The cryptoverse is a wild, wild west where fortunes can be mined out of blockchain mountains or stolen by bandits wearing digital masks over their faces. Let's not minimize the amount of value we're talking here, over the last year the value has skyrocked in the Alt community!

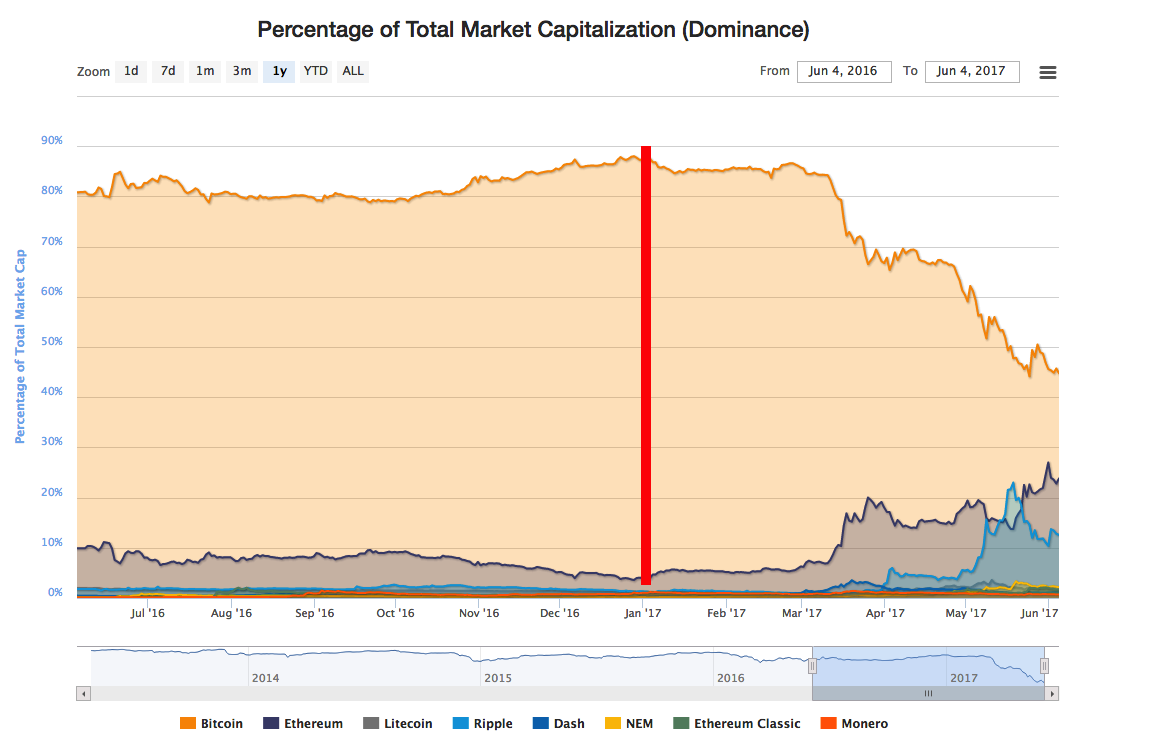

For example, if you'd invested in Alt Coins just six months ago, you would've done so at a time when BTC was still dominating at nearly 90% of the whole crypto market cap. Many of the current Alt Coin big winners were much cheaper on Jan 4, 2017, and some were even cheaper still, such as syscoin, Dash, Maidsafe... you get the idea. This was the lowest point for the Alt Market over the last year, and a great time to invest.

What's Going On and Where Does the Road End?

Those who have been into crypto for two years or more and were holding Alt Coins faithfully have reaped massive rewards for their patience. I know this because I've only been in the space for a year; this is my first anniversary for my first BTC purchase (June 2016) and over that year I have seen returns that I never thought possible.

Yes, in that same period of one year BTC has gone from 500-740 USD range to the 2000-2500 USD range. And that increase is nothing to ignore, but it's also not an entry point that works for most levels of investors, myself included.

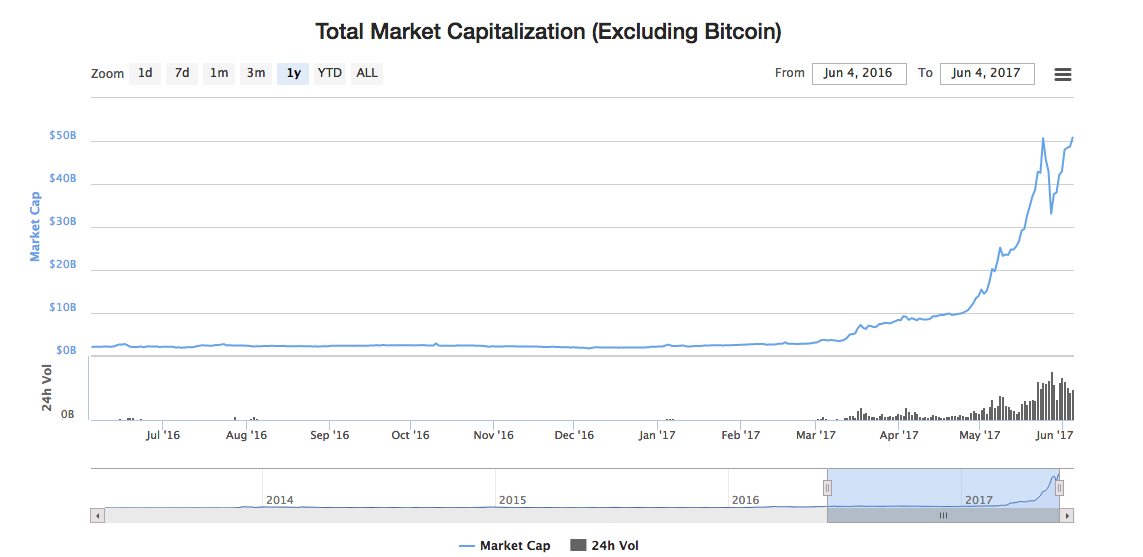

But a look at the increase in the Alt Market Cap shows how investors at this level saw potentially greater returns if they made smart token choices.

For those who are just getting into trading, there are already fewer obstacles to onboarding, from verifying at your chosen exchange or deciding to pay premium with a debit/credit card, to choosing services like LibertyX or Local Bitcoins, which also come at a premium. This wasn't feasible just a few years ago, and it was much more difficult to onboard securely.

And now that the fever has taken hold through Japan and South Korea, with BTC in the lead for greatest demand, it's not going to get any easier for smaller investors to wrap their head around entering at these levels. I mean, most new crypto investors seem to think that you need to buy one bitcoin when you buy, and get intimidated by the increasing USD value.

But with the right research, it's possible to get in on the action and start building btc.

Thankfully, I found Steemit shortly after finding my way to cryptocurrency, and almost immediately when they launched for public beta. It's a personal story for everyone, but for me Steemit was the second crypto I invested in, and was the first use of my BTC. I didn't care about the premium I may have paid, I knew I'd be on the platform from that moment on and I wanted to show my appreciation by buying Steem. I have never regretted a single Steem or SBD that I have invested or given away since.

It's how I learned about everything that has helped me develop strategies in the markets.

Please Hodl for the next available cryptocurrency

I happened to get into the space right before the Alt Coin market started boiling upwards. Since last summer, I have been researching projects and dev teams and conducting analysis on these groups to gauge wether or not I want to wager on their success, invest for the long-term, or put on an 'ignore' list.

And that was how I first started learning about Eth, and I bought some to tuck away. Having successfully navigated my way through my first session what I later learned is considered due diligence, I felt more confident in my research workflow. It's a mixture of forums, white papers, articles, and social media, and synthesizing that information into a buy/don't buy decision.

Full Disclosure: I didn't Hodl that particular ETH. I didn't realize at the time that my motivation was to be involved in more action, and you can see by the above chart that Ethereum wasn't exactly getting the blood pumping. I decided to move that value back into BTC, fearing as all new investors do that my first steps were doomed to failure since the market didn't seem to value ETH like I did. I now understand that I didn't have a full perspective of having a portfolio, so my decisions about long, medium, and short term were confused and irrational.

Various authors on Steemit taught me a lot over the succeeding months, and pretty soon I was rocking a hardware wallet, had wallets and trading accounts and I was much more prepared to pull the trigger on projects, including projects like TRIG.

Here Comes the Sun

What I realized pretty quickly was that the greater opportunity for a beginner like me was in alt coins, with BTC as my savings and hedge. Of course, I still had weekly buys in place to dollar cost average my btc accrual, and most of my portfolio stayed in BTC offline.

My epiphany was that I should be conducting due diligence and identifying winners to come and trends in the groups within the space. I have never sold BTC for USD, so I knew that I wasn't interested in holding USD, but in gathering more BTC. I could put that BTC to work by supporting the next generation of products and services that are inevitable after the introduction of a world-changing technology like Blockchain.

So I set about making trades for small quick increases in profits over time, while also holding onto tokens that represented projects I believed in on a deeper level. In the beginning I lost more than I made, but each mistake taught me something for next time, and eventually I started turning profit and gathering extra btc.

This strategy really started paying off in March through April of 2017, when suddenly the alt coin market's traction took hold and took off. It's been on a tear ever since, and I believe it isn't a bubble, but the market realization of the value that some alt coins bring to the table.

Projects like LTC and DGB activated segwit, Dash popularized governance models and the masternode system, the fork called PIVX is pushing governance models even further with full community voting, and projects like Syscoin, Particl, Bitbay, etc are starting to reshape the way we view marketplaces. This isn't mentioning Brave Browser and BATs which is the beginning of a quiet revolution in digital advertising operations (My current profession).

These projects aren't meant to replace BTC and can only serve to enrich the offerings of Blockchain to help continue reshaping the future.

Where Next?

As always, this shouldn't be taken as investment advice. This is my experience during my first year of crypto trading, which has happened to coincide with the significant rise of the Alt Market. So that being said, where to next?

If you're new (I still consider myself a baby), then you may be thinking that you've missed the train. But if the last year has shown me anything, it's that the train hasn't even been turned on yet, let alone left the station. Sure, you may not be able to afford a shiny set of Dash Masternodes but as a newbie to crypto you aren't going to make money with BTC trading unless you're bringing a significant fiat investment to the table, say, 150k USD. And even then, you're still a very small drop in a vast ocean of BTC.

For my level, my upside is better realized in the Alt Coin market. Outside of the cardinal rule that you should not invest anything you're not willing to lose, the risk and volatility involved in alt coins seems to mirror what can happen with BTC, sharp spikes and deep valleys.

The difference is that it's been easier to go from fractions of a cent to .10 cents or more than it has been for Bitcoin to offer that same speedy return. That doesn't mean BTC isn't the King of the Hill, only that it has become a better savings account for lower level traders. Invest BTC, search for opportunities to recoup initial investment, let the rest ride or pull profits, rinse and repeat. And all profits pulled are always kept in BTC, though more and more XRP is becoming a competing vehicle to offer greater potential upside in the short to medium term on the value stored there.

Outside of BTC and long term hedge, it seems more prudent to me to spread my trading value over the projects that I believe are the next generation in their respective spaces, and hedging my offline hodlings appropriately. But with a potential August event incoming A Bitcoin Beginner’s Guide to Surviving the BIP 148 UASF, it may just be a good time weather the bitcoin storm in foreign crypto ports.

After all, stormy seas can cause huge waves. Good luck with your hodlings and trading, may the markets be ever in your favor.

What's your strategy? Comment below and let me know how you're handling this booming market!

images from pixabay and coinmarketcap.com Giphs from Giphy.com

@prufarchy

Righteous post.

I started buying small amounts of BTC a little over a year ago, and soon diversified into a few selected alts. Due diligence is key, as you highlighted. There are some awesome projects out there, that could shake up a few industries.

The one that has done me really well recently is Siacoin. My plan was to hodl everything for 5 years,and see where I end up, but i'm now considering dipping my toes in the trading market with some of the profits.

I will check out some of the alts you mentioned! Cheers.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I was very happy when sia showed up on Bittrex! Thanks for reading, it sounds we're doing similar strategies and have been at it roughly the same amount of time. Good luck!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good post. I just started investing in other alt. coins this week after thinking about it for months. My BTC and Steem is great but wider exposure was needed. Sitting on my heads just meant getting in at higher prices, but I atleast only have bought ETH, SRAT and PIVX on pullback so far.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Those are great coins to be selective about!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great overview on your strategy.

Though I SO MUCH DISAGREE WITH BATS [ i hate it ] I love te sentiment behind your actions :)

Looking forward to the next recommendations!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha :) Why do you hate it?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I just read the article you linked. amazing read man. god damn it, come on chat time from time!!

That being said....to me BATS fked up, 180 investors?! come on. They could have had 10000 fans holding bats and loving it. As it is, I'm uninstalling brave - which I ENJOYED- and fk them. I know they'll do good but the ico really was badly handled...then i see ppl buying the coins at 7x hours after..

WTF man.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree, the ICO was less than ideal :/ here's my theory, as a guy doing the job that brave and BATs would replace...

Given the name recognition of who is leading this effort, and the clear trend towards cryptocurrency (albeit on the long term), I think that some major players got involved... remember, there are 3 main groups in the Brave/BATs dynamic - audience, advertiser, and publisher. Perhaps the way the ico was structured was meant to help solidify support among the publishers and advertisers, as crypto incentives are fairly straightforward enough to entice the audience...

I don't truly know, of course. But I had planned to be part of that Ico and wasn't able to participate either. But instead of that upsetting me, it's showing me that there's a lot of support (and future) in this project.

Let's call this strike one, maybe?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This was excellent and talk about synchronicity! I just wrote my first ever cryptocurrency post yesterday, though it was much simpler-for the beginning beginners, also using lots of fun gifs including a dancing one, haha! It took off and I'm giving all of the credit to Jensen Ackles!

And I'm doing my best to learn more and edge away from clueless into amateur land, and posts like these are definitely helpful. By 'these' I mean, not dry and technical which I have a difficult time retaining.

Also, I replied to your chat, just awaiting your response to finalize the plan. So excited!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice post bro... Thank you for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit