Introduction

VaultSwap is the legitimate instrument for proficient disclosure trade. Before VaultSwap a colossal measure of lawyer time was spent mentioning disclosure (data) that the other party had yet didn't yet need to unveil. This issue endures in each claim. VaultSwap shortcircuits this by giving the other party motivation to give disclosure when they can. Utilizing VaultSwap, a gathering places the disclosure they expect to give bond, to be hung on VaultSwap.com. That transferred disclosure is delivered to the next gathering just when the other party likewise gives revelation to VaultSwap.

When the two players have given their revelation to VaultSwap, the disclosure is traded as it is delivered at the same time to the two players. Consequently, as an escrow administration, VaultSwap guarantees no gathering appreciates any preferred position in deferring their creation of revelation. Lawyers who use VaultSwap get revelation quicker, and with less issue.

What is VaultSwap?

VaultSwap is a Decentralized Exchange and Yield Farming, Staking application subject to Ethereum Blockchain. It gives direct cross-anchor asset for asset exchange. VaultSwap doesn't rely upon 'wrapped' ERC-20 tokens or other fabricated assets to achieve cross-chain exchanges. It doesn't figure out how to exchange assets. Customers needn't waste time with any uncommon wallets or other programming. Each of the customers requires is a program, an asset, and a wallet address for the asset they're exchanging into.

All of VaultSwap's liquidity pools are set apart against VAULT tokens. Using a comprehensive referring to and state machine part, swappers can exchange their assets — exchanging BTC into ETH, for example — without hoping to have a VAULT wallet, with the exchange occurring as fast as the start and target chains grant.

- VaultSwap Features

- Instant Operations

- Without Blockchain Fluctuations

- Protects the Identity

- No Transaction Fees

- Global System and Secure

Benefits Of VaultSwap

1. Staking:

Stake VaultSwap and get an APR of 30% and it tends to be opened whenever.

2. Lending:

Best return in market Upto 26% APR for upheld coins (DAI, USDC, USDT, TUSD, BUSD, PAX)

3. NFT Market:

On VaultSwap network, clients are offered the occasion to make exceptional collectibles and either sell or save them for individual use. NFT proprietors have total authority over their collectibles and can do whatever satisfies them with it.

4. Yield Farming:

Get Upto 2000% APR by giving liquidity in VaultSwap and Uniswap Protocols.

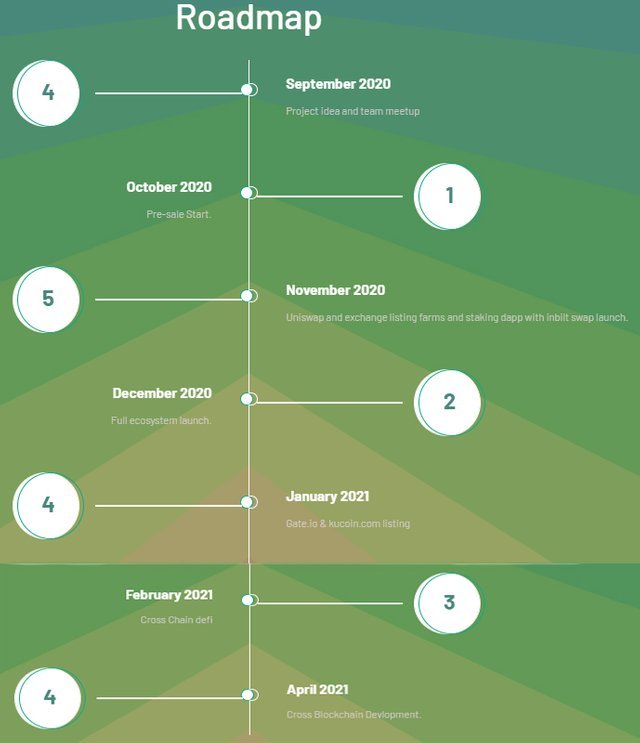

Roadmap

Token Information

Name:VaultSwap

- Max Token: 200,000 VAULT

- Hard Cap: 5000 ETH

- Price: 1 ETH = 20 VAULT

- Currency: ETH

- Min Purchase: 0.1 ETH / 2 VAULT

- Starts: November 20 (9:00 AM)

- Ends: December 20 (11:59 PM)

Social Links

- Website : https://vaultswap.io/

- Telegram: http://t.me/VaultSwap

- Linkedin : https://www.linkedin.com/in/jasonwrightt

- Twitter : https://twitter.com/Vault_Swap

- Discord : https://discord.gg/bJy23Rc

- ANN : https://bitcointalk.org/index.php?topic=5291703