A couple weeks ago, I posted Steem post promotion: Past, present, and future. For that post, I had to track down the post, Introducing Promoted Content.

Pixabay license, source

And while searching for that, I came across the post of interest for today, Supply of Steem Decreasing! which was posted six days before I joined in July, 2016. I'm not sure if I saw the post at the time or not, but if I did, it had slipped my mind.

In the post about Steem's supply decreasing, @dan made a sort of hand-waving argument that the Steem supply was decreasing because the "virtual supply" went down, and that happened because they had recently printed 350 thousand SBDs.

It struck me as odd that a blockchain can be constantly producing new tokens, burning nothing, and still be deflationary - even in the short term. On the other hand, I had previously observed this exact phenomenon with the circulating supply from coinmarketcap.com (see here). So, knowing that @dan was one of the founders, of course I believed this claim, but I wanted to understand it better.

To that end, I've been playing around with PowerBI and steemdb.io for the last couple weeks, and I think I understand it better now.

If I understand it, it goes something like this:

The "current supply" of Steem is about 407 million, and the "current supply" of Steem Dollars is about 11 million. We need to remember, however, that those two values are connected. In point of fact, the Steem Dollar represents one dollar's worth of debt, which is redeemable from the blockchain by "converting" an SBD to the equivalent amount of STEEM.

Therefore, the "virtual supply" is the total amount of STEEM plus the total value of SBDs in terms of STEEM (with SBDs valued at $1, not at external market prices).

So that means the "virtual supply" of STEEM would be equal to this formula:

virtual_supply == current_supply (STEEM) + ( current_sbd_supply / price of STEEM )

At today's price of about $0.27, this means that the virtual supply is:

407 million + ( 11 million / 0.27 ) =~ 407 million + 41 million =~ 448 million.

(obviously, all figures are rounded for purposes of simplicity)

The crux of @dan's argument was that - all else being equal - when the STEEM price in the denominator of the second term goes up, the virtual supply necessarily goes down (and the same happens in reverse). Basically, any time the price of STEEM increases at a rate that outpaces inflation, the blockchain will be deflationary. Here's how he phrased it:

Steem Dollars give the entire network leverage and amplify the gains (and losses) of those who hold STEEM and Steem Power.

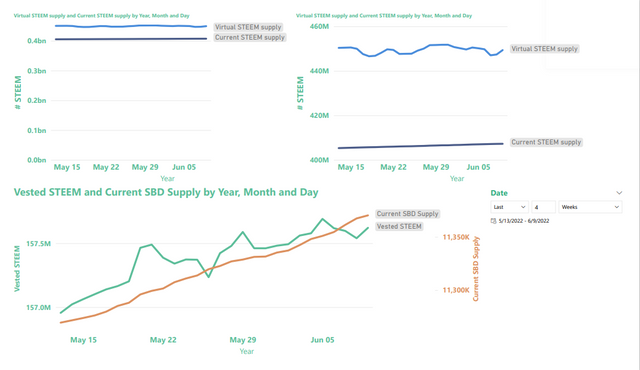

So all of that is presented as background for understanding the following graph, which justifies the claim in the headline:

As can be seen by squinting carefully at the graph in the top-right corner, when we account for both STEEM and SBDs, the Steem blockchain really has been deflationary during the last 4 weeks. According to steemdb.io and as shown above, four weeks ago the virtual supply of STEEM stood at 450,358,059 and today it was measured at 449,361,803.

The same mechanism also means that when we burn SBDs, that act of retiring the debt is exactly equivalent to burning a certain number of STEEM ( number of burned SBDs / price of STEEM ). At today's price, each SBD that gets burned is equivalent to burning [ 1 / 0.27 ] =~ (3.7) STEEM.

If we burn SBDs for post promotion, all this gives us an interesting little rule of thumb which hadn't occurred to me before:

The lower the price of STEEM, the more impact post promotion can have on the overall supply. (and vice versa)

Left as an exercise to the reader -- The blockchain reports its "current_supply" on the order of 407 million and its "virtual supply" on the order of 450 million. So, how do coinmarketcap.com and coingecko.com derive their circulating supply figures, in the neighborhood of 395 million? I have a theory, but first I'd like to hear your ideas.

IVery interesting post. Thank you. It made me look for more information on this topic. You may also find this post interesting:

https://steemit.com/sbd/@timcliff/sbd-explained

In particular, there is an explanation of the terms current supply and virtual supply.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the link. I'll have to take a closer look at the post... 🧐

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Honestly, I don't know what the theory is like. but I'm just trying to guess, that the total current supply in coinecko and marketcap is 395 million based on the following calculation:

= Current Suplay Steem - Current Suplay SBD

= 407,305,482 - 11,374,310

= 395,931,172

I hope you are willing to explain the theory, with a special post about eg.

Honestly, all this time I was also curious about the number 395 million.

🙏🙏

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Those numbers actually match up pretty well, but I don't think they would mix SBD and STEEM without some sort of scaling factor for SBDs. Obviously, I'm not sure, though. I am going to check my theory over some days or weeks, and I'll post about it if it still seems to make sense after that. (unless someone else can explain it first)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm also not sure about the calculations based on combining Steem with SBD. But, coincidentally, when I guessed like that, the result was 395 million. ☺☺

if you are willing to post a theory about it. I would love to read it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think you have derived this very well from the formula. It is comprehensible.

However, based on the data you obtained, I still think that the main influence is given by the STEEM price. The burning of the SBD or STEEM, on the other hand, has only a minor influence.

From your graph at the bottom left, it can be seen that over the period the SBD supply has risen continuously. Burning (small amounts of SBD) obviously had no influence here.

Maybe you could make a graph with the direct comparison of price and Virtual STEEM Supply. I suspect that the lines will be quite similar.

To your exercise: :-)

According to information from coinmarketcap, "circulating supply" means that only free tokens are included. In the case of Steem, the vested Steem would then have to be deducted. But that doesn't bring me to 395 million. coinmarketcap explains the methods here, but even with that I can't figure it out. Especially since coingecko has the same value and retrieves it from a tronscan api...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hmm... Looks like that link might have stopped updating last December...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@steemcurator01, @steemcurator02: Just FYI. Did you see the above comment? I think the number from this TronScan link is finding its way to coingecko, coinmarketcap, yahoo, binance, and who knows where else... Unless there's something going on that I don't understand, it seems like maybe it stopped updating last December.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for this. It has been pass on to the engineering team to investigate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear @steemcurator01 sir, I seek your help and cooperation for the flood affected people of Sylhet Sunamganj district of Bangladesh.🇧🇩

See my post. 👇

https://steemit.com/hive-153970/@abalam/steemit-engagement-challenge-season2-week3-or-markdown-style-contest-your-hopes-and-contributions-to-the-world-smile-project

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

One point - please don't vote on @steemcurator01.

Please use all your votes to help other members of the community.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

ok. I will note that for the future. Thanks for mentioning that.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have pointed this out many times to big SP amount holders, that they need to direct this vote to their community members and not your account. But I guess all of them love you and your services.

What I have mentioned again and again will be considered now only, when you have mentioned it.

Thanks for making it clear to all the Steemians.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have an incredible mind. Because there are people like you, humanity still survives on the face of the earth and the amount of money I get for flood-affected people is very small. So from your engagement in the work of generosity of humanity you will cooperate to help me and see my next post. 👇

https://steemit.com/hive-153970/@abalam/steemit-engagement-challenge-season2-week4-or-your-involvement-in-acts-of-kindness-assistance-in-distribution-of-tcb-products-to

❤️🇧🇩❤️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please stop spamming your links everywhere.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If that's true, I think "the numbers have been broken for months and nobody noticed" is pretty hard to square with the "burning will improve the price" hypothesis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Maybe. I'm not sure. The numbers coming from the blockchain were always right. I'm not sure how many investors/traders use that feed vs. the actual on-chain numbers.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ups, I guess something is wrong with that value. Maybe the calculation is disturbed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep. I completely agree. In total, I think we have burned somewhere around 6K STEEM, 6/10 of a percentage of the four week difference in virtual supply, so I guess that >99% of the reported 4-week change comes from STEEM's price change.

My theory also relies on this point. I need to look at the numbers over the course of a couple weeks to see if it holds up. Unfortunately, I'm not aware of a way to get the historical numbers that I would need in order to check it using past data.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice insight!

I have no idea what you might be theorizing, but I can't wait to see it. = )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think my theory is out the window unless/until someone gets the API link to start updating again. At this point, I am not aware of any way to validate it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I look at most projects, such moves are mostly made during bear periods. I think such deflationary steps should be taken during bull periods. Price declines will be smoother. The rises will be healthier, the volatility will be lower. Of course, we cannot expect anyone to burn steem while the price is rising.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is quite hard to me to say about the circulating steem. I even didn't know that respective number of sbd with respect to steem price is counted as steem supply. This post is too informative. There is big difference between your analysis and coinmarket or coingecko. I don't kno whether this two site is recently updated or not. Steem is being produced at every moment. So the supply is changing rapidly.

There can be also some mistake or any technical issues. Anyway Thanks a lot for this post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It should be counted towards the total steem supply, as it is a form of debt that is backed by the value of steem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is very good news . In particular, you have a very high share in this. Events like this increase the Steem price and attract investors.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'll be honest, the statistics only inform me, I will always convert my STEEM into SBD, no matter what else, the price of SBD is the most important thing for me, the rest is simple information, manipulated or not.

Excuse my sincerity, but it's what I feel

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Isn't that what should be done backwards. I mean conversion of SBD to steem and not vice-versa?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice post

[WhereIn Android] (http://www.wherein.io)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice article keep it up

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit