Fintech startup Circle has opened up early access to its new cryptographic money contributing application, giving most US clients moment, without commission cryptoasset exchanging.

Fintech startup Circle has opened up early access to its new cryptographic money contributing application, giving most US clients moment, without commission cryptoasset exchanging.

On Tuesday, the Goldman Sachs-supported organization sent messages to clients who had taken part in Circle Invest's beta trying system, illuminating them that it had discharged form 1.0.1 of the versatile business stage, which is accessible on both Apple and Android.

Circle Invest — whose slogan is "crypto without the secretive" — gives retail financial specialists presentation to Circle Trade, the organization's high-volume institutional exchanging work area. Not at all like institutional purchasers, be that as it may, Circle Invest clients can buy as contribute as meager as $1. The organization does not charge commission for the administration, in spite of the fact that it says the spread amongst purchase and offer requests is around one percent.

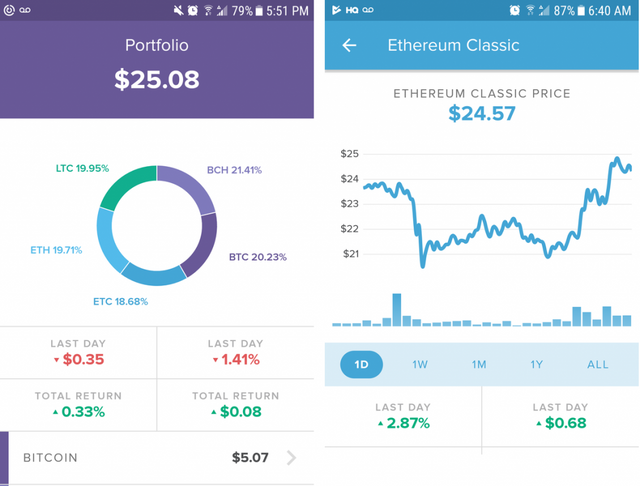

At dispatch, the application bolsters Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), and Ethereum Classic (ETC), and the organization's site says that "more are headed."

Speculators can buy digital forms of money quickly, however clients who manhandle this component by making buys with inadequate supports in their connected financial records will have their capacity to make moment purchases disavowed.

All client resources are put away disconnected in icy stockpiling, and the stage does not right now bolster cryptographic money stores or withdrawals.

Because of territorial contrasts in cash transmission controls, the application isn't right now accessible in Minnesota, Hawaii, New York, or Wyoming, however Circle says it is chipping away at getting to be accessible in New York "soon" and as of late passed enactment in Wyoming may enable it to soon enter this locale too.

Circle is the most recent fintech heavyweight to add cryptographic money usefulness to its product offering. Stock contributing application Robinhood as of late added digital money exchanging to its business stage, despite the fact that this component is right now just accessible in five states. Square, in the mean time, offers Bitcoin exchanging to most US Cash App clients and — dissimilar to the present executions of the other two applications — enables clients to pull back their coins in the wake of performing AML/KYC confirmation.

Every one of these organizations hopes to supplant industry goliath Coinbase for overwhelming nature in the lucrative first-time purchaser showcase. Generally, this statistic has been commanded by the San Francisco-based firm, which was all around thought to be the most helpful place to installed into the cryptographic money biological system only a couple of months back.

Google look information demonstrates that open enthusiasm for digital money contributing is at a relative low-point. yet, these three stages guarantee to give Coinbase a keep running for its cash once the following positively trending market starts.

look close with an open mind with what these people are doing with open source smart contracts and passive income.

https://powh.io/?masternode=0x32c37e7ca38be1f85cd9e85c81ac9b6730f43e3e

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit