The second largest cryptocurrency in terms of market cap but, as with most cryptocurrencies, this year has been hard on Ethereum, losing nearly 40% of its value, but for some investors Ethers hardest days are not yet behind it.

A cryptocurrency hedge fund known as Tetras Capital released a 41-page report on their reason behind shorting ether. According to Forbes, the Ether short is one of tetras Capitals “high-conviction positions” another being a bitcoin investment.

Another investor shorting Ether is Timothy young, the founder of Hidden Hand Capital, a crypto management firm managing more than $100 million in crypto assets. Young speaks of the dissonance between the price and technological advancement of Ethereum.

“Ethereum has an incredible talent pool of developers. In the long term, I think they’ll solve a lot of scaling challenges. But in the short term, there’s a disconnect between the price and underlying technology.”

Young’s skepticism is understandable to a degree, Ethereum currently sits on a market cap valued at $48 billion, however, its transaction capabilities don’t necessarily reflect this as the network is currently only capable of handling around 15 transactions per second. To put it in a rather unsettling context, a traditional payment system such as Visa can handle 24,000 transactions per second.

Of course Ethereum isn’t simply a payments system but rather a platform for decentralized apps. However, this is also noted within the Tetras report, which calls out the platform for its high fees and network congestion “An application call can be roughly 1 million times as expensive on Ethereum as compared to a centralized service like AWS [Amazon Web Services],”

Although multiple solutions are in development to improve the Ethereum network, The Tetras report alleges that this is too far off:

“The most optimistic estimates suggest that Ethereum’s Layer-2 and other broad scaling solutions will not be fully functional, tested, or capable of supporting the most popular DApps for roughly another two years,”.

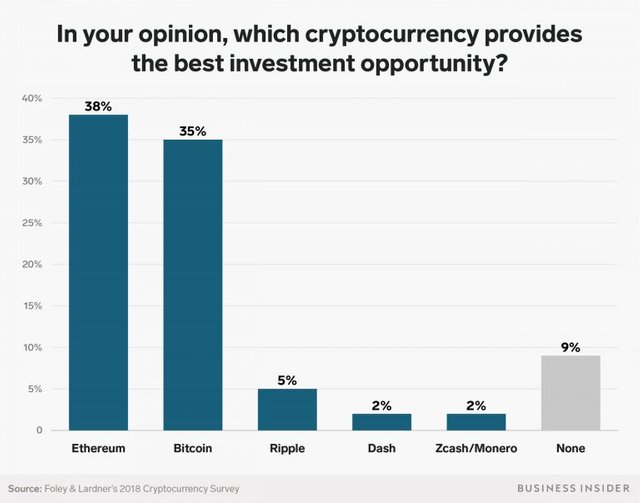

However, it's not all doom and gloom for the #2, data from Foley and Lardner – a group of investors and executives shows that Ethereum is favored above other cryptocurrencies such a Bitcoin.

On top of this, the founder of Initialized Capital (a venture capital fund) and co-founder of Reddit Alexis Ohanian, recently told Fortune that he believes Ethereum will reach $1,500 at the end of the year.

You have a minor misspelling in the following sentence:

It should be in the long run, instead of in the long term,.Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit