PayBlok is a token aimed at solving small and medium size business cash flow problems by offering an early payment function on top of the existing features within the InstaSupply platform, which is already supporting the trade of over 2300 businesses, and is growing daily.

What is PayBlok ?

PayBlok is a utility token created by InstaSupply aimed for the use of ‘small and mid-sized businesses (SMBs)’ to improve their cash flows. InstaSupply is a platform designed to reduce SMBs credit gap. SMBs credit gap is caused by delays in payment by their suppliers as they have weaker negotiable power than their suppliers so ‘credit sales fail to be paid their due date.’ Because of this, SMBs depend on credit to fund their existence but banks are unable or unwilling to lend the extra credit demanded, constraining the SMBs potential, damaging growth potential, limiting productivity and job creativity.

InstaSupply, ‘with over 2000 businesses currently on the platform and $60 million invoices,’ ’empower users to create and place purchase orders, track deliveries, and match orders to corresponding invoices; this enables buyers to track, manage and control their spend.’ However, InstaSupply does not handle invoices directly, causing ‘the customer to record on InstaSupply manually when an invoice has been paid.

PayBlok is the solution by InstaSupply to help SMBs grow into larger, more successful businesses. PayBlok is a token created and specifically designed for the InstaSupply platform that ‘can be created without restriction or the need for consent or participation from InstaSupply.’ Which can also be used as ‘an integrated payment solution, supply chain financing, and asset-based lending.

Aspects :

Integrated Payment solution : This removes the need for the workforce to record invoices directly or by using other accounting platforms which will reduce the risk of human error so that transactions are made faster and more efficiently. The integrated payment solution will also create ‘a payment portal within the platform’ that will encourage ‘user-managed ‘Automation Policies”‘ so that invoices can be approved automatically, without the hassle of going through different levels of communication per transaction. The payment portal will use ‘AI (Artificial Intelligence) to accept invoices’ that are familiar or similar ‘and if invoices are unrecognized than they can be manually implemented’ but will be remembered for future transactions. SMBs can benefit from this as the integrated payment solution can ‘settle an unlimited number of invoices, send remittances and update their accounting books in a single transaction,’ reducing the need for the workforce as its all automated and decreasing the likelihood for human error. SMBs can, therefore, save on labor costs and use the money elsewhere to benefit the organization.

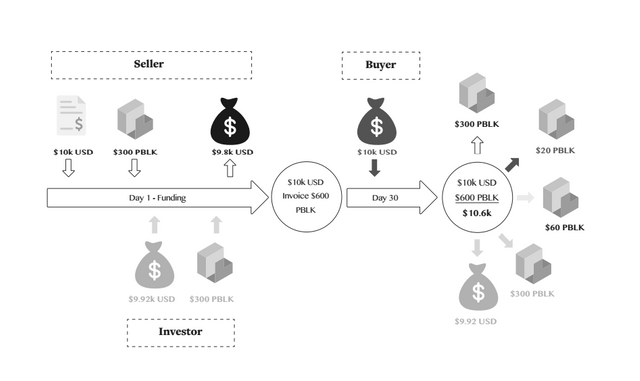

Supply Chain Financing : Due to the blockchains nature of being decentralized, profusing transparency, suppliers can benefit by ‘receiving early payment’, or ‘within 24 hours’, ‘without it affecting payment terms for buyers.’ Buyers can also benefit as PayBlok can ‘provide longer payment times for buyers without suppliers having to wait for their payment.’ This is down to the integrated payment solution and automatic invoice approvals of Payblok and InstaSupplys platform. SMBs can now plan their future and execute this plan in a more effective manner as cash flows are more likely to be certain. This reduces time wasted to have to adopt to another plan and may increase the SMBs credibility overall as borrowed money is paid promptly. Therefore, reducing costs for the SMBs as interests will be less due to an improved credit score and a reduction in time to repay the loan.

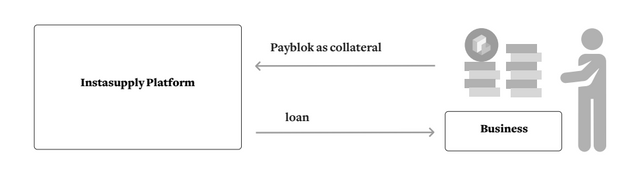

Asset-Based Lending : PayBlok can provide InstaSupplys platform with a form of collateral if businesses fail to repay their loans. The borrowing business must have ‘60% of the required loan value in custody as PayBlok tokens to provide guarantee collateral.’ With interests having the possibility of only being 1% value per annum due to collateral requirements, businesses can use PayBlok and the InstaSupply as a bank alternative that could be significantly cheaper and willing to lend. SMBs can use the borrowed money to, therefore, improve the overall functionality and efficiency of the company in order for it to thrive.

Token Information :

- Token: PBLK

- Accepting : ETH

- Platform : Ethereum

- Type : ERC20

- Price in ICO : 1 PBLK = 0.10 USD

- Total Supply : 250,000,000 PBLK

- Restricted Areas : USA

- Tokens for Sale : 150,000,000 PBLK

- Distributed in ICO : 60%

- Soft cap : 5,000,000 USD

- Hard cap : 15,000,000 USD

For more information :

- Website : https://payblok.instasupply.com/

- Telegram :https://t.me/joinchat/HZSTLA9rcKJJZKXUHlHkfA

- Medium : https://medium.com/instasupply-blog

- Twitter : https://twitter.com/instasupply

- Linkedin : https://www.linkedin.com/company/instasupply/

- Facebook : https://www.facebook.com/instasupply

- Youtube : https://www.youtube.com/channel/UCoYhK-h2xW8oBy3KlxwK0bQ

- Bitcointalk : https://bitcointalk.org/index.php?topic=3740408.msg36983691#msg36983691

- Reddit : https://www.reddit.com/r/ico/comments/8jccem/payblok_is_a_cryptoasset_that_incentivizes_b2b/

- Whitepaper : https://assets.ctfassets.net/5vuk877t9hxd/5WnTZdghpeAe8acWoQUkgs/81b04deb901d6b4391fb4fe7c0e87816/whitepaper-v1.1.5-020718.pdf

Author: Raghav

Bounty0x User Name : raghav078

Bitcointalk: https://bitcointalk.org/index.php?action=profile;u=2235966

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://thetechinsider.org/cryptocurrencies/payblok-pblk-ico-review/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit