Full disclosure: I invested in NEXO's private sale. This analysis is meant to be a short primer on NEXO. These points were originally part of my due diligence when I evaluated the opportunity. Hopefully it will be useful to those thinking of acquiring it off exchanges.

What is NEXO?

NEXO is a lending platform with digital assets as collateral. Say that again? Cryptocurrency owners in need of fiat but do not want to liquidate their cryptoassets can use the NEXO platform. Owners will lock up their tokens/coins in exchange for fiat. The cash can be spent on a credit card or via a typical bank transfer. The bank transfer will take longer than crediting the card. In the event of price volatility (remember, this cryptocurrencies are highly volatile), the spending limit of the card will mirror the overall fair market value of the collateralized cryptocurrency.

I break down the components of NEXO and where possible compare it to certain competitors.

Repayment

Loan repayment can be paid in fiat, other cryptocurrencies stored outside of Nexo, and tokens contained within the Nexo wallet. I'll get back to the Nexo wallet later. Compare this to Nexo's prime competitor, SALT. With SALT, loan repayment must be paid in fiat.

Platform Access

Nexo is based in Switzerland and offers its loans worldwide. As long as you have cryptocurrencies, you have the opportunity to receive a loan. There is no need to worry about credit history since all loans are collateral based. Using a collateral backed approach, Nexo loans will be limited in its use cases. By comparison, a residential home mortgage in the USA allows for 20% down payments. Rising cryptocurrency prices make Nexo a compelling alternative for those wishing to hold their cryptocurrency.

SALT is available in the USA. It is also a collateral-based platform which is a positive thing for borrowers with limited to no credit history. It differentiates itself from Nexo with its membership structure. Owning certain amounts of SALT tokens unlocks certain membership features. The more tokens one owns, the better the membership tier. The tiers are Membership, Premier, and Enterprise. As you move up in tier holders will unlock: 1) longer repayment terms, 2) additional fiat currencies (not just USD), and 3) higher borrowing limits.

More on Token Utility

Nexo tokens will also pay out dividends to token holders. Thirty percent of profits from Nexo loans will fund a dividend payment pool which is then distributed to faithful Nexo holders. Repayment will be in ETH but I foresee repayment in fiat or other cryptocurrencies in the long run. In addition to dividends, Nexo tokens can be used for loan repayments. The benefit of doing so is a discount on repayment interest. Similar to SALT, holding Nexo tokens in your wallet will enable higher loan limits. This is similar to bank loans that offer a discount on payment rates if auto-payment methods are selected (thus reducing chances of missed payments and mitigating risk for the banks themselves).

Compliance

Nexo is very public that they are the first USA compliant security token under Regulation D Rule 506(c). If you go through their documentation they refer to the Nexo token as a compliant dividend paying asset backed by collateralized assets. The difference between fiat collateral is that crypto-based collateral has additional utility (as mentioned above, discount on interest payment). My hypothesis is crypto based projects will either get in line with regulation or risk subpoenas in law abiding jurisdictions. In my opinion, it's better to get in front of this issue like Coinbase has done.

Asset Volatility

Dealing with price volatility is a major problem in cryptocurrencies. Stablecoins can sustain price increases but when price declines occur that's when problems start to arise. Nexo touts its flexibility in dealing with asset volatility. Traditional lending uses a metric of Loan-to-Value (LTV) to assess risk. For borrowers deemed a higher risk of repayment, a higher LTV is required. In the case of cryptocurrencies, the asset is wildly volatile. Price swings of 10% are daily realities, 30% swings are common, and 50% swings are common month-to-month. With such volatility in the underlying asset Nexo will need to resolve these issues. The algorithms used by Nexo Oracle (mentioned below) will offer an LTV ratio for borrowers. Much like a risky borrower, LTV ratios will likely sit north of 50%.

Remember the housing crisis when the price of homes were less than the value of the loan? The same risk sits with crypto backed loans. In the event of price declines, the Nexo Oracle will issue notifications to the borrower to provide additional collateral to get back in good standing. Borrowers who ignore warnings run the risk of forced position liquidations to recover a proper LTV ratio.

Technology

Nexo’s platform is powered by what they call the Nexo Oracle system. This technlogy is accountable to regulate the entirety of the Nexo environment such as wallet maintenance, analytics, asset monitoring, distribution, and analytics. Borrowers will issue cryptocurrency into Nexo's crypto overdraft wallet. Loan issuance and repayment is handled directly between the client and Nexo's user interface. On top of that, the application will be available on mobile as well. The addition of a payment card, mobile app, and a desktop interface will serve as a familiar set of actions for the every day person. Using existing form factors will lower the adoption barrier for the every day person.

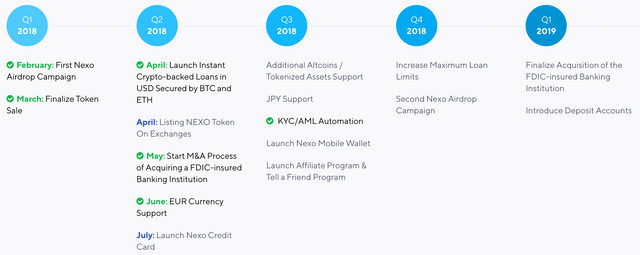

Roadmap

Nexo has an aggressive product roadmap. Below is an update on their website of where they stand. We are in Q2 of 2018 now and two items are not marked in green. Three items however are marked complete. If Nexo can nail the credit card within the quarter I will definitely be impressed.

Why I invested

My hypothesis is cryptocurrencies have real world utility as money. It may not replace fiat currency as a whole, but certainly sovereign assets such as Bitcoin have real world utility as money: medium of exchange, unit of account, and/or store of value. Cryptocurrency holders may need fiat currencies from time to time but are at odds with liquidating their positions. For example, paying taxes on cryptocurrency holdings may be a pressing issue for a holder. Rather than liquidating their Bitcoin, they can turn to Nexo and cover some or all of their obligation(s).

The team behind Nexo are experienced in running Credissimo, an established financial services firm. They have been in business for several years. Additionally, they are advised by Michael Arrington, co-founder of TechCrunch. The fundraising hard cap during their private sale and ICO was a whopping $50M so it begs the question of how much upside is there for investors. I posit that crypto lending is a multi billion or trillion dollar industry in the long run. With that "large market" assumption in mind, investing in Nexo appeared to be a no-brainer. Nexo is now on exchanges and sitting at multiples of its USD, ETH, and BTC based pricing so perhaps the growth opportunity has passed investors by. If you're asking for my opinion, I don't think so. I haven't sold one unit of my NEXO tokens.

These are my opinions. Please form yours. If you found my "cliff notes" version of Nexo a useful guide please don't be shy to give this post a thumbs up, a heart, or a comment.

Thank you for coming to the site. Quantalysus publishes blockchain research and analysis for the crypto community. Please follow on Twitter, Steem (please follow and upvote if you can – thanks!), Telegram channel (New!), and Medium to stay up to date.

If you want to earn Aelf (ELF) tokens for just using Twitter and Reddit, sign up for their candy / bounty program.

If you learned something:

- Please consider donating to keep this website up and running

- Earn Aelf tokens by following them on Twitter (my referral link)

- Follow me on Steem (@quantalysus). I appreciate upvotes!

- Follow me on Twitter (@CryptoQuantalys)

- Education Series: Why we need Bitcoin

- Education Series: The History of Bitcoin

- Education Series: Airdrops

- Education Series: Byzantine General’s Problem

- Education Series: Regulation A and D

- ICO Review: Lightstreams

- ICO Review: Hero Node

- ICO Review: Solana

- ICO Review: Phantasma

- ICO Review: Holochain

- ICO Review: Edenchain

- ICO Review: Quarkchain

- ICO Review: DAOStack

- ICO Review: Alchemint

- ICO Review: Loki Network

- Coin Review: Ontology

- Coin Review: Aelf

- Coin Review: Mithril

- Coin Review: Qtum

- Coin Review: Waves

- Coin Review: Banyan Network (BBN)

- Opinion: Token economics

- Opinion: ICO paradox

- Opinion: Why we love Steem

- Analysis: If Steem were a country, it would be the most unequal society

I think the volatility of crypto currencies poses a problem for the loaning process. But I would much rather take a loan this way, than from the banks. At least here your asset can accumulate in value, and when your loan repayment is finished, your asset have accumulated in value, been in a beneficial HODL phase, and you will not be a loser but a winner in this situation. It which will be tax efficient as well to hold your asset for at least a year, so you have to choose your crypto well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Uncomplicated article. I learned a lot of interesting and cognitive. I'm screwed up with you, I'll be glad to reciprocal subscription))

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I learned a lot of new things from this post. Great post mate.

I also have a steemit blog, where i post daily analysis of CRYPTOCURRENCY AND FOREX MARKETS to help the new traders. If I get help from a blogger like you, then I will benefit a lot and newcomers trader can also benefit from me. So if it is possible, then please subscribe to me @syeedhossain24

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations, your post received 77.08% up vote form @spydo courtesy of @quantalysus! I hope, my gratitude will help you getting more visibility.

You can also earn by making delegation. Click here to delegate to @spydo and earn 95% daily reward payout! Follow this link to know more about delegation benefits.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

NEXO is a new platform for me and I 'll try to do with it thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Just to let you know; i found this extremely meaningful........ It's a thumbs up from me

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Out of all the projects that i've seen looking into lending Nexo has been the only one that looks like a legitimate step in the right direction

It's the only lending platform that ive seen with a reasonable business model and Holders of Nexo aren't tied to the loan process they are simply silent investors who receive a share of the 30% of the interest accrued from the loans made.

Also with the backing of creddissimo it gives me additional confidence that the compan y can remain liquid and provice its service irrespective of fluctuations or a massive devaluation in the cryptomarket

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'll try out of this

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

how do you think abt libra credit? they raised more than 22m from vcs and mostly no pool could get in. Their source of funds, business model, their team and advisors are all stronger imo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit