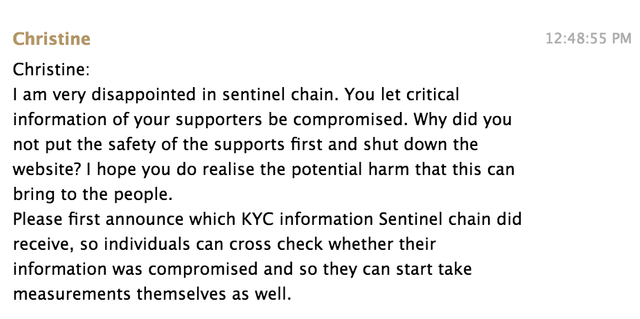

In Sentinel’s Telegram chat, investors were deeply critical.

With ICOs now holding the passports and other identification documents of thousands of crypto investors together with their emails and wallet addresses, hackers have an added incentive to target crowdsales. Even if they’re unsuccessful in altering the contribution address, the raw data of tens of thousands of crypto holders is a honeypot of significant value in its own right. Some of that honey was stolen from The Bee Token, whose email database was accessed and used to send out phishing emails which raised over $1 million.

This week, Sentinel ICO had an even bigger fail after the passport data of its users was leaked. In a Medium post, the startup confessed that a website vulnerability had allowed uploaded files to be accessed by another user. To compound the problem, the user who discovered the flaw then claimed to have been reported to the police by Sentinel for their actions, despite having done nothing wrong.

KYC: Good for ICOs, Bad for Investors

It is hard to put a figure on the success rate for ICO whitelist applicants, though it’s likely to stand at less than 50%. At least half of the time, in other words, participants are submitting personally identifiable documents in exchange for nothing, be it due to whitelist oversubscription or network congestion that prevents them from contributing ether in time. The likelihood of that data being leaked is low, but cumulatively, over the course of dozens of KYC applications, those odds start to mount up. It only takes one failure to expose an individual’s data once and for all time. Email and wallet addresses can be changed; passports and driving licenses are permanent.

Gaining approval to participate in pre and public sales is now viewed by many ardent ICO participants as a game. The price for admission is the time it takes to complete the KYC registration process and the chance that none of the countless ICOs they apply to will suffer a catastrophic data breach. As if investing in ICOS wasn’t risky enough, KYC requirements have ironically made crowdsales even more hazardous.

The question is do you think KYC requirements for ICOs are excessive or necessary? Let us know in the comments section below.

The USA has now limited ICO participation to accredited investors only. While this is for average Joe's "protection". This is some what ironic in that to be an accredited investor you must have a large net worth. I think this will really incentivize attackers as you can now say without doubt you are getting identities worth stealing. Or maybe I'm just crazy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think burdening the investor sucks, it just sets up exactly what the article said, security problems with information, the burden should be on the ico, the people offering, and the government should already be on top of figuring out taxes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/kyc-requirements-are-making-icos-riskier-not-safer/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit